Delegated trusts are legal arrangements that allow a third party, known as the trustee, to hold and manage assets on behalf of the grantor (the person who creates the trust) for the benefit of one or more beneficiaries. This arrangement can provide various benefits such as asset protection, privacy, and avoidance of probate, depending on the specific type of trust and its terms. Delegated trusts serve several important purposes in estate planning and asset management. They can be used to preserve wealth for future generations, provide for the needs of a beneficiary with a disability, or support charitable causes. By providing an effective and flexible means of controlling assets, delegated trusts help ensure that resources are allocated and used according to the grantor's wishes, promoting financial security and independence for beneficiaries. A delegated trust is created when a grantor transfers assets to a trustee, who then holds and manages those assets in accordance with the trust document's terms. The trust document outlines the grantor's intentions and provides instructions for the trustee on how to manage the assets, distribute income, and make decisions on behalf of the beneficiaries. The trustee's duties can include investing assets, making distributions to beneficiaries, filing tax returns, and providing regular accountings to the grantor or beneficiaries. While the trustee is responsible for acting in the best interests of the beneficiaries, they are also accountable to the grantor and must abide by the trust's terms. In some cases, a protector can be appointed to oversee the trustee's actions and ensure the trust is being managed properly. The grantor, also known as the settlor or trustor, is the individual who creates and funds the trust. They establish the trust by transferring assets to the trustee and outlining the terms and conditions of the trust in a written trust document. The grantor's objectives and preferences determine the type of trust, its terms, and the parties involved. In some cases, the grantor may also serve as the trustee, particularly in revocable living trusts. However, this arrangement may not be suitable for all situations, and it is essential to consider the potential advantages and disadvantages of serving as both grantor and trustee. The trustee is the individual or entity responsible for managing the trust's assets according to the trust document's terms. Trustees have a fiduciary duty to act in the best interests of the beneficiaries and must follow the trust's instructions carefully. Trustee responsibilities can include investing assets, making distributions, filing tax returns, and providing accountings to the grantor or beneficiaries. Trustees can be individuals, such as family members or trusted advisors, or professional entities, such as banks or trust companies. When selecting a trustee, it is crucial to choose someone who is responsible, knowledgeable, and capable of carrying out the trust's objectives. The beneficiary is the individual or entity that receives the benefits from the trust, such as income or distributions of assets. Beneficiaries can include family members, friends, or charitable organizations, depending on the grantor's wishes. The trust document will outline the specific terms and conditions under which the beneficiaries will receive benefits from the trust. In some cases, a trust may have multiple beneficiaries, with different levels of priority or types of benefits. It is essential for the trustee to understand the trust's terms and act in the best interests of all beneficiaries, balancing their needs and preferences according to the grantor's instructions. A protector, sometimes referred to as a trust protector or trust advisor, is an individual or entity appointed to oversee the trustee's actions and ensure that the trust is being managed according to the trust document's terms. Protectors are not required for all trusts but can provide an additional layer of oversight and protection for the grantor and beneficiaries. Protectors can have various powers and responsibilities, such as the ability to remove and replace trustees, approve or veto certain trustee decisions, or modify the trust's terms in response to changing circumstances. When appointing a protector, it is essential to choose someone who is knowledgeable about trust matters and capable of acting impartially to protect the interests of the grantor and beneficiaries. A revocable delegated trust, also known as a living trust, is a flexible estate planning tool that can be modified or terminated by the grantor at any time during their lifetime. This type of trust allows the grantor to maintain control over their assets while they are alive and provides for the efficient transfer of assets to beneficiaries upon the grantor's death. Revocable trusts offer several advantages, including the ability to avoid probate, which can be a lengthy and costly process. Additionally, revocable trusts can provide privacy, as the trust's assets and terms are not subject to public disclosure. However, assets within a revocable trust are still considered part of the grantor's estate for tax purposes, and the grantor is generally responsible for paying taxes on the trust's income. An irrevocable delegated trust is a trust that cannot be modified or terminated by the grantor once it has been established. These trusts provide a higher level of asset protection, as the assets held in the trust are no longer considered part of the grantor's estate. This can be particularly advantageous for avoiding estate taxes and protecting assets from creditors. While irrevocable trusts offer greater asset protection, they also involve a loss of control for the grantor. Once the trust has been established, the grantor generally cannot change its terms or regain control over the assets. However, this loss of control can be mitigated by carefully selecting the trustee and, in some cases, appointing a protector to oversee the trustee's actions. Living delegated trusts, also known as inter vivos trusts, are trusts created and funded during the grantor's lifetime. These trusts can be either revocable or irrevocable, depending on the grantor's preferences and objectives. Living trusts allow the grantor to transfer assets to the trust while still alive, providing a mechanism for managing assets and distributing income to beneficiaries. One of the primary advantages of a living trust is the ability to avoid probate, which can save time and money for the beneficiaries. Additionally, living trusts provide a level of privacy, as the trust's assets and terms are not subject to public disclosure. In some cases, living trusts can also offer tax benefits, particularly when used in conjunction with other estate planning strategies. Testamentary delegated trusts, also known as trusts under will, are trusts that are created upon the grantor's death through provisions in their will. These trusts are irrevocable, as they cannot be modified after the grantor's death. Testamentary trusts can serve various purposes, such as providing for minor children, managing assets for beneficiaries who may not be financially responsible, or supporting a surviving spouse. Unlike living trusts, testamentary trusts are subject to probate, which means that the trust's assets and terms may become public record. However, testamentary trusts can still provide important benefits, such as ensuring that assets are managed according to the grantor's wishes and providing for the needs of beneficiaries in a controlled and structured manner. Delegated trusts offer a high degree of flexibility in terms of asset management, distribution, and control. The trust document