Trustee fees are compensation paid to a trustee for their services. They are an essential consideration for anyone who is setting up a trust or managing an existing trust. The trustee is responsible for managing the assets held in the trust and ensuring that the trust is administered in accordance with the trust document. In exchange for their services, trustees are entitled to a fee, which can vary based on a number of factors, including the type of trust, the assets held in the trust, and the services provided by the trustee.

When establishing a trust, it is imperative to include details regarding the compensation of the trustee in the trust document. The payment structure can be determined based on the size of the trust and the trustee's duties. For larger trusts, the trustee may be paid a percentage of the assets held in the trust each year, while a flat dollar amount or hourly rate may be more suitable for smaller trusts. The grantor holds the authority to determine the terms of payment for the trustee, which can include setting a maximum limit on the trustee fees that can be paid out. Furthermore, the grantor can establish different payment terms for any subsequent trustees named in the document. In the absence of any mention of trustee fees in the trust document, state laws will come into play to determine the payment structure. Typically, the same guidelines for executor fees are followed. In addition, state laws may also lay out the payment terms for successor trustees. An hourly fee is a common method of trustee compensation, where the trustee is paid a predetermined hourly rate that usually falls between $100 and $175 per hour for their services. This approach provides a clear and straightforward way to calculate the trustee's earnings based on the time they spend managing the trust. The hourly fee structure encourages the trustee to work efficiently while ensuring they are fairly compensated for their time and effort. However, it may not be the best option for trusts with a significant amount of assets or complex management needs, as the trustee's fees could become excessive. A fixed fee is another method of trustee compensation, in which the trustee receives a predetermined, flat amount for their services. This fee structure is typically agreed upon in advance and can be paid in a lump sum or through periodic payments. The fixed fee approach which usually starts at $1,000, provides certainty for both the trustee and the beneficiaries, as the compensation is set and will not change regardless of the time spent on trust administration. However, this method may not be appropriate for all trusts, as it may not adequately compensate the trustee for complex or time-consuming tasks. Percentage-based fee structures tie trustee compensation to the value of the assets held in the trust. In this arrangement, the trustee receives a percentage usually from 1% to 1.5% of the value of the trust assets per year of the trust's assets as payment for their services. This approach can be advantageous for trustees managing large or high-value trusts, as their compensation will be commensurate with the size and complexity of the trust. However, it may not be suitable for smaller trusts or those with assets that fluctuate in value, as it could lead to inconsistent or disproportionate compensation. A performance-based fee structure rewards the trustee based on the performance of the trust's assets. This approach aligns the trustee's financial interests with those of the beneficiaries, incentivizing the trustee to maximize the trust's returns. While performance-based fees can encourage the trustee to actively manage the trust's assets, they may also introduce conflicts of interest or encourage excessive risk-taking. It is essential to carefully consider the potential implications of a performance-based fee structure before implementing it. This percentage can vary depending on the size of the trust. It's common for trustees to charge around 1% and 1.5% of the trust's assets annually, but this can be higher or lower depending on the circumstances. Several factors can influence the amount of trustee fees charged. These include: A trust that holds primarily liquid assets, such as cash or securities, may have lower trustee fees than a trust that holds primarily illiquid assets, such as real estate or closely held business interests. Managing illiquid assets requires more time and effort on the part of the trustee. A trust with a more intricate document, such as a trust that includes provisions for charitable donations, may require more time and effort from the trustee. Similarly, a trust that has a unique investment strategy, such as investing in hedge funds or private equity, may require a higher level of investment expertise from the trustee. This can result in higher trustee fees to compensate for the additional time and expertise required. If the trust requires frequent attention and management, such as a trust that pays out monthly distributions, the trustee may charge higher fees to account for the additional time and effort required to manage the trust. The complexity of the assets and investments held in the trust can also play a role in the amount of time required to manage the trust. A trust that has a complex investment strategy may require a trustee with a high level of investment expertise, which may result in higher trustee fees. In addition, if the trust includes provisions for tax planning or estate planning, the trustee may need to possess specialized knowledge in these areas, which can also result in higher fees. When determining trustee fees, there are no set rules, but there are common guidelines that can be followed. Trustee fees usually begin at a minimum of 1% for larger trusts with substantial assets. For instance, a trust with $10 million in assets could result in a fee of $100,000 per year. Smaller trusts may have a different fee structure. A trust with $100,000 in assets may follow the 1% rule, which means the trustee would receive $1,000 annually. However, if the trust requires minimal management, a flat fee of $1,000 may be more appropriate. A mutually agreed-upon fee structure can be negotiated if an individual is selected as a trustee instead of an institution. When selecting a financial institution as a corporate trustee, it is possible to request an explanation of their fees before making any decisions. If someone is asked to serve as a trustee, they should consider the expected commitment and