A Voting Trust is a legal arrangement in which shareholders transfer their voting rights to a trustee who exercises these rights on their behalf. The purpose of a Voting Trust is to centralize control over voting rights and ensure the smooth transfer of wealth and the continued success of businesses or other entities. Voting Trusts are commonly used in estate planning to manage interests in corporations or other entities, streamline decision-making processes, and protect assets. At the core of a voting trust is the trust agreement, which outlines the terms and conditions governing the trust. This document specifies the roles and responsibilities of the trustee and beneficiaries, the scope of the trustee's authority, and the purpose of the trust. It also sets forth guidelines for decision-making, distribution of income or assets, and trust termination. The trustee is a crucial player in a voting trust. They are responsible for managing the trust assets, exercising voting rights, and making decisions on behalf of the beneficiaries. The trustee must act in the best interest of the beneficiaries and adhere to the terms of the trust agreement. Trustees can be individuals or entities, such as trust companies or banks. Beneficiaries are the individuals or entities who benefit from the voting trust. They may receive income or assets from the trust or benefit from the trustee's management of the voting rights. The trust agreement should clearly identify the beneficiaries and outline their rights and interests in the trust. Voting trusts are designed to centralize control over voting rights. The trustee exercises these rights on behalf of the beneficiaries, making decisions that impact the direction and management of the corporation or entity in question. The trust agreement should provide clear guidance on how the trustee is expected to exercise these rights and the extent of their authority. To form a voting trust, the parties involved must draft and execute a trust agreement. This document must comply with the applicable state laws and regulations governing trusts. It should also include all necessary provisions to ensure the trust's validity and enforceability, such as the names of the trustee and beneficiaries, the purpose of the trust, and the duration of the trust. The duration of a voting trust is typically specified in the trust agreement. State laws may impose limitations on the maximum duration of voting trusts. The trust agreement should also provide for the circumstances under which the trust may be terminated, such as the occurrence of a specific event, the passage of a certain period, or the discretion of the trustee or beneficiaries. Voting trusts may be subject to disclosure and reporting requirements under federal and state securities laws. These requirements may include periodic reporting of the trust's activities, disclosing the existence of the trust to shareholders, and providing information about the trust to regulatory agencies. The trust agreement should outline the trustee's responsibilities for meeting these requirements. Voting trusts must comply with various federal and state laws governing trusts, securities, and corporate governance. These may include the Uniform Trust Code, state trust laws, the Securities Exchange Act of 1934, and the rules and regulations of the Securities and Exchange Commission (SEC). Compliance with these laws and regulations is essential to ensure the trust's validity and protect the interests of the trustee and beneficiaries. One of the primary benefits of incorporating a voting trust into estate planning is centralized management. By consolidating voting rights under a single trustee, decision-making processes can be streamlined, and the trustee can act swiftly to protect the interests of the beneficiaries. This can be especially useful for businesses or other entities where decision-making can become complicated due to the involvement of multiple stakeholders. Another significant advantage of voting trusts in estate planning is succession planning. By establishing a voting trust, individuals can ensure that their interests in the corporation or entity continue to be managed effectively after their death. This can help avoid disputes among heirs and ensure that the business or entity remains stable and profitable. Voting trusts can also provide confidentiality for individuals involved in estate planning. By consolidating voting rights under a trustee, individuals can avoid disclosing their interests in the corporation or entity to the public. This can be especially useful for high-net-worth individuals who value their privacy. Voting trusts can also provide asset protection for individuals involved in estate planning. By centralizing control over voting rights, individuals can protect their interests from potential creditors or legal claims. This can be particularly useful for individuals who own significant assets or have complex financial situations. Family businesses can benefit significantly from incorporating a voting trust into estate planning. By centralizing control over voting rights, the trustee can manage the business's affairs and ensure a smooth transition of ownership to the next generation. This can help avoid disputes among family members and ensure the continued success of the business. Individuals with complex investment portfolios can also benefit from incorporating a voting trust into estate planning. By consolidating control over voting rights, the trustee can make informed decisions regarding the management of investments and ensure that the individual's interests are protected. This can be especially useful for high-net-worth individuals with diversified investment portfolios. Voting trusts can also be used to support philanthropic endeavors. By establishing a voting trust, individuals can ensure that their interests in charitable organizations are managed effectively after their death. This can help ensure that their charitable legacy continues and that their contributions have a lasting impact. Voting trusts can also be used for multi-generational wealth transfer. By establishing a voting trust, individuals can ensure that their interests in the corporation or entity are managed effectively over multiple generations. This can help ensure that the family's wealth is preserved and that the business or entity remains successful for years to come. Estate planning lawyers play a crucial role in the formation of voting trusts. They can help individuals assess the need for a voting trust, draft the trust agreement, and ensure compliance with legal requirements. Estate planning lawyers can also coordinate with other professionals, such as financial advisors and accountants, to ensure that the trust meets the individual's needs and objectives. Voting trusts can also present several challenges and risks that individuals should be aware of. Conflicts of interest can arise among beneficiaries, mismanagement by trustees can occur, and disputes among beneficiaries can become complicated. Regulatory scrutiny and litigation can also be potential risks associated with voting trusts. Individuals should carefully consider these risks and consult with an estate planning lawyer to determine if a voting trust is appropriate for their situation. While voting trusts can be a useful tool in estate planning, they are not suitable for everyone. Individuals should consider alternatives such as proxy voting, shareholders' agreements, family-limited partnerships, and other types of trusts, such as living trusts or irrevocable trusts. Voting Trusts are a valuable tool for individuals involved in estate planning, as they provide centralized control over voting rights and ensure the smooth transfer of wealth and the continued success of businesses. By incorporating a Voting Trust in estate planning, individuals can benefit from centralized management, succession planning, confidentiality, and asset protection, among other advantages. However, Voting Trusts also present potential challenges and risks that individuals should be aware of. To mitigate these risks and ensure that the Voting Trust meets its needs and objectives, individuals should follow best practices and seek the services of an estate planning lawyer. Estate planning lawyers play a crucial role in the formation of Voting Trusts, helping individuals assess the need for trust, drafting the trust agreement, and ensuring compliance with legal requirements. Therefore, it is recommended that individuals seek the services of an experienced estate planning lawyer to assist them in the formation of a Voting Trust.Definition of Voting Trust

