A Housing Authority Bond is a type of municipal bond issued by local or state government housing authorities to finance the construction, renovation, or improvement of affordable housing projects. These bonds serve as an important source of funding for housing initiatives, aimed at providing safe and affordable living options for low-income families, senior citizens, and people with disabilities. Housing Authority Bonds are backed by the revenues generated from the housing projects they finance, such as rental income or other fees, and in some cases, by the full faith and credit of the issuing authority. Investors in these bonds receive interest payments periodically, typically on a semiannual basis, and the principal is returned upon the bond's maturity. Housing Authority Bonds play a crucial role in addressing the need for affordable housing in communities across the country. By providing financing for housing projects, these bonds help to increase the availability of affordable living options, reduce housing costs for low-income individuals and families, and promote economic development in underserved areas. In addition to their societal benefits, Housing Authority Bonds can also offer attractive investment opportunities for individuals and institutions looking for a relatively safe, income-generating investment with potential tax advantages. Revenue bonds are a type of Housing Authority Bond that is backed solely by the revenues generated from the housing projects they finance. This can include rental income, fees, or other income sources related to the housing development. The creditworthiness of these bonds depends on the financial performance of the projects and their ability to generate sufficient revenue to meet interest and principal payment obligations. Investors considering revenue bonds should carefully evaluate the financial viability of the underlying projects, as well as the experience and track record of the housing authority and project developers. General Obligation (GO) bonds are another type of Housing Authority Bond, backed by the full faith and credit of the issuing authority. This means that the government entity issuing the bond is obligated to use its taxing power or other available resources to meet the bond's interest and principal payment obligations. As a result, GO bonds are generally considered to be a lower-risk investment compared to revenue bonds, as they are less dependent on the financial success of individual housing projects. However, investors should still carefully assess the creditworthiness of the issuing authority and its overall financial health before investing in GO bonds. Taxable Housing Authority Bonds are a type of bond subject to federal income tax on the interest earned. While most municipal bonds, including many Housing Authority Bonds, are exempt from federal income tax, certain bonds may be taxable due to the nature of the projects they finance or other regulatory factors. Although taxable bonds may offer a higher yield compared to tax-exempt bonds, investors should carefully consider the tax implications of investing in these bonds and weigh the potential benefits against the additional tax burden. One of the primary benefits of investing in Housing Authority Bonds is the regular income stream they provide. Investors receive interest payments, typically on a semiannual basis, which can serve as a reliable source of income, particularly for retirees or those seeking a more conservative investment strategy. The predictability and stability of these interest payments can be an attractive feature for investors looking to diversify their income-generating investments or to balance their overall portfolio risk. Housing Authority Bonds are generally considered to be a low-risk investment, particularly when compared to other fixed-income securities such as corporate bonds or stocks. While the risk associated with Housing Authority Bonds can vary depending on the type of bond and the creditworthiness of the issuer, many bonds are backed by the full faith and credit of the issuing authority or by the revenues generated from the housing projects they finance, providing a level of security for investors. Moreover, since Housing Authority Bonds are issued by government entities, they are subject to stringent regulatory oversight and disclosure requirements, which can further mitigate the risks associated with these investments. Another key benefit of investing in Housing Authority Bonds is the potential tax advantages they can offer. Most Housing Authority Bonds are exempt from federal income tax, and in some cases, state and local taxes as well, depending on the investor's state of residence. This tax-exempt status can result in higher after-tax returns compared to other taxable fixed-income investments, particularly for investors in higher tax brackets. However, investors should be aware that not all Housing Authority Bonds are tax-exempt, and they should carefully review the tax implications of any bond investment before making a decision. Credit risk is the risk that the issuer of a Housing Authority Bond may default on its interest or principal payment obligations. While Housing Authority Bonds are generally considered to be a low-risk investment, the creditworthiness of the issuer and the specific projects being financed can impact the level of credit risk associated with a particular bond. To assess credit risk, investors should review the bond's credit rating, the financial health of the issuing authority, and the performance of the underlying housing projects. Interest rate risk is the risk that the value of a bond will decrease due to changes in market interest rates. When interest rates rise, the market value of existing bonds with lower fixed interest rates typically falls, as new bonds with higher interest rates become more attractive to investors. While Housing Authority Bonds are generally less sensitive to interest rate fluctuations compared to other fixed-income securities, investors should still consider the potential impact of interest rate changes on their bond investments, particularly if they plan to sell their bonds before maturity. Inflation risk is the risk that the purchasing power of the interest payments and principal returned from a Housing Authority Bond will be eroded over time due to rising inflation. Fixed-income investments, including Housing Authority Bonds, can be particularly vulnerable to inflation risk, as their fixed interest payments may not keep pace with increasing costs of living. To help mitigate inflation risk, investors may consider diversifying their portfolio with investments that have the potential to outpace inflation, such as stocks or inflation-protected securities. One way to invest in Housing Authority Bonds is through a broker or financial advisor. These professionals can help investors identify suitable bond offerings, provide guidance on assessing credit risk and other factors, and facilitate the purchase and sale of bonds on the secondary market. Before working with a broker, investors should ensure that they understand the fees and commissions associated with bond transactions, as well as any ongoing account management fees. In some cases, investors may be able to purchase Housing Authority Bonds directly from the issuing authority or through a designated agent. This can potentially result in lower transaction costs compared to purchasing bonds through a broker, although the availability of direct purchase options may be limited depending on the specific bond offering. Investors should carefully review the offering documents and consult with a financial professional if needed to ensure they understand the terms, risks, and potential benefits of a direct bond purchase. Another option for investing in Housing Authority Bonds is through a bond fund, such as a mutual fund or exchange-traded fund (ETF), that specializes in municipal bonds or specifically targets housing-related investments. Bond funds can offer diversification and professional management, as well as the potential for liquidity through the ability to buy and sell fund shares on the open market. However, investors should be aware that bond funds typically charge management fees, which can impact overall returns. Additionally, the performance of a bond fund may not directly correspond to the performance of individual Housing Authority Bonds, as fund managers may invest in a variety of bonds with different credit ratings, maturities, and interest rates. Before investing in a bond fund, investors should carefully review the fund's prospectus and other materials to understand the fund's investment objectives, risks, fees, and past performance. Housing Authority Bonds are municipal bonds issued by local or state government housing authorities to finance affordable housing projects. These bonds play a crucial role in addressing the need for affordable housing and can offer attractive investment opportunities for those seeking a relatively safe, income-generating investment with potential tax advantages. There are several types of Housing Authority Bonds, including revenue bonds, general obligation bonds, and taxable bonds. Each type of bond carries its unique risks and benefits, and investors should carefully consider these factors when deciding which type of bond best suits their investment objectives and risk tolerance. Investing in Housing Authority Bonds can offer several benefits, including a regular income stream, relatively low risk, and potential tax advantages. However, these investments also carry certain risks, such as credit risk, interest rate risk, and inflation risk. Investors should carefully assess these risks and consider diversifying their investment portfolios to mitigate potential losses. By understanding the various types of Housing Authority Bonds, their benefits and risks, and the different methods of investing in these bonds, investors can make more informed decisions. This can potentially enhance their overall investment strategy while contributing to the development of affordable housing in their communities.What Is a Housing Authority Bond?

