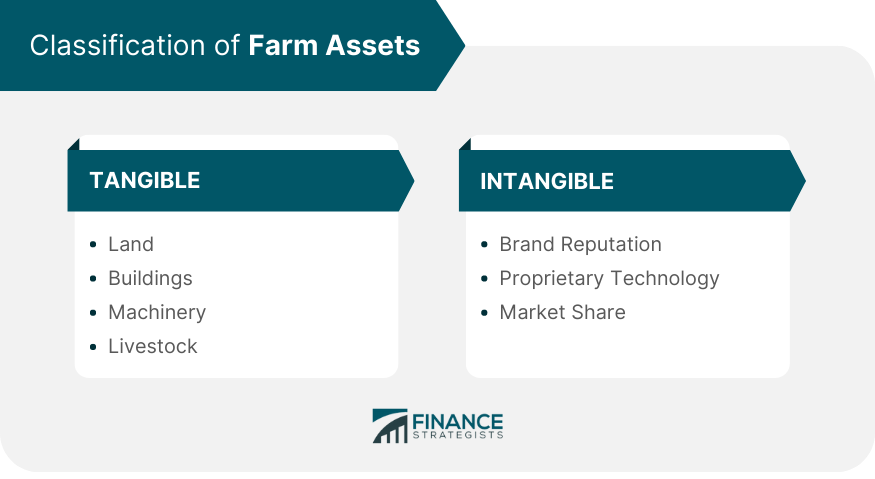

Estate planning is a process that involves organizing your assets and determining how they will be divided after your death. It aims to maximize the assets passed on to heirs while minimizing taxes and other costs. Estate planning for farmers, however, presents a unique set of challenges due to the nature of farm assets and operations. Estate planning for farmers goes beyond the conventional components of estate planning to account for the distinctive characteristics of farming businesses - which are often family-oriented, heavily tied to the land and other tangible assets, and subject to unpredictable market forces. Estate planning for farmers goes beyond the ordinary. It's about safeguarding a legacy, not just dividing assets. Such considerations often make farm estate planning complex and nuanced, necessitating a tailored approach that accounts for both family aspirations and business sustainability. Farm assets are unique because they are often a blend of personal and business assets. They typically include land, machinery, livestock, crops, and even the farmer's personal residence. This intertwining of personal and business assets makes the valuation, division, and tax treatment of these assets during estate planning a complicated affair. The absence of an estate plan can have severe consequences for a farming family. For example, if a farmer dies intestate (without a will), state laws will determine the division of the farm assets. This division may not align with the farmer's wishes and may even jeopardize the continued operation of the farm. Moreover, a lack of planning can result in hefty estate taxes, potentially forcing the sale of the farm. Farm assets can be broadly categorized into tangible and intangible assets. Tangible assets include physical items like land, buildings, machinery, and livestock. Intangible assets, on the other hand, include things like brand reputation, proprietary technology, and market share. Both categories of assets need to be carefully considered in farm estate planning. Valuing farm assets is often a complex process due to their unique nature. Land and machinery values can fluctuate based on various factors, including market conditions and the age and condition of the equipment. Livestock values can also vary based on breed, age, health, and market conditions. Intangible assets, such as a farm's brand value or goodwill, can be even harder to accurately quantify but are equally important. Farm assets play a crucial role in estate planning because they often constitute the bulk of a farmer's estate. The accurate valuation and equitable division of these assets are key to ensuring the farm's continuity and the family's financial security. Furthermore, farm assets' treatment can significantly impact the estate's tax liability, influencing the total wealth passed on to heirs. A will is a legal document that outlines how a person's assets should be distributed after their death. For farmers, creating a will is crucial to ensure that their farm assets are divided according to their wishes. The will can specify who inherits the farmland, machinery, livestock, and any other farm assets, providing clarity and reducing potential conflicts among heirs. Trusts can be a useful tool in farm estate planning. They allow the farmer to transfer assets to a trust, which is then managed by a trustee for the benefit of the designated beneficiaries. Trusts can offer various benefits, including potential tax advantages, protection of assets from creditors, and the ability to control how and when beneficiaries receive their inheritance. A power of attorney is a legal document that allows a person (the principal) to appoint someone else (the agent) to act on their behalf. In the context of farm estate planning, a power of attorney can ensure that the farm's operations continue smoothly if the farmer becomes incapacitated. An advanced healthcare directive, also known as a living will, is a document that specifies what actions should be taken regarding a person's health if they are no longer able to make decisions due to illness or incapacity. For farmers, having an advanced healthcare directive can provide peace of mind and reduce potential burdens on family members. A business succession plan outlines how the farm will be transferred to the next generation or another successor. It's crucial for ensuring the farm's continued operation after the current farmer's retirement, incapacity, or death. A well-crafted succession plan considers various factors, including the successor's readiness, the financial implications of the transfer, and the current owner's retirement needs. Estate taxes can take a significant bite out of a farm's value, potentially disrupting its operations or forcing a sale. Several strategies can minimize these taxes, including using marital deductions, applying for estate tax deferral for farms, establishing trusts, and taking advantage of the lifetime gift tax exemption. Farmers can use various asset protection strategies to shield their assets from potential liabilities. These may include setting up business entities such as LLCs or corporations, obtaining adequate insurance coverage, and using trusts. Succession planning is vital to ensuring the farm's continued operation and the family's financial security. Strategies may include developing a succession plan early, involving potential successors in the farm's operations, considering multiple successors, and using buy-sell agreements or trusts to facilitate the transition. Life insurance can be a valuable tool in farm estate planning. It can provide liquidity to pay estate taxes, support surviving family members, or buy out a deceased owner's share in the farm. Gifting allows farmers to transfer assets during their lifetime, potentially reducing estate tax liability. Charitable contributions can also offer tax benefits, support causes the farmer cares about, and serve as a lasting legacy. Estate planning attorneys can provide valuable guidance in creating an effective farm estate plan. They can help understand the legal implications of different decisions, draft essential documents, and navigate complex tax laws. CPAs can provide critical assistance in valuing farm assets, understanding tax implications, and implementing tax-efficient strategies. Their expertise is essential in creating a financially sound estate plan. Financial advisors can help farmers develop a comprehensive financial plan that integrates estate planning, retirement planning, investment management, and risk management. Their input can be invaluable in ensuring the farm's and family's financial security. Agricultural consultants understand the unique challenges and opportunities in farming. They can provide industry-specific advice on matters like succession planning, land use, and farm management, complementing the expertise of other professionals. Open and honest communication is crucial in farm succession planning. It allows the current owner to explain their decisions, the successors to express their aspirations, and all family members to understand and support the plan. Family meetings can be a useful forum for discussing the estate plan. They can promote transparency, reduce misunderstandings, and foster a shared vision for the farm's future. Conflicts can arise during estate planning due to differing expectations, perceived unfairness, or communication breakdowns. Effective conflict resolution strategies may include facilitating dialogue, seeking mediation, or involving a neutral third party. Farm estate plans should be reviewed regularly, ideally every three to five years. However, significant changes in the farm's operations, the family's circumstances, or tax laws may necessitate more frequent reviews. Certain events can significantly impact a farm estate plan. These may include the purchase or sale of major farm assets, changes in marital status, the birth or death of potential heirs, or changes in tax laws. Modifying an estate plan generally involves revising or creating new estate planning documents with the assistance of estate planning professionals. This ensures that the modifications are legally sound and align with the farmer's current wishes and circumstances. Estate planning for farmers is a crucial process that requires careful consideration of the unique nature of farm assets and operations. The blending of personal and business assets, the unpredictable market forces, and the family-oriented nature of farming businesses make estate planning a complex affair. The absence of an estate plan can lead to severe consequences, such as the division of farm assets not aligning with the farmer's wishes and potential financial burdens due to hefty estate taxes. To navigate these challenges, farmers must understand the classification and valuation of farm assets and implement key components of estate planning, including wills, trusts, powers of attorney, advanced healthcare directives, and business succession plans. By utilizing strategies to minimize taxes, protect assets, and involve professionals in the process, farmers can secure the future of their farms and ensure a smooth transition for the next generation. Regular review and updates to the estate plan are also essential to adapt to changing circumstances. Through strategic estate planning, farmers can safeguard their farm and family's future, leaving a lasting legacy for generations to come.Overview of Estate Planning for Farmers