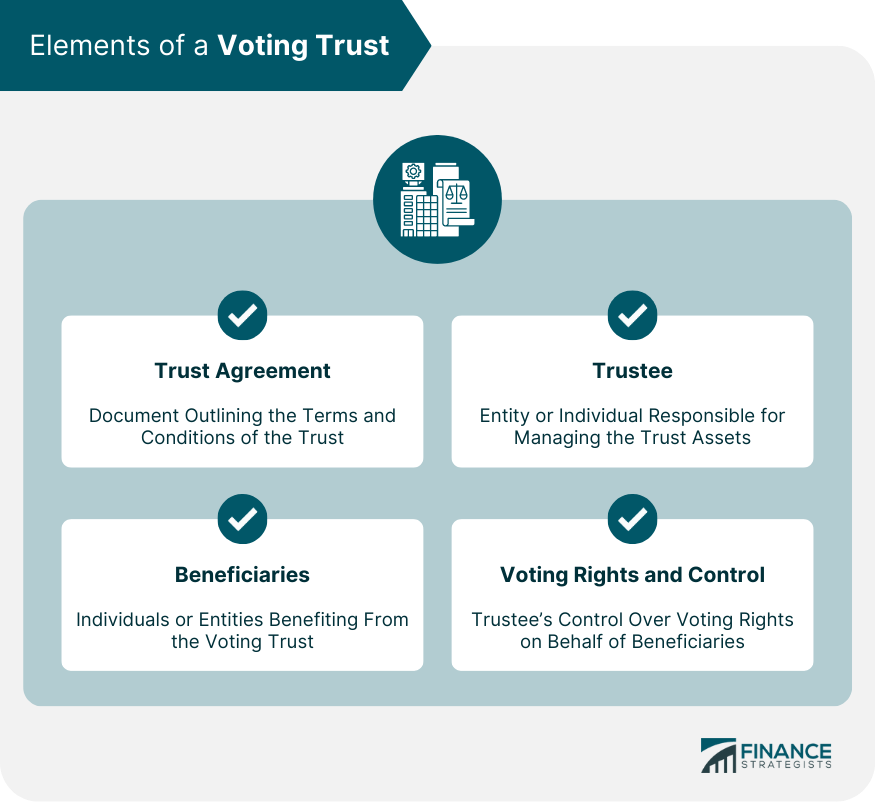

Elements of a Voting Trust

Trust Agreement

Trustee

Beneficiaries

Voting Rights and Control

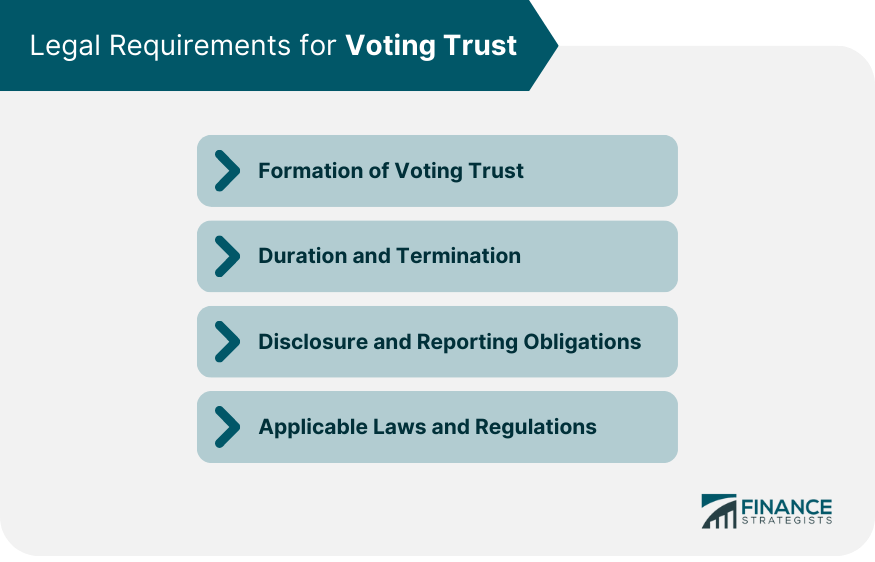

Legal Requirements for Voting Trust

Formation of Voting Trust

Duration and Termination

Disclosure and Reporting Obligations

Applicable Laws and Regulations

Voting Trust in Estate Planning

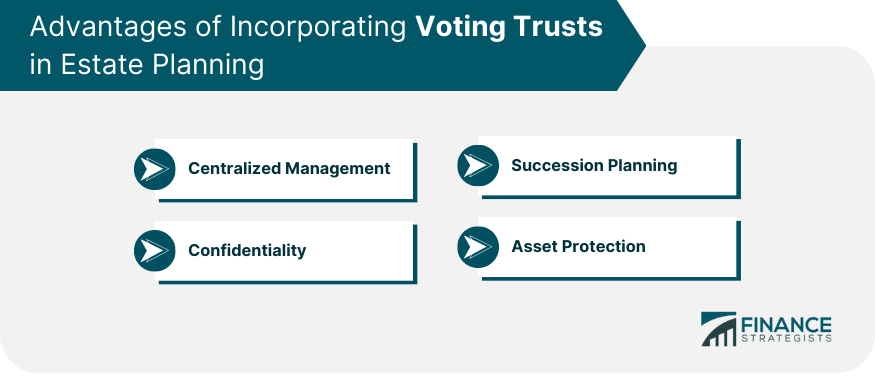

Advantages of Incorporating Voting Trusts in Estate Planning

Centralized Management

Succession Planning

Confidentiality

Asset Protection

Estate Planning Strategies With Voting Trust

Family Businesses

Investment Portfolios

Philanthropic Endeavors

Multi-Generational Wealth Transfer

Estate Planning Lawyer's Role in Voting Trust Formation

Potential Challenges and Risks in Voting Trust

Alternatives to Voting Trust

Bottom Line

Voting Trust FAQs

A Voting Trust is a legal arrangement where shareholders transfer their voting rights to a trustee who exercises these rights on their behalf.

Estate planning lawyers play a crucial role in the formation of Voting Trusts. They can help individuals assess the need for a Voting Trust, draft the trust agreement, and ensure compliance with legal requirements.

Incorporating a Voting Trust in estate planning can provide centralized management, succession planning, confidentiality, and asset protection. It can also be used for philanthropic endeavors and multi-generational wealth transfer.

Voting Trusts can present challenges and risks, such as conflicts of interest, mismanagement by trustees, disputes among beneficiaries, regulatory scrutiny, and litigation.

Yes, alternatives to Voting Trusts in estate planning include proxy voting, shareholders' agreements, family limited partnerships, and other types of trusts, such as living trusts or irrevocable trusts.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.