Estate planning refers to the preparation of tasks aimed at managing an individual's asset base in the event of their incapacity or death. The planning includes the bequest of assets to heirs and the settlement of estate taxes. Most plans are set up with the help of an attorney experienced in estate law. Estate planning takes on added layers of complexity when it caters to people with disabilities. The process is crucial to ensure that the person with the disability continues to receive proper care and maintain their quality of life after the parents or caregivers have passed on. Additionally, a well-crafted plan can provide financial security without jeopardizing the person's eligibility for public benefits. Intellectual disabilities, encompassing conditions like Down syndrome and Autism, often require lifelong care and supervision. Individuals with such disabilities may need assistance with daily living activities, continuous education, and social engagement opportunities. Estate plans for individuals with intellectual disabilities need to account for continuous care needs. This often includes the creation of a special needs trust, which can provide funds for care without disqualifying the individual from public benefits. Guardianships are another crucial aspect, where the estate plan must provide for a trusted individual or organization to make decisions on behalf of the person when their primary caregiver is no longer able to do so. Individuals with physical disabilities, such as cerebral palsy or spinal cord injuries, may have different estate planning needs. While they may be intellectually capable of making decisions for themselves, they often have significant physical needs. Estate plans for individuals with physical disabilities must consider funds for accessibility modifications in the home, specialized medical equipment, and possibly regular therapy or personal care assistance. If the physical disability may lead to future incapacitation, setting up a durable power of attorney can ensure that a trusted individual can make decisions on behalf of the person with the disability. This legal document is crucial for managing both financial and healthcare decisions when the individual cannot do so themselves. A special needs trust is a legal instrument specifically designed to hold assets for a person with disabilities without affecting their eligibility for public benefits. Setting up a special needs trust involves legal expertise. An experienced attorney drafts the trust document, which names a trustee and outlines how the funds should be used. Third-party special needs trusts are funded by someone other than the beneficiary, often parents or relatives. In contrast, self-settled trusts are funded with the beneficiary's assets, such as from a lawsuit settlement. Guardianship and conservatorship grant authority to an individual (the guardian or conservator) to make decisions on behalf of the person with the disability (the ward) who lacks the capacity to do so. Establishing guardianship or conservatorship requires a court process. A petition must be filed in the relevant court, accompanied by medical documentation to prove the ward's incapacity. A power of attorney (POA) is a legal document that grants one person (the agent) the authority to act on another person's (the principal's) behalf. A POA for a person with disabilities should ideally include both financial and healthcare matters. Selecting the right person as the agent is critical. The individual must be trustworthy, capable of handling the responsibilities, and ideally, familiar with the principal's values, wishes, and needs. An advance healthcare directive ensures that the person's healthcare wishes are followed when they cannot communicate or make decisions independently. Creating a healthcare directive involves documenting the individual's preferences for future medical care. It often includes provisions for end-of-life care and names a healthcare proxy to make decisions if the individual is unable to do so. Achieving a Better Life Experience (ABLE) accounts are tax-advantaged savings accounts for individuals with disabilities. Funds in these accounts do not count towards the asset limits for means-tested public benefits. Setting up an ABLE account involves choosing a suitable state program (it need not be the person's home state), meeting eligibility requirements, and