Charitable remainder trusts (CRTs) are a popular estate planning strategy for high-net-worth individuals and philanthropists looking to reduce their tax liability, provide for their loved ones, and support charitable causes. CRTs allow a donor to make a charitable gift while retaining an income stream from the trust for a specified period or until their death. The remainder of the trust assets goes to the designated charitable organization(s) after the donor's death or the specified period. The purpose of CRTs is to provide financial security to the donor while supporting charitable organizations they care about. CRTs let donors receive a tax deduction for their charitable gift, receive income for life, and potentially reduce their estate tax liability. Have questions about Charitable Remainder Trusts? Click here. There are two main types of CRTs: charitable remainder annuity trusts and charitable remainder unitrusts. CRAT pays a fixed income to the donor for life or a specified term. The CRAT is established by transferring assets, such as cash, securities, or real estate, to a trust. The donor receives an immediate income tax deduction for the present value of the charitable remainder interest that will eventually go to the charity. The trustee of the CRAT is responsible for managing its assets and distributing income payments to the donor according to its terms. The income payment is a fixed percentage of the initial value, which is determined when the trust is established. The fixed percentage must be at least 5% but cannot exceed 50% of the initial value of the trust. Once the donor dies or the specified term of the trust ends, the remaining trust assets are distributed to the designated charitable organization/s based on the present value of assets at the end of the trust term. A CRUT pays a variable income to the donor for life or a specified term. The income payment is a percentage of the fair market value of the trust assets, revalued annually. It means that the income payments of a CRUT may fluctuate depending on the performance of the trust assets. Like a CRAT, the income payments are limited to 5% to 50% of trust assets. The donor also receives a tax deduction based on the present value of the remainder interest that will go to the charity at the end of the term or the donor's death. A charitable remainder unitrust is also created by transferring assets to a trust. It is also managed by a trustee who distributes the income payments to the donor. Establishing a CRT involves several key steps, including choosing the charitable organization, selecting the trustee, determining the terms of the trust, and transferring assets to the trust. It is the necessary first step. Donors can select any charitable organization approved by the Internal Revenue Service (IRS) to be the beneficiary of the remainder interest in the trust. It is essential to research and identify one or more charitable organizations that align with the donor's values and mission to ensure that their philanthropic goals are met. The trustee is responsible for managing the CRT assets and ensuring that the terms of the trust are followed. Donors can choose to act as trustees or appoint a professional to manage the trust. It is crucial to select a trustee with experience managing CRTs to ensure that the trust is properly administered. The terms include the income payout rate, the duration of the trust, and the charitable organization/s that will receive the remainder interest. Donors can work with their financial advisor or attorney to determine the optimal payout rate and duration of the trust based on their financial goals and circumstances. Donors must transfer assets to the trust, which can include cash, securities, real estate, or other assets. The trustee is responsible for managing the CRT assets and selling any nonperforming or non-income-producing assets. Donors may want to consider working with a qualified financial advisor or estate planning lawyer to determine the specific resources and property to transfer to the CRT. There are several benefits to establishing a CRT as part of an estate planning strategy, including tax incentives, income for life, estate planning benefits, and philanthropic impact. One of the most significant benefits of CRTs is the tax savings they offer. Donors can receive an immediate income tax deduction for the present value of the charitable remainder interest that will eventually go to the charity. CRTs can also potentially reduce estate tax liability by removing assets from the donor's taxable estate. CRTs provide donors with a lifetime income source or up to a specified term. It can be a crucial source of financial security for retirees. The income payment can be either a fixed or variable amount, depending on the type of trust chosen. CRTs can be a useful tool for high-net-worth individuals who want to leave a legacy while minimizing their tax liability. By establishing a CRT, donors can transfer assets out of their taxable estate, which can reduce their estate tax liability. Additionally, CRTs can provide a way to pass on assets to heirs while also supporting charitable organizations. CRTs offer donors