Trustee removal refers to the process of removing a trustee from their position as the manager of a trust. This can occur for various reasons, including breaches of fiduciary duty, conflicts of interest, incompetence, or mismanagement of trust assets. Trustee removal is an essential tool for ensuring the proper management of trusts and protecting the interests of the beneficiaries. It can help prevent further harm to the trust and its assets, and provide the beneficiaries with a mechanism to hold the trustee accountable for their actions or omissions. It also promotes accountability, transparency, and responsible management of trusts, which is essential for maintaining the beneficiaries' trust and confidence in the trustee's ability to manage the trust effectively. A breach of fiduciary duty occurs when a trustee fails to fulfill their obligations to act in the best interests of the beneficiaries, avoid conflicts of interest, and exercise reasonable care, diligence, and skill in managing the trust's assets. Breaches of fiduciary duty can result in trustee removal, as they demonstrate the trustee's failure to fulfill their duties and responsibilities and prioritize the beneficiaries' interests. Incompetence or incapacity can be grounds for trustee removal if the trustee is unable to manage the trust's affairs effectively due to a lack of knowledge, skill, or mental capacity. Incompetence or incapacity can lead to mismanagement of trust assets, improper distributions, and other breaches of duty that can harm the trust and its beneficiaries. A conflict of interest occurs when the trustee's personal interests or relationships interfere with their ability to act in the best interests of the beneficiaries. A conflict of interest can result in trustee removal if it leads to breaches of fiduciary duty or other actions that harm the trust and its beneficiaries. Mismanagement of trust assets, such as improper investment or distribution decisions, can be grounds for trustee removal if it results in harm to the trust or its beneficiaries. Mismanagement of trust assets can demonstrate the trustee's failure to fulfill their duties and responsibilities and act in the best interests of the beneficiaries. Other grounds for trustee removal may include criminal activity, fraud, or other misconduct that goes beyond mere negligence or breaches of duty. Judicial proceedings are the most common method of trustee removal, where the beneficiaries or other interested parties initiate legal action to remove the trustee. Judicial proceedings require a showing of sufficient grounds for removal, such as breaches of fiduciary duty, incompetence, or mismanagement of trust assets. The court may order the trustee's removal and appoint a successor trustee. Administrative removal occurs when the trust instrument or applicable law provides for the trustee's removal by an administrative body, such as a regulatory agency or governmental entity. Administrative removal requires a showing of sufficient grounds for removal, and the decision to remove the trustee is made by the administrative body rather than a court. Trust agreement provisions may provide for the trustee's removal in specific circumstances, such as breaches of fiduciary duty, conflict of interest, or incompetence. Trust agreement provisions may require specific procedures to be followed, such as notice to the trustee and a hearing, and may provide for the appointment of a successor trustee. Procedural challenges to trustee removal may include allegations of insufficient notice, lack of due process, or failure to follow the required procedures for removal. Procedural challenges can delay or prevent trustee removal and may require additional legal proceedings to resolve. Substantive challenges to trustee removal may include allegations that the grounds for removal are insufficient or that the trustee's conduct did not rise to the level required for removal. Substantive challenges may require a showing of evidence that demonstrates the trustee's conduct constituted grounds for removal. The appointment of a successor trustee is necessary when the previous trustee is removed or resigns from their position. The appointment of a successor trustee must be done in accordance with the trust instrument and applicable law, and the new trustee must fulfill the same duties and responsibilities as the previous trustee. In some cases, the removal of a trustee may require the distribution of trust assets to the beneficiaries or the appointment of a new trustee to manage the trust's assets. The distribution of trust assets must be done in accordance with the trust instrument and applicable law, and the new trustee must manage the trust's assets in the best interests of the beneficiaries. Trustee removal refers to the process of removing a trustee from their position as the manager of a trust. It is essential for ensuring the proper management of trusts and protecting the interests of the beneficiaries. Grounds for trustee removal may include breach of fiduciary duty, incompetence, conflict of interest, mismanagement of trust assets, and other misconduct. Trustee removal underscores the importance of responsible and diligent trust management and promotes accountability, transparency, and responsible management of trusts. What Is Trustee Removal?

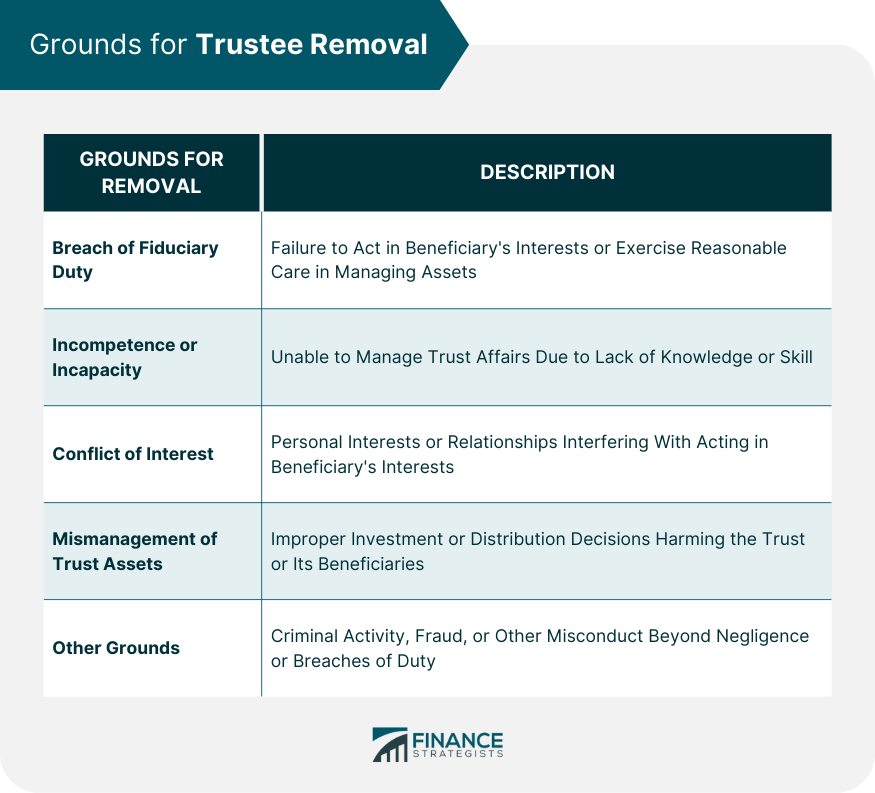

Grounds for Trustee Removal

Breach of Fiduciary Duty

Incompetence or Incapacity

Conflict of Interest

Mismanagement of Trust Assets

Other Grounds

Procedures for Trustee Removal

Judicial Proceedings

Administrative Removal

Trust Agreement Provisions

Challenges to Trustee Removal

Procedural Challenges

Substantive Challenges

Trustee Replacement

Appointment of Successor Trustee

Distribution of Trust Assets

Bottom Line

Trustee Removal FAQs

Trustee removal is the process of removing a trustee from their position due to incompetence, conflict of interest, mismanagement, or other grounds.

Grounds for trustee removal include breach of fiduciary duty, incompetence or incapacity, conflict of interest, mismanagement of trust assets, and other reasons specified in the trust agreement.

The procedure for trustee removal varies depending on the situation, but it can involve judicial proceedings, administrative removal, or provisions outlined in the trust agreement.

Challenges to trustee removal can include procedural challenges, such as complying with specific notice and hearing requirements, or substantive challenges, such as proving that the trustee acted inappropriately.

Yes, a trustee can be replaced after removal through the appointment of a successor trustee, who will take over the management of the trust assets and distribution to beneficiaries.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.