DIY Estate Planning is a self-directed approach to determining the distribution and management of one's assets after death. It involves key components such as a Last Will and Testament, a Durable Power of Attorney, Health Care Directives, Trusts, and Beneficiary Designations. The process requires a meticulous step-by-step guide, starting from inventorying assets, determining beneficiaries, choosing an executor or trustee, to creating legal documents and possibly establishing trusts. Like any self-managed process, DIY Estate Planning has its pros and cons. On one hand, it offers flexibility, cost-effectiveness, and a sense of control over your financial legacy. On the other hand, it may involve potential risks of oversights and misunderstandings due to legal complexities. Thus, thorough understanding and careful handling are vital in ensuring its effectiveness and reliability. A last will and testament is a legal document outlining how an individual’s assets should be distributed upon their death. It's the cornerstone of any estate plan and serves as the final say on the decedent's wishes. A valid will prevents familial disputes and potential legal battles. A durable power of attorney (POA) is another vital component of an estate plan. This legal document authorizes another individual to manage your financial affairs should you become incapacitated. Health care directives, also known as advance directives, allow you to communicate your health care preferences should you become unable to make such decisions yourself. This typically includes a living will and a health care power of attorney. A trust is a legal arrangement whereby a trustee holds and manages assets on behalf of beneficiaries. Trusts can be an effective way to manage and distribute assets according to specific guidelines and timings. Beneficiary designations dictate who will receive specific assets like life insurance policies, retirement accounts, and payable-on-death accounts. These designations can bypass probate, simplifying the process of asset distribution. The first step in estate planning is compiling a comprehensive inventory of your assets. This list should include real estate, investments, retirement accounts, life insurance policies, and personal belongings. Next, decide who will inherit your assets upon your death. Be as specific as possible to avoid potential disputes among your heirs. Your executor (for a will) or trustee (for a trust) will be responsible for carrying out your wishes as outlined in your estate plan. Choose someone you trust to handle this responsibility. Once you've established your assets, beneficiaries, and executor, you can create your will. Online tools and software can help you draft a legally binding document. Set up your health care directives to ensure your medical wishes are honored if you're unable to make decisions yourself. Establishing a POA ensures that someone can handle your financial matters if you become unable to do so. If your estate is complex or you have specific desires for asset management and distribution, establishing one or more trusts may be beneficial. DIY estate planning can be a cost-effective solution, but it's not for everyone. One of the most significant advantages of DIY estate planning is the cost savings. Professional estate planning can be expensive, and if your estate is straightforward, you may be able to create a valid plan yourself using available online resources, thereby saving on attorney fees. DIY estate planning also offers flexibility. You can draft, review, and revise your documents at your own pace. It's convenient, especially with online platforms offering state-specific guidance and templates for creating legal documents. On the downside, DIY estate planning can be risky due to the complex nature of estate laws. A lack of legal expertise may lead to mistakes or oversights in your documents. Misunderstanding the legal jargon can result in a will or trust that doesn't reflect your true intentions, potentially leading to disputes among beneficiaries. The one-size-fits-all nature of online templates may not account for unique situations in your estate. If you have a large or complex estate, own a business, or have a complicated family situation, a DIY approach may not be adequate. Each state has specific regulations for estate planning. You should understand the legal requirements to ensure your documents are valid and enforceable. These requirements usually involve notarization and the presence of witnesses. Regular updates and revisions to your estate plan are also essential as your personal circumstances and financial situation change. Every state has its own laws regarding the validity of wills and trusts. You need to ensure your documents comply with your state’s regulations. Most estate planning documents need to be signed in front of a notary or witnesses to be legally enforceable. Understanding these requirements is crucial to avoid any complications down the line. Life changes, such as marriage, divorce, the birth of a child, the death of a beneficiary, or significant financial shifts, necessitate regular reviews and updates to your estate plan. An outdated estate plan can lead to unintended consequences. There are numerous resources available to help you with your DIY estate planning. Online services like LegalZoom, Nolo, and Rocket Lawyer provide templates for creating wills, trusts, and other estate planning documents. They can also offer state-specific guidance. Software programs like Quicken WillMaker & Trust allow you to create comprehensive estate plans on your computer. These programs often provide step-by-step guidance and legal information. You can find a plethora of legal forms and document templates online. These can serve as a basis for your estate planning documents, although they should be used with caution and properly tailored to your specific situation. While DIY estate planning can be a good start, there are situations when professional help is needed. If your estate is complex, has significant assets, or involves complicated family situations, it's advisable to consult with an estate planning attorney. If you have a child with special needs, own a business, or have other unique circumstances, professional help can ensure these situations are properly addressed in your estate plan. Professional estate planners have the expertise to navigate legal intricacies and potential tax issues. They can provide advice on estate tax, gift tax, and income tax implications of your estate plan. DIY estate planning offers a cost-effective way to manage your personal legacy. It empowers you to document your wishes regarding asset distribution, choose responsible parties to oversee financial and healthcare decisions and prevent potential legal disputes among heirs. While this approach requires meticulous consideration and knowledge of legal nuances, a wealth of online resources and tools can aid the process. However, complexity, unique circumstances, or legal hurdles may necessitate professional guidance. Regardless of the approach, updating your estate plan to match life changes is paramount. It is important to remember that the objective of estate planning, DIY or otherwise, is to ensure your desires for your legacy are met, providing peace of mind for you and clarity for your loved ones.DIY Estate Planning Overview

