Trust property, also known as trust assets or trust corpus, encompasses the tangible or intangible items held within a trust. The trust is established by the settlor (or grantor), who transfers assets into the trust. This process of establishing trust property involves selecting the appropriate assets, determining the type of trust, and drafting a trust agreement. Trust property is then managed by the trustee, who has a fiduciary duty to manage the assets in the best interests of the beneficiary. The beneficiary is the individual or entity that stands to benefit from the trust property. In some cases, a protector may be appointed to oversee the trustee's actions. Ultimately, the arrangement allows for efficient wealth management, asset protection, and structured transfer of assets. Trust property plays a vital role in financial and estate planning, enabling efficient wealth management and a structured transfer of assets to beneficiaries. By placing assets in a trust, the settlor can protect these from creditors, minimize estate taxes, and ensure the orderly disposition of wealth. Furthermore, trust property provides a mechanism for settlors to stipulate specific conditions for asset distribution, thus ensuring their wishes are fulfilled even after their demise. This way, trust property ensures a legacy, provides for loved ones, and can even support charitable causes. The settlor, also known as the grantor, is the individual who establishes the trust. They transfer their assets into the trust, determine the trust's terms, and identify the beneficiaries. The trustee is entrusted with the management of the trust property. They have a fiduciary duty to act in the best interests of the beneficiary, manage assets wisely, and distribute them according to the trust's terms. The beneficiary is the person or entity that receives the benefits from the trust property. Beneficiaries can enjoy benefits such as income generated from the trust property, or they can be entitled to the trust property itself. A protector's role can vary significantly based on the trust's terms. Generally, a protector has the power to oversee the trustee’s actions, ensuring they act according to the trust's terms and the beneficiaries' best interests. Selecting trust property involves determining which assets the settlor wants to include in the trust. These assets should align with the settlor's goals—whether it's wealth preservation, tax planning, or providing for loved ones. The type of trust selected plays a significant role in achieving the settlor's goals. It's essential to consider factors such as tax implications, control over assets, and the level of asset protection needed when choosing a trust type. The trust agreement is a legal document outlining the terms of the trust. It should clearly define the roles of the settlor, trustee, and beneficiaries; the trust property; and instructions for the trust property's management and distribution. Transferring property into a trust requires changing the legal ownership of the asset to the trust. This can involve signing a new deed for real estate, transferring stock certificates, or re-titling other assets. Title companies often facilitate the transfer of real estate into a trust. They ensure clear title, handle the legal paperwork, and provide insurance against title defects. Improper transfer of assets into a trust can lead to disputes over ownership, tax complications, and potential invalidation of the trust. It's essential to consult with legal professionals to ensure correct procedures are followed. The trustee's primary role is managing the trust property. They must protect the assets, invest them prudently, and follow the trust's terms. They are also responsible for accounting and reporting obligations to keep beneficiaries informed about the trust's status. The trustee is bound by a fiduciary duty, meaning they must prioritize the beneficiaries' interests above their own. They must adhere to the trust agreement, avoid conflicts of interest, invest trust assets wisely, and act with care, skill, and prudence. Mismanagement of trust property can lead to legal consequences for the trustee, including removal, damages, or personal liability. It can also disrupt the trust's purposes and potentially harm the beneficiaries' interests. The conditions for distribution of trust property are typically outlined in the trust agreement. These can include specific dates, the beneficiary reaching a certain age, or the occurrence of certain events. Trust property is distributed to beneficiaries as per the trust's terms. This can involve direct payments, creating sub-trusts, or transferring asset ownership. The trustee must carry out this process in a fair and transparent manner. Disputes over trust property distribution can arise due to misunderstandings, alleged trustee mismanagement, or conflicts among beneficiaries. Legal proceedings, mediation, or arbitration are common methods to resolve such disputes. The settlor's tax implications depend on the trust type. For instance, in a revocable trust, the settlor remains liable for taxes on trust income, while in an irrevocable trust, they can potentially remove assets from their taxable estate. Beneficiaries may owe taxes on income or distributions they receive from the trust. However, tax liability can vary based on the trust's nature and the beneficiary's circumstances. Trusts may be subject to income tax on retained income and may have to file annual tax returns. Trust tax rules can be complex, necessitating expert advice. Trust property is often protected from the creditors of the settlor and beneficiaries, especially with irrevocable trusts. This makes trusts a powerful tool for asset protection. Similarly, trust property can be shielded from legal judgments, providing a layer of security against potential lawsuits or claims. Trust property plays a crucial role in estate planning, offering a way to manage and protect assets, minimize estate taxes, and ensure the orderly transfer of wealth to beneficiaries. Trust property is typically not considered marital property in divorce cases, unless the trust was established during the marriage or marital assets were used to fund the trust. In bankruptcy, trust property is usually safe from the debtor's creditors, depending on the trust's nature and the bankruptcy laws in the jurisdiction. Upon a trustee's death, a successor trustee named in the trust agreement takes over the trust's management. The transition should be smooth, with minimal impact on the trust property. Trust property is a vital component of financial and estate planning, encapsulating a wide range of assets, including real estate, cash, and securities, held in a trust. The key players in the dynamics of trust property—such as the settlor, who creates and funds the trust, the trustee who manages the assets, the beneficiaries who receive the benefits, and the protector who ensures compliance—are instrumental in maintaining the trust's purpose and functionality. The process of establishing trust property involves careful selection of assets, determining the type of trust best suited to the settlor's objectives, and drafting a precise trust agreement. Understanding these facets of trust property can provide a valuable framework for wealth preservation, tax efficiency, and the seamless transfer of assets across generations.Definition of Trust Property