the value of their time. While an hourly rate similar to that of an attorney may not be feasible for those who are not licensed, they should not undercharge themselves either. It is important to find a fair and reasonable fee structure that takes into account the time and effort required to manage the trust effectively. Trustee fees are paid out of the assets held within the trust, rather than directly from the grantor's personal funds. The frequency at which trustee fees are paid can be specified in the trust document, with options typically ranging from once per year to quarterly. In addition to their fee, trustees are also entitled to reimbursement for any out-of-pocket expenses incurred while managing the trust. Such expenses include travel costs, storage fees, taxes, or insurance premiums. Trustees must maintain accurate records of these expenses in order to claim reimbursement, regardless of whether the trust document outlines specific guidelines for reimbursement. State laws play a significant role in governing trustee compensation. Each state has its own rules and regulations that outline how trustees should be compensated for their services. These laws may set maximum compensation levels or provide guidance on how to calculate trustee fees based on the trust's assets, the trustee's time and effort, or other factors. It is essential for trustees and beneficiaries to familiarize themselves with the applicable state laws to ensure that trustee compensation complies with legal requirements. The Uniform Trust Code (UTC) is a set of model laws designed to provide a consistent legal framework for trusts across the United States. While not all states have adopted the UTC, many have incorporated its provisions into their own trust laws. The UTC offers guidance on trustee compensation, suggesting that trustees should receive "reasonable compensation" for their services. The term "reasonable" is open to interpretation, and it is ultimately up to the trustee, beneficiaries, and the courts to determine what constitutes reasonable compensation based on the specific circumstances of the trust. The trust agreement itself may also dictate the terms of trustee compensation. The trust's grantor may include specific provisions outlining the trustee's fees or compensation structure. In such cases, the trustee and beneficiaries must adhere to the terms of the trust agreement when determining and paying trustee compensation. If the trust agreement does not provide clear guidance on trustee compensation, the trustee and beneficiaries should look to state laws and the UTC for direction. Trustee fees have important tax implications both for the trust and the trustee. From a tax perspective, there are two key rules to be aware of when setting up a trust or serving as a trustee. First, trustee fees are deductible for the trust. This means that the cost of paying trustee fees can be deducted from the income of the trust when calculating taxes owed. Second, trustee fees are considered taxable income for the trustee. This means that the trustee must report the fees they receive as income on their personal tax return. For professional trustees, this income is also subject to self-employment tax. It is vital for individuals setting up a trust to consider the tax implications of trustee fees when developing their estate plan. Similarly, individuals who are asked to serve as trustees should be aware of how receiving fees as taxable income may impact their personal tax liability when they file their taxes. Transparency is crucial when it comes to trustee compensation. The trustee should provide clear and detailed information about their fees to the beneficiaries, and any changes to the trustee's compensation should be communicated openly and promptly. By fostering a transparent environment, the trustee can help build trust with the beneficiaries and prevent misunderstandings or disputes over their fees. Trustee compensation should be fair and reasonable based on the specific circumstances of the trust. Factors such as the complexity of the trust, the size of the trust, the type of assets held in trust, and the geographic location should be considered when determining the trustee's fees. By ensuring that the trustee's compensation is fair, the trustee can maintain a positive relationship with the beneficiaries and fulfill their fiduciary duties effectively. Seeking expert advice from legal or financial professionals can be beneficial when determining trustee compensation. Professionals with experience in trust administration can provide valuable guidance on what constitutes fair and reasonable compensation based on the specific circumstances of the trust. By consulting with experts, trustees and beneficiaries can ensure that the trustee's fees are in line with industry standards and comply with applicable laws and regulations. Proper documentation of trustee compensation is essential to prevent misunderstandings or disputes between the trustee and the beneficiaries. The trust agreement should clearly outline the trustee's fees or compensation structure, and any changes to the trustee's compensation should be documented in writing. Maintaining thorough and accurate records of the trustee's fees can help provide transparency and serve as evidence in the event of a dispute or legal challenge. Trustee fees are the compensation paid to the trustee for managing and administering the assets held in a trust. The payment structure of trustee fees can vary depending on the size of the trust, the trustee's duties, and the type of trust being managed. Factors that influence trustee fees include the complexity of the trust document, the amount of time required to manage the trust, the type of trust being managed, and the level of expertise required of the trustee. While there are no set rules, common guidelines suggest that trustee fees usually begin at a minimum of 1% for larger trusts with substantial assets. It is crucial to find a fair and reasonable fee structure that takes into account the time and effort required to manage the trust effectively. Trustees are entitled to reimbursement for any out-of-pocket expenses incurred while managing the trust. It is important to note that trustee fees are deductible for the trust and are considered taxable income for the trustee. Therefore, it is recommended to seek the advice of a financial advisor to help you navigate the complexities of trustee fees and other tax implications. What Are Trustee Fees?