a way to support charitable organizations that they care about while also receiving tax benefits and income for life. By designating one or more charitable organizations as the beneficiary of the remainder interest in the trust, donors can make a lasting impact on their communities or support causes that they are passionate about. Consider the following risks and limitations before establishing a CRT. Once assets are transferred to the CRT, the donor loses control of those assets, especially if a professional trustee is hired. Remember that transferred assets cannot be returned to the donor or their heirs, which means that the donor must carefully consider their financial needs and the needs of their heirs before establishing a CRT. If the trust assets do not perform as expected, the income payments may be lower than anticipated, which could impact the donor's financial security. Donors should carefully consider the type of CRT that best suits their financial goals and circumstances. They should also work with their financial advisor or attorney to determine the optimal payout rate and duration of the trust based on their financial goals and circumstances. CRTs are subject to stringent monitoring and rules set by the IRS. Note that any violation of these rules can result in severe tax consequences. Donors should work with their financial advisors or attorney to ensure that the CRT is established in compliance with all IRS regulations. Not all assets are eligible for transfer to a CRT. Assets that do not produce income, such as personal property or artwork, may not be suitable for transfer to a CRT. Such limitations are set because CRTs are designed to generate income for donors and designated charitable organizations. If non-income-producing assets are transferred, the CRT may fail to provide desired income payouts based on its terms. Donors may need to engage an attorney to help them establish the CRT. Legal fees can vary widely depending on the complexity of the CRT and the geographic location of the attorney. Appraisal fees may also be incurred in the transfer process. If a professional trustee is hired, they may charge a fee for their services, including administering the trust and investment management. Termination fees may also be charged if the donor decides to abolish the CRT before the end of the specified term. Donors may want to consider the following when deciding on an alternative charitable giving strategy. DAFs are accounts that donors can use to make charitable donations to various organizations. Donors receive an immediate income tax deduction for their contribution to the DAF, and can then recommend grants to specific charitable organizations over time. DAFs are typically managed by a third-party sponsor, such as a community foundation or financial institution, which can help donors with the administrative aspects of charitable giving. Charitable gift annuities are similar to CRATs, in that they provide donors with a fixed income for life in exchange for a charitable donation. However, CGAs are typically simpler and less expensive to establish than CRATs. Donors receive an immediate income tax deduction for their charitable donation, and the annuity payments are guaranteed by the issuing charity. CLTs are the opposite of CRTs, in that they provide income to a designated charitable organization for a specified term, after which the remaining trust assets are distributed to the donor or their heirs. Donors receive an immediate income tax deduction for their charitable donation, and the remainder interest can potentially reduce the donor's estate tax liability. Donors can always opt to make direct donations to charitable organizations without establishing a CRT, DAF, CGA, or CLT. Direct donations can be made in cash or appreciated assets. High-net-worth individuals can also receive an immediate income tax deduction for their donations. CRTs are a popular estate planning tool for high-net-worth individuals who want to support charitable organizations while reducing their tax liability and providing income for life. The two main types are charitable remainder annuity trusts and charitable remainder unitrusts, which differ in the way the income payouts and percentages are calculated. Setting up a CRT involves selecting the charitable organizations to receive the remainder after a donor’s death or trust duration, choosing a trustee, defining the terms, and transferring assets. While CRTs offer several benefits, like tax deductions, income payouts, estate planning, and philanthropic impact, they also come with risks and limitations, such as a reduction in control of assets, potentially lower income, strict rules, limited asset eligibility, and costs. Donors may opt for other charitable giving strategies, such as donor-advised funds, charitable gift annuities, charitable lead trusts, or making direct charitable donations, which may involve lower fees and expenses. It is crucial for donors to carefully consider their financial goals and circumstances and work with a financial advisor or estate planning lawyer to determine the optimal charitable giving strategy.What Is a Charitable Remainder Trust?

