Estate Planning and Probate are crucial aspects of managing and transferring wealth. Estate Planning involves preparing for the distribution of an individual's assets upon their death or incapacitation. It includes creating wills, trusts, power of attorney, and healthcare directives, among other elements. Probate, on the other hand, is the legal process that occurs after a person's death to authenticate their will, settle debts, and distribute their assets. Both processes significantly impact readers as they directly concern the control and legacy of their assets. In the broader context, effective estate planning can simplify the probate process, reduce potential disputes among beneficiaries, and ensure that one's wishes are carried out accurately. By understanding these concepts, individuals can make informed decisions about their financial futures and ultimately provide peace of mind for themselves and their loved ones. Estate planning and probate are intertwined in several crucial ways. Estate planning strategies such as creating a will or establishing a trust directly influence the probate process. These legal tools dictate how your assets will be distributed after your death and whether your estate will be subject to probate at all. A well-crafted estate plan can streamline the probate process or avoid it altogether, saving your beneficiaries time, money, and stress. Conversely, dying without an estate plan, or "intestate," leaves the distribution of your assets to the state's probate laws, which may not align with your wishes. Using revocable living trusts, joint ownership structures, and beneficiary designations are strategies to bypass probate. Maintaining an updated and accurate estate plan is the best way to ensure your assets are distributed according to your wishes and to minimize potential disputes or issues during probate. Estate planning attorneys, tax advisors, and financial planners play crucial roles in the estate planning and probate processes. They can offer expertise and guidance, help avoid common pitfalls, and ensure your plan aligns with your goals. Every individual's situation is unique, and certain circumstances can add complexity to the estate planning and probate processes. Some states have simplified probate procedures for small estates, which can make the process quicker and less expensive. However, even those with small estates can benefit from basic estate planning to ensure their wishes are followed. Estates that include business interests, multiple real estate properties, or other unique assets require careful planning to manage potential tax implications and to ensure these assets are distributed or managed as desired. Blended families can present unique challenges for estate planning and probate. Careful planning is needed to balance the needs and interests of a current spouse, previous spouses, and children from multiple relationships. Owning assets in multiple countries can complicate estate planning and probate. Different countries have different laws regarding asset distribution and taxes upon death, which need to be taken into account when planning. An effective estate plan is like a jigsaw puzzle, with each piece fitting together to create a clear picture of your intentions. Five key components often form the basis of a robust estate plan. Will: The cornerstone of most estate plans, a will, outlines how you want your assets distributed after your death. It also allows you to name an executor to oversee this process and nominate guardians for minor children. Trusts: Trusts offer a way to transfer wealth and property outside the probate process. They can be designed to address specific needs, such as special needs trusts for disabled beneficiaries or revocable living trusts to avoid probate. Durable Powers of Attorney: This document allows you to appoint someone to manage your financial affairs if you're unable to do so due to incapacity. Advance Health Care Directives: Also known as living wills, these documents specify your wishes regarding medical treatment if you cannot communicate them due to illness or incapacity. Beneficiary Designations: These are direct designations on financial accounts or insurance policies that bypass probate and directly transfer to the named beneficiaries upon death. Ideal for individuals with uncomplicated estates. It usually involves creating a will, designating beneficiaries on financial accounts, and setting up an advance healthcare directive and