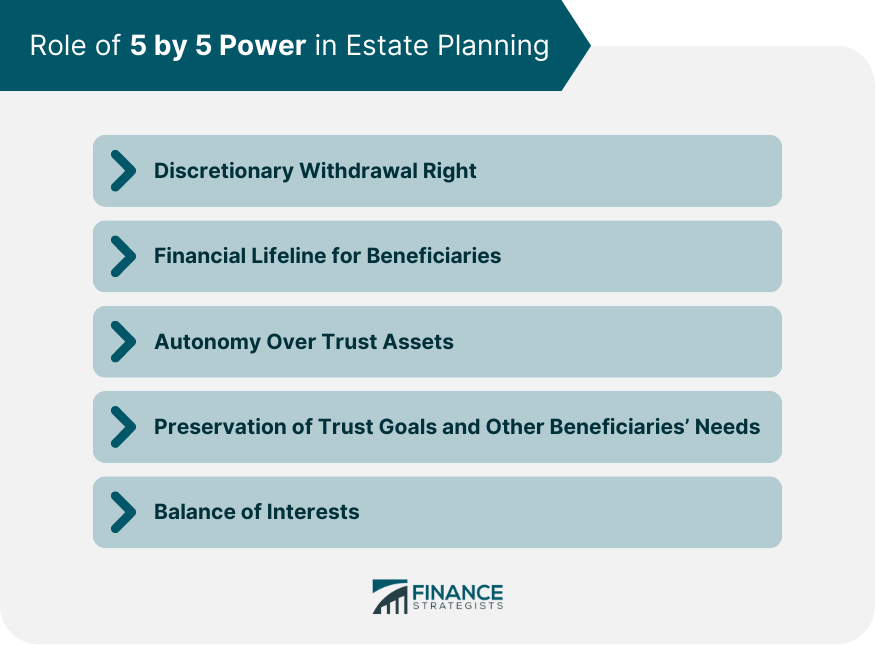

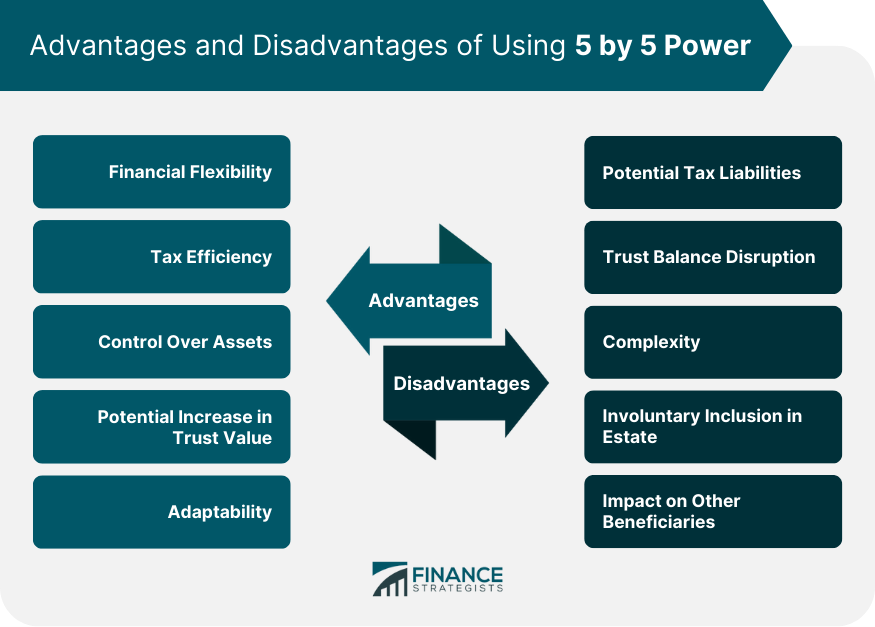

The 5 by 5 Power is a fundamental provision within trust agreements that offers beneficiaries the option to withdraw the greater of $5,000 or 5% of the trust assets annually. This clause is a key consideration in trust management and estate planning, with its purpose being to provide financial flexibility to beneficiaries without disrupting the overall goals of the trust. It impacts beneficiaries by potentially influencing their tax liabilities depending on whether they choose to exercise their withdrawal rights. Furthermore, it can affect the asset distribution dynamics within the trust. For trustees and individuals involved in trust transactions, understanding the 5 by 5 Power is crucial as it holds significant implications for the effective and tax-efficient management of trust assets. The 5 by 5 Power essentially revolves around withdrawal rights and the role of beneficiaries. Beneficiaries, under this provision, can exercise their withdrawal rights to access a portion of the trust assets. While this can provide a level of financial liberty to beneficiaries, it also carries a set of implications. For one, the exercising of withdrawal rights can affect the trust's value and the subsequent distribution of assets among other beneficiaries. On the other hand, if beneficiaries choose not to exercise these rights, it may cause potential complications, such as inadvertent tax consequences or a shift in the trust's asset distribution dynamics. The 5 by 5 Power has substantial tax implications. When beneficiaries exercise their withdrawal rights, they might need to account for this distribution in their income tax returns. Depending on the size and type of the trust, this could potentially lead to significant tax liabilities. The dynamics of 5 by 5 Power aren't always straightforward. Certain circumstances can significantly influence its operation. One such scenario is when beneficiaries choose not to exercise their withdrawal rights. This inaction can alter the financial composition of the trust and could potentially create unexpected tax liabilities for the beneficiary. Moreover, in the event of a beneficiary's death, the implications of the 5 by 5 Power become more complex. The deceased beneficiary's estate might become subject to additional estate taxes, and the remaining trust assets' distribution could be affected significantly. The 5 by 5 Power assumes a significant role as it introduces an element of adaptability into the process of trust management. This provision allows beneficiaries the discretionary right to withdraw either $5,000 or 5% of the trust's assets annually, whichever is higher. This withdrawal right extends a financial lifeline to beneficiaries, enabling them to meet immediate needs or unexpected expenses, without the risk of destabilizing the trust's foundational structure or deviating from its established objectives. This flexibility not only provides beneficiaries with a degree of autonomy over the trust's assets but also ensures that the trust's long-term goals and the needs of other beneficiaries remain undisturbed. The 5 by 5 Power thus carefully balances individual beneficiary interests with the overarching intent of the trust, making it a valuable component in the realm of estate planning. Financial Flexibility: The 5 by 5 Power provides beneficiaries with a degree of financial independence by allowing them access to a portion of the trust's assets. Tax Efficiency: By enabling beneficiaries to withdraw trust assets, the 5 by 5 Power can help minimize the total taxable estate. Control Over Assets: It provides beneficiaries with a measure of control over trust assets without disrupting the overall trust structure. Potential Increase in Trust Value: If beneficiaries decide not to exercise their withdrawal rights, the value of the trust could potentially