completing the necessary paperwork. A letter of intent is a comprehensive document providing guidance to future caregivers. While not legally binding, it ensures the continuity of care and quality of life for the person with disabilities. The letter of intent should detail the individual's history, routines, medical care, social activities, and other preferences. It should also include relevant contact information for doctors, therapists, and other crucial parties. A special needs attorney is an essential partner in the estate planning process. Their knowledge and experience in this niche field ensure that all elements of the plan are legally sound and effectively cater to the person's needs. They understand the intricate web of federal and state laws related to disability benefits and can structure the estate plan to maintain these benefits while providing additional financial security. A comprehensive estate plan often involves multiple professionals. Financial advisors can provide insights into investment strategies and tax implications. Social workers or care coordinators can offer their expertise on daily care needs, available services, and eligibility for different programs. Choosing professionals to aid in estate planning should involve careful consideration. Look for professionals with experience in special needs planning, a good reputation, and the ability to communicate complex concepts clearly. Consultations before deciding on a professional can help gauge whether they are a good fit for your unique situation. Supplemental Security Income and Medicaid are critical for many people with disabilities. SSI provides a monthly income to individuals with disabilities who have limited income and resources. Medicaid offers health coverage to eligible low-income adults, children, pregnant women, elderly adults, and people with disabilities. Estate planning can impact SSI and Medicaid eligibility due to their income and asset limits. A poorly planned inheritance or a lump-sum settlement can disqualify a person with disabilities from these benefits. However, tools like special needs trusts and ABLE accounts can help maintain eligibility. Maintaining eligibility for SSI and Medicaid is often crucial for financial stability and healthcare coverage. Losing these benefits can be catastrophic, making it essential to consider them in the estate planning process. Life insurance plays a crucial role in estate planning, offering a source of funding for future care needs. It can be directed to a special needs trust to avoid disqualification from government benefits. The right life insurance plan depends on several factors, such as the amount needed for future care, premium affordability, and the health of the person purchasing the policy. Term life insurance or permanent life insurance like whole or universal life insurance could be options depending on individual circumstances. Common mistakes include procrastinating estate planning, disinheriting the person with disabilities to preserve benefit eligibility, or leaving assets directly to them, which can jeopardize their government benefits. Avoid these mistakes by consulting with a special needs attorney and starting the planning process early. Regularly reviewing and updating the estate plan ensures it continues to meet the person's needs as circumstances change. These changes could be related to health, finances, or laws governing public benefits. Estate planning for people with disabilities requires careful consideration of their unique needs and circumstances. Special needs trusts play a vital role in providing lifelong care without jeopardizing eligibility for public benefits. Designating guardianships and establishing powers of attorney ensure decision-making continuity. Components such as advance healthcare directives and ABLE accounts further support comprehensive planning. Collaborating with professionals experienced in special needs planning is crucial. Maintaining eligibility for Supplemental Security Income (SSI) and Medicaid is vital, and life insurance can provide funding for future care. Avoiding common pitfalls and regularly reviewing the estate plan ensures its effectiveness over time. By addressing these key aspects, individuals with disabilities can secure their financial well-being and quality of life.Overview of Estate Planning for People With Disabilities

