Gilt-edged securities, or simply "gilts," refer to high-quality debt instruments issued by governments or reputable corporations. These securities are considered to be among the safest and most reliable investments in the financial markets, offering a lower risk profile and predictable returns. Gilts are known for their low default risk, as they are issued by financially stable entities. This low risk is often accompanied by a lower yield when compared to other investments. These securities typically have a fixed interest rate, which is paid periodically to bondholders. Gilt-edged securities play a crucial role in global financial markets, as they provide a benchmark for risk-free investments. They also offer a stable source of income for investors, facilitate long-term financial planning, and serve as a significant source of capital for governments and corporations. Government bonds are debt securities issued by national governments. They are generally backed by the full faith and credit of the issuing country, making them low-risk investments. Treasury bonds are long-term debt securities issued by the government's treasury department. They generally have a maturity period of more than ten years and pay a fixed interest rate to bondholders. Investors consider them among the safest fixed-income investments. Sovereign bonds are debt securities issued by a country's government in foreign currencies. They carry slightly higher risk than domestic treasury bonds, as they are subject to currency fluctuations and the creditworthiness of the issuing country. Corporate bonds are debt securities issued by companies to raise capital for business expansion or other purposes. They typically offer higher yields than government bonds, as they carry a higher risk of default. Investment-grade corporate bonds are issued by companies with strong credit ratings, indicating a lower risk of default. These bonds are considered gilt-edged securities because of their high credit quality and lower default risk, making them attractive to conservative investors. Convertible bonds are corporate bonds that can be converted into a predetermined number of the issuer's shares at specific times during the bond's life. These bonds offer the potential for capital appreciation if the company's stock price rises, while still providing the safety of a fixed-income investment. Gilt-edged securities are considered low-risk investments due to the creditworthiness of the issuers. Investors can rely on these securities for consistent income, making them ideal for conservative investment strategies and long-term financial planning. The fixed interest rates offered by gilt-edged securities provide a predictable income stream for investors. This stability is particularly attractive during periods of economic uncertainty, as it allows investors to maintain a steady income despite market fluctuations. Including gilt-edged securities in an investment portfolio provides diversification, as they generally have a low correlation with other asset classes. This diversification can help reduce overall portfolio risk, protecting investors from potential losses in other areas of their investments. Gilt-edged securities serve as an essential source of capital for governments and corporations, allowing them to finance large-scale projects and manage their debt. By issuing these low-risk securities, entities can attract investors and secure funding at lower interest rates. While gilt-edged securities offer low risk and stable returns, these returns are generally lower than those of higher-risk investments such as equities. Investors seeking higher returns may find gilt-edged securities less appealing, as their conservative nature may not align with more aggressive investment strategies. Gilt-edged securities are sensitive to changes in interest rates. When interest rates rise, the market value of existing fixed-income securities with lower interest rates decreases. Investors holding these securities may face capital losses if they need to sell before maturity, making interest rate risk an important consideration. The fixed income generated by gilt-edged securities may not keep pace with inflation, reducing the real value of returns over time. This risk is particularly relevant for long-term bondholders, as the purchasing power of their investments may erode due to rising prices in the economy. Gilt-edged securities primarily generate income through fixed interest payments, offering limited potential for capital appreciation. Investors seeking capital growth may find these securities less attractive, as their potential for price gains is typically lower than that of growth-oriented assets such as equities. Investors can purchase gilt-edged securities directly from the issuer or through secondary markets, providing opportunities for both primary and secondary market investments. In the primary market, investors buy gilt-edged securities directly from the issuer at the time of issuance. This market offers the opportunity to invest in newly issued securities, often at a fixed price determined by the issuer. The secondary market allows investors to buy and sell previously issued gilt-edged securities among themselves. Prices in this market are determined by supply and demand, providing opportunities for capital gains or losses based on market conditions. Indirect investment options, such as mutual funds, exchange-traded funds (ETFs), and pension funds, allow investors to gain exposure to gilt-edged securities without directly purchasing them. Mutual funds pool investors' money to purchase a diverse range of assets, including gilt-edged securities. Investing in a mutual fund focused on gilt-edged securities offers diversification and professional management, while minimizing the need for individual research and decision-making. Exchange-Traded Funds (ETFs) are investment funds that trade on stock exchanges, providing investors with exposure to a specific market index or a basket of assets. Gilt-edged securities ETFs offer an easy and cost-effective way to invest in a diversified portfolio of high-quality bonds, while providing liquidity and real-time price information. Institutional investors, such as pension funds and insurance companies, often invest in gilt-edged securities to match their long-term liabilities and provide stable income. Individual investors can gain exposure to these securities by participating in pension plans or purchasing insurance products with fixed-income components. Interest rates have a significant impact on the prices of gilt-edged securities. As interest rates rise, the market value of existing bonds with lower interest rates decreases, while falling interest rates generally lead to higher bond prices. The overall economic outlook influences investor sentiment and demand for gilt-edged securities. During periods of economic uncertainty, investors may flock to these low-risk investments, driving up prices. Conversely, improving economic conditions may lead investors to pursue higher-risk assets, reducing demand for gilt-edged securities and causing prices to fall. The credit rating of the issuer plays a critical role in determining the value of gilt-edged securities. Upgrades or downgrades in credit ratings can affect investor perceptions of risk and the attractiveness of the securities, resulting in changes in their prices. High credit ratings typically lead to lower yields and higher prices, while lower ratings result in higher yields and lower prices. Investor sentiment and market trends also influence the prices of gilt-edged securities. Factors such as geopolitical events, financial news, and changes in investor risk appetite can all impact the demand for and prices of these securities. Gilt-edged securities play an essential role in asset allocation strategies, as they provide stability and income generation to balance the risks associated with other asset classes. By incorporating these securities into a diversified investment portfolio, investors can achieve a more balanced risk-reward profile. Including gilt-edged securities in a portfolio can help manage risk by reducing overall portfolio volatility. These securities generally have a low correlation with riskier asset classes, such as equities, making them a valuable tool for mitigating potential losses and smoothing out returns. Gilt-edged securities generate a steady income through fixed interest payments, making them an attractive option for investors seeking regular income. This income can be used to meet living expenses, reinvested for compound growth, or allocated to other investment opportunities. Due to their low-risk nature and stable returns, gilt-edged securities are well-suited for long-term financial planning. Investors can rely on these securities to help achieve long-term financial goals, such as funding retirement or saving for a child's education, with a lower risk of significant capital loss. Gilt-edged securities are high-quality debt instruments issued by governments and reputable corporations, offering low risk, stable returns, and diversification benefits for investors. Despite some disadvantages, such as lower returns compared to other investments and sensitivity to interest rate changes, these securities play an essential role in portfolio management and long-term financial planning. In modern finance, gilt-edged securities remain a vital component of the global financial landscape, providing a benchmark for risk-free investments and serving as a significant source of capital for governments and corporations. Their stable nature and income generation capabilities make them an attractive option for investors, particularly during times of economic uncertainty.What Are Gilt-Edged Securities?

