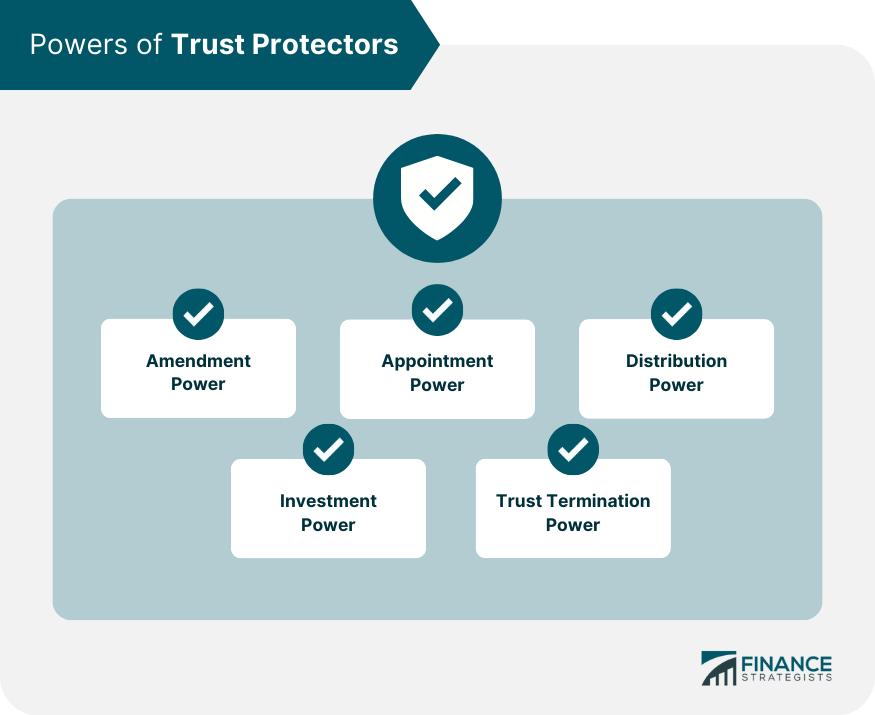

Trust protectors are individuals or entities appointed to oversee and protect the interests of the beneficiaries in a trust. They serve as an additional layer of protection for trust assets, ensuring that the trust is administered according to the settlor's intentions and in the best interests of the beneficiaries. Trust protectors play a crucial role in trust administration, providing oversight and guidance to trustees while safeguarding the rights and interests of beneficiaries. Their involvement helps to maintain the integrity of the trust and can prevent potential mismanagement or conflicts of interest among trustees. Trust protectors act as an additional layer of oversight and protection for trust beneficiaries. They have the authority to intervene in trust administration, monitor trustee actions, and exercise specific powers granted to them by the trust agreement. Their involvement helps ensure that the trust is managed effectively and in the best interests of the beneficiaries. Trust protectors can also serve as a valuable resource for trustees, providing guidance and support on complex trust matters. They can help navigate challenging situations and act as a mediator between trustees and beneficiaries when disputes arise. Independent trust protectors are individuals or entities not related to the settlor, beneficiaries, or trustees. They are appointed to provide an unbiased perspective and ensure the trust is administered fairly and in accordance with the trust agreement. Some trust protectors are directly appointed by the settlor, the person who establishes the trust. In these cases, the settlor typically selects someone they trust to uphold their intentions and protect the interests of the beneficiaries. In some instances, trust protectors may be appointed by the beneficiaries themselves. This arrangement allows beneficiaries to have a say in who oversees the trust's administration and ensures their interests are represented and protected. Trust protectors often have the authority to amend the trust agreement in response to changes in circumstances or laws. This power enables them to ensure the trust remains effective and relevant over time, adapting to the needs of the beneficiaries. Trust protectors may have the power to appoint or remove trustees, either directly or by providing consent for such actions. This authority helps ensure that competent and trustworthy individuals are managing the trust assets. In some cases, trust protectors may have the authority to make decisions regarding the distribution of trust assets to beneficiaries. This power allows them to ensure that distributions are made in accordance with the settlor's intentions and the best interests of the beneficiaries. Trust protectors may have the authority to oversee or make decisions regarding the trust's investments. This power helps ensure that trust assets are invested prudently and in a manner consistent with the trust's objectives and the beneficiaries' best interests. In certain circumstances, trust protectors may have the authority to terminate the trust. This power enables them to end the trust if it becomes unviable or if its purpose has been fulfilled. Trust protectors are responsible for monitoring the trust's administration and ensuring that it is managed effectively and in the best interests of the beneficiaries. This responsibility includes overseeing the actions of the trustees and intervening when necessary to protect the beneficiaries' interests. One of the primary responsibilities of a trust protector is to protect the rights and interests of the trust beneficiaries. This may involve reviewing trust documents, monitoring trustee actions, and intervening when necessary to ensure that the trust is administered according to the settlor's intentions. Trust protectors may have a fiduciary duty to the beneficiaries, meaning they are legally obligated to act in the best interests of the beneficiaries. This duty requires trust protectors to exercise their powers prudently and in good faith, always considering the well-being and interests of the beneficiaries. Trust protectors are responsible for making important decisions related to the trust's administration, such as appointing or removing trustees, amending the trust agreement, or approving distributions. They must make these decisions carefully and objectively, keeping the best