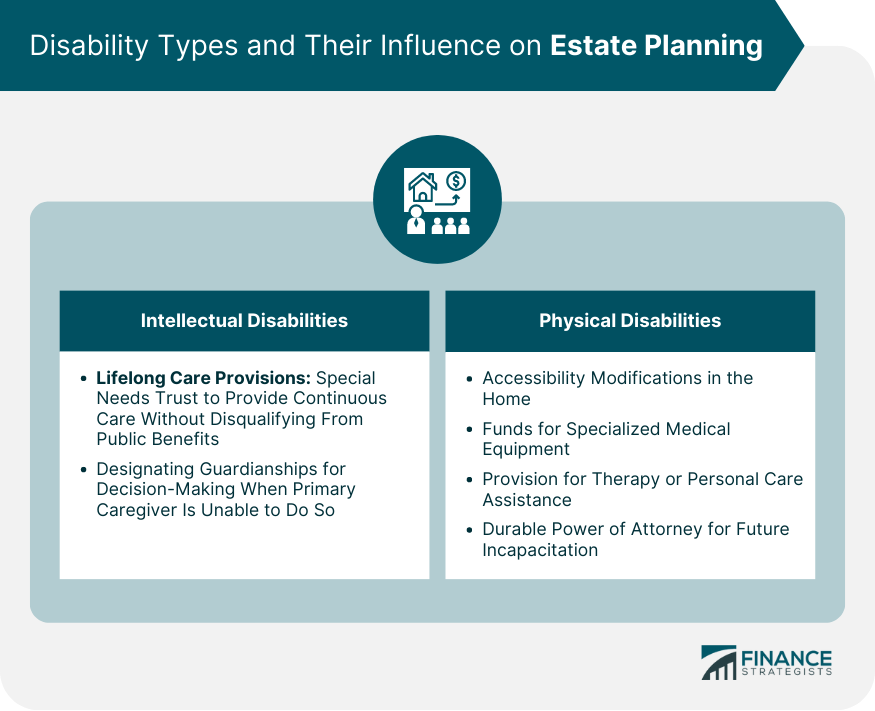

Disability Types and Their Influence on Estate Planning

Intellectual Disabilities

Lifelong Care Provisions

Designating Guardianships

Physical Disabilities

Accessibility and Medical Needs

Power of Attorney

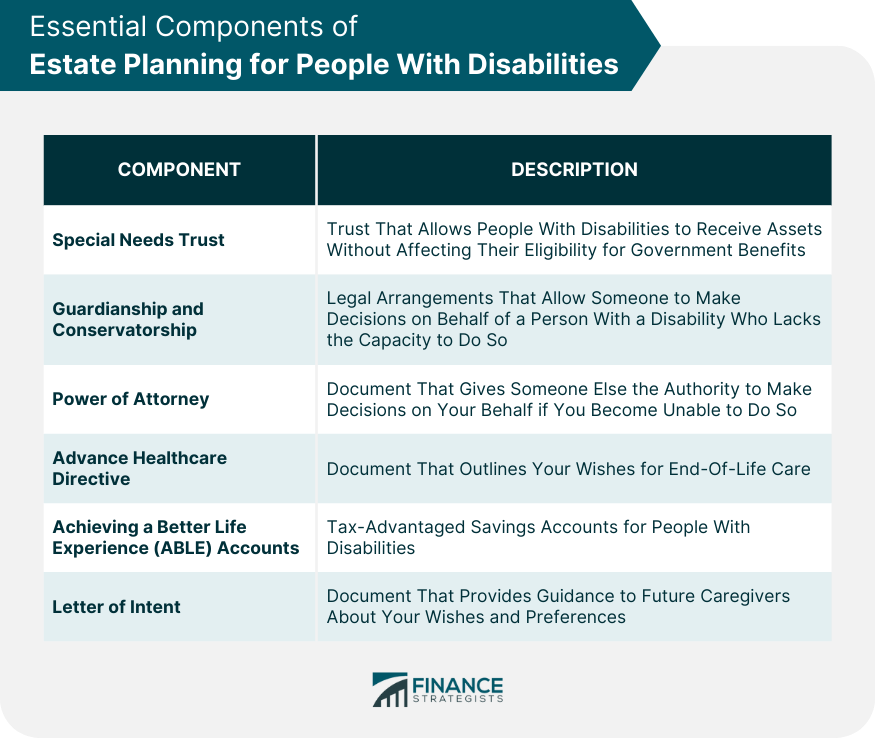

Essential Components of Estate Planning for People With Disabilities

Special Needs Trusts

Guardianships and Conservatorships

Power of Attorney

Advance Healthcare Directives

ABLE Accounts

Letter of Intent

Working With Professionals

Special Needs Attorney

Other Professionals

Government Benefits and Estate Planning

Supplemental Security Income (SSI) and Medicaid

How Estate Planning Affects SSI and Medicaid

Maintain Eligibility

Life Insurance and Disability

Role of Life Insurance in Estate Planning

How to Choose the Right Life Insurance Plan

Potential Pitfalls in Estate Planning for People With Disabilities

Common Mistakes and How to Avoid Them

Importance of Regular Review and Update of the Estate Plan

Bottom Line

Estate Planning for People With Disabilities FAQs

A special needs trust holds assets for a person with disabilities without affecting their eligibility for public benefits such as SSI and Medicaid.

An ABLE account is a tax-advantaged savings account that doesn't count towards the asset limits for means-tested public benefits, providing a way to save for future expenses.

Common mistakes include waiting too long to start planning, disinheriting the person with disabilities to preserve benefit eligibility, or leaving assets directly to them, which can jeopardize their government benefits.

Life insurance can offer a source of funding for future care needs. It can be directed to a special needs trust to avoid disqualification from government benefits.

Professionals such as special needs attorneys and financial advisors have the expertise needed to navigate the complex legal and financial aspects of planning an estate for a person with disabilities.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.