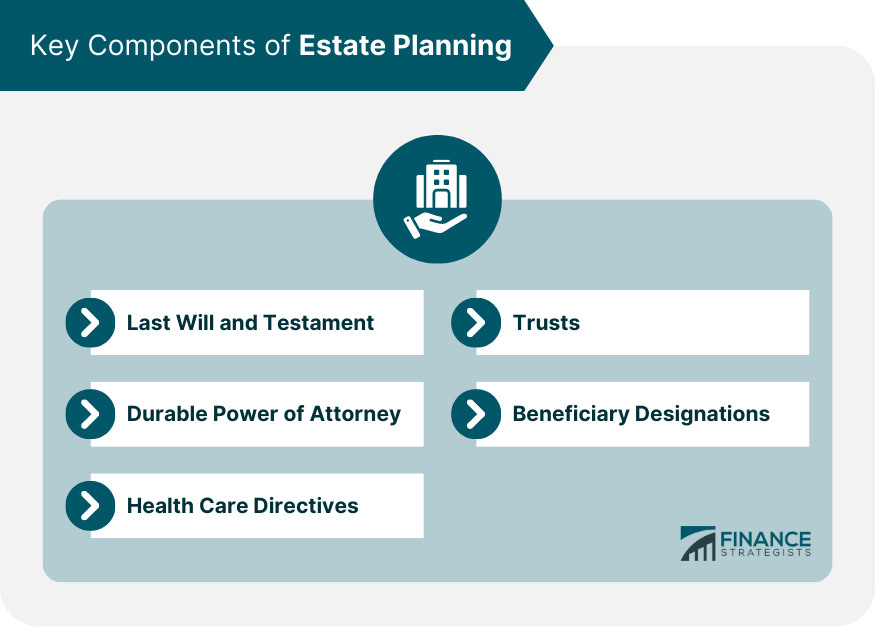

Key Components of Estate Planning

Last Will and Testament

Durable Power of Attorney

Health Care Directives

Trusts

Beneficiary Designations

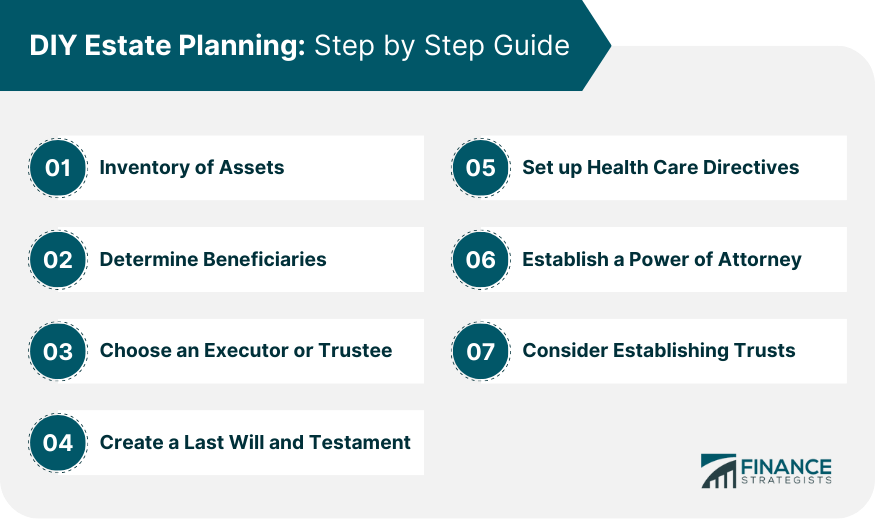

DIY Estate Planning: Step by Step Guide

Step 1: Inventory of Assets

Step 2: Determine Beneficiaries

Step 3: Choose an Executor or Trustee

Step 4: Create a Last Will and Testament

Step 5: Set up Health Care Directives

Step 6: Establish a Power of Attorney

Step 7: Consider Establishing Trusts

Pros and Cons of DIY Estate Planning

Advantages of DIY Estate Planning

Disadvantages of DIY Estate Planning

Understanding Legal Requirements in DIY Estate Planning

State-Specific Regulations

Notarization and Witnesses

Regular Updates and Revisions

DIY Estate Planning: Necessary Tools and Resources

Online DIY Estate Planning Services

Estate Planning Software

Legal Forms and Document Templates

When to Seek Professional Help in Estate Planning

Complex Estates and High Net Worth

Special Situations

Legal Complications and Tax Issues

Conclusion

DIY Estate Planning FAQs

DIY estate planning is a self-managed process of organizing and documenting how your assets should be distributed after your death. It's important because it provides a clear roadmap for your loved ones, minimizes potential disputes, and ensures your wishes are carried out.

The key components include a Last Will and Testament, Durable Power of Attorney, Health Care Directives, Trusts, and Beneficiary Designations. Each element plays a significant role in detailing your wishes and designating trusted individuals to carry them out.

Online services like LegalZoom, Nolo, and Rocket Lawyer provide templates and guidance. Software programs, such as Quicken WillMaker & Trust, and various legal forms and document templates available online can also aid the process.

DIY estate planning can save attorney fees, offers flexibility, and gives a sense of control. However, it can potentially lead to oversights or misunderstandings due to its complex legal nature, which can result in disputes among beneficiaries.

While DIY estate planning is a great start, it's advisable to seek professional help for complex estates, high net worth situations, special needs, or legal complications. Professional estate planners can navigate these intricacies effectively.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.