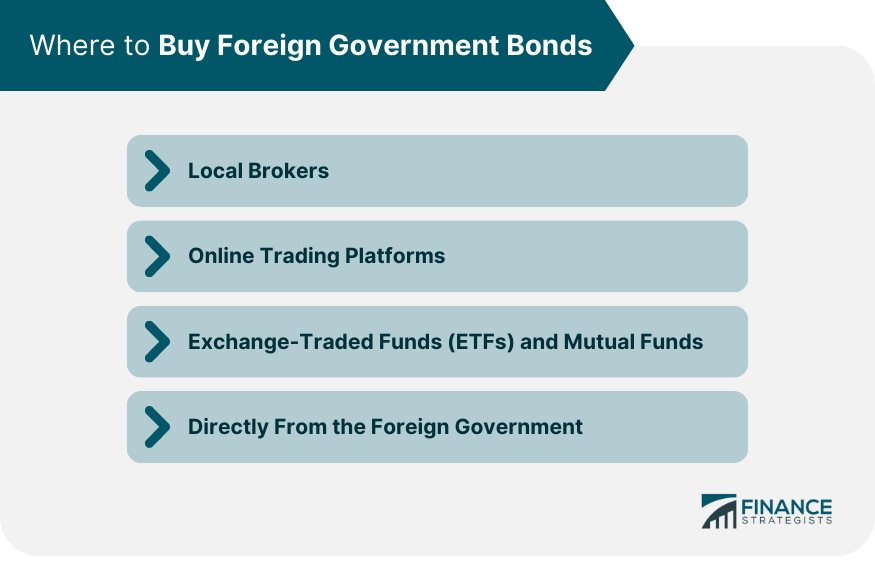

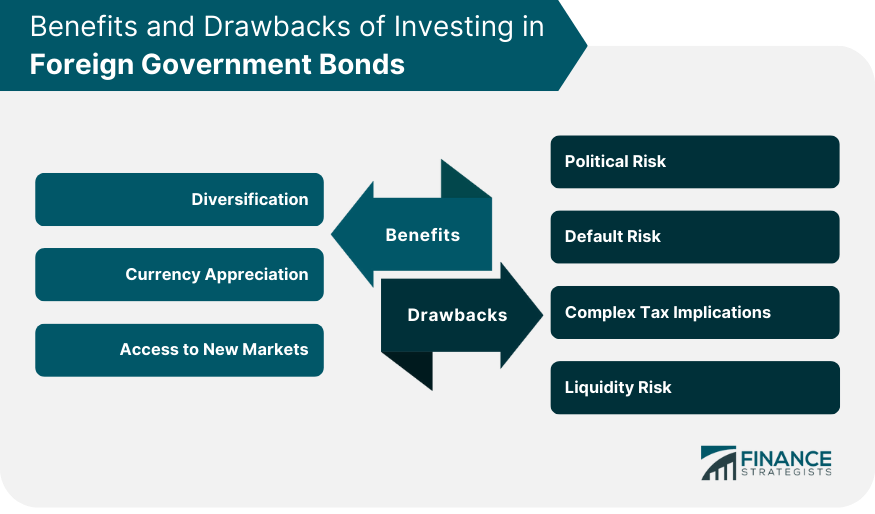

Foreign government bonds are debt securities issued by a country's government in a currency other than the home currency. These instruments are utilized to finance a government's fiscal deficit and stimulate economic growth. Investing in foreign government bonds serves multiple purposes. It provides portfolio diversification, which can reduce overall investment risk. This strategy allows investors to take advantage of potentially higher yields in foreign economies and benefit from potential currency appreciation. Currency exchange rates play a significant role in foreign bond investment. The bond's value can either increase or decrease based on the fluctuation of the foreign currency against the investor's home currency. Hence, understanding currency risk is crucial as it can significantly impact the overall returns of foreign bond investments. Brokerage firms offer a traditional avenue to access foreign government bonds. Firms such as Charles Schwab, Fidelity, or TD Ameritrade have extensive networks and alliances allowing them to offer a wide range of foreign bonds. When using a local broker, it's crucial to understand their fee structures and the breadth of their foreign bond offerings. Typically, brokers offer robust research and analytics tools to aid in decision-making. Local brokers also offer personalized financial advice. The rise of financial technology has seen the emergence of numerous online trading platforms offering access to foreign government bonds. Platforms such as Interactive Brokers or E*TRADE can provide access to a multitude of foreign markets. They also often feature lower fees than traditional brokerage firms. With these platforms, investors can conduct transactions at any time, and they often offer advanced analytical tools for investors to conduct thorough research. However, investors are usually responsible for their own decision-making when using these platforms. For those looking for a more hands-off approach or seeking diversification, ETFs and mutual funds offer excellent alternatives. These funds consist of a variety of bonds, including those issued by foreign governments. Examples include the Vanguard Total International Bond ETF (BNDX) or the T. Rowe Price International Bond Fund (RPIBX). These funds are managed by professionals, relieving investors of the task of choosing and managing individual bonds. Moreover, they provide instant diversification, reducing the risk of exposure to a single issuer. However, investors should be aware of management fees associated with these funds. In some instances, foreign governments allow direct purchase of their bonds by international investors. This approach eliminates the need for a broker, thus removing any brokerage fees. For example, the US Treasury operates the TreasuryDirect system, which allows non-US investors to buy and hold US government securities. However, this method might not be available for all countries, and it may involve more complex procedures compared to buying through a broker or fund. Furthermore, investors should be prepared to handle their own research and risk assessment when investing directly. Diversification is a fundamental risk management strategy that involves spreading investments across various asset classes to reduce exposure to any single asset or risk. By adding foreign bonds to a portfolio, investors can mitigate risks associated with domestic market downturns or economic instability. Also, because foreign bond markets may not move in tandem with domestic markets, portfolio volatility can be reduced. If the currency of the bond's issuing country strengthens against the investor's home currency during the bond's tenure, the investment return can be significantly boosted. This can provide a windfall for investors, but the opposite is also true; currency depreciation can erode investment returns. Emerging markets are often characterized by rapid economic growth and development. By investing in government bonds from these countries, investors can gain exposure to these fast-growing economies. This can lead to higher yields and potentially significant capital appreciation. However, investors must be mindful of the higher risks associated with these markets, including economic volatility, political instability, and lower liquidity. Political instability in the bond-issuing country can negatively affect the value of its bonds. Changes in government, policies, or political unrest can lead to economic instability and increase the risk of default. Investors should carefully consider the political climate of the issuing country before investing in its bonds. Default risk, or credit risk, is the chance that the bond issuer will fail to make the promised interest payments or return the principal at maturity. While this is a risk with all bonds, it can be particularly high for foreign government bonds, especially those issued by countries with unstable economies or weak fiscal policies. Depending on the tax laws in the investor's home country and the bond-issuing country, the investor may be taxed on interest income, capital gains, or both. This double taxation can eat into the investment's returns. Liquidity risk refers to the ease with which