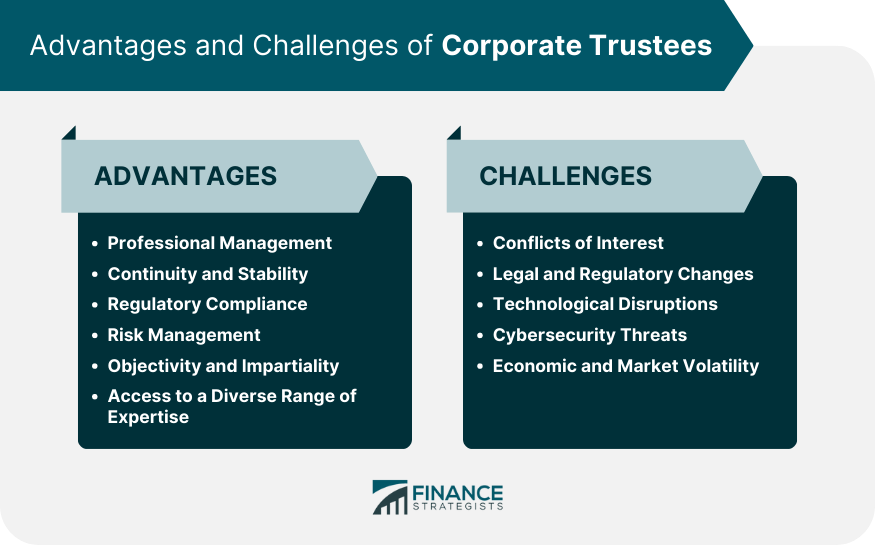

Corporate trustees are professional organizations, typically banks or trust companies, that are legally authorized to serve as trustees for various types of trusts, such as living trusts, testamentary trusts, and charitable trusts. Their primary responsibility is to manage and administer the trust in accordance with the terms and conditions set forth by the trustor (the person who creates the trust). Corporate trustees manage and administer various types of trusts, including living trusts, testamentary trusts, and special needs trusts. Their responsibilities include distributing assets to beneficiaries, managing investments, and ensuring legal and tax compliance. Corporate trustees often possess extensive investment knowledge and expertise. They are responsible for managing trust investments, balancing risk and return, and ensuring the trust's assets are in line with the grantor's objectives and the needs of the beneficiaries. Corporate trustees can play a critical role in estate planning by offering guidance on asset distribution, minimizing taxes, and providing for beneficiaries' long-term financial needs. They work closely with clients to develop comprehensive estate plans that align with their goals. Corporate trustees offer custody services to safeguard and manage clients' assets, such as securities, cash, and real estate. They are responsible for executing transactions, collecting income, and providing detailed reporting on the assets held in custody. As neutral third parties, corporate trustees can act as escrow agents in various financial transactions. They hold and manage assets, including funds, securities, and property, until the parties involved fulfill the agreed-upon conditions. Corporate trustees may administer and manage retirement plans, such as 401(k)s and pension plans. They provide plan sponsors with guidance on compliance, investments, and participant communication while ensuring the plan's smooth operation. Corporate trustees have a fiduciary duty to act in the best interests of the trust and its beneficiaries. This includes managing trust assets prudently, exercising reasonable care, and avoiding conflicts of interest. Corporate trustees must follow the prudent investor rule, which requires them to invest trust assets in a manner that balances risk and return while considering the needs of the beneficiaries and the grantor's objectives. Corporate trustees are responsible for maintaining accurate and detailed records of trust transactions, investments, and distributions. They must also provide regular reports to beneficiaries and other relevant parties, ensuring transparency and accountability. Corporate trustees must ensure that the trust complies with all applicable tax laws and regulations. This includes filing tax returns, paying taxes owed, and keeping abreast of changes in tax laws that may affect the trust. Corporate trustees are responsible for managing and distributing trust assets to beneficiaries according to the trust agreement. This may involve making periodic payments, providing financial support for specific purposes, or disbursing assets upon the occurrence of specific events. Corporate trustees must maintain open lines of communication with trust beneficiaries, addressing their questions and concerns and keeping them informed of trust activities and performance. When choosing a corporate trustee, consider factors such as their reputation and track record, financial stability, range of services offered, fee structure, and communication and responsiveness. Evaluate different corporate trustee providers by comparing their services, fees, and customer reviews. This will help you find a trustee that best meets your needs and preferences. Once you have selected a corporate trustee, work with them to establish a trust agreement and outline their responsibilities and duties. Regular communication and updates will help ensure a successful partnership. Corporate trustees offer professional trust and asset management services. Their expertise ensures that trust assets are managed effectively and in line with the grantor's intentions. Corporate trustees provide continuity and stability in trust management, as they continue to operate even when individual employees leave or retire. This ensures that the trust's administration remains uninterrupted and consistent. Corporate trustees are well-versed in legal and regulatory requirements, ensuring that trusts remain compliant with relevant laws and regulations. This helps to protect the trust and its beneficiaries from legal complications and financial penalties. Corporate trustees possess risk management expertise, enabling them to identify and mitigate risks associated with trust assets and investments. This helps to safeguard the trust's value and ensure it meets the grantor's objectives. As neutral third parties, corporate trustees can make unbiased decisions in the best interests of the trust and its beneficiaries. This objectivity helps prevent conflicts of interest and ensures the trust is managed fairly. Corporate trustees have access to a broad range of expertise, including legal, tax, investment, and accounting professionals. This enables them to address complex trust issues and provide comprehensive services to clients. Corporate trustees must avoid conflicts of interest that could compromise their objectivity and ability to act in the best interests of the trust and its beneficiaries. Corporate trustees must stay informed about changes in laws and regulations that could impact the trusts they manage, adjusting their practices and strategies accordingly. The increasing digitization of the financial industry requires corporate trustees to adapt to new technologies and integrate them into their operations to remain competitive and effective. Corporate trustees must protect their client's sensitive information and assets from cybersecurity threats, implementing robust security measures and regularly updating their systems to guard against potential breaches. Corporate trustees must navigate economic and market volatility, adjusting their investment strategies to minimize risk and protect trust assets. Corporate trustees operate under the oversight of various regulatory bodies and frameworks, which may include the Securities and Exchange Commission (SEC), the Office of the Comptroller of the Currency (OCC), and state banking regulators. Corporate trustees may adhere to industry standards and obtain certifications, such as the Certified Trust and Financial Advisor (CTFA) designation, to demonstrate their commitment to professionalism and best practices. Corporate trustees are professional organizations that offer various types of trust and asset management services, such as trust administration, investment management, estate planning, custody services, escrow services, and retirement plan services. Corporate trustees have fiduciary duties, including prudent investment management, record keeping and reporting, tax compliance, trust distribution management, and communication with beneficiaries. When selecting a corporate trustee, consider factors such as their reputation, financial stability, range of services offered, fee structure, and communication and responsiveness. Advantages of corporate trustees include professional management, continuity and stability, regulatory compliance, risk management, objectivity and impartiality, and access to a diverse range of expertise. However, corporate trustees also face challenges, such as conflicts of interest, legal and regulatory changes, technological disruptions, cybersecurity threats, and economic and market volatility. Corporate trustees operate under the oversight of various regulatory bodies and frameworks, and may adhere to industry standards and obtain certifications to demonstrate their commitment to professionalism and best practices.Definition of Corporate Trustees

