An in-kind transfer refers to moving assets from one brokerage account to another without selling or buying new assets. Suppose an investor owns 500 shares of XYZ mutual fund in their current brokerage account. They have been dissatisfied with their current broker and want to transfer their assets to a new brokerage firm. Instead of selling off their shares, they decide to do an in-kind transfer to the new brokerage firm. The process is relatively simple – they would initiate the transfer with their current broker and complete the necessary paperwork. The in-kind transfer allows the investor to maintain their positions and avoid any unnecessary tax consequences that could arise from selling off the assets. In contrast, an all-in-cash transfer requires the assets to be sold and converted to cash before opening a new brokerage account and purchasing new investments. Depending on the brokerage firm, individuals may have the option to do a partial in-kind transfer of some assets while doing an in-cash transfer of others. Have questions about an In-Kind Transfer? Click here. An in-kind transfer is a straightforward process that involves transferring assets from one brokerage account to another without selling or buying new assets. Here is a step-by-step guide on how to do an in-kind transfer: The first step in an in-kind transfer is to select a new brokerage firm to transfer your assets to. When choosing a new brokerage firm, consider factors such as fees, investment options, and customer service. Fees. Compare the fees of different brokerage firms, including account maintenance fees, transaction fees, and any other charges that may apply. Look for a brokerage firm that offers competitive fees that fit your investment budget. Investment Options. Consider the investment options offered by the brokerage firm, such as stocks, bonds, mutual funds, and ETFs. Choose a brokerage firm that offers a range of investment options that align with your investment goals and strategies. Customer Service. Look for a brokerage firm with a reputation for excellent customer service. Check online reviews and ask for referrals from other investors to find a brokerage firm that is responsive and helpful. You can ensure a smooth and successful in-kind transfer process by selecting a new brokerage firm that meets your investment needs and preferences. Once you have selected a new brokerage firm, the next step is to initiate the transfer process. Contact your current brokerage firm and request the necessary paperwork or online transfer form to do this. You will need to provide information about the new brokerage firm and the assets you want to transfer. The transfer process may vary depending on the brokerage firm, but in general, you will need to provide the following information: Personal Information. This includes your name, address, and contact information. Account Information. You will need to provide information about the account you want to transfer, including the account number, the account type, and the name of the brokerage firm. Information About the New Brokerage Firm. You will need to provide information about the new brokerage firm you have selected, including the name, address, and contact information. Information About the Assets You Want to Transfer. You will need to provide information about the assets you want to transfer, including the type of asset like stocks, bonds, mutual funds, the quantity, and the current market value. Once you have completed the necessary paperwork or online transfer form, submit it to your current brokerage firm to initiate the transfer process. It is important to note that some brokerage firms may charge a fee for in-kind transfers, so be sure to check for any fees before initiating the transfer. After you have initiated the transfer process, the next step is to complete the transfer paperwork. The paperwork will include information about the assets you want to transfer, the account numbers of the old and new brokerage accounts, and any fees associated with the transfer. Here is what you need to do: Carefully Review the Paperwork. Read through the paperwork carefully to ensure that all the information is accurate and complete. Mistakes or omissions in the paperwork could delay the transfer process or even result in the transfer being rejected. Provide Information About the Assets You Want to Transfer. The paperwork will require you to provide information about the assets you want to transfer, including the type of asset, the quantity, and the current market value. Provide Information About the Old and New Brokerage Accounts. You will need to provide the account numbers for both the old and new brokerage accounts. This will ensure that the assets are transferred to the correct account. Check for Any Fees Associated With the Transfer. Some brokerage firms may charge fees for in-kind transfers, so be sure to check for any fees and factor them into your decision-making process. Sign and Submit the Paperwork. Once you have completed the paperwork, sign it and submit it to your current brokerage firm. They will then initiate the transfer process. Completing the transfer paperwork carefully and accurately ensures that the transfer process goes smoothly and that your assets are transferred to the correct account. After you have submitted the transfer paperwork, the final step is to wait for the transfer to be complete. Your current brokerage firm will transfer the assets to your new brokerage account, and the transfer typically takes a few business days to complete. During the transfer process, it is important to