an investment can be sold without affecting its market price. Some foreign government bonds, particularly those from smaller or less developed countries, may have less liquid markets than domestic bonds. This could make it harder to sell the bonds before maturity without incurring significant losses. Liquidity risk is an important factor to consider, particularly for investors who may need to access their investment on short notice. When investing in foreign government bonds, consider diversifying across a range of countries and regions. This way, if one country or region experiences economic or political instability, it will not disproportionately affect your entire investment portfolio. Thorough research and analysis are crucial when investing in foreign government bonds. This involves staying informed about the political and economic conditions in the countries where you are investing. Regularly monitor news, economic indicators, and credit ratings from established agencies such as Moody's, Standard & Poor's, and Fitch. This information can help you assess the risk associated with each bond. Ensure that you are aware of any taxes that may be imposed by the bond-issuing country and your home country. In some cases, a tax treaty between the two countries may prevent double taxation. Consult with a tax advisor or financial planner to understand these implications and plan accordingly. Given the complexity of investing in foreign government bonds, you may find it beneficial to seek professional advice. Financial advisors and brokers can provide valuable insights into the risks and potential returns of different bonds. They can also help you understand and navigate the complexities of investing in foreign markets. Regular review does not only involve tracking your returns but also re-assessing the political and economic stability of the bond-issuing countries. If the situation changes, you may need to adjust your investments accordingly. A regular review can help you stay on top of your investment performance and manage your risk effectively. Foreign government bonds are securities issued by countries other than an investor’s own. It is offered by governments as a means to address fiscal deficits and improve economic stability. Interested investors can buy foreign government bonds through local brokerages, online trading platforms, or directly from other countries. These securities can also be accessed as part of ETFs and mutual funds. Investing in these bond types offers investors benefits, such as diversification, currency appreciation, and access to new markets. However, various risks should be taken into account, including political, default, and liquidity risks, as well as complex tax implications. For strategic investing, individuals should buy foreign government bonds from different countries and regions, conduct thorough research and analysis, perform tax planning, and seek professional advice.Overview of Foreign Government Bonds

Where and How to Buy Foreign Government Bonds

Local Brokers

Online Trading Platforms

Exchange-Traded Funds (ETFs) and Mutual Funds

Directly From the Foreign Government

Benefits of Investing in Foreign Government Bonds

Diversification

Currency Appreciation

Access to New Markets

Drawbacks of Investing in Foreign Government Bonds

Political Risk

Default Risk

Complex Tax Implications

Liquidity Risk

Strategies for Investing in Foreign Government Bonds

Invest in Different Countries and Regions

Research and Analyze

Plan Taxes

Use of Professional Advice

Conduct Regular Review

Final Thoughts

How to Buy Foreign Government Bonds FAQs

Foreign government bonds are debt securities issued by a country's government in a currency other than the home currency. They are used to finance a government's fiscal deficit and stimulate economic growth.

Investing in foreign government bonds provides portfolio diversification, which can reduce overall investment risk. It also allows investors to potentially benefit from higher yields in foreign economies and take advantage of currency appreciation.

There are different methods to invest in foreign government bonds. You can use local brokers who offer a wide range of foreign bonds and personalized financial advice. Online trading platforms provide access to multiple foreign markets with lower fees. Exchange-Traded Funds (ETFs) and mutual funds offer diversification and professional management. In some cases, direct purchases from the foreign government may be possible.

There are several risks to consider. Political risk arises from political instability or changes in government, which can negatively impact the value of the bonds. Default risk is the chance that the bond issuer may fail to make interest payments or return the principal. Other risks include complex tax implications and liquidity risk, particularly for bonds from smaller or less developed countries.

Diversifying investments across different countries and regions helps mitigate risk. Thorough research and analysis of political and economic conditions are essential. Tax planning, seeking professional advice, and regularly reviewing investments are also important strategies to consider when investing in foreign government bonds.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.