A Declaration of Trust, also known as a Deed of Trust, is a legal document that specifies how property held in trust is managed and distributed. It outlines the rights, responsibilities, and interests of the trustee and beneficiaries. It provides clarity and security over asset ownership, reducing potential disputes. If you're considering holding property jointly or on someone else's behalf, a Declaration of Trust can ensure your assets are handled according to your wishes, protecting your financial interests. Thus, it's crucial to get legal advice to understand all implications and to construct this document properly. Also known as a grantor or trustor, the settlor is the individual who creates the trust by transferring their own property into it. The settlor has the responsibility of choosing the trustee and beneficiaries, and deciding the terms of the trust. In some cases, the settlor can also be a trustee or beneficiary. The settlor appoints the trustee to manage the trust property. This management can involve a variety of tasks, from straightforward property care to complex financial tasks like investing trust assets or managing tax obligations. Trustees have a fiduciary duty to manage the trust in the best interest of the beneficiaries. The beneficiary is the individual or entity (like a charity or other organization) who is intended to benefit from the trust. Beneficiaries can have different levels of rights - for instance; some beneficiaries may be entitled to income generated by the trust during their lifetime, while others may be entitled to the remaining trust property after other beneficiaries' rights have ended. This refers to the specific assets that are placed into the trust by the settlor. It can include a wide range of assets, such as real estate, cash, stocks, business interests, life insurance policies, and other valuable property. These are the instructions given by the settlor regarding how the trust should be managed and how the trust assets are to be distributed to the beneficiaries. For instance, the settlor might instruct that a beneficiary is to receive income from the trust property when they reach a certain age. The trust duration refers to how long the trust is intended to last. This could be a set number of years, until the death of the settlor or a certain beneficiary, or until a particular event happens. Some trusts can even last for generations. Trusts can be either revocable or irrevocable. A revocable trust can be changed or terminated by the settlor at any time during their lifetime. An irrevocable trust, once established, generally cannot be changed or terminated except under very specific circumstances and usually with the permission of the court or the beneficiaries. In a bare trust, assets are held in the trustee's name, but the trustee has no discretion or decision-making power over the trust's assets. The beneficiary has a right to the trust's assets and income anytime if they're over 18 (in most jurisdictions). Bare trusts often transfer assets to minors until they reach legal age. In a discretionary trust, the trustees have discretion over how and when to distribute the trust's income or capital to the beneficiaries. This type of trust offers flexibility and can be beneficial for beneficiaries who need to be more capable or responsible in handling their financial affairs. With this type of trust, the beneficiary has an immediate right to income from the trust as it arises. However, they don't necessarily have a right to the trust's capital. This is often used to provide for a spouse during their lifetime while preserving the capital for children or other beneficiaries. In an accumulation trust, trustees can accumulate income generated by the trust within the trust structure and add it to the trust's capital. This is often done when beneficiaries are minors or legally incapacitated, allowing the trust to grow until it is deemed appropriate for the beneficiary to begin receiving benefits. A mixed trust combines elements of different types of trusts. For example, some assets within the trust could be held as an interest in possession trust, while others are held as a discretionary trust. In a settlor-interested trust, the person who establishes the trust retains an interest. This means the settlor, or their spouse or civil partner, is among the trust's beneficiaries. This can have tax implications and is often used in wealth and estate planning. This type of trust is created when the trustees are residents in a different jurisdiction than the trust, often for tax reasons. Rules surrounding non-resident trusts vary greatly depending on the countries involved, so specialist advice is needed when creating such a trust. A Declaration of Trust provides a detailed understanding of how assets are held and managed within the trust. It specifies the roles and responsibilities of the trustee and beneficiaries and outlines how the trust's assets will be distributed. By providing a clear, written agreement, a Declaration of Trust helps to minimize confusion or disputes over asset ownership and control, and it can offer reassurance that assets will be handled as intended. Trusts can serve as a form of asset protection. When assets are properly transferred into a trust, they are typically out of reach from creditors, lawsuits, or in some cases, divorce settlements. Moreover, certain types of trusts may offer tax advantages by removing assets from the settlor's taxable estate. The Declaration of Trust allows a high degree of flexibility, with various types of trusts available to meet specific needs. For example, in a discretionary trust, the trustee has the power to make decisions about how the trust's income or capital should be distributed among the