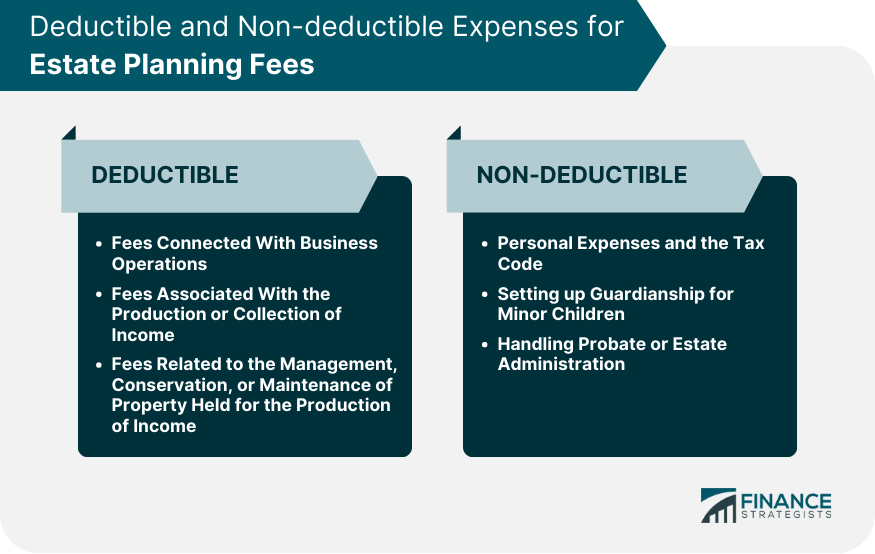

Estate planning fees are considered personal expenses and are not tax-deductible according to the Internal Revenue Service in the United States. However, there can be exceptions. For instance, if the estate planning fees are directly tied to business operations, the production or collection of taxable income, or the management, conservation, or maintenance of the income-generating property, they may be tax-deductible. The IRS provides clear guidelines about what constitutes a deductible expense. For estate planning fees to be tax-deductible, they need to be associated with one of three categories. If an estate planning fee directly relates to your business operations, it might be deductible. For instance, if your estate plan involves the transfer of a family business, you might be able to deduct the legal fees involved in the planning and transfer process. Fees related to producing or collecting taxable income could also be deductible. This might include fees paid to advisors or attorneys to advise on income-generating investments within the estate. Similarly, fees paid for advice on managing, conserving, or maintaining property held for the production of income could be tax-deductible. For example, if you paid fees for advice regarding rental properties in your estate, you might be able to deduct these expenses. While there are instances where estate planning fees may be tax-deductible, there are also clear cases where they are not. Generally, fees considered personal expenses are non-deductible. The IRS typically views estate planning as a personal expense, which is generally non-deductible. This would include fees paid for drafting a will, setting up a living trust, or fees associated with powers of attorney. Fees for services that don't directly correlate to income production, such as setting up guardianship for minor children, are also typically non-deductible. The same applies to the costs of handling probate or estate administration, which are generally considered personal expenses. Maintaining appropriate documentation for all estate planning expenses is crucial, whether or not they are deductible. Without proper documentation, even fees that could potentially be deductible could be disallowed by the IRS. Therefore, it is critical to maintain a thorough and accurate record of all expenses related to estate planning. Appropriate documentation typically includes itemized invoices, receipts, and payment records. It's advisable to ask your attorney or advisor to clearly state the purpose of the fee on any invoice or receipt to establish the potential deductibility. The Tax Cuts and Jobs Act (TCJA) of 2017 significantly changed the landscape of tax deductions, including those related to estate planning fees. The TCJA brought sweeping tax reform with significant implications for individual and corporate taxpayers. One notable change was the suspension of miscellaneous itemized deductions subject to the 2% floor. Miscellaneous itemized deductions were those expenses that taxpayers could deduct from their income to the extent they exceeded 2% of their adjusted gross income. Under TCJA, these deductions have been suspended until 2025, which means that, for the time being, most taxpayers cannot deduct their estate planning fees. Given the complexity of tax law and its implications for estate planning, it is advisable to seek professional advice. Tax advisors can provide valuable guidance on estate planning, including advising on potential tax deductions. They can ensure your estate plan aligns with current tax laws and helps minimize your overall tax burden. When selecting a tax advisor for estate planning, look for someone with expertise in estate law and taxation. They should have a thorough understanding of federal and state tax laws and stay updated on recent changes that could impact your estate plan. While estate planning fees are generally considered personal expenses and, therefore, not tax-deductible according to IRS guidelines, exceptions do exist. If these fees are directly related to business operations, income production, or the management of income-generating property, they may be deductible. However, navigating the complexity of tax law, especially in light of significant changes brought by the Tax Cuts and Jobs Act of 2017, necessitates accurate record-keeping and informed judgment. The deductibility of expenses is a nuanced area of tax law, and the guidance of a knowledgeable tax advisor could prove invaluable. As such, anyone considering estate planning should carefully select an advisor with expertise in estate law and taxation who stays updated on current changes in legislation that may impact their estate plan. The value of professional advice in this intricate area cannot be overstated.Are Estate Planning Fees Tax-Deductible?

When Estate Planning Fees Could Be Tax-Deductible

Fees Connected With Business Operations

Fees Associated With the Production or Collection of Income

Fees Related to the Management, Conservation, or Maintenance of Property Held for the Production of Income

When Estate Planning Fees Are Not Tax-Deductible

Personal Expenses and the Tax Code

Non-deductible Situations in Estate Planning

Documenting Estate Planning Fees for Possible Deduction

Importance of Proper Documentation

What Constitutes Appropriate Documentation

Impact of the Tax Cuts and Jobs Act (TCJA) on Estate Planning Fees Deductibility

Effect of TCJA on Miscellaneous Itemized Deductions

How to Obtain Professional Advice

Role of Tax Advisors in Estate Planning

Choosing the Right Tax Advisor for Estate Planning

The Bottom Line

Are Estate Planning Fees Tax-Deductible? FAQs

Generally, the IRS considers estate planning fees as personal expenses, which are not tax-deductible. However, exceptions may apply if the fees are related to business operations, the production or collection of income, or the management, conservation, or maintenance of property held for the production of income.

Estate planning fees could potentially be tax-deductible when they are directly tied to business operations, the production or collection of taxable income, or the management, conservation, or maintenance of the income-generating property. Each situation is unique and would require careful assessment of the facts and circumstances.

Yes, the TCJA, enacted in 2017, has suspended miscellaneous itemized deductions subject to the 2% floor until 2025. This includes most estate planning fees, making them currently non-deductible for most taxpayers.

Proper documentation is critical for all estate planning expenses, especially if they could be deductible. This includes itemized invoices, receipts, and payment records. It's also beneficial if your attorney or advisor clearly states the purpose of the fee on any invoice or receipt.

Yes, due to the complexity of tax law and its implications on estate planning, it's highly recommended to seek advice from a tax advisor with expertise in estate law and taxation. They can provide valuable guidance and help ensure your estate plan is in line with current tax laws.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.