Trustee Fee Structure

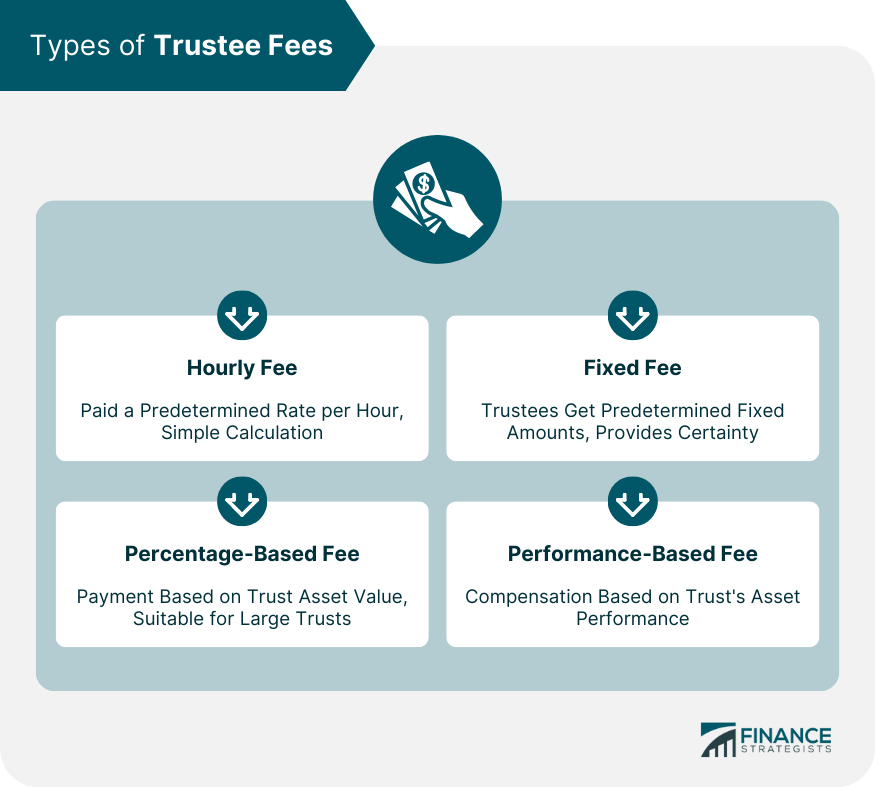

Types of Trustee Fees

Hourly Fee

Fixed Fee

Percentage-Based Fee

Performance-Based Fee

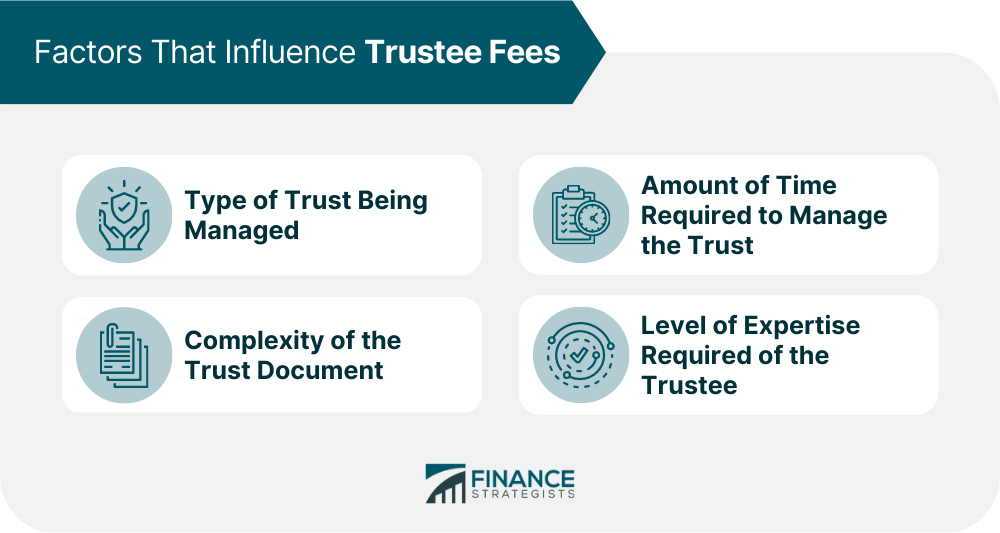

Factors That Influence Trustee Fees

Type of Trust Being Managed

Complexity of the Trust Document

Amount of Time Required to Manage the Trust

Level of Expertise Required of the Trustee

How Much Is the Typical Trustee Fee?

Trustee Fee Payment

Legal Requirements for Trustee Fees

State Laws

Uniform Trust Code

Trust Agreement

Tax Treatment of Trustee Fees

Best Practices for Trustee Fees

Transparency

Fairness

Expert Advice

Documentation

Final Thoughts

Trustee Fees FAQs

The factors that influence trustee fees can vary based on the type of trust and the complexity of its administration. Some common factors that can affect trustee fees include the size of the trust estate, the amount of time and effort required to manage the trust, the degree of responsibility and liability involved, and the experience and qualifications of the trustee.

Trustee fees are typically paid out of the trust estate itself. The terms of the trust document will usually specify how much the trustee is entitled to be paid and how often they will receive payments. In some cases, the trustee may be required to submit invoices or other documentation to support their fees.

The determination of a fair trustee fee will depend on a variety of factors. Generally, a trustee's fee should reflect the amount of time and effort required to manage the trust, as well as their level of expertise and the level of risk involved. In some cases, it may be appropriate to consult with a financial advisor or attorney to determine a reasonable fee.

The amount of trustee fees can vary widely depending on the type and complexity of the trust, as well as other factors such as the location of the trustee and the size of the trust estate. Generally, trustee fees range from 1% to 2% of the trust estate annually, but fees can be higher or lower depending on the specific circumstances.

The trustee is typically paid according to the terms of the trust document, which may specify how often payments should be made and what documentation is required to support the fees. In some cases, the trustee may receive payments quarterly or annually, while in other cases they may be paid on a more frequent basis. Payments are typically made directly from the trust estate to the trustee.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.