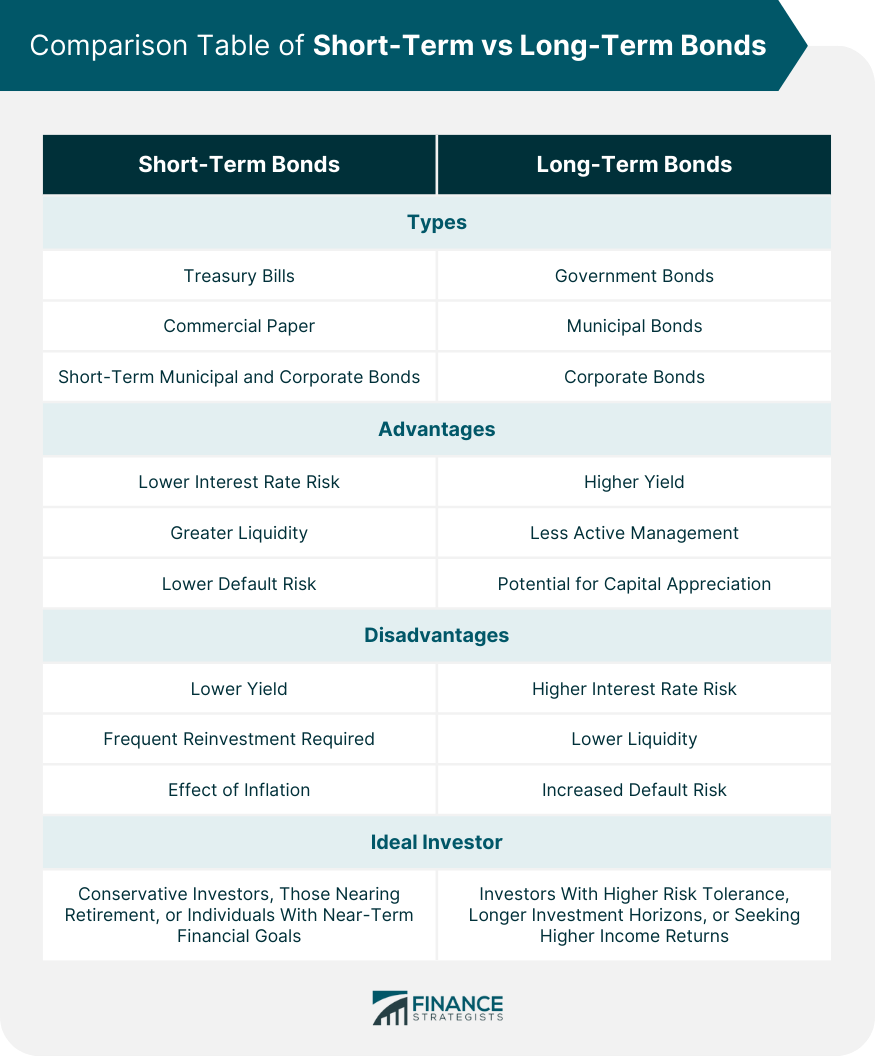

Short-term bonds, maturing within three years, offer conservative investors lower risk exposure, excellent liquidity, and limited impact from interest rate fluctuations. Conversely, they generally yield less and are more susceptible to inflation. Long-term bonds, with maturities exceeding ten years, appeal to those with extended investment horizons. These bonds provide higher yields and capital appreciation potential but carry an increased risk due to interest rate sensitivity and prolonged issuer default potential. In essence, the choice between short-term and long-term bonds hinges on your investment goals, risk tolerance, and timeline. Remember, an astute investor leverages the unique characteristics of both short and long-term bonds to achieve a well-balanced, diversified portfolio, mitigating risk while optimizing returns. Short-term bonds are those with maturities of three years or less. They often bear lower interest rates than longer-term bonds and offer less risk exposure to interest rate fluctuations. These attributes make them popular among conservative investors and those with shorter investment horizons. Notable short-term bonds include Treasury bills, commercial paper, and short-term municipal and corporate bonds. Each comes with varying degrees of risk and reward, largely dependent on the issuer's creditworthiness. Short-term bonds are less sensitive to interest rate fluctuations, making them less volatile than their longer-term counterparts. Thus, if interest rates rise, short-term bond prices fall less dramatically. Due to their shorter maturities, these bonds return the principal to the investor sooner, potentially allowing for reinvestment opportunities in higher-yielding instruments or other assets. The shorter maturity period lessens the likelihood of issuer default, rendering short-term bonds generally safer investments. Short-term bonds generally provide lower yields than long-term bonds due to their lower risk. Investors must continually reinvest the principal from maturing bonds, which can be time-consuming and expose them to reinvestment risk. Inflation erodes the purchasing power of bond returns. This effect can be more pronounced in short-term bonds due to their lower yields. Conservative investors, those nearing retirement, or individuals with near-term financial goals may favor short-term bonds for their stability and predictable income. Long-term bonds have maturities exceeding ten years. They offer higher yields to compensate investors for the increased risk of interest rate fluctuations and potential issuer default. Long-term bonds include government bonds, municipal bonds, and corporate bonds. Some government bonds, like U.S. Treasury bonds, have maturities extending up to 30 years. Long-term bonds typically offer higher yields than short-term bonds due to the greater risk investors undertake. Given their long duration, these bonds can be held for extended periods, requiring less active portfolio management. If interest rates decrease, long-term bonds can significantly increase in price, leading to potential capital gains for the investor. Long-term bonds are more susceptible to price fluctuations resulting from interest rate changes, leading to potential capital losses. These bonds tie up investor capital for more extended periods, decreasing portfolio liquidity. The more extended