A bankruptcy discharge is a legal order that releases a debtor from the personal liability of certain types of debts. If your bankruptcy has been discharged, it means that you are now off the hook for the discharged debts. You are no longer obligated to pay them. This means that once your debt is discharged in bankruptcy, you're no longer legally required to pay it. For debtors, a bankruptcy discharge signals the end of a financially distressing period. It effectively eliminates many of their existing debts and prohibits creditors from taking any further collection action on those debts. This provides debtors with the opportunity to start anew, financially speaking. Depending on your circumstances and what chapter you filed, you may have some, all, or none of your debts discharged. Any debts that are not discharged are still obligatory. Achieving a bankruptcy discharge isn't automatic. There are conditions and processes that must be fulfilled and complied with before a court can grant a discharge. The bankruptcy process varies depending on whether you file for Chapter 7 or Chapter 13 bankruptcy. In either case, you must complete all required steps, including filing the necessary paperwork, attending credit counseling sessions, and more. Debtors must comply with all bankruptcy laws and regulations to qualify for a discharge. This includes honest disclosure of all assets, income, and debts, as well as cooperating fully with the bankruptcy trustee in all aspects of the case. In addition to following the general bankruptcy laws, debtors must satisfy all obligations and requirements imposed by the bankruptcy court. For example, they may need to make certain payments, attend additional counseling sessions, or participate in a debtor education course. Bankruptcy discharge not only impacts debtors but also has significant implications for creditors. When a debtor's obligation is discharged, the associated creditor loses its right to collect the debt. The creditor is legally prevented from taking any further action to collect the discharged debt. Following a bankruptcy discharge, creditors are prohibited from engaging in any collection activities related to the discharged debt. This includes making phone calls, sending letters, filing lawsuits, or garnishing wages. After a debt has been discharged in bankruptcy, creditors lose the ability to initiate or continue any legal action to collect that debt. This means they can no longer sue the debtor or enforce a judgment if one has been obtained before the discharge. Obtaining a bankruptcy discharge is a multi-step process that requires careful attention to detail and patience. The process begins by filing a bankruptcy petition with the court. This involves preparing and submitting a set of legal documents that detail your financial situation, including your assets, debts, income, and expenses. To qualify for a bankruptcy discharge, you must meet certain eligibility criteria. This can include requirements related to your income level, the types and amounts of your debts, and whether you've received a previous bankruptcy discharge. Debtors are required to complete mandatory credit counseling before filing for bankruptcy and a debtor education course after filing. These courses aim to equip debtors with the financial skills needed to avoid future bankruptcy. Certain waiting periods must be fulfilled before a discharge can be granted. The duration varies depending on the type of bankruptcy filed. For instance, in a Chapter 7 case, the court generally grants the discharge promptly on the expiration of the time allowed for filing a complaint objecting to discharge. In some cases, a discharge hearing may be held. This is a court proceeding where the judge reviews the case and determines whether to grant a discharge. Bankruptcy discharge provides significant benefits to debtors, especially those struggling with insurmountable debt. The primary benefit of a bankruptcy discharge is the elimination of personal liability for many types of debt. This means that you are no longer legally obligated to pay off these debts. A bankruptcy discharge can provide a fresh financial start. It offers immediate debt relief, enabling you to move forward without the burden of overwhelming debt. Once your debts are discharged, creditors are prohibited from taking collection actions against you. This means an end to harassing phone calls, letters, lawsuits, wage garnishments, and other types of creditor harassment. While bankruptcy discharge offers numerous benefits, it also comes with its own set of limitations that should be carefully considered. One of the biggest limitations of bankruptcy discharge is its impact on your credit score and credit history. A bankruptcy discharge can remain on your credit report for up to 10 years, which may make it difficult to obtain future credit. After a bankruptcy discharge, you may find it challenging to obtain new credit or loans. Some lenders may view you as a risky borrower, leading to higher interest rates or outright denial of credit. In certain types of bankruptcy, you may lose some of your property. In a Chapter 7 bankruptcy, for instance, non-exempt assets may be sold to repay your creditors. How long it takes to get a discharge in bankruptcy depends on under what chapter you filed. A chapter 7 case typically moves quickly, and you may receive a discharge after 4-5 months. A chapter 13 bankruptcy will only be discharged after you complete your repayment plan, usually 3-5 years. You may be able to discharge a judgment by filing bankruptcy. If the lawsuit was filed by a creditor over unpaid dischargeable debts and they have not yet placed a lien on your property, filing bankruptcy may remove it. If they have placed a lien, then they cannot pursue collection, but will be paid from the proceeds of selling the asset. If the debt is nondischargeable, filing bankruptcy will not affect it. A bankruptcy discharge is a legal order that releases a debtor from personal liability for certain types of debts. To receive a bankruptcy discharge, debtors must complete the required bankruptcy process, comply with all bankruptcy laws and regulations, and satisfy court-imposed obligations and requirements. The effects of a bankruptcy discharge on creditors are significant, as they lose the right to collect discharged debts and are prohibited from engaging in collection activities or pursuing legal action. However, there are limitations to consider, including the impact on credit score and credit history, limited access to future credit and loans, and the potential loss of assets and property. The time it takes to obtain a bankruptcy discharge varies depending on the bankruptcy chapter filed, with Chapter 7 cases typically taking 4-5 months and Chapter 13 cases requiring completion of a repayment plan over 3-5 years. Bankruptcy may also discharge a judgment, depending on the circumstances and whether a lien has been placed on the debtor's property.What Is a Bankruptcy Discharge?