can be tailored to the grantor's specific objectives and preferences, allowing for customized arrangements that address unique family situations, tax considerations, or other factors. This flexibility can make delegated trusts an attractive estate planning tool for many individuals. Additionally, certain types of trusts, such as revocable trusts, allow the grantor to modify the trust's terms or terminate the trust during their lifetime, providing even greater control and adaptability. Delegated trusts can provide significant asset protection benefits, particularly in the case of irrevocable trusts. Assets held in an irrevocable trust are generally not considered part of the grantor's estate, which can protect them from creditors, lawsuits, and estate taxes. This protection can be especially valuable for individuals with significant wealth or those in high-risk professions. However, it is important to note that asset protection benefits can vary depending on the specific type of trust and the applicable laws and regulations in the trust's jurisdiction. Trusts offer a level of privacy that other estate planning tools may not provide, as the details of a trust are typically not subject to public scrutiny. Unlike wills, which are public documents that must be filed with the court upon the grantor's death, trusts can remain private, keeping the trust's assets, terms, and beneficiaries confidential. This privacy can be particularly important for high-net-worth individuals or those with sensitive family situations, as it can help protect the grantor's and beneficiaries' personal and financial information from unwanted attention. Delegated trusts, particularly living trusts, can help avoid the probate process, which can be time-consuming and costly. By transferring assets to a trust during the grantor's lifetime, those assets can be distributed directly to the beneficiaries upon the grantor's death, without the need for probate court involvement. Avoiding probate can save time and money for the beneficiaries, as well as provide privacy, as the probate process is a matter of public record. Delegated trusts can be complex legal arrangements that require careful planning and administration. Establishing and managing a trust involves various legal, financial, and tax considerations, which can be challenging for the grantor and trustee to navigate. It is essential to work with experienced professionals, such as estate planning attorneys and financial advisors, to ensure that the trust is properly structured and managed to achieve its intended objectives. The costs associated with establishing and administering a delegated trust can be significant. These costs can include legal fees, trustee fees, tax preparation fees, and other administrative expenses. While the potential benefits of a trust may outweigh these costs in many cases, it is important for the grantor to carefully consider the financial implications of establishing a trust before proceeding. In some cases, establishing a delegated trust can result in a loss of control for the grant or, particularly in the case of irrevocable trusts. Once assets have been transferred to an irrevocable trust, the grantor generally cannot modify the trust's terms or regain control over the assets. This loss of control can be a significant drawback for some individuals, especially those who value autonomy over their financial affairs. However, the degree of control that a grantor retains can vary depending on the specific type of trust and its terms. Careful trust design and trustee selection can help mitigate the potential loss of control associated with a delegated trust. While delegated trusts can offer certain tax advantages, such as avoiding estate taxes or providing income tax benefits, they can also have negative tax implications in some cases. For example, assets held in a revocable trust are still considered part of the grantor's estate for tax purposes, and the grantor is generally responsible for paying taxes on the trust's income. Additionally, certain types of trusts may be subject to specific tax rules, such as the generation-skipping transfer tax or the rules governing tax-exempt charitable trusts. It is crucial for the grantor and trustee to understand the tax implications of a delegated trust and to work with knowledgeable professionals to minimize potential tax liabilities. Generation-skipping trusts, also known as dynasty trusts, are designed to transfer wealth across multiple generations while minimizing estate and gift taxes. These trusts typically provide for the grantor's grandchildren or later generations, skipping the grantor's children, who may still receive benefits from the trust during their lifetime. By bypassing the children's generation, generation-skipping trusts can help preserve wealth for future generations and minimize the cumulative impact of estate taxes on family assets. Charitable trusts are established to support charitable organizations or causes. These trusts can provide tax benefits to the grantor, such as income tax deductions or estate tax savings, while also furthering the grantor's philanthropic goals. There are various types of charitable trusts, including charitable remainder trusts, which provide income to the grantor or other non-charitable beneficiaries for a period before ultimately distributing the trust's assets to a charitable organization. Special needs trusts are designed to provide financial support for individuals with disabilities without jeopardizing their eligibility for government benefits, such as Supplemental Security Income (SSI) or Medicaid. These trusts can be used to pay for various expenses, such as medical care, education, or recreation, that are not covered by government benefits. By establishing a special needs trust, the grantor can help ensure that a loved one with a disability has access to the resources they need to maintain their quality of life without compromising their access to essential government assistance. Spendthrift trusts are established to protect a beneficiary's interest in the trust from creditors and to prevent the beneficiary from squandering their inheritance. These trusts include provisions that restrict the beneficiary's access to the trust's assets, allowing the trustee to control the timing and amount of distributions. Spendthrift trusts can be especially valuable for beneficiaries who may be financially irresponsible, have substance abuse issues, or face significant creditor risks, such as professional liability or divorce. A Delegated Trust is a legal arrangement in which a grantor delegates the authority over their assets to a trustee who manages the assets on behalf of a beneficiary. This type of trust is created to ensure that the assets are managed in a specific way and are used to benefit the intended parties. Delegated Trusts work by establishing a relationship between the grantor, the trustee, and the beneficiary. The grantor creates the trust and delegates the authority over the assets to the trustee, who holds and manages the assets for the benefit of the beneficiary. The trustee has a fiduciary duty to act in the best interest of the beneficiary and manage the assets according to the terms of the trust. Delegated trusts offer benefits such as flexibility, asset protection, privacy, and avoidance of probate. However, they also have drawbacks such as complexity, cost, loss of control, and tax implications. It is important to carefully consider these factors before deciding to use a Delegated Trust, and to seek the advice of a qualified legal professional to ensure that the trust is structured in a way that meets the grantor's goals and needs.What Are Delegated Trusts?

