Treasury bills, often referred to as T-bills, are short-term debt instruments issued by the government that are sold at a discount and redeemed at their face value upon maturity. On the other hand, Treasury bonds, or T-bonds, are long-term debt securities that pay semi-annual interest and return the face value at maturity. Both T-bills and T-bonds are backed by the full faith and credit of the government, making them highly secure investment options. They are essential components of the government's finance strategy and play a crucial role in the nation's monetary policy. These instruments are unique in their risk profile and returns, offering a fascinating study for both novice investors and seasoned financial experts.

Treasury bills (T-bills) are short-term debt instruments issued by the government to finance national borrowing needs. They are often referred to as the safest investments in the market due to their backing by the government's full faith and credit. Unlike traditional bonds, T-bills do not pay interest. Instead, they are issued at a discount and redeemed at face value upon maturity. The maturity period of T-bills varies, ranging from a few days to a maximum of 52 weeks. This flexibility of terms allows investors to select a period that best matches their financial requirements. The most common types are 4-week, 13-week, 26-week, and 52-week T-bills. In a nutshell, Treasury bills work on the concept of a discount from their face value. Investors purchase T-bills for less than their face value. Upon maturity, the government pays the investor the face value of the bill. The difference between the purchase price and the face value is the interest earned by the investor. For example, if an investor purchases a $1,000 T-bill for $950 and holds it until maturity, the government would repay the full $1,000. Thus, the investor makes a $50 profit. T-bills are among the lowest-risk investments available. As they are backed by the government, the risk of default is virtually nonexistent. Thus, they are an attractive option for risk-averse investors who seek to preserve their capital while earning a consistent, albeit modest, return. Due to their short-term nature, T-bills offer high liquidity. This makes them a suitable choice for investors looking for a temporary place to park their cash without compromising on accessibility. Investors can easily sell their T-bills in the secondary market if they need cash before the maturity date. T-bills play a crucial role in the country's monetary policy. The central bank often uses them as a tool to control the money supply in the economy. By changing the issue volume and interest rates on T-bills, the government can indirectly impact the level of economic activity in the country. While T-bills are safe and liquid, they typically offer lower returns compared to other investment options. This is because their risk is minimal, and in the investment world, lower risk usually translates to lower returns. Therefore, for those looking to maximize their potential returns and willing to accept higher risk, T-bills might not be the most attractive option. Inflation is another factor to consider when investing in T-bills. When inflation rates are high, the purchasing power of the returns from T-bills can diminish. If the inflation rate surpasses the yield of the T-bill, investors may end up with a negative real return. This scenario is particularly important to consider for long-term investors who might be more exposed to the adverse effects of inflation. Treasury bonds, often simply called "T-bonds," are long-term fixed-interest government debt securities. Unlike T-bills, Treasury bonds pay interest to the bondholder every six months until the bond matures, at which point the face value is returned. The maturity period of Treasury bonds is much longer than that of T-bills. Treasury bonds typically have maturities of 10, 20, or 30 years. This long maturity period makes them a common choice for long-term investors seeking predictable income streams. An investor who purchases a Treasury bond lends money to the government. In return, the government promises to pay a fixed rate of interest, known as the coupon rate, every six months for the life of the bond. Once the bond reaches its maturity date, the government repays the principal amount to the investor. One of the significant benefits of Treasury bonds is the semi-annual interest payments they offer. This predictable income stream can be particularly beneficial for individuals seeking stable returns, such as retirees or those nearing retirement. Like T-bills, Treasury bonds are backed by the full faith and credit of the U.S. government, making them one of the safest investments. Their high creditworthiness can be a significant advantage for risk-averse investors. Treasury bonds can play a critical role in diversifying an investment portfolio. Their predictable income stream and low correlation with equities can help reduce portfolio volatility and provide a hedge against market downturns. While the long maturity period of Treasury bonds can be a benefit for some investors, it can also be a disadvantage. The longer the maturity period, the longer the investor's capital is tied up, which may not be ideal for those needing more short-term liquidity. One of the main risks associated with Treasury bonds is interest rate risk. If interest rates rise, the price of existing bonds, which pay lower interest, tends to fall. Therefore, if an investor needs to sell a bond before maturity during a period of rising interest rates, they could suffer a capital loss. The most apparent difference between Treasury bills and bonds is their maturity periods. T-bills are short-term investments with maturities ranging from a few days to 52 weeks, whereas Treasury bonds have much longer maturities of 10 to 30 years. Generally, Treasury bonds offer higher yields compared to T-bills due to their longer maturity period and the greater risk associated with the potential for changing interest rates. Another significant difference is the payment structure. T-bills do not offer interest payments, instead being sold at a discount to face value and redeemed at full face value at maturity. On the other hand, Treasury bonds offer semi-annual interest payments, providing a regular income stream for bondholders. While both T-bills and T-bonds are considered low-risk investments due to their government backing, T-bonds are more exposed to interest rate risk due to their long maturity periods. When choosing between Treasury bills and bonds, several factors come into play: Your investment goals significantly influence your choice. If you seek a short-term, low-risk investment with good liquidity, T-bills are a better fit. If you seek regular income over the long term, T-bonds would be more suitable. Your investment time horizon is another critical factor. If you can afford to tie up your money for an extended period, you may lean towards Treasury bonds. If you need a short-term investment, T-bills might be more appropriate. While both T-bills and T-bonds are low risks, T-bonds carry slightly more risk due to interest rate fluctuations. Therefore, if you have a very low-risk tolerance, T-bills might be more suitable. Understanding the differences between Treasury bills and bonds is crucial for investors looking to make informed investment decisions. Treasury bills offer short-term, low-risk investments with high liquidity, while Treasury bonds provide long-term investments with regular income through semi-annual interest payments. Both options are backed by the government, ensuring their safety. When choosing between the two, investors should consider their investment objectives, time horizon, and risk tolerance. T-bills are suitable for those seeking short-term, low-risk investments, while T-bonds are ideal for individuals looking for regular income over a longer period. By considering these factors, investors can align their choices with their financial goals and risk preferences.Treasury Bills vs Bonds: Overview