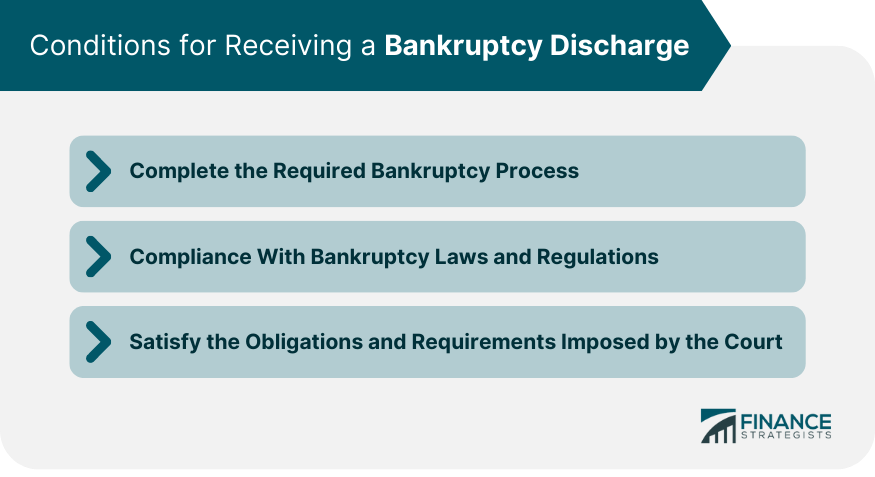

Conditions for Receiving a Bankruptcy Discharge

Completing the Required Bankruptcy Process

Compliance With Bankruptcy Laws and Regulations

Satisfying the Obligations and Requirements Imposed by the Court

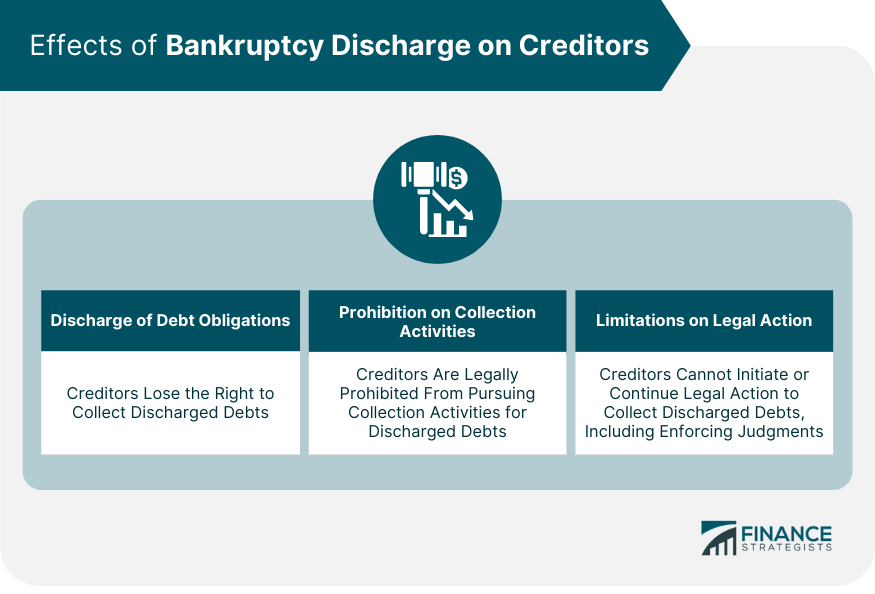

Effects of Bankruptcy Discharge on Creditors

Discharge of Debt Obligations

Prohibition on Creditor Collection Activities

Impact on Creditors' Ability to Pursue Legal Action

Process of Obtaining Bankruptcy Discharge

Filing for Bankruptcy

Meeting the Eligibility Criteria

Completion of Mandatory Courses and Counseling

Fulfillment of Required Waiting Periods

Discharge Hearing

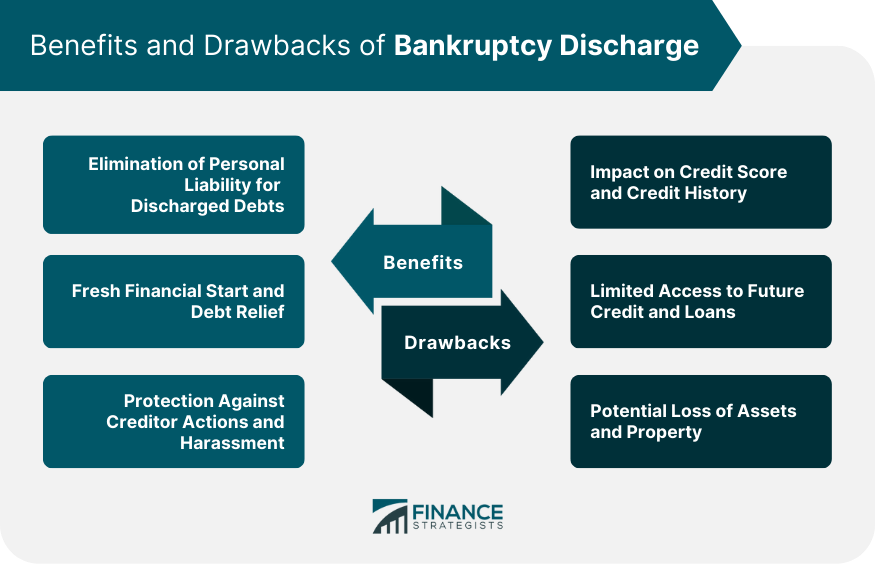

Benefits of Bankruptcy Discharge

Elimination of Personal Liability for Discharged Debts

Fresh Financial Start and Debt Relief

Protection Against Creditor Actions and Harassment

Limitations of Bankruptcy Discharge

Impact on Credit Score and Credit History

Limited Access to Future Credit and Loans

Potential Loss of Assets and Property

How Long Does It Take for Bankruptcy to Be Discharged?

Can a Judgment Be Discharged in Bankruptcy?

Conclusion

What Does Bankruptcy Discharged Mean? FAQs

Bankruptcy discharged is the end of a debtor’s responsibility for most types of debts that were included in the bankruptcy filing. This status is recognized by the court and grants protection from creditors seeking repayment.

It typically takes three to six months after filing for a Chapter 7 or Chapter 13 bankruptcy before a debtor can receive their discharge. The exact length of time depends on several factors, including the amount of debt and whether all necessary documents were filed properly.

No, not all debts may be eligible for discharge during bankruptcy proceedings. Some debts, such as child support, student loan payments, and taxes may remain even after a debtor is discharged from other debts.

If you do not receive your bankruptcy discharge, it means that the court did not approve the filing and there is still an outstanding debt or issue that needs to be addressed before you can be officially released from your financial obligations.

Yes, once a debtor has been discharged through their bankruptcy case they are no longer responsible for repaying their debts and creditors will no longer be able to contact them seeking payment. It is important to note however that if new debt is incurred after receiving a discharge, it may not be eligible for bankruptcy protection.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.