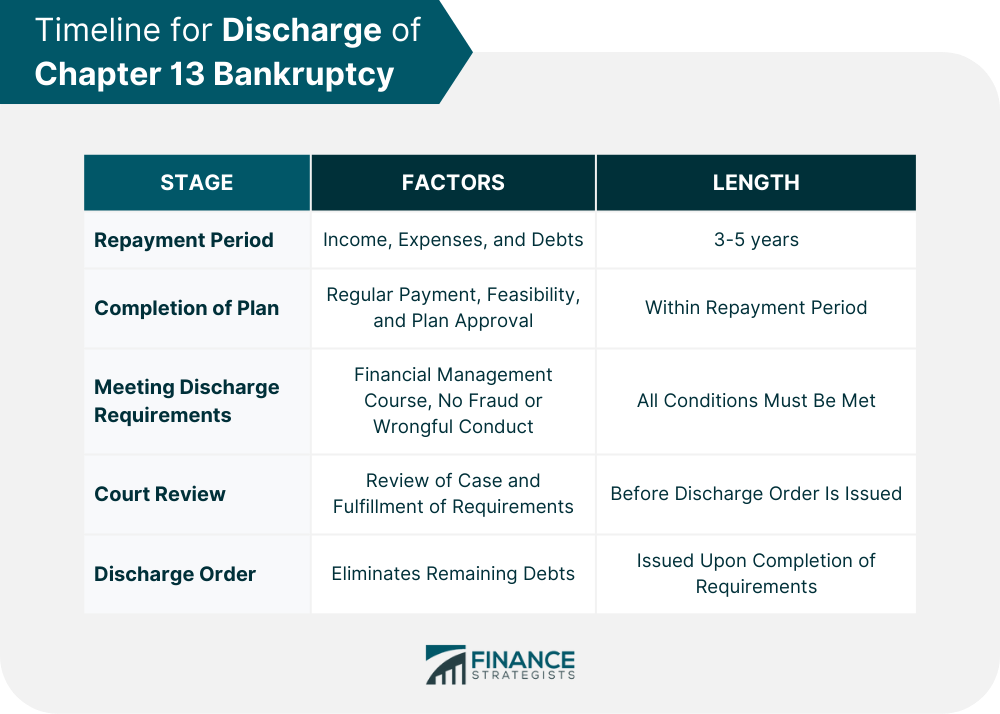

Chapter 13 bankruptcy can be discharged once the individual has completed their repayment plan. However, there are several conditions that must be met before a discharge can be granted. First, the individual must have made all of their payments to the bankruptcy trustee according to the terms of their repayment plan. Second, the individual must have completed a financial management course. Third, the bankruptcy court must review the case and determine that the individual has met all of the requirements for bankruptcy discharge. There are certain debts that are not dischargeable in Chapter 13 bankruptcy, such as most taxes, student loans, and child support payments. Additionally, the individual must not have committed any fraud or other wrongful conduct in connection with the bankruptcy case. If the court determines that the individual has met all of the requirements for discharge, a discharge order will be issued, and the individual's remaining debts will be eliminated. Timeline for discharge of chapter 13 bankruptcy comprises several stages, including the repayment period, completion of plan, meeting discharge requirements, court review, and discharge order issuance. The length of the repayment period for Chapter 13 bankruptcy is typically three to five years, depending on the individual's income and expenses. The repayment plan must be completed within this time frame, and the individual must make all of their payments to the bankruptcy trustee according to the terms of the plan. There are several factors that can affect the timeline of discharge for Chapter 13 bankruptcy. One factor is the length of the repayment period. If the repayment period is shorter, the individual may be able to complete their plan and receive a discharge more quickly. However, if the repayment period is longer, it may take longer for the individual to complete their plan and receive a discharge. Another factor is the individual's financial situation. If their income changes during the repayment period, it may affect their ability to make payments and complete their plan. Additionally, if the individual experiences financial hardship, such as job loss or a medical emergency, they may be able to request a modification of their repayment plan. The typical length of time to discharge for Chapter 13 bankruptcy is three to five years. Once the individual has completed their repayment plan and met all of the conditions for discharge, the court will issue a discharge order, and the individual's remaining debts will be eliminated. After Chapter 13 bankruptcy is discharged, the individual's remaining debts will be eliminated, and they will no longer be legally obligated to pay them. However, there are several other steps that must be taken after discharge. After discharge, the bankruptcy court will close the case, and the bankruptcy trustee will distribute any remaining funds to the individual's creditors. The court will also send a notice of discharge to the individual and their creditors. Once Chapter 13 bankruptcy is discharged, the individual's remaining debts will be eliminated, with a few exceptions. Some debts, such as most taxes, student loans, and child support payments, are not dischargeable in Chapter 13 bankruptcy. Additionally, if the individual has any liens on their property, such as a mortgage or a car loan, those debts may not be eliminated in bankruptcy. Chapter 13 bankruptcy is a complex legal process that allows individuals with regular income to reorganize their debts and create a repayment plan. The discharge process for Chapter 13 bankruptcy can take several years, depending on the individual's income, expenses, and debts. Once the individual has completed their repayment plan and met all of the conditions for discharge, they will receive a discharge order, and their remaining debts will be eliminated. It is important for individuals who are considering Chapter 13 bankruptcy to understand the process and the conditions for discharge, as well as the steps that must be taken after discharge.When Can Chapter 13 Bankruptcy Be Discharged?

Conditions for Discharge

Timeline for Discharge of Chapter 13 Bankruptcy

Length of Repayment Period

Factors That Affect the Timeline of Discharge

Typical Length of Time to Discharge

What Happens After Chapter 13 Bankruptcy Is Discharged?

Steps Taken by the Bankruptcy Court

Discharge of Remaining Debts

Final Thoughts

When Does Chapter 13 Bankruptcy Get Discharged? FAQs

Chapter 13 bankruptcy is a legal process that allows individuals with regular income to reorganize their debts and create a repayment plan. Chapter 13 bankruptcy gets discharged once the individual has completed their repayment plan and met all of the requirements for discharge.

To be eligible for Chapter 13 bankruptcy discharge, an individual must have a regular income and owe less than a certain amount in unsecured and secured debts. They must also not have filed for Chapter 13 bankruptcy within the last two years or Chapter 7 bankruptcy within the last four years.

The timeline for discharge of Chapter 13 bankruptcy typically lasts three to five years, depending on the individual's income and expenses. The individual must complete their repayment plan within this time frame and meet all of the conditions for discharge.

After Chapter 13 bankruptcy is discharged, the individual's remaining debts will be eliminated, and the bankruptcy court will close the case. The court will also send a notice of discharge to the individual and their creditors.

Several factors can affect the timeline of discharge for Chapter 13 bankruptcy, including the length of the repayment period, the individual's financial situation, and any financial hardships that may arise during the repayment period.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.