increase. Adaptability: The 5 by 5 Power creates flexibility in trust management, allowing for adjustments in response to changing financial circumstances of the beneficiaries. Potential Tax Liabilities: Beneficiaries who exercise their withdrawal rights might face increased income tax liabilities. Trust Balance Disruption: Withdrawal of trust assets could potentially disrupt the financial balance of the trust. Complexity: Understanding and managing the implications of the 5 by 5 Power can be complex and may require professional advice. Involuntary Inclusion in Estate: If beneficiaries choose not to exercise their rights, the unwithdrawn amount could be involuntarily included in their taxable estate. Impact on Other Beneficiaries: The withdrawal of assets by one beneficiary could potentially impact the distribution of assets among other beneficiaries. The 5 by 5 Power serves as a pivotal mechanism within trust agreements, granting beneficiaries the flexibility to withdraw trust assets annually. It's a cornerstone within trust management and estate planning, designed to balance beneficiaries' financial needs without disrupting the trust's overarching objectives. Despite the potential for financial autonomy and tax efficiency, beneficiaries must thoughtfully consider the decision to exercise their withdrawal rights, given the significant tax implications that could arise. The provision's complexities underscore the need for expert guidance to navigate the nuanced aspects of trust management. Furthermore, in instances of unexpected events, such as the death of a beneficiary, the implications of the 5 by 5 Power extend further, potentially affecting estate taxes and the distribution of remaining trust assets. Given the potential for disruption to trust balance and inadvertent inclusion in a taxable estate, the 5 by 5 Power presents both advantages and challenges. Ultimately, understanding this provision is critical for any individual involved in trust transactions, ensuring effective and tax-efficient trust management.5 by 5 Power Overview

How 5 by 5 Power Works

Legal Implications of 5 by 5 Power

Tax Implications for Beneficiaries

Circumstances Affecting 5 by 5 Power

Role of 5 by 5 Power in Estate Planning

Advantages of Using 5 by 5 Power in Estate Planning

Disadvantages of Using 5 by 5 Power in Estate Planning

The Bottom Line

5 by 5 Power FAQs

The 5 by 5 Power is a provision in trust agreements that gives beneficiaries the option to withdraw the greater of $5,000 or 5% of the trust's assets annually. This feature offers financial flexibility to beneficiaries and influences the trust's overall management.

The 5 by 5 Power functions around beneficiaries' withdrawal rights. Beneficiaries can choose to exercise these rights to access a part of the trust assets. The decision to exercise or not exercise these rights can have significant implications on the trust's value, asset distribution, and potential tax liabilities.

When beneficiaries exercise their withdrawal rights under the 5 by 5 Power, they may need to report this distribution in their income tax returns, potentially leading to tax liabilities. If they don't exercise these rights, the unwithdrawn amount could be involuntarily included in their taxable estate.

The 5 by 5 Power offers flexibility in trust management, which is crucial in estate planning. It allows beneficiaries to address their financial needs without significantly disrupting the trust's overall structure and objectives.

Using the 5 by 5 Power can lead to increased income tax liabilities for beneficiaries who exercise their withdrawal rights. It can disrupt the financial balance of the trust, complicate trust management, and potentially affect other beneficiaries' asset distribution. Furthermore, unexercised withdrawal rights could lead to involuntary inclusion in a taxable estate.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.