Importance of Trust Properties

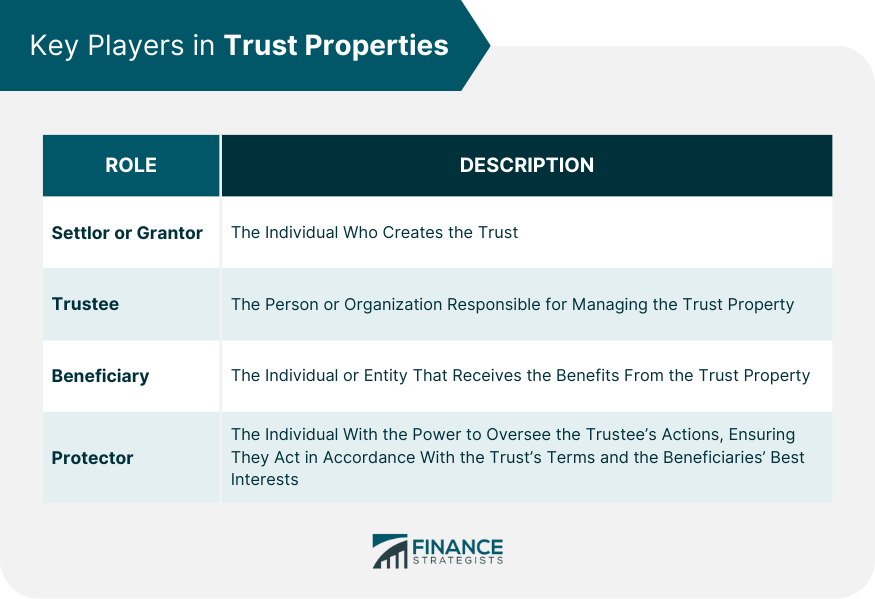

Key Players in Trust Properties

Settlor or Grantor

Trustee

Beneficiary

Protector

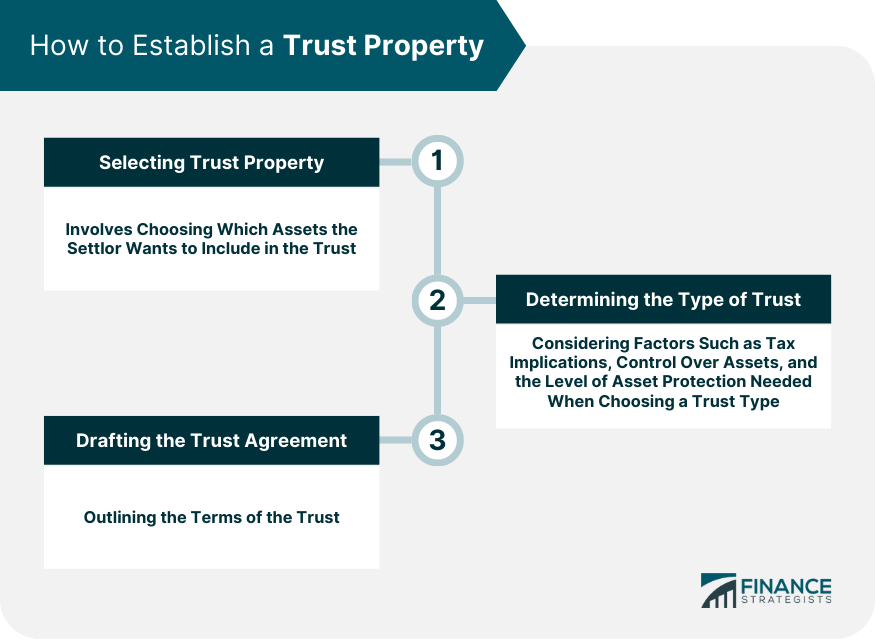

How to Establish a Trust Property

Selecting a Trust Property

Determining the Type of Trust

Drafting the Trust Agreement

Transfer of Trust Property

How a Property is Transferred Into a Trust

Role of Title Companies in Trust Property Transfers

Consequences of Improper Transfers

Management of Trust Properties

Trustee's Role in Managing a Trust Property

Legal Duties of a Trustee

Consequences of Mismanaging Trust Properties

Distribution of Trust Properties

Conditions for Distribution

Process of Distribution to Beneficiaries

Possible Disputes and Their Resolution

Trust Properties and Taxes

Tax Implications for the Settlor

Tax Implications for the Beneficiary

Tax Implications for the Trust Itself

Protecting Trust Properties

Protection From Creditors

Protection From Legal Judgments

Role of Trust Properties in Estate Planning

Trust Properties in Special Circumstances

Trust Properties in Divorce Cases

Trust Properties in Bankruptcy

Trust Properties in the Death of the Trustee

Conclusion

Trust Property FAQs

Trust property can encompass a broad range of assets, from tangible items like real estate, vehicles, and personal belongings, to intangible assets such as cash, stocks, bonds, or ownership stakes in a business.

Determining the type of trust for trust property depends on the settlor's objectives. Factors to consider include tax implications, control over assets, desired level of asset protection, and the needs of the intended beneficiaries.

A trust agreement is a critical legal document when establishing trust property. It outlines the terms of the trust, defines the roles of involved parties, identifies the trust property, and provides instructions for its management and distribution.

This depends on the type of trust. In a revocable trust, the settlor can add or remove trust property during their lifetime. However, changes are generally not allowed in an irrevocable trust without the beneficiaries' consent.

One common pitfall is neglecting to formally transfer the chosen assets into the trust, which can lead to ownership disputes. Also, choosing inappropriate assets for the trust—ones that don't align with the settlor's goals—can cause complications. Consulting with a legal or financial advisor is advisable to avoid these and other pitfalls.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.