Farm Assets and Estate Planning

Special Nature of Farm Assets

Risks of Not Having an Estate Plan as a Farmer

Understanding Farm Assets

Classification of Farm Assets

Valuation of Farm Assets

Role of Farm Assets

Key Components of Estate Planning for Farmers

Will

Trusts

Power of Attorney

Advanced Healthcare Directive

Business Succession Plan

Strategies for Estate Planning in Farming

Minimize Estate Taxes

Asset Protection Strategies

Succession Planning Strategies

Utilize Life Insurance in Estate Planning

Gifting and Charitable Contributions

Involve Professionals in Farm Estate Planning

Estate Planning Attorneys

Certified Public Accountants (CPAs)

Financial Advisors

Agricultural Consultants

Communicate Estate Plan

Facilitate Family Meetings

Deal With Potential Conflicts

Review and Update Estate Plan

Frequency of Review

Situations That Necessitate an Update

Process of Modifying an Estate Plan

Bottom Line

Estate Planning for Farmers FAQs

Estate planning for farmers is the process of planning for the distribution and management of a farmer's assets during their lifetime and at death. This involves legal, financial, and business strategies to ensure the farm's continuity and protect the farmer's wealth.

Estate planning is vital for farmers to ensure the smooth transition of the farm to the next generation, protect the farm's assets from potential liabilities and taxes, and reduce potential family conflicts over inheritance.

Estate planning for farmers considers both tangible and intangible assets. Tangible assets include land, buildings, machinery, and livestock, while intangible assets may include brand reputation and market share.

Farmers should consider involving several professionals in their estate planning, including estate planning attorneys, Certified Public Accountants (CPAs), financial advisors, and agricultural consultants.

Farmers should review their estate plan regularly, typically every three to five years. However, significant changes in the farm's operations, family circumstances, or tax laws may necessitate more frequent reviews.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.