interests of the beneficiaries in mind. Trust protectors should regularly review the trust's administration, documents, and investments to ensure that they remain compliant with the trust agreement and relevant laws. This review process helps identify any potential issues or areas of concern that may need to be addressed. Trust protectors can be appointed through various methods, including directly by the settlor, by the beneficiaries, or through a provision in the trust agreement. The method of appointment will depend on the trust's specific terms and the preferences of the settlor and beneficiaries. Trust protectors can be removed for various reasons, including failure to fulfill their responsibilities, a breach of their fiduciary duty, or if they become unable or unwilling to serve in their role. The process for removal will depend on the trust's specific terms and the circumstances surrounding the removal. The process for removing a trust protector may be outlined in the trust agreement or determined by relevant laws. This process may involve a vote by the beneficiaries, a decision by the trustees, or the trust protector's resignation. It is essential to follow the trust's specific terms and any applicable laws when removing a trust protector. Trustees and trust protectors serve different roles in trust administration. Trustees are responsible for managing the trust's assets, making investment decisions, and distributing assets to beneficiaries according to the trust agreement. Trust protectors, on the other hand, serve as an additional layer of oversight and protection, ensuring that trustees act in the best interests of the beneficiaries and adhere to the trust agreement's terms. While both roles are important, they have distinct responsibilities and functions within the trust. Trust protectors play a crucial role in trust administration, providing oversight and guidance to trustees while safeguarding the rights and interests of beneficiaries. They act as an additional layer of protection, ensuring that the trust is administered according to the settlor's intentions and in the best interests of the beneficiaries. Trust protectors have various types, including independent trust protectors, those appointed by the settlor, and those appointed by the beneficiaries. They are granted specific powers such as amendment power, appointment power, distribution power, investment power, and trust termination power. Responsibilities of trust protectors include overseeing trust administration, safeguarding beneficiary interests, fulfilling fiduciary duties, making important decisions, and conducting regular reviews. Trust protectors can be appointed through various methods and can be removed if they fail to fulfill their responsibilities or breach their fiduciary duty. It is important to understand the differences between trustees and trust protectors, as they have distinct roles and responsibilities within the trust.What Are Trust Protectors?

Role of Trust Protectors in Trusts

Types of Trust Protectors

Independent Trust Protectors

Trust Protectors Appointed by Settlor

Trust Protectors Appointed by Beneficiaries

Powers of Trust Protectors

Amendment Power

Appointment Power

Distribution Power

Investment Power

Trust Termination Power

Responsibilities of Trust Protectors

Overseeing Trust Administration

Safeguarding Beneficiary Interests

Fiduciary Duty

Decision-Making

Regular Review

Appointment and Removal of Trust Protectors

Methods of Appointing Trust Protectors

Reasons for Removing Trust Protectors

Process for Removing Trust Protectors

Differences Between Trustees and Trust Protectors

Final Thoughts

Trust Protectors FAQs

Trust Protectors are appointed to oversee the trustee's actions, ensuring that the trust is managed in the best interest of the beneficiaries.

Trust Protectors can be appointed by the settlor, beneficiaries, or the court, depending on the terms of the trust.

Trust Protectors have various powers, such as removing trustees, modifying the trust, and changing beneficiaries or distribution terms.

The process for removing a Trust Protector usually involves following the procedure outlined in the trust document, such as through a notice and a vote.

A Trustee manages the trust, while a Trust Protector oversees the trustee's actions and has the power to make changes to the trust if necessary.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.