monitor the progress of the transfer and ensure that the assets are transferred to the correct account. You can do this by checking the account balances of both the old and new brokerage accounts. Once the transfer is complete, you will have successfully completed an in-kind transfer. You can continue to monitor your investments and manage your portfolio as usual. When an individual plan to transfer their assets from one brokerage account to another through an in-kind transfer, the types of investments that can be transferred may vary depending on the rules set by the brokerage they plan to transfer to. Generally, individual and joint brokerage accounts, IRAs, and custodial accounts can be transferred in-kind. The investments that can be transferred in-kind include stocks, bonds, mutual funds, ETFs, money market funds, certificates of deposit, options, and unit investment trusts. However, it is important to note that cryptocurrency and precious metals are typically excluded from in-kind transfers. Before initiating an in-kind transfer, one should research the brokerages to open a new investment account and check which assets can be transferred in-kind and which ones may need to be sold first. In-kind transfers offer several benefits over other types of transfers, including the avoidance of tax penalties, cost and time savings, the maintenance of asset allocation and diversification, flexibility and control over investments, and potential tax benefits. One of the main benefits of an in-kind transfer is that it helps investors avoid tax penalties that may be incurred in a cash transfer. In a cash transfer, assets are sold, and the proceeds are used to purchase new investments, which may result in capital gains taxes and other fees. With an in-kind transfer, there is no need to sell assets, so that investors can avoid these tax penalties. In-kind transfers can also save investors time and money. With a cash transfer, investors may need to pay fees and commissions for selling and purchasing assets. In contrast, in-kind transfers do not involve the selling and buying of assets, so investors can avoid these fees and save money. Additionally, in-kind transfers are quicker and more efficient than cash transfers. Another advantage of an in-kind transfer is that they allow investors to maintain their asset allocation and diversification strategies. When selling assets during a cash transfer, investors may need to adjust their investment portfolios to account for the assets that were sold. This can disrupt the balance of their investment portfolios and make it more difficult to achieve their investment goals. In-kind transfers, on the other hand, allow investors to transfer their investments without disrupting their asset allocation and diversification strategies. In-kind transfers can also provide investors with flexibility and control over their investments. Investors may want to transfer their investments to a new brokerage firm without selling their current assets because they believe the new brokerage offers better investment options, lower fees, or better customer service. In-kind transfers allow investors to maintain their current investments while enjoying the benefits of a new brokerage. While in-kind transfers offer several benefits, they also come with potential risks that investors should be aware of. Some of these risks include market volatility, liquidity issues, and tax implications. One of the primary risks associated with in-kind transfers is market volatility. If the value of the assets being transferred changes significantly during the transfer process, it can result in unintended consequences, such as unexpected tax bills or losses. To mitigate this risk, investors should consider monitoring their portfolios regularly and choose a time when the market is relatively stable to initiate the transfer. Another potential risk of in-kind transfers is liquidity issues. Certain assets may not be easily transferable or have limited liquidity, making it difficult to move them to a new brokerage account. To mitigate this risk, investors should do their due diligence before choosing a new brokerage firm and ensure that the firm is capable of handling the assets they want to transfer. In-kind transfers can also have tax implications, such as triggering capital gains taxes if the assets being transferred have appreciated in value. It is important to consult with a tax professional before making any transfers to understand the potential tax consequences. Additionally, investors can mitigate this risk by choosing to transfer assets that have not appreciated significantly in value or by using tax-loss harvesting strategies to offset any potential capital gains taxes. An in-kind transfer refers to moving assets from one brokerage account to another without selling or buying new assets. This type of transfer offers several benefits, including the avoidance of tax penalties, cost and time savings, the maintenance of asset allocation and diversification, flexibility and control over investments, and potential tax benefits. However, there are also potential risks associated with in-kind transfers, such as market volatility, liquidity issues, and tax implications. To mitigate these risks, investors should do their due diligence before choosing a new brokerage firm, monitor their portfolios regularly, and consult with a tax professional. Seeking the guidance of a financial advisor can help investors navigate the complexities of in-kind transfers and make informed decisions about their investment portfolios.What is an In-Kind Transfer?

