A dynasty trust is a type of trust designed to provide long-term asset protection and financial benefits to future generations. The primary purpose of a dynasty trust is to keep assets within a family for as long as possible, ensuring that they remain in the family for generations to come. Dynasty trusts are often used by high-net-worth individuals, business owners, and families with substantial assets who wish to establish a long-term legacy and ensure their wealth is passed down to their heirs in a tax-efficient manner. Have questions about Dynasty Trusts? Click here.

I'm Taylor Kovar, a Certified Financial Planner (CFP), specializing in helping business owners with strategic financial planning. I worked closely with a high-net-worth entrepreneur who had concerns about passing on his substantial wealth to his children and grandchildren. He wanted to minimize estate taxes and protect those assets from creditors and divorce. We discussed the benefits of establishing a Dynasty Trust and implemented this trust structure to help preserve his wealth for multiple generations, ensuring financial security, shielding assets, and providing for future needs. Contact me at (936) 899 - 5629 or [email protected] to discuss how we can achieve your financial objectives. WHY WE RECOMMEND: IDEAL CLIENTS: Business Owners, Executives & Medical Professionals FOCUS: Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation A dynasty trust is an irrevocable trust designed to allow individuals and families to transfer wealth to future generations while minimizing tax liabilities. Understanding how it works is crucial for anyone considering this powerful estate planning tool. To set up a dynasty trust, the grantor must first create and fund the trust with assets. The trust document specifies the terms and conditions of the trust, including who the beneficiaries are, how and when assets are distributed, and who the trustee is. The grantor can also specify whether the trust is irrevocable or revocable and whether it is grantor or non-grantor. The trustee is responsible for managing the trust and ensuring the grantor's wishes are fulfilled. The trustee can be an individual, corporation, or professional. The trustee has a fiduciary duty to act in the best interests of the beneficiaries and must manage the trust assets prudently. The terms and provisions of a dynasty trust can vary widely depending on the grantor's wishes. However, some common provisions include the ability to distribute to beneficiaries for certain purposes, such as education or medical expenses. The trust may include provisions for the trustee to distribute to beneficiaries based on certain criteria, such as age or life events. The trust may also include provisions for appointing a successor trustee if the original trustee is unable or unwilling to continue serving in that role. The trust document's terms determine the distribution of assets from a dynasty trust to beneficiaries. Depending on the terms of the trust, assets may be distributed to beneficiaries regularly, such as annually or monthly. Alternatively, distributions may be made only under certain circumstances, such as when a beneficiary reaches a certain age or achieves a certain milestone, such as college graduation. The following are the different types of dynasty trusts: There are two main types of dynasty trusts: domestic and foreign. Domestic dynasty trusts are established under the laws of the state in which the grantor resides. Foreign dynasty trusts are established under the laws of a foreign jurisdiction, such as the Cayman Islands or the Bahamas. Foreign dynasty trusts are often used for their added asset protection benefits and privacy. Another distinction between dynasty trusts is whether they are grantor or non-grantor trusts. In a grantor dynasty trust, the grantor retains certain powers over the trust, such as the ability to modify or revoke the trust. In a non-grantor dynasty trust, the grantor gives up all control over the trust and its assets. Non-grantor dynasty trusts offer more excellent asset protection and tax benefits but have fewer control options for the grantor. Dynasty trusts can also be classified as perpetual or term trusts. A perpetual dynasty trust is designed to last indefinitely, allowing assets to be passed down to future generations indefinitely. On the other hand, a term dynasty trust has a set term or expiration date, after which the trust terminates, and the assets are distributed to the beneficiaries. Setting up a dynasty trust can be a complex process that requires careful consideration of several factors, including the type of trust, the trustee, the beneficiaries, and the assets being transferred. Choosing the right trustee is critical when setting up a dynasty trust. The trustee is responsible for managing the trust and ensuring the grantor's wishes are fulfilled. It is crucial to choose a trustee who is knowledgeable about trust law, investment management, and financial planning. Additionally, the trustee should be trustworthy, responsible, and with the beneficiaries' best interests in mind. The selection of beneficiaries is another important consideration when setting up a dynasty trust. The grantor should carefully consider who will benefit from the trust and how the assets will be distributed to them. Beneficiaries can include children, grandchildren, great-grandchildren, and even more distant descendants. The grantor may also consider including charities or other organizations as trust beneficiaries. Funding the dynasty trust is an important consideration. The grantor must transfer assets to the trust, which the trustee will manage. The grantor can