A voluntary Trust is a legal arrangement in which an individual, known as the trustor or grantor, willingly transfers ownership and control of their assets to a designated trustee. The trustee is responsible for managing these assets according to the terms and conditions specified in the trust agreement, ultimately for the benefit of one or more beneficiaries. Voluntary Trusts are often used in estate planning to achieve various objectives, such as asset protection, tax minimization, privacy, and providing for beneficiaries with special needs.

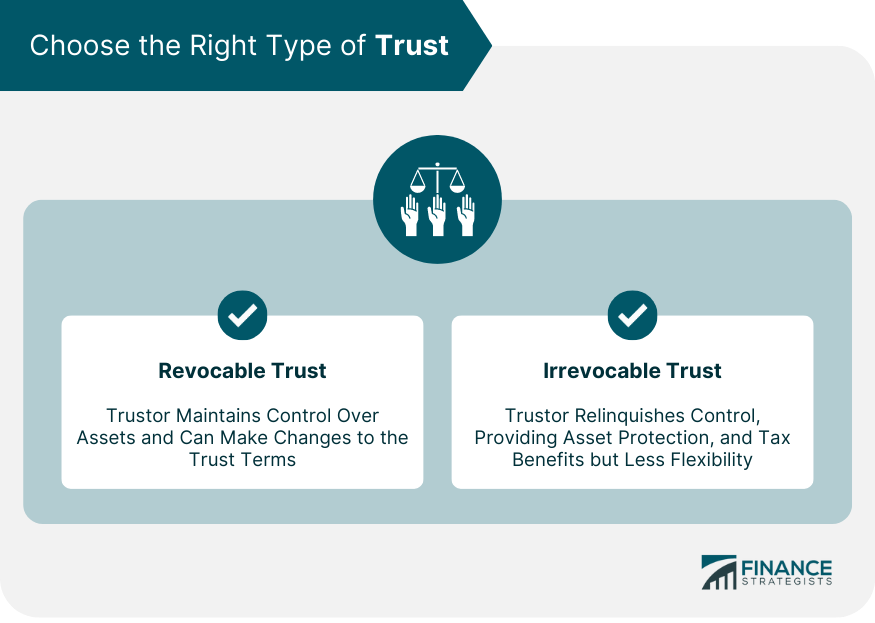

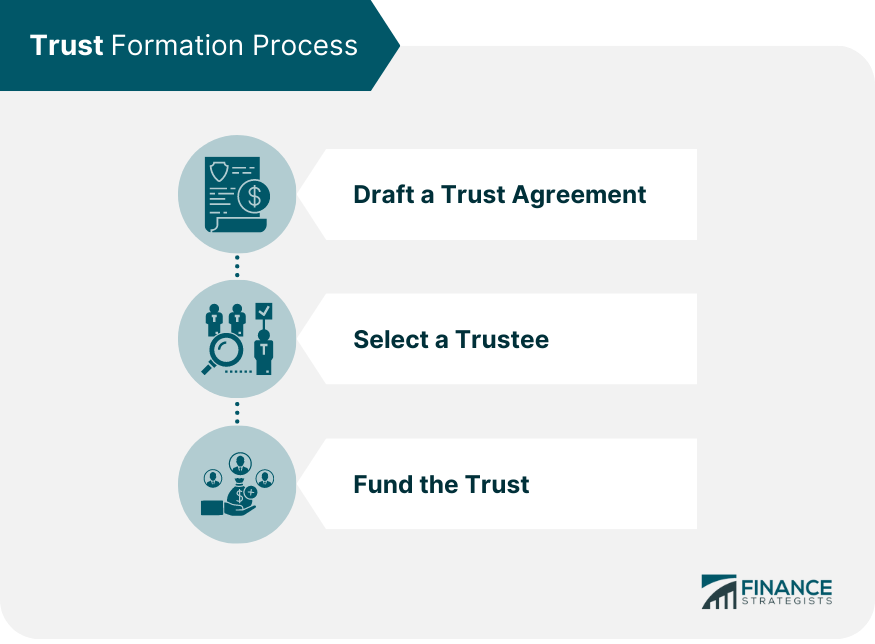

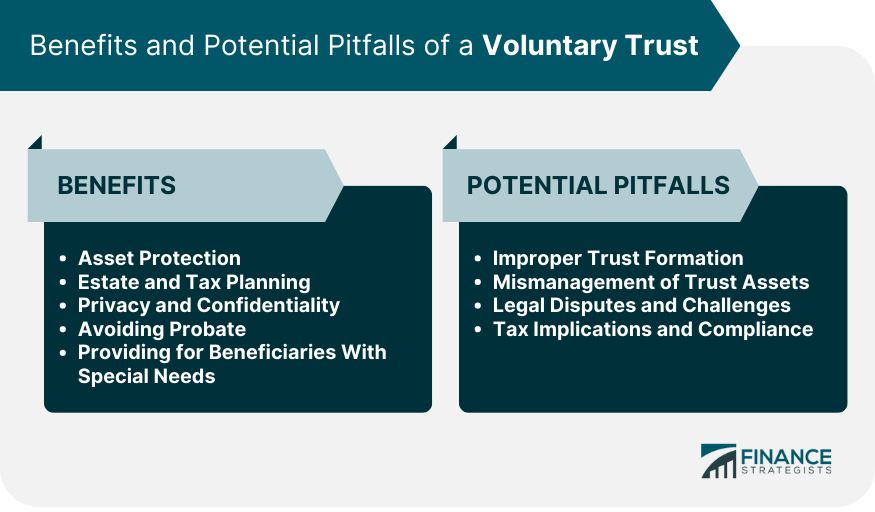

I'm Taylor Kovar, a Certified Financial Planner (CFP), specializing in helping business owners with strategic financial planning. In a notable case, I guided a client through setting up a Voluntary Trust, focusing on diversifying investments across stocks, bonds, and real estate to mitigate risk and enhance growth potential. We capitalized on tax-efficient strategies, such as utilizing annual gift tax exclusions, to transfer wealth into the trust without incurring hefty taxes. This proactive approach not only protected the estate from excessive taxation but also provided a structured way to support the client's beneficiaries with educational expenses and start-up capital for ventures. Let's craft a tailored Voluntary Trust strategy that meets your unique goals. Contact me at (936) 899 - 5629 or [email protected] to discuss how we can achieve your financial objectives. WHY WE RECOMMEND: IDEAL CLIENTS: Business Owners, Executives & Medical Professionals FOCUS: Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation When establishing a voluntary trust, it is essential to understand the different types of trusts available and the process involved in forming one. An estate planning lawyer can provide invaluable guidance and advice throughout this process. There are two main types of voluntary trusts: revocable and irrevocable trusts. The choice between these two options depends on your financial goals and personal circumstances. A revocable trust allows the trustor (the person who creates the trust) to maintain control over the trust assets and make changes to the trust terms during their lifetime. An irrevocable trust, on the other hand, cannot be changed or revoked once it has been established. The trustor relinquishes control over the trust assets, which are managed by a trustee according to the trust terms. Irrevocable trusts can offer greater asset protection and tax benefits but come with less flexibility than revocable trusts. The trust formation process involves three main steps: The trust agreement is a legal document outlining the terms and conditions of the trust. It includes details such as the trust's purpose, the names of the trustor, trustee, and beneficiaries, and the trust's assets. An estate planning lawyer can help draft a comprehensive trust agreement that meets your specific needs and goals. The trustee is responsible for managing the trust assets and ensuring that they are used according to the trust terms. It is crucial to choose a trustworthy and competent individual or institution to serve as a trustee. To establish a trust, it must be funded with assets, such as real estate, cash, stocks, or other property. The process of transferring these assets into the trust is known as "funding." An estate planning lawyer can assist with the proper transfer of assets to ensure the trust is legally and effectively funded. An estate planning lawyer plays a crucial role in trust formation by providing