maturity period amplifies the risk of issuer default. Long-term bonds are better suited for investors with higher risk tolerance, longer investment horizons, or those seeking higher returns. The investor's objectives and timeline are paramount. If the goal is wealth preservation with a near-term focus, short-term bonds might be a better fit. If the investor seeks higher returns and has a long-term horizon, long-term bonds can be more attractive. Long-term bonds, while potentially more rewarding, come with increased risk. An investor must consider their ability to bear this risk. Investment horizons are crucial when choosing bond durations. Longer-term bonds make sense for long-term financial goals, while short-term bonds are better suited for near-term goals. An investor must consider the current and forecasted economic conditions, including interest rate movements, which can significantly impact bond prices. During periods of rising interest rates or inflation, short-term bonds are generally more attractive because they can be reinvested at higher rates sooner. Investors should aim for a diversified bond portfolio, spanning different bond types, maturities, and issuers to manage risk. Bond duration measures a bond's sensitivity to interest rate changes. It's a complex but essential concept in constructing a balanced bond portfolio. A well-diversified portfolio should contain both short-term and long-term bonds. This approach mitigates risk and allows the investor to take advantage of various market conditions. Bonds plays a critical role in a balanced investment portfolio. They provide income, stability, and risk diversification, often balancing the volatility inherent in equity investments. Interest rates significantly affect bond prices. When rates increase, bond prices fall, and vice versa. Long-term bonds are more sensitive to interest rate changes than short-term bonds. Inflation erodes the real return on bonds. In an inflationary environment, short-term bonds can be more attractive due to their shorter duration. Economic growth can affect the demand for bonds. If the economy is robust, demand for riskier assets like stocks may increase, reducing demand for bonds. In times of high market volatility, bonds, especially short-term, lower-risk bonds, can be an attractive option for investors seeking safe havens. Understanding bonds, particularly the dichotomy between short-term and long-term bonds, is crucial for insightful investment decision-making. With their limited risk, high liquidity, and resilience against interest rate fluctuations, short-term bonds offer stability and predictability. Conversely, long-term bonds, while susceptible to interest rate and default risks, provide opportunities for higher yields and capital gains. The choice largely depends on one's financial goals, risk tolerance, and investment timeline. Regardless of preference, a balanced, diversified portfolio encompassing both bond types is the gold standard. This strategy mitigates risk, leverages different market conditions, and optimizes returns. Also, keeping an eye on economic indicators, such as interest rates, inflation, and market volatility, aids in informed investment decisions. Overall, the bond market, through its range of short-term and long-term offerings, presents varied avenues to meet a spectrum of investment goals and risk profiles.Short-Term vs Long-Term Bonds Overview