transfer various assets to the trust, including cash, securities, real estate, and business interests. The grantor must also ensure that the transfer of assets to the trust is done in a tax-efficient manner. Finally, the grantor should consider the flexibility of the dynasty trust. The trust document should be drafted in a way that allows for changes to be made as circumstances change over time. This may include the ability to modify the terms of the trust or the selection of beneficiaries. A dynasty trust is a powerful estate planning tool that offers a wide range of benefits for individuals and families looking to preserve their wealth and pass it down to future generations. One of the main benefits of a dynasty trust is the long-term asset protection it provides. By setting up a dynasty trust, assets are placed in a separate legal entity, which a trustee manages. This means the assets are protected from creditors, lawsuits, and other potential risks. Additionally, by passing assets to future generations through a Dynasty Trust, the assets are shielded from potential family disputes and divorces. Another benefit of a dynasty trust is the tax efficiency it provides. When assets are transferred to a dynasty trust, they are no longer considered part of the grantor's estate for tax purposes. This means that the assets are not subject to estate tax, gift tax, or generation-skipping transfer tax (GST). As a result, more of the grantor's assets can be passed down to future generations. A dynasty trust can also help preserve family wealth by ensuring that assets are passed down to future generations in a structured manner. With a dynasty trust, the trustee can control the distribution of assets to beneficiaries, ensuring that they are used responsibly and beneficially. Additionally, this trust can help prevent beneficiaries from squandering or misusing the assets, thereby preserving the family's wealth for future generations. A dynasty trust gives the grantor greater control over asset distribution. The grantor can specify how and when assets are distributed to beneficiaries by setting up a dynasty trust. This can help ensure that the assets are used for their intended purposes and prevent beneficiaries from misusing or squandering them. While dynasty trusts offer many benefits, such as long-term asset protection and tax efficiency, there are also potential challenges that individuals should be aware of, including the complexity of setting up and managing the trust, restrictions on the transfer of assets, and the possibility of family disputes. One potential challenge of dynasty trusts is the complexity of trust administration. Dynasty trusts are typically complex legal documents that require careful management and administration. The trustee must be knowledgeable about trust law, investment management, and financial planning to manage the trust effectively. Another potential challenge of dynasty trusts is the generation-skipping transfer tax. The GST Tax is a federal tax on transfers of assets to grandchildren or more distant descendants. Dynasty trusts are designed to avoid this tax by keeping assets within the family for multiple generations. However, the GST Tax can be complex and requires careful planning to avoid. Finally, dynasty trusts are subject to state laws governing trusts. Each state has its own laws governing the creation, management, and administration of trusts, which can add complexity to the trust planning process. When it comes to estate planning, individuals and families have a range of strategies at their disposal: Dynasty trusts are similar to revocable and irrevocable trusts in that they allow for the transfer of assets outside of the grantor's estate. However, unlike revocable trusts, which can be modified or revoked by the grantor, dynasty trusts are typically irrevocable, meaning that the grantor gives up control over the assets placed in the trust. This provides greater asset protection and tax benefits but comes with fewer control options for the grantor. Wills are another estate planning tool that individuals can use to pass down assets to future generations. Unlike a dynasty trust, a will must go through probate court, which can be a lengthy and expensive process. Additionally, a will provides a different level of asset protection than a Dynasty Trust. Lifetime gifts are another strategy individuals can use to transfer assets to future generations. Lifetime gifts can be subject to gift tax, which can significantly reduce the number of assets that can be transferred. Lifetime gifts do not provide the same level of asset protection as a dynasty trust. Family-limited partnerships are another strategy individuals can use to pass down assets to future generations. Family-limited partnerships can be complex and expensive to set up and maintain. They may provide different asset protection and tax benefits than a dynasty trust. Dynasty trusts are an incredibly valuable estate planning tool. They provide a wide range of benefits for individuals and families looking to preserve their wealth and pass it down to future generations. They offer long-term asset protection and tax efficiency and can also help ensure the responsible distribution of assets to heirs. However, setting up a dynasty trust can be a complex process that requires careful planning and attention to detail. Working with a knowledgeable estate planning attorney and financial advisor is crucial to ensure that the trust is structured properly and managed effectively over time. With the right guidance, a dynasty trust can be invaluable for achieving long-term financial security and legacy planning goals.What Is a Dynasty Trust?