legal advice and guidance, drafting trust documents, and ensuring compliance with laws and regulations. A knowledgeable lawyer can help you choose the right type of trust for your situation, create a well-crafted trust agreement, and guide you through the process of funding the trust. Voluntary trusts offer numerous benefits, including asset protection, estate and tax planning, privacy, and providing for beneficiaries with special needs. An estate planning lawyer can help you maximize these benefits and ensure your trust is set up to achieve your goals. One of the primary advantages of a voluntary trust is its ability to protect assets from creditors, lawsuits, and other potential threats. By placing assets in a trust, they are legally separated from your personal property and can be shielded from creditors' claims. This protection is particularly valuable for business owners or professionals who may face liability risks. Voluntary trusts can also help minimize estate taxes and streamline the transfer of assets to your beneficiaries. By transferring assets to a trust, they are removed from your taxable estate, potentially reducing the amount of estate taxes your beneficiaries may owe. Trusts can also be structured to minimize income taxes, both for the trust itself and the beneficiaries who receive income from the trust. Another benefit of voluntary trust is the privacy it provides. Unlike a will, which becomes a public document when it goes through probate, a trust's terms and the distribution of assets can remain confidential. This privacy can be especially valuable if you wish to keep the details of your estate plan or the extent of your assets away from public scrutiny. Probate is the legal process through which a deceased person's assets are distributed according to their will. It can be a lengthy and expensive process, especially in cases of complex estates or disputes among beneficiaries. By placing assets in a trust, they bypass the probate process, allowing for faster and more efficient distribution of assets to your beneficiaries. Voluntary trusts can be specifically designed to support beneficiaries with special needs, such as physical or mental disabilities. A special needs trust can ensure that a beneficiary's government benefits, like Supplemental Security Income (SSI) or Medicaid, are not jeopardized by an inheritance. The trust can provide supplemental financial support for the beneficiary's needs without affecting their eligibility for government assistance programs. While voluntary trusts offer numerous benefits, there are potential pitfalls and risks to be aware of. These include improper trust formation, mismanagement of trust assets, legal disputes, and tax implications. If a trust is not properly established, it may be deemed invalid, jeopardizing its intended benefits. This can result from a poorly drafted trust agreement, failure to fund the trust, or non-compliance with applicable laws and regulations. Working with an experienced estate planning lawyer can help ensure your trust is correctly formed and legally valid. The trustee has a fiduciary duty to manage the trust assets in the best interests of the beneficiaries. If the trustee fails to fulfill this duty, it may lead to mismanagement, financial loss, or even legal disputes. Choosing a competent and trustworthy trustee is essential to avoid these issues. Trusts can sometimes become the subject of legal disputes, particularly if beneficiaries or other interested parties feel the trust terms are unfair or the trustee is not acting in their best interests. Such disputes can be costly and