Types of Corporate Trustee Services

Trust Administration

Investment Management

Estate Planning

Custody Services

Escrow Services

Retirement Plan Services

Responsibilities and Duties of Corporate Trustees

Fiduciary Duty

Prudent Investment Management

Record Keeping and Reporting

Tax Compliance

Trust Distribution Management

Communication With Beneficiaries

Selecting a Corporate Trustee

Factors to Consider

Comparing Different Providers

Engaging a Corporate Trustee

Advantages of Corporate Trustees

Professional Management

Continuity and Stability

Regulatory Compliance

Risk Management

Objectivity and Impartiality

Access to a Diverse Range of Expertise

Challenges and Risks of Corporate Trustees

Conflicts of Interest

Legal and Regulatory Changes

Technological Disruptions

Cybersecurity Threats

Economic and Market Volatility

Regulatory Oversight

Regulatory Bodies and Frameworks

Industry Standards and Certifications

Conclusion

Corporate Trustees FAQs

Corporate trustees offer a range of services, including trust administration, investment management, estate planning, custody services, escrow services, and retirement plan services. They provide professional management and expertise to ensure the efficient administration of trusts and other financial matters.

Corporate trustees provide professional management, continuity and stability, regulatory compliance, risk management, objectivity and impartiality, and access to a diverse range of expertise. These advantages help to ensure that trusts are managed effectively and in line with the grantor's objectives and the needs of the beneficiaries.

When selecting a corporate trustee, consider factors such as reputation and track record, financial stability, range of services offered, fee structure, and communication and responsiveness. Comparing different providers and evaluating their services, fees, and customer reviews can help you find a trustee that best meets your needs and preferences.

Corporate trustees have various responsibilities and duties, including fulfilling their fiduciary duty, prudent investment management, record keeping and reporting, tax compliance, trust distribution management, and communication with beneficiaries. They must act in the best interests of the trust and its beneficiaries while ensuring compliance with relevant laws and regulations.

Corporate trustees address challenges and risks by staying informed about legal and regulatory changes, adapting to technological disruptions, implementing robust cybersecurity measures, navigating economic and market volatility, and maintaining transparency and accountability in their operations. They must also follow industry best practices and adhere to regulatory oversight to ensure they continue to serve their clients effectively.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.