Read Taylor's Story

Fee-Only Financial Advisor

Certified Financial Planner™

3x Investopedia Top 100 Advisor

Author of The 5 Money Personalities & Keynote Speaker

How a Dynasty Trust Works

Creation and Funding of the Trust

Role of the Trustee

Terms and Provisions of the Trust

Distribution of Assets to Beneficiaries

Types of Dynasty Trusts

Domestic vs. Foreign Dynasty Trusts

Grantor vs. Non-Grantor Dynasty Trusts

Perpetual vs. Term Dynasty Trusts

Considerations When Setting Up a Dynasty Trust

Choosing the Right Trustee

Selection of Beneficiaries

Funding the Trust

Flexibility of the Trust

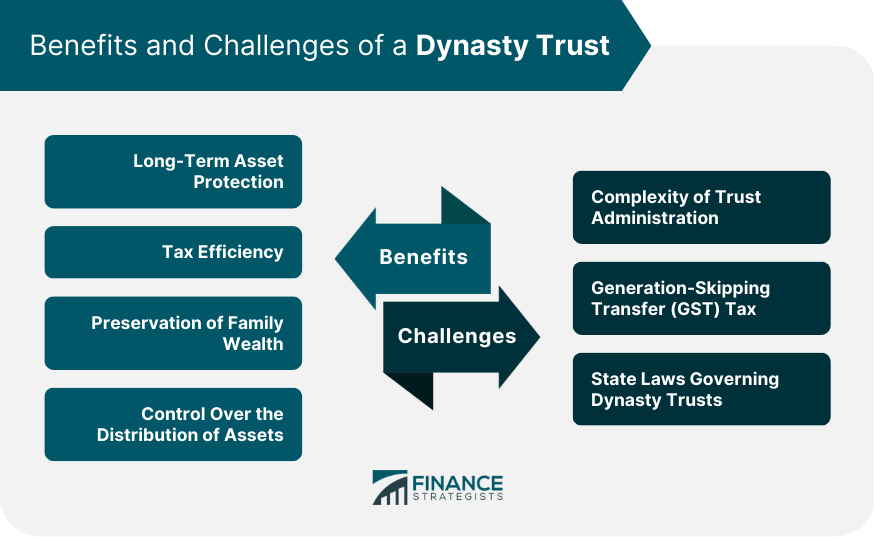

Benefits of a Dynasty Trust

Long-Term Asset Protection

Tax Efficiency

Preservation of Family Wealth

Control Over the Distribution of Assets

Potential Challenges of Dynasty Trusts

Complexity of Trust Administration

Generation-Skipping Transfer (GST) Tax

State Laws Governing Dynasty Trusts

Dynasty Trusts vs Other Estate Planning Strategies

Revocable and Irrevocable Trusts

Wills

Lifetime Gifts

Family Limited Partnerships

Conclusion

Dynasty Trust FAQs

A dynasty trust is a type of trust designed to provide long-term asset protection and financial benefits to future generations, ensuring that assets remain within a family for generations to come.

A dynasty trust can provide long-term asset protection, tax efficiency, preservation of family wealth, and greater control over the distribution of assets, making it a valuable tool for estate planning.

There are three main types of dynasty trusts: domestic vs. foreign dynasty trusts, grantor vs. non-grantor dynasty trusts, and perpetual vs. term dynasty trusts.

When setting up a dynasty trust, choosing the right trustee, selecting beneficiaries carefully, funding the trust appropriately, and ensuring the trust is flexible enough to adapt to changing circumstances are important.

Some potential challenges of dynasty trusts include the complexity of trust administration, generation-skipping transfer (GST) tax, and state laws governing trusts, making it important to work with a knowledgeable attorney and financial advisor.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.