What Are Treasury Bills?

Maturity Period of Treasury Bills

How Treasury Bills Work

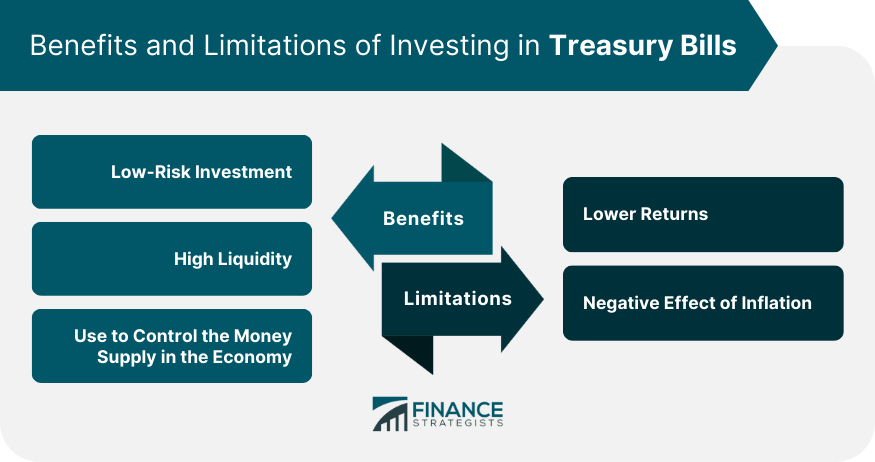

Benefits of Investing in Treasury Bills

Low-Risk Investment

High Liquidity

Use to Control the Money Supply in the Economy

Limitations of Treasury Bills

Lower Returns

Negative Effect of Inflation

What Are Treasury Bonds?