Types of Charitable Remainder Trusts

Charitable Remainder Annuity Trust (CRAT)

Charitable Remainder Unitrust (CRUT)

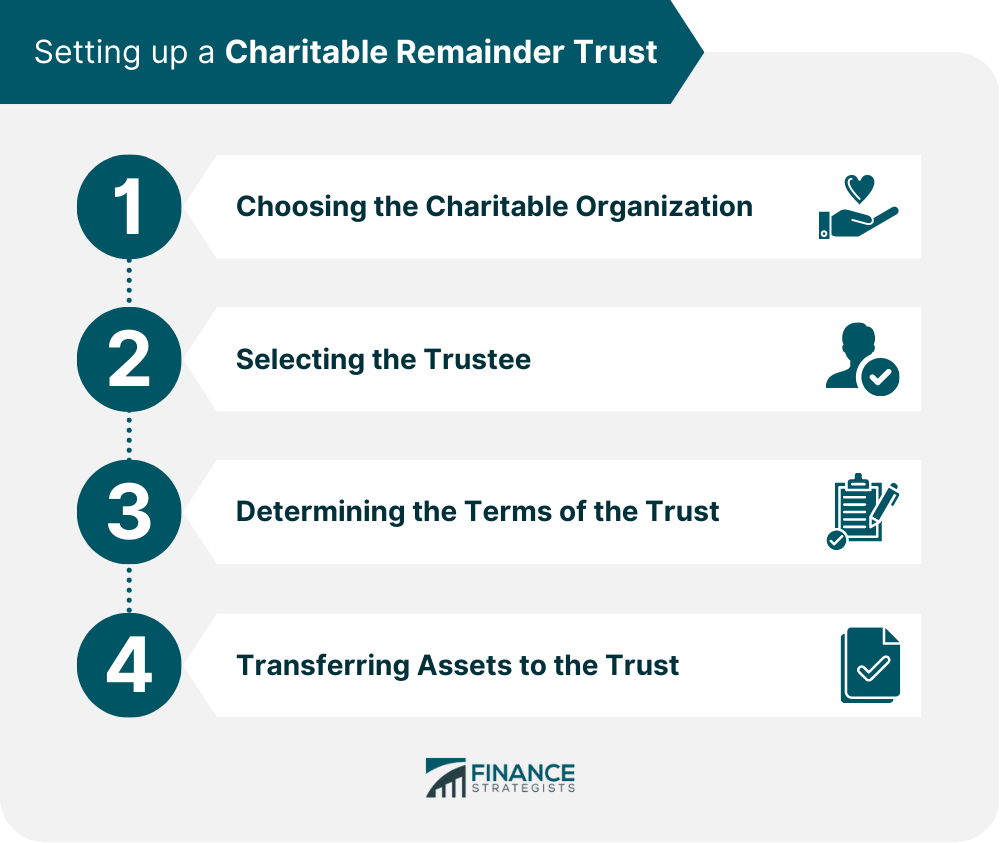

Setting up a Charitable Remainder Trust

Choosing the Charitable Organization

Selecting the Trustee

Determining the Terms of the Trust

Transferring Assets to the Trust

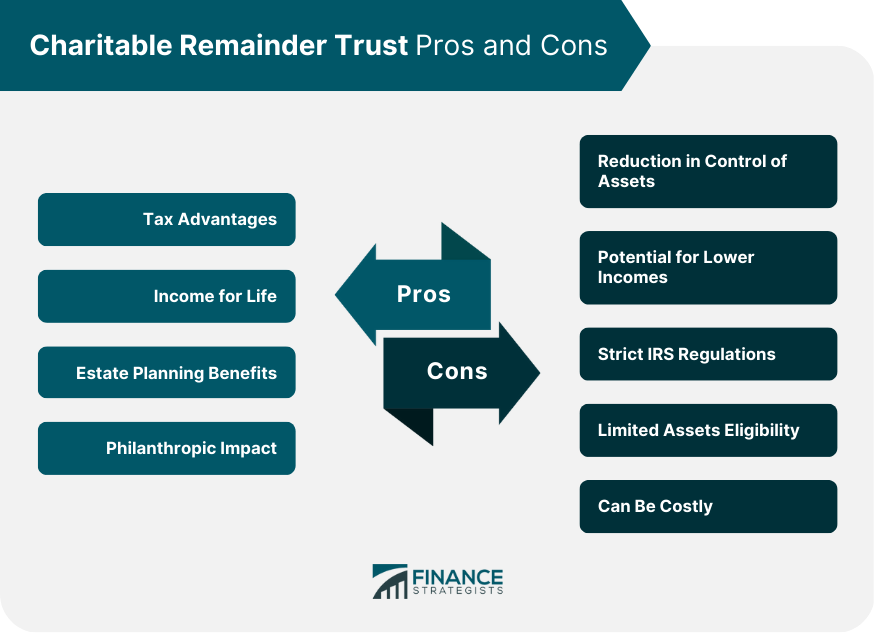

Benefits of Charitable Remainder Trusts

Tax Advantages

Income for Life

Estate Planning Benefits

Philanthropic Impact

Drawbacks of Charitable Remainder Trusts

Reduction in Control of Assets

Potential for Lower Income

Strict IRS Regulations

Limited Assets Eligibility

Can Be Costly

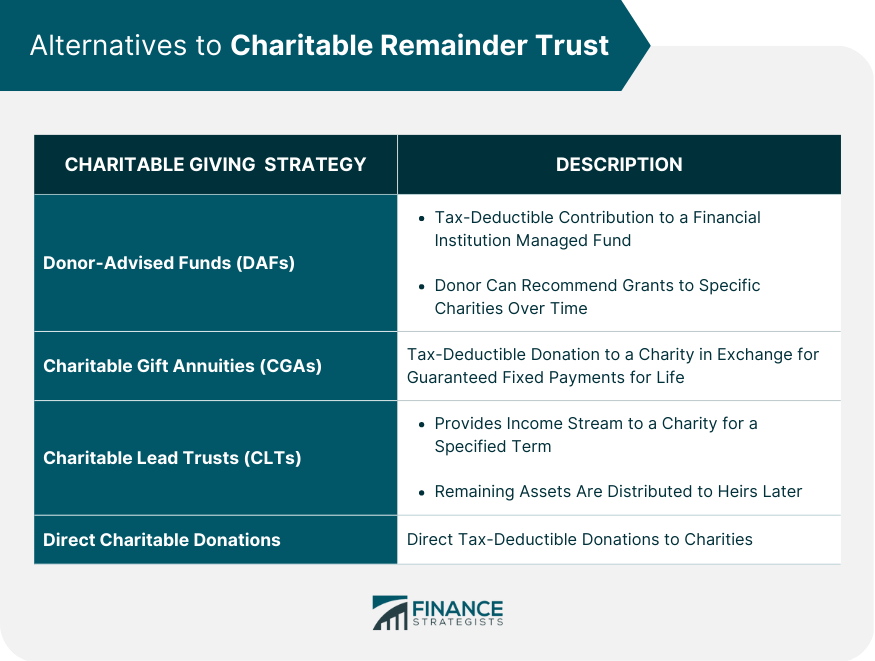

Alternatives to Charitable Remainder Trusts

Donor-Advised Funds (DAFs)

Charitable Gift Annuities (CGAs)

Charitable Lead Trusts (CLTs)

Direct Charitable Donations

Final Thoughts

Charitable Remainder Trust FAQs

A charitable remainder trust is a type of estate planning tool that allows donors to make a charitable gift while retaining an income stream from the trust for a specified period or until their death. The remainder of the trust assets goes to the designated charitable organization(s) after the donor's death or the specified period.

There are two main types of charitable remainder trusts: charitable remainder annuity trusts (CRATs) and charitable remainder unitrusts (CRUTs). CRATs pay a fixed income to the donor for life or a specified term, while CRUTs pay a variable income based on the fair market value of the trust assets.

Charitable remainder trusts offer several benefits, including tax savings, income for life, estate planning benefits, and philanthropic impact. Donors can receive an immediate income tax deduction for their charitable gift, receive income for life, and potentially reduce their estate tax liability.

Charitable remainder trusts come with risks and limitations, such as a reduction in control of assets, potential for lower income, strict IRS regulations, limited asset eligibility, and potentially high costs associated with establishing and managing the trust.

Donors may consider alternative charitable giving strategies, such as donor-advised funds, charitable gift annuities, charitable lead trusts, or direct charitable donations, which may involve lower fees and expenses. It is crucial for donors to evaluate their financial goals and circumstances and work with a financial advisor or attorney to determine the best approach for them.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.