Understanding Short-Term Bonds

Definition and Characteristics

Types of Short-Term Bonds

Advantages of Short-Term Bonds

Lower Interest Rate Risk

Greater Liquidity

Lower Default Risk

Disadvantages of Short-Term Bonds

Lower Yield

Frequent Reinvestment Required

Effect of Inflation

Ideal Investors for Short-Term Bonds

Understanding Long-Term Bonds

Definition and Characteristics

Types of Long-Term Bonds

Advantages of Long-Term Bonds

Higher Yield

Less Active Management Required

Potential for Capital Appreciation

Disadvantages of Long-Term Bonds

Higher Interest Rate Risk

Lower Liquidity

Increased Default Risk

Ideal Investors for Long-Term Bonds

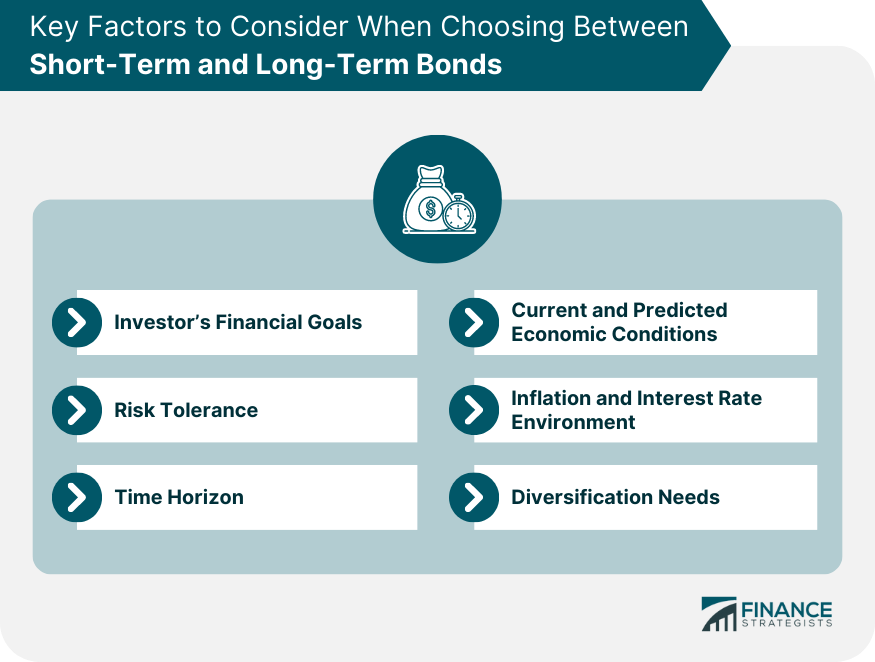

Key Factors When Choosing Between Short-Term and Long-Term Bonds

Investor's Financial Goals

Risk Tolerance

Time Horizon

Current and Predicted Economic Conditions

Inflation and Interest Rate Environment

Diversification Needs

Portfolio Strategy: Balancing Short-Term and Long-Term Bonds

Understanding Bond Duration

Diversification and Risk Management

Role of Bonds in a Balanced Portfolio

Impact of Economic Indicators on Short-Term vs Long-Term Bonds

Interest Rates

Inflation

Economic Growth Rates

Market Volatility

Conclusion

Short-Term vs. Long-Term Bonds FAQs

Short-term and long-term bonds primarily differ in their maturity periods. Short-term bonds mature in three years or less, while long-term bonds have maturities exceeding ten years. These durations affect their yield, liquidity, default risk, and sensitivity to interest rate fluctuations.

Short-term bonds generally carry lower risk due to their short maturity periods. They are less susceptible to interest rate fluctuations and have lower default risk. However, they also yield less. Long-term bonds, on the other hand, offer higher yields but are more sensitive to interest rate changes and have a higher default risk over their longer lifetimes.

Short-term bonds are ideal for conservative investors, those nearing retirement, or those with financial goals in the near future due to their lower risk and greater liquidity. Long-term bonds, offering higher yields, are more suitable for investors with higher risk tolerance and longer investment horizons.

Economic indicators like interest rates, inflation, economic growth rates, and market volatility significantly affect both short-term and long-term bonds. Rising interest rates can lead to decreasing bond prices, with long-term bonds being more sensitive. Inflation can erode the real return on bonds, with short-term bonds typically less affected due to their shorter durations.

A well-balanced portfolio should ideally include a mix of both short-term and long-term bonds. This blend allows investors to benefit from the stability and liquidity of short-term bonds and the higher yield potential of long-term bonds. This diversification can help mitigate risk and enhance portfolio performance over time.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.