Maturity Period of Treasury Bonds

How Treasury Bonds Work

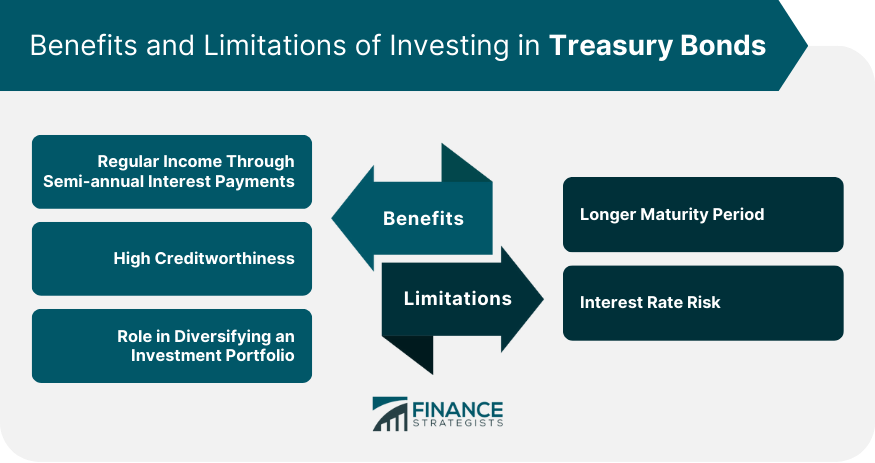

Benefits of Investing in Treasury Bonds

Regular Income Through Semi-Annual Interest Payments

High Creditworthiness

Role in Diversifying an Investment Portfolio

Limitations of Treasury Bonds

Longer Maturity Period

Interest Rate Risk

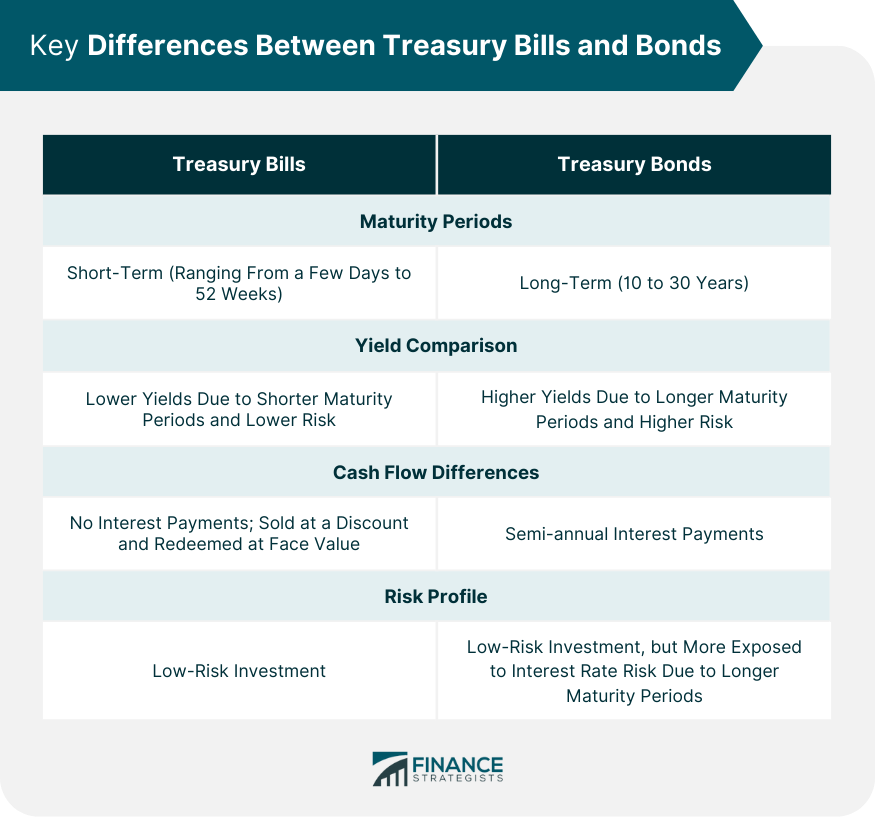

Key Differences Between Treasury Bills and Bonds

Comparison of Maturity Periods

Yield Comparison

Cash Flow Differences

Difference in Risk Profile

Factors to Consider When Choosing Between Treasury Bills and Bonds

Investment Objectives

Time Horizon

Risk Tolerance

Final Thoughts

Treasury Bills vs Treasury Bonds FAQs

Treasury bills are short-term securities that do not pay interest but are sold at a discount. In contrast, Treasury bonds are long-term securities that pay semi-annual interest and return the face value upon maturity.

Both Treasury bills and bonds are considered safe investments as they are backed by the full faith and credit of the U.S. government. However, Treasury bonds carry a slightly higher interest rate risk.

Yes, both Treasury bills and bonds can be sold in the secondary market before their maturity, though the price you receive may be more or less than your original investment.

Typically, Treasury bonds offer higher yields compared to Treasury bills due to their longer maturity period and the greater risk associated with a potential for changing interest rates.

The government often uses Treasury bills and bonds to control the money supply in the economy. They can influence interest rates and indirectly impact the level of economic activity in the country.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.