How Delegated Trusts Work

Parties Involved in Delegated Trusts

Grantor

Trustee

Beneficiary

Protector

Types of Delegated Trusts

Revocable Delegated Trusts

Irrevocable Delegated Trusts

Living Delegated Trusts

Testamentary Delegated Trusts

Benefits of Delegated Trusts

Flexibility

Asset Protection

Privacy

Avoidance of Probate

Drawbacks of Delegated Trusts

Complexity

Cost

Loss of Control

Tax Implications

Examples of Delegated Trusts

Generation-Skipping Trusts

Charitable Trusts

Special Needs Trusts

Spendthrift Trusts

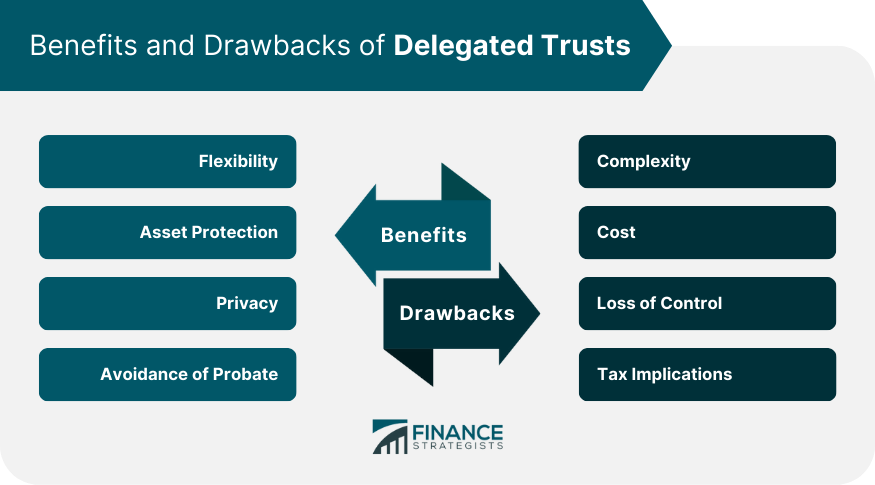

Final Thoughts

Delegated Trusts FAQs

A Delegated Trust is a legal arrangement where a grantor delegates authority over their assets to a trustee, who holds and manages the assets for the benefit of a beneficiary.

The parties involved in a Delegated Trust include the grantor who creates the trust, the trustee who manages the trust assets, and the beneficiary who receives the benefits from the trust.

The types of Delegated Trusts include Revocable Delegated Trusts, Irrevocable Delegated Trusts, Living Delegated Trusts, and Testamentary Delegated Trusts.

The benefits of using a Delegated Trust include flexibility, asset protection, privacy, and avoidance of probate.

The drawbacks of using a Delegated Trust include complexity, cost, loss of control, and tax implications.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.