beneficiaries. This can be particularly useful if the beneficiaries are minors or otherwise incapable of managing their own financial affairs. Trusts are often used as an integral part of estate planning. They can help avoid the lengthy and costly probate process that follows death. Additionally, they can be set up to provide for minor or disabled beneficiaries, manage assets until beneficiaries reach a certain age, or provide a lifetime income to a spouse while preserving the capital for children or other beneficiaries. Unlike wills, which become public records once probated, the details of trusts generally remain private. The distribution of assets can be carried out discreetly, which some families prefer. One of the most attractive features of a trust is its control over how your assets are used and distributed. You can specify the terms of the trust in detail - for instance, directing that funds be used only for education expenses or that a beneficiary only receives their inheritance once they reach a certain age. Trust law is a specialized field with many intricacies. To navigate these complexities, you'll often need expert advice from lawyers, financial advisors, and tax consultants. Understanding all aspects of the trust—such as the implications for asset control, tax management, and beneficiaries' rights—requires significant time and effort. Making an error in the structuring or administration of a trust can have serious consequences, including financial loss or legal complications. Trustees handle day-to-day tasks such as record keeping, asset management, asset distribution, and communication with beneficiaries and parties involved. This ongoing commitment can be burdensome, especially for trustees with other professional or personal responsibilities. Setting up a trust can involve considerable expenses. These may include professional fees for legal counsel, accountants, and financial advisors, as well as court fees, if relevant. Once the trust is established, there may be ongoing administration, asset management, tax filing, and trustee remuneration costs. Sometimes, the cost of establishing and maintaining the trust may outweigh the benefits. Once a trust has been established, altering its terms can be problematic, especially if it's an irrevocable trust. Circumstances can change—beneficiaries' needs may evolve, tax laws may shift, and asset values can fluctuate. If a trust is not structured with some flexibility, it may not be able to adapt effectively to these changes. While trusts can provide certain tax advantages, they can also have adverse consequences if improperly structured and managed. For example, income retained within some trusts may be subject to higher tax rates than if an individual earned it. Understanding and managing these tax implications require expert knowledge and diligent administration. Trustees have a fiduciary duty to act in the best interests of the beneficiaries. They can be held personally liable if they fail to do so—whether through negligence, misunderstanding, or willful misconduct. This legal risk underscores the importance of trustees possessing or gaining access to the necessary expertise to manage the trust effectively. When multiple parties are involved, there's potential for conflict. Disagreements can arise between trustees and beneficiaries about the management of the trust's assets, the interpretation of its terms, or the distribution of its benefits. Such conflicts can be stressful, damage relationships, and potentially result in costly litigation. Decide why you're setting up the trust. This could be for asset protection, estate planning, tax planning, supporting a family member with special needs, or another reason. Determine what assets you'll put into the trust. This could include real estate, stocks, bonds, cash, or other assets. Decide who will benefit from the trust. This could be a spouse, children, grandchildren, a charity, or others. Choose who will manage the trust. This could be a trusted individual or a professional entity, like a bank or law firm. Outline the terms of the trust. This includes when and how the assets will be distributed to the beneficiaries, any conditions that must be met, and what powers the trustee has. Hire an attorney to draft the trust agreement. This legal document sets out the terms and conditions of the trust. Once everyone is satisfied with its contents, the parties involved (the settlor and trustee, at minimum) sign the document. Finally, legally transfer the identified assets into the trust. This step can involve significant paperwork and potential costs, depending on the types of assets involved. A Declaration of Trust is a crucial legal document that brings clarity, security, and protection to the management and distribution of assets held in trust. The key components, such as the settlor, trustee, beneficiary, trust property, terms of the trust, trust duration, and revocability, establish a solid foundation for asset ownership and management. A Declaration of Trust offers numerous benefits, including clear agreements, asset protection, flexibility, estate planning advantages, privacy, and control over asset usage and distribution. However, challenges such as the complexity of trust law, time-consuming administration, associated costs, potential inflexibility, tax implications, legal risks, and potential conflicts must be considered. Establishing a Declaration of Trust involves defining the purpose, identifying assets, selecting beneficiaries and a trustee, outlining the terms, drafting and signing the trust agreement, and transferring assets. Seeking professional legal advice is crucial to ensure the proper establishment and execution of the trust.What Is a Declaration of Trust?