Types of Gilt-Edged Securities

Government Bonds

Treasury Bonds

Sovereign Bonds

Corporate Bonds

Investment-Grade Corporate Bonds

Convertible Bonds

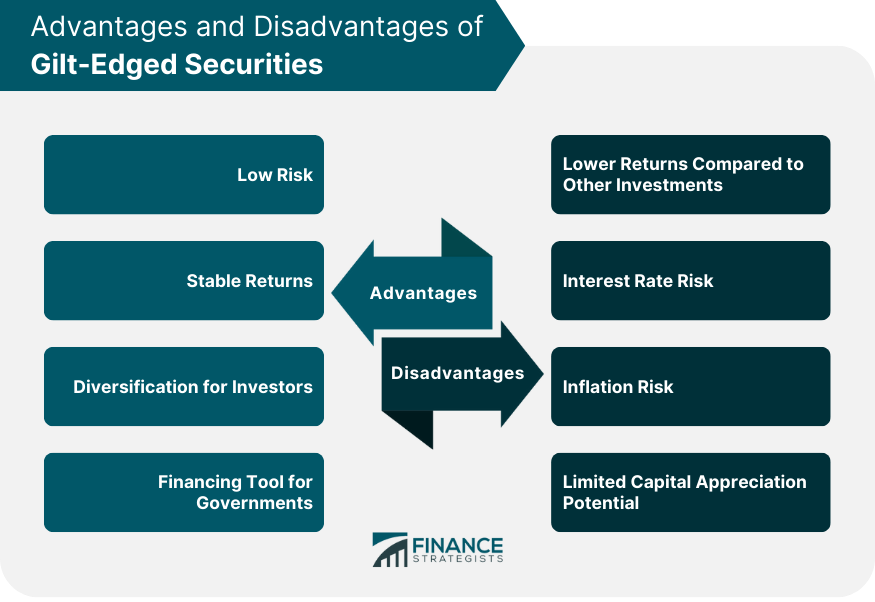

Advantages of Gilt-Edged Securities

Low Risk

Stable Returns

Diversification for Investors

Financing Tool for Governments and Corporations

Disadvantages of Gilt-Edged Securities

Lower