durable power of attorney. May be necessary for those with larger, more complicated estates. These might include multiple real estate properties, business ownership interests, complex family situations, or substantial assets that could be subject to estate tax. The estate planning process is not a one-size-fits-all proposition. It is customized to your unique situation, assets, goals, and family dynamics. Here are the general steps involved in creating an estate plan: 1. Inventory of Assets: This is a comprehensive list of everything you own and owe. It includes your home, other real estate, bank accounts, investments, retirement plans, insurance policies, and personal belongings 2. Identifying Goals and Objectives: These could range from providing for your family, ensuring your business continues to operate smoothly, minimizing taxes, or making charitable contributions. 3. Document Preparation and Execution: Depending on your goals and assets, this could involve drafting a will, creating various types of trusts, setting up durable powers of attorney, and more. 4. Review and Update of the Plan: An estate plan isn't a "set it and forget it" document. It should be reviewed and updated regularly to account for changes in your life, laws, and financial situation. Probate is a multi-step process that is overseen by the courts. Here are the basic steps involved: 1. Validating the Will: If a will exists, the court will first confirm its validity. 2. Appointing the Executor: The court appoints the executor named in the will (or appoints an administrator if no will exists) to manage the probate process. 3. Inventory and Appraisal of the Estate: The executor must identify and appraise all estate assets. 4. Payment of Debts and Taxes: The executor uses estate funds to pay off debts, taxes, and probate expenses. 5. Distribution of Remaining Assets: Once debts and taxes are paid, the remaining assets are distributed to the beneficiaries according to the will's instructions (or according to state law if no will exists). Probate assets are those owned solely by the deceased person at the time of death, without a named beneficiary. Examples include personal property, bank accounts in the deceased's name only, and real estate titled solely in the deceased's name. Non-probate assets bypass the probate process and are transferred directly to the designated beneficiaries. These include assets with named beneficiaries, such as life insurance policies or retirement accounts, property held in joint tenancy with rights of survivorship, and assets held in a trust. There are several strategies that can help you avoid the probate process: Joint Ownership: Assets owned jointly with rights of survivorship automatically pass to the surviving owner upon your death. Beneficiary Designations: Naming beneficiaries on life insurance policies, retirement accounts, and certain bank accounts can help these assets bypass probate. Revocable Living Trusts: Assets held in a revocable living trust are not subject to probate. You maintain control of the assets during your lifetime, and they are distributed to your beneficiaries upon your death according to your instructions in the trust. Probate lawyers, also known as estate or trust lawyers, help executors manage the probate process. They assist with various tasks, such as filing the necessary paperwork, advising on legal and tax issues, and ensuring assets are distributed correctly. Estate Planning and Probate are essential parts of wealth management and transfer. Through estate planning, including creating wills, trusts, and appointing power of attorney, individuals can safeguard their assets and ensure they are distributed as per their wishes upon death or incapacitation. Probate, the legal process post-death, validates a will, settles debts, and manages the distribution of assets. With an effective estate plan, one can simplify the probate process, avoid potential disputes among beneficiaries, and even evade probate entirely in some instances. Special circumstances like small or complex estates, blended families, or international assets add intricacy to the process, requiring meticulous planning. Staying updated with recent trends, like legislative changes and the emergence of digital assets, is equally important. Understanding and actively engaging in these processes enables individuals to make informed decisions, providing peace of mind for themselves and their loved ones.Estate Planning and Probate: Overview