time-consuming to resolve. An estate planning lawyer can help draft a clear and legally sound trust agreement to minimize the risk of disputes. While trusts can offer tax benefits, they also come with specific tax filing requirements and potential tax implications. Failure to comply with these requirements can result in penalties and fines. An estate planning lawyer can provide guidance on tax compliance and help you navigate the complex tax landscape associated with trusts. There may be circumstances in which it is necessary or desirable to modify or terminate a voluntary trust. Revocable trusts can generally be modified or terminated by the trustor at any time. However, irrevocable trusts are more challenging to change or terminate, as they typically require the consent of the trustor, trustee, and all beneficiaries or a court order. The legal process for modifying or terminating a trust depends on the type of trust and the specific circumstances. For a revocable trust, the trustor can typically amend or revoke the trust by following the procedures outlined in the trust agreement. In the case of an irrevocable trust, it may be necessary to obtain the consent of all parties involved or petition the court for approval. Selecting the right estate planning lawyer is crucial for the successful establishment and management of a voluntary trust. Here are some factors to consider when choosing a lawyer: Look for a lawyer with specific qualifications and experience in estate planning and trust law. This specialized knowledge is essential for ensuring that your trust is established and managed effectively. Choose a lawyer who focuses their practice on estate planning and trusts. A lawyer with this specialization will be well-versed in the latest developments, laws, and regulations related to trusts and can provide the most up-to-date advice and guidance. Understand the fees and billing structure of your prospective lawyer before engaging in their services. Look for transparency in billing and ensure that their fee structure aligns with your budget and expectations. A good estate planning lawyer should be easily accessible and responsive to your questions and concerns. Effective communication is essential for a successful trust establishment and management. Ask for client testimonials or referrals to gauge the quality of service and the level of satisfaction among the lawyer's past clients. This can provide valuable insights into the lawyer's expertise, professionalism, and ability to deliver results. Voluntary Trusts are a powerful and versatile tool in estate planning, offering numerous benefits such as asset protection, tax minimization, privacy, and catering to beneficiaries with special needs. The distinction between revocable and irrevocable trusts is essential to understand, as each offers unique advantages depending on your financial goals and personal circumstances. Engaging an experienced estate planning lawyer is crucial for the successful establishment and management of a Voluntary Trust, as they can provide valuable legal advice, draft comprehensive trust agreements, and ensure compliance with applicable laws and regulations. It is also important to be aware of potential pitfalls, such as improper trust formation and mismanagement of trust assets, and to work with a competent trustee. As you consider incorporating a Voluntary Trust into your estate plan, it is highly recommended to seek professional services from a qualified estate planning lawyer to ensure your trust is effectively structured and managed to achieve your desired objectives.Definition of Voluntary Trusts