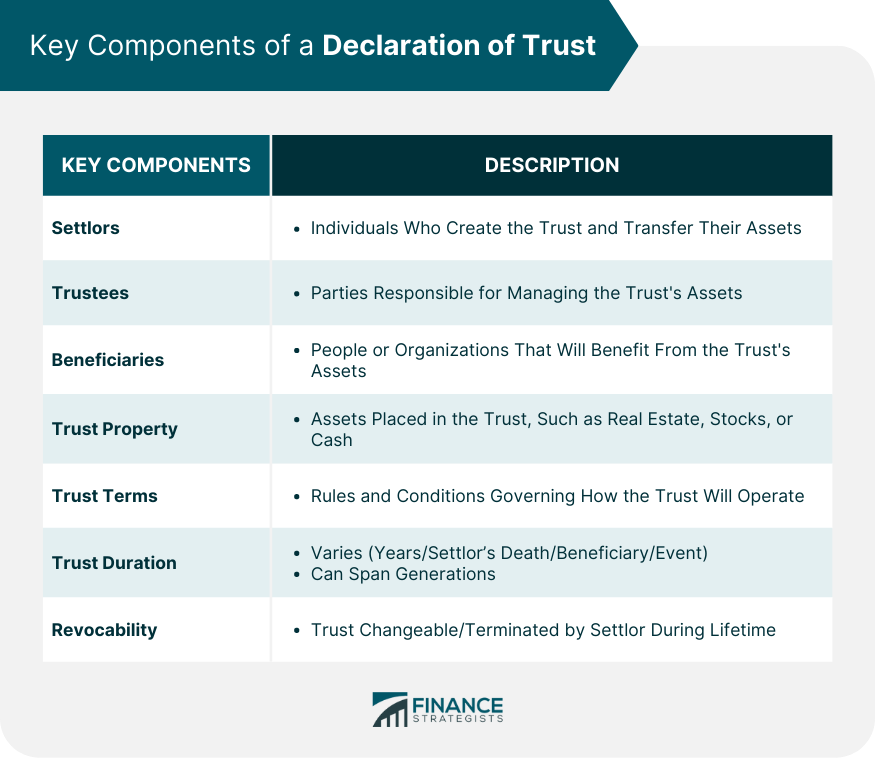

Key Components of a Declaration of Trust

Settlor

Trustee

Beneficiary

Trust Property

Terms of the Trust

Trust Duration

Revocability

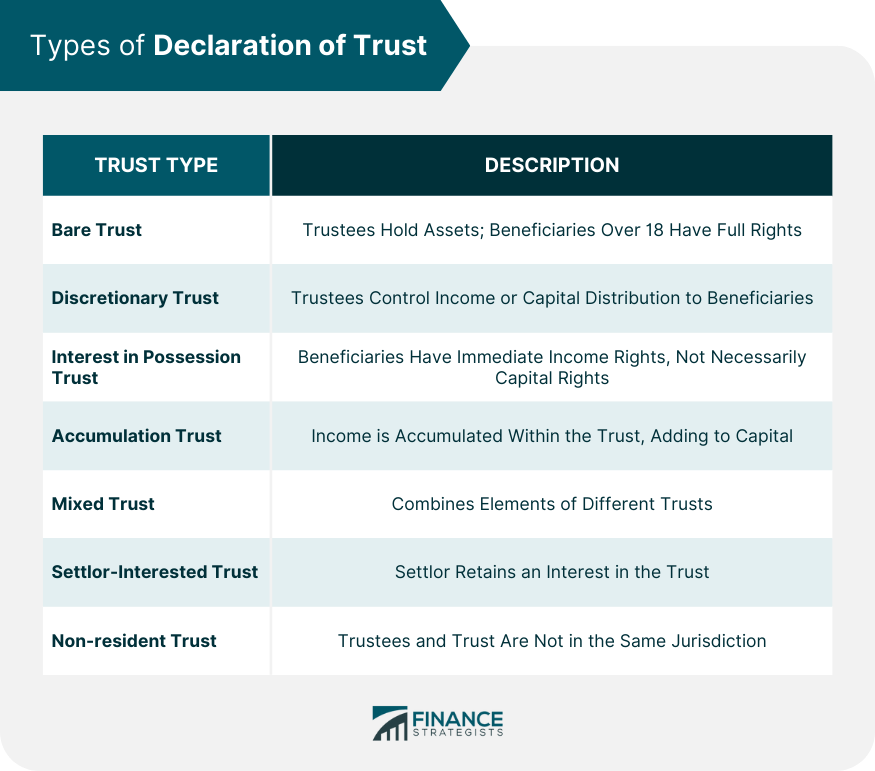

Types of Declaration of Trust

Bare Trust

Discretionary Trust

Interest in Possession Trust

Accumulation Trust

Mixed Trust

Settlor-Interested Trust

Non-resident Trust

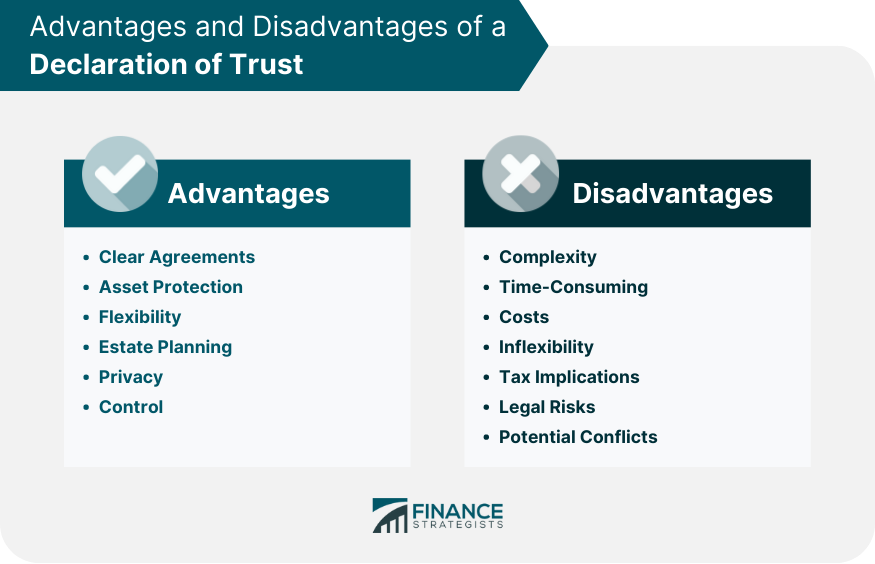

Benefits of a Declaration of Trust

Clear Agreements

Asset Protection

Flexibility

Estate Planning

Privacy

Control

Challenges and Pitfalls in a Declaration of Trust

Complexity

Time-Consuming

Costs

Inflexibility

Tax Implications

Legal Risks

Potential Conflicts

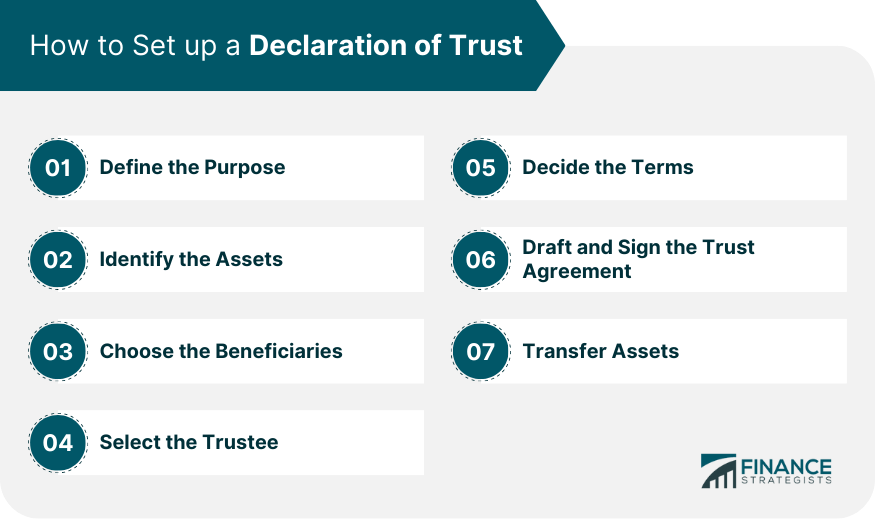

Setting up a Declaration of Trust

Define the Purpose

Identify the Assets

Choose the Beneficiaries

Select the Trustee

Decide the Terms

Draft and Sign the Trust Agreement

Transfer Assets

Conclusion

Declaration of Trust FAQs

A Declaration of Trust is a legal document that establishes the ownership of assets by a trustee on behalf of beneficiaries. It sets out the terms and conditions under which the trustee will hold and manage the assets.

The purpose of a Declaration of Trust is to provide a legally binding agreement that specifies how assets will be held and distributed among beneficiaries. It is commonly used to protect assets and ensure they are passed on to intended recipients in a tax-efficient manner.

A Declaration of Trust can be created by anyone who wishes to transfer ownership of assets to a trustee to benefit beneficiaries. This could include individuals, businesses, or charitable organizations.

A wide range of assets can be included in a Declaration of Trust, including property, shares, cash, and other investments. The assets must be legally owned by the person creating the trust, and the trust must comply with relevant legal and tax requirements.

Yes, a Declaration of Trust can be changed or revoked by the person who created it. This is typically done through a legal process that involves amending or revoking the original document and notifying all relevant parties. It is important to seek legal advice before making any changes to a Declaration of Trust to ensure that it is done correctly.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.