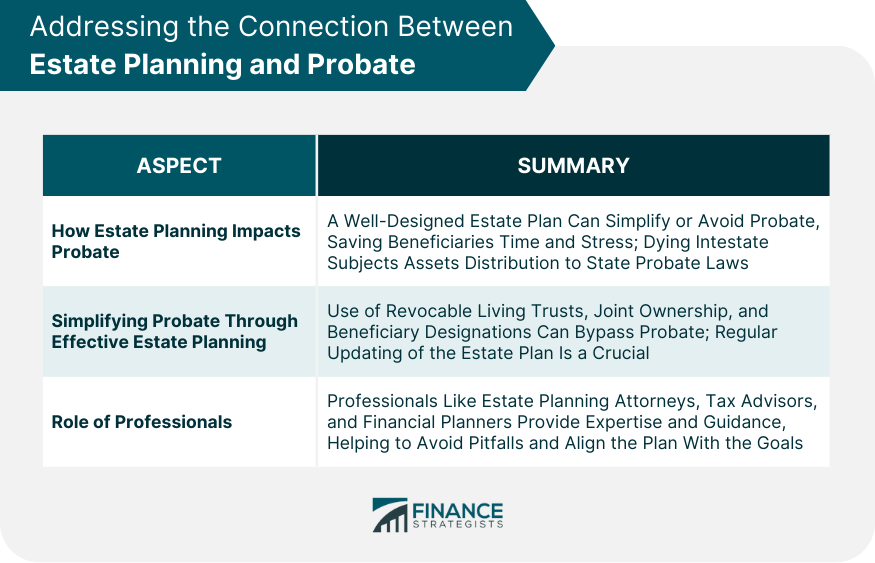

Addressing the Connection Between Estate Planning and Probate

How Estate Planning Impacts Probate

Strategies to Simplify or Avoid Probate

Role of Professionals in Coordinating Estate Planning and Probate Processes

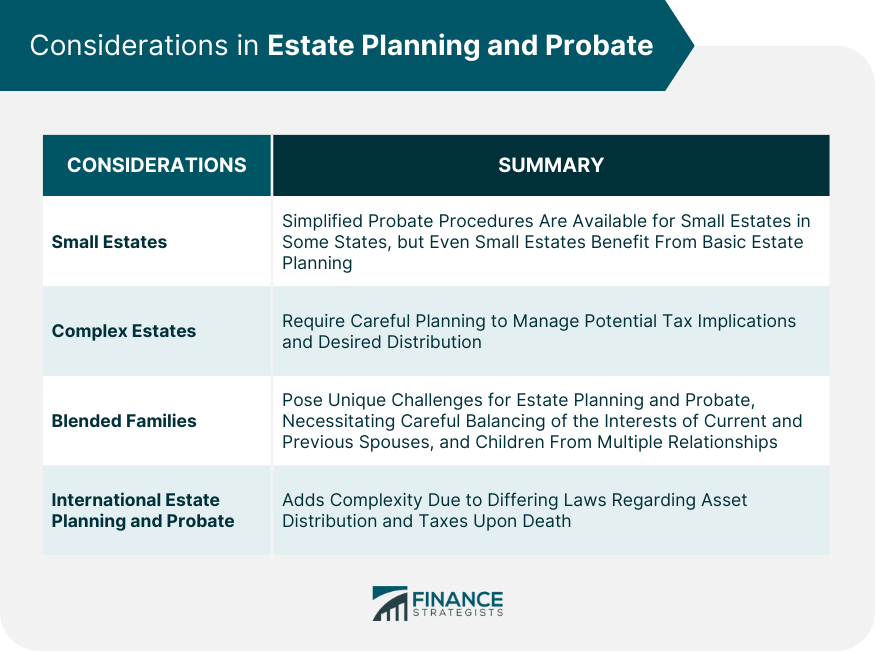

Special Considerations in Estate Planning and Probate

Estate Planning and Probate for Small Estates

Complex Estates

Estate Planning and Probate for Blended Families

International Estate Planning and Probate

Understanding Estate Planning

Key Components of an Estate Plan

Types of Estate Planning

Simple Estate Planning

Complex Estate Planning

Estate Planning Process

Delving Into Probate

Probate Process

Probate vs Non-probate Assets

Avoiding Probate

Role of a Probate Lawyer

Conclusion

Estate Planning and Probate FAQs

Estate planning and probate are intimately connected. Estate planning involves making arrangements for the management and distribution of your assets upon death or incapacitation. Probate is the legal process through which a deceased person's estate is administered and distributed. A well-constructed estate plan can streamline or even bypass the probate process, making it easier and less stressful for your heirs.

An estate plan dictates how you want your assets distributed after your death. If you pass away without a plan (intestate), state law will determine how your assets are divided, which may not align with your wishes. Additionally, estate planning can include tools to avoid or simplify probate, saving time, reducing costs, and lessening the potential for disputes among heirs.

Key components of estate planning that can impact the probate process include wills, trusts, durable powers of attorney, advance health care directives, and beneficiary designations. For example, assets held in a trust or with a designated beneficiary can usually avoid probate altogether, making the transfer of assets faster and less complicated.

Estate planning provides a roadmap for how your assets should be distributed, which can be particularly helpful in complex situations. For blended families, a comprehensive estate plan can help ensure fair treatment of all family members and reduce potential conflicts. For multiple real estate properties, careful estate planning can address issues related to property management, sales or distribution to heirs, and potential tax implications.

While it's not legally required to have an attorney, consulting with an experienced estate planning attorney is highly recommended. Estate planning involves complex legal and financial considerations, and an attorney can help ensure your documents are valid, comprehensive, and tailored to your specific needs and goals. In probate matters, an attorney can guide you through the process, handle paperwork, advocate for your interests, and help resolve any disputes that may arise.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.