Types of Housing Authority Bonds

Revenue Bonds

General Obligation Bonds

Taxable Bonds

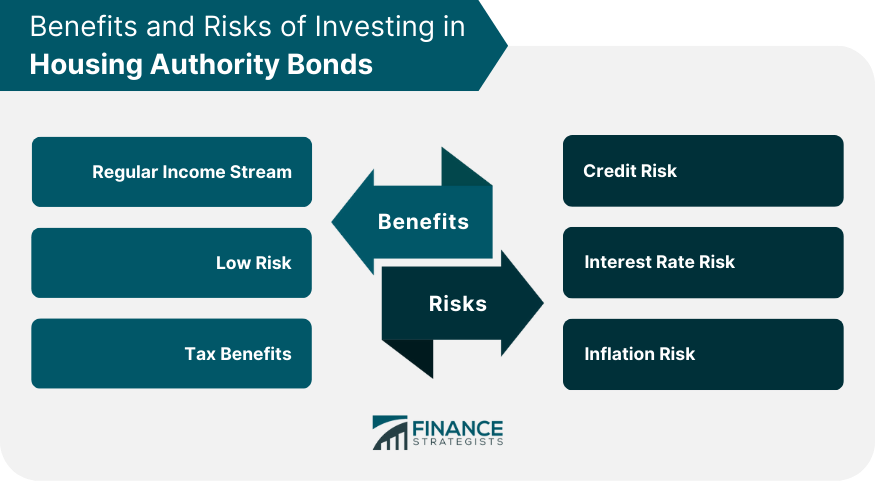

Benefits of Investing in Housing Authority Bonds

Regular Income Stream

Low Risk

Tax Benefits

Risks of Investing in Housing Authority Bonds

Credit Risk

Interest Rate Risk

Inflation Risk

How to Invest in Housing Authority Bonds

Work With a Broker

Purchase Directly From an Issuer

Invest in a Bond Fund

The Bottom Line

Housing Authority Bond FAQs

Housing Authority Bond is a debt security issued by a housing authority to raise funds for affordable housing projects.

Some benefits of investing in Housing Authority Bonds are a regular income stream, low risk, and tax benefits.

The risks include credit risk, interest rate risk, and inflation risk.

Yes, individual investors can invest in Housing Authority Bonds either directly or through a broker or bond fund.

Revenue Bonds are backed by revenue generated by a specific project, while General Obligation Bonds are backed by the taxing power of the issuing authority.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.