Read Taylor's Story

Fee-Only Financial Advisor

Certified Financial Planner™

3x Investopedia Top 100 Advisor

Author of The 5 Money Personalities & Keynote Speaker

Establishing a Voluntary Trust

Choosing the Right Type of Trust

Revocable Trust

This flexibility can be beneficial for those who want to retain the ability to manage their assets and revise their estate plan as their circumstances change.Irrevocable Trust

Trust Formation Process

Drafting a Trust Agreement

Selecting a Trustee

Funding the Trust

Role of an Estate Planning Lawyer in Trust Formation

Benefits of a Voluntary Trust

Asset Protection

Estate and Tax Planning

Privacy and Confidentiality

Avoiding Probate

Providing for Beneficiaries With Special Needs

Potential Pitfalls of a Voluntary Trust

Improper Trust Formation

Mismanagement of Trust Assets

Legal Disputes and Challenges

Tax Implications and Compliance

Modifying or Terminating a Voluntary Trust

Conditions for Modification or Termination

Legal Process for Trust Modification or Termination

Choosing the Right Estate Planning Lawyer

Qualifications and Experience

Specialization in Estate Planning and Trusts

Fees and Billing Structure

Communication and Responsiveness

Client Testimonials and Referrals

Conclusion

Voluntary Trusts FAQs

A Voluntary Trust is a legal arrangement in which a person (the trustor) transfers their assets to a trustee, who manages the assets on behalf of the beneficiaries. Voluntary Trusts play a crucial role in estate planning by providing asset protection, tax minimization, privacy, and the ability to cater to beneficiaries with special needs, among other benefits.

A revocable Voluntary Trust allows the trustor to maintain control over the trust assets and make changes to the trust terms during their lifetime. In contrast, an irrevocable Voluntary Trust cannot be changed or revoked once established, and the trustor relinquishes control over the trust assets. Irrevocable trusts typically offer greater asset protection and tax benefits, while revocable trusts provide more flexibility.

An estate planning lawyer plays a crucial role in establishing a Voluntary Trust by providing legal advice and guidance, drafting trust documents, and ensuring compliance with laws and regulations. They can help choose the right type of trust, create a well-crafted trust agreement, and guide the trustor through the process of funding the trust.

Some potential pitfalls when setting up a Voluntary Trust include improper trust formation, mismanagement of trust assets, legal disputes, and tax implications. To mitigate these risks, it's essential to work with an experienced estate planning lawyer who can ensure the trust is correctly formed, legally valid, and well-managed.

A revocable Voluntary Trust can generally be modified or terminated by the trustor at any time. However, modifying or terminating an irrevocable trust typically requires the consent of the trustor, trustee, and all beneficiaries or a court order. An estate planning lawyer can provide guidance on the legal requirements and procedures involved, draft necessary documents, and represent your interests in court if needed.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.