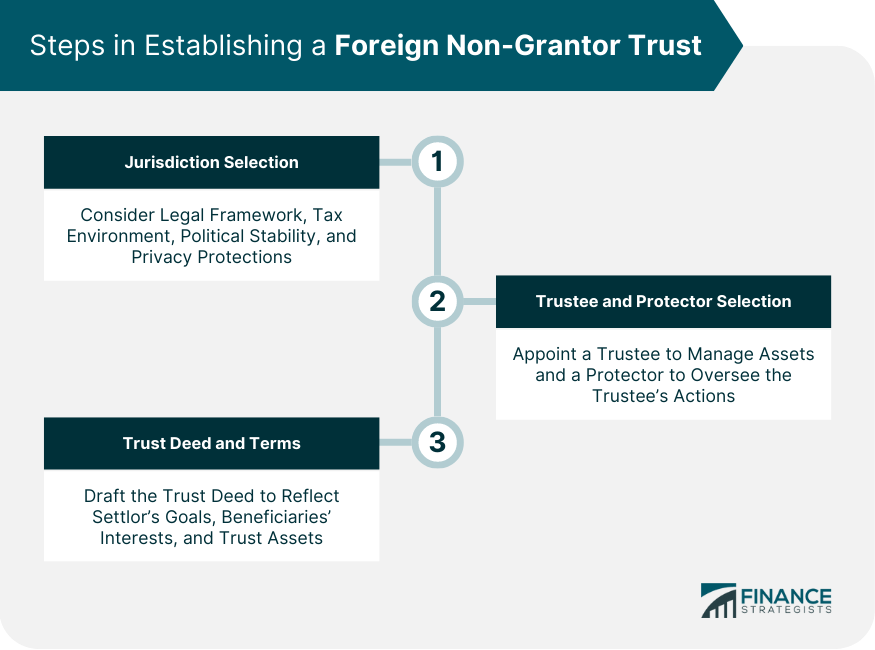

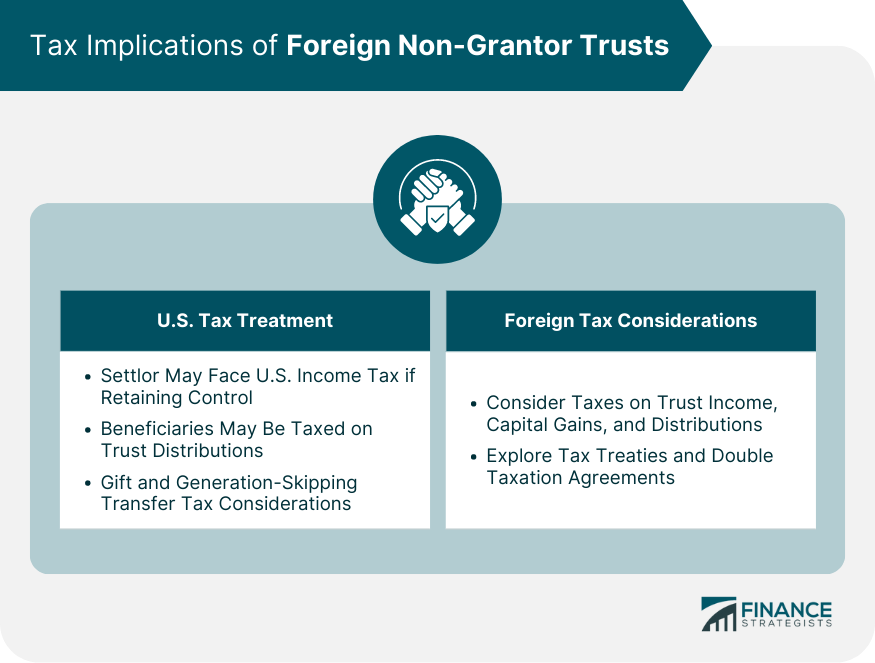

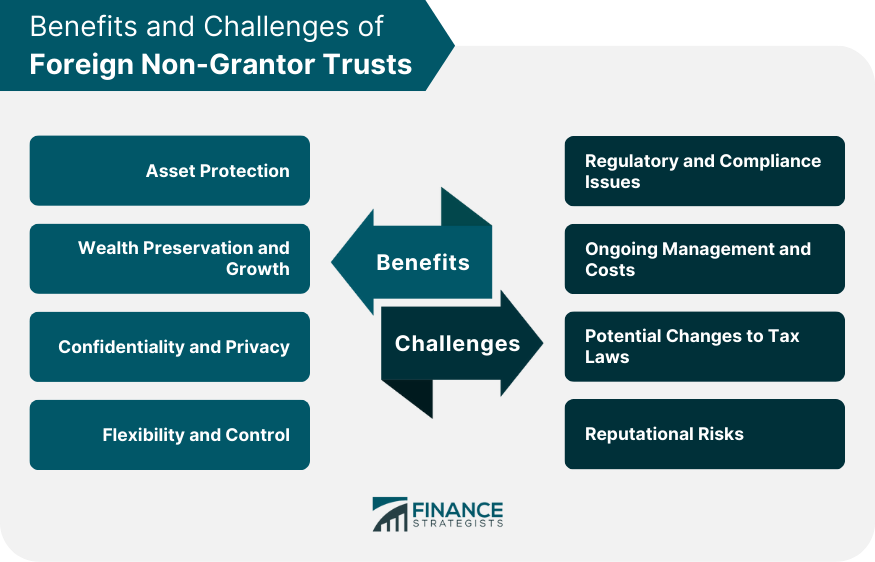

A Foreign Non-Grantor Trust (FNGT) is a type of trust established under the laws of a foreign (non-U.S.) jurisdiction, where the person creating the trust (the grantor or settlor) does not maintain control over the trust's assets or income for U.S. tax purposes. This means that the grantor is not treated as the owner of the trust's income or assets under U.S. tax law. Foreign Non-Grantor Trusts can be used for various purposes, including estate planning, asset protection, and tax planning. When creating a foreign non-grantor trust, the first step is to choose the appropriate jurisdiction. Factors to consider include the legal framework, tax environment, political stability, and confidentiality and privacy protections offered by the jurisdiction. Some popular choices include the Cook Islands, the British Virgin Islands, and Switzerland. The next step is to appoint a trustee and a protector. The trustee is responsible for managing the trust's assets and making distributions to beneficiaries in accordance with the trust's terms. The protector, on the other hand, ensures that the trustee is acting in the best interests of the beneficiaries and can remove and replace the trustee if necessary. The trust deed is the legal document that sets out the terms of the foreign non-grantor trust. This should be carefully crafted to reflect the settlor's goals and objectives, including the interests of the beneficiaries and the assets to be held in trust. Foreign non-grantor trusts can have complex tax implications for both the settlor and beneficiaries. For the settlor, the trust's income may be subject to U.S. income tax if the settlor retains certain powers over the trust. Beneficiaries may be subject to income tax on distributions received from the trust. Gift tax and generation-skipping transfer tax implications should also be considered when establishing a foreign non-grantor trust. In addition to U.S. tax considerations, the tax implications of the trust's jurisdiction must be taken into account. This may include taxes on trust income, capital gains, and distributions to beneficiaries. Tax treaties and double taxation agreements between the U.S. and the trust's jurisdiction should be considered to minimize the overall tax burden. One of the primary benefits of foreign non-grantor trusts is asset protection. By placing assets in a trust, they are shielded from creditors, legal claims, and political risks, ensuring that the settlor's wealth is preserved for future generations. Foreign non-grantor trusts can offer tax-efficient strategies for wealth preservation and growth. By taking advantage of the trust's jurisdiction, the trust can benefit from lower tax rates and favorable investment