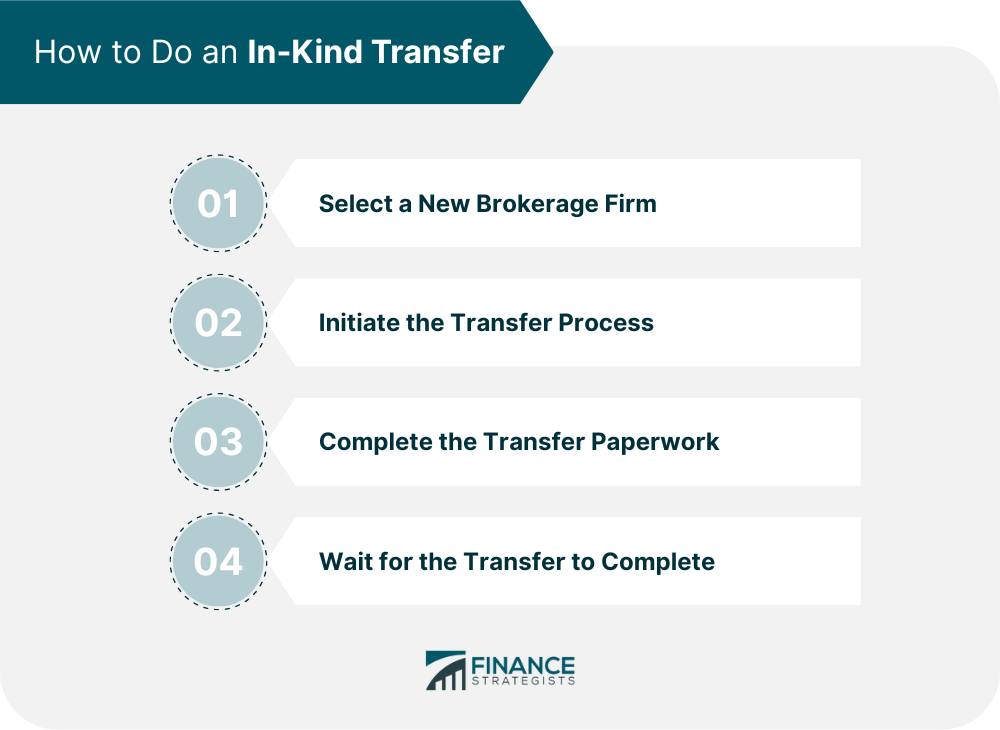

How Does an In-Kind Transfer Work?

Step 1: Select a New Brokerage Firm

Step 2: Initiate the Transfer Process

Step 3: Complete the Transfer Paperwork

Step 4: Wait for the Transfer to Complete

Types of Investments Eligible for In-Kind Transfer

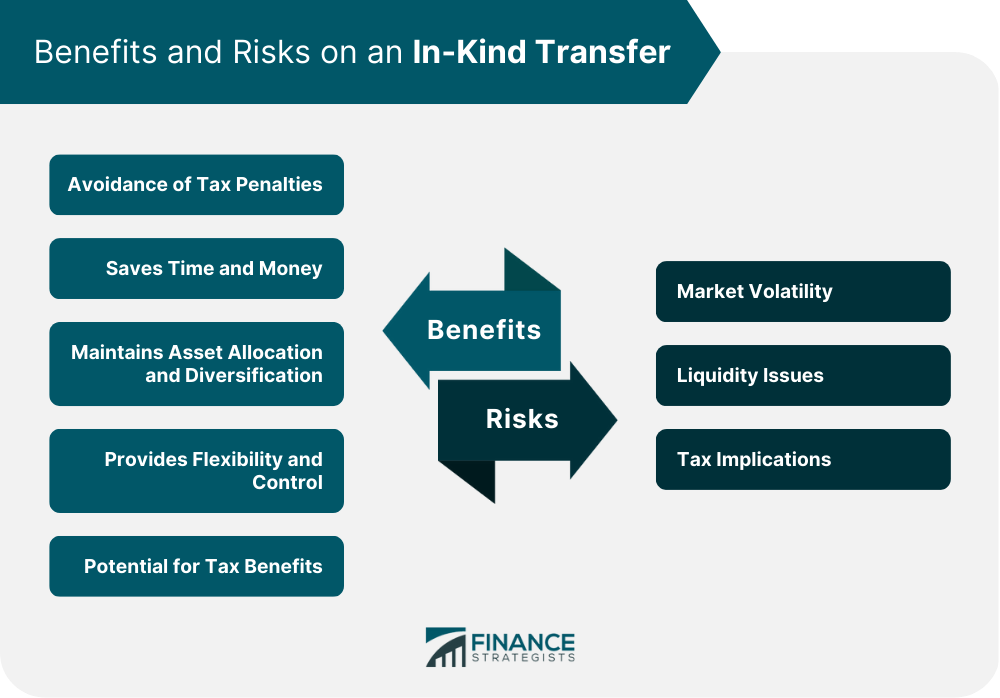

Benefits of an In-Kind Transfer

Avoidance of Tax Penalties

Saves Time and Money

Maintains Asset Allocation and Diversification

Provides Flexibility and Control

Potential Risks of an In-Kind Transfer

Market Volatility

Liquidity Issues

Tax Implications

Final Thoughts

In-Kind Transfer FAQs

An in-kind transfer involves moving assets from one brokerage account to another without selling or buying new assets.

Generally, individual and joint brokerage accounts, IRAs, and custodial accounts can be transferred in-kind. The investments that can be transferred in-kind include stocks, bonds, mutual funds, ETFs, money market funds, certificates of deposit, options, and unit investment trusts.

Benefits of an in-kind transfer include avoiding tax penalties, saving time and money, maintaining asset allocation and diversification, providing flexibility and control over investments, and potential tax benefits.

Risks of an in-kind transfer include market volatility, liquidity issues, and tax implications.

Investors can mitigate the risks of an in-kind transfer by monitoring their portfolios regularly, doing due diligence before choosing a new brokerage firm, consulting with a tax professional before making any transfers, and choosing a time when the market is relatively stable to initiate the transfer.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.