opportunities, allowing the trust's assets to grow over time. Foreign non-grantor trusts can provide a high level of confidentiality and privacy for the settlor and beneficiaries, often due to the trust's jurisdiction having strict secrecy laws and limited reporting requirements. Foreign non-grantor trusts can be tailored to the settlor's specific needs, offering flexibility in terms of asset management, distributions, and succession planning. This allows the settlor to retain a degree of control over the trust's assets, even after they have been transferred to the trust. Foreign non-grantor trusts are subject to a range of regulatory and compliance requirements, including the Foreign Account Tax Compliance Act (FATCA), Common Reporting Standard (CRS), and Anti-money Laundering (AML) and Know Your Customer (KYC) regulations. Failure to comply with these requirements can result in significant penalties and reputational damage. Managing a foreign non-grantor trust can be time-consuming and expensive, particularly when dealing with multiple jurisdictions and complex tax and regulatory requirements. It is essential to work with experienced professionals, such as attorneys, accountants, and trust administrators, to ensure that the trust is properly managed and compliant with all relevant laws and regulations. The tax environment for foreign non-grantor trusts can change rapidly, as governments around the world continue to update their tax laws and regulations. Settlors and beneficiaries must remain vigilant and stay informed about any changes that may impact their trust, adjusting their estate planning strategies accordingly. While foreign non-grantor trusts can offer significant benefits, they can also carry reputational risks. Trusts may be perceived as vehicles for tax evasion or money laundering, potentially damaging the settlor's or beneficiaries' reputation. It is crucial to ensure that the trust is used for legitimate estate planning purposes and that all required disclosures and reporting are completed. Foreign Non-Grantor Trusts (FNGTs) provide valuable benefits in estate planning, including asset protection, wealth preservation, confidentiality, and flexibility. Establishing an FNGT involves selecting the right jurisdiction, appointing a trustee and protector, and drafting a comprehensive trust deed. Tax implications must be carefully considered, as FNGTs can have complex U.S. and foreign tax treatment, affecting both the settlor and beneficiaries. Compliance with regulatory requirements, ongoing management, and potential changes in tax laws present challenges. Reputational risks associated with FNGTs should also be considered. Engaging experienced professionals and staying informed is essential to effectively utilize FNGTs while ensuring compliance and safeguarding reputations.Foreign Non-Grantor Trusts

Establishing a Foreign Non-Grantor Trust

Jurisdiction Selection and Considerations

Selection of a Trustee and Protector

Trust Deed and Terms

Tax Implications of Foreign Non-Grantor Trusts

U.S. Tax Treatment

Foreign Tax Considerations

Benefits of Foreign Non-Grantor Trusts

Asset Protection

Wealth Preservation and Growth

Confidentiality and Privacy

Flexibility and Control

Challenges and Risks Associated With Foreign Non-Grantor Trusts

Regulatory and Compliance Issues

Ongoing Management and Costs

Potential Changes to Tax Laws

Reputational Risks

Final Thoughts

Foreign Non-Grantor Trusts FAQs

Foreign non-grantor trusts are a type of trust established in a foreign jurisdiction, typically used for estate planning purposes to provide asset protection, tax efficiency, and privacy. They differ from other types of trusts, such as grantor trusts and domestic trusts, in that they are subject to different tax and legal regulations due to their foreign location.

Foreign non-grantor trusts offer several estate planning benefits, including asset protection from creditors, legal claims, and political risks, tax-efficient strategies for wealth preservation and growth, confidentiality and privacy, and flexibility and control in managing assets and distributing them to beneficiaries.

Tax implications for foreign non-grantor trusts include U.S. income tax considerations for both the settlor and beneficiaries, as well as gift tax and generation-skipping transfer tax implications. Additionally, foreign tax considerations such as taxes on trust income, capital gains, and distributions to beneficiaries in the trust's jurisdiction must be taken into account. Tax treaties and double taxation agreements can help minimize the overall tax burden.

Challenges and risks associated with foreign non-grantor trusts include regulatory and compliance issues (e.g., FATCA, CRS, AML, and KYC regulations), ongoing management and costs, potential changes to tax laws, and reputational risks. It is essential to work with experienced professionals to ensure that the trust is properly managed and compliant with all relevant laws and regulations.

When selecting a jurisdiction for a foreign non-grantor trust, factors to consider include the legal framework, tax environment, political stability, and confidentiality and privacy protections offered by the jurisdiction. Popular jurisdictions for foreign non-grantor trusts include the Cook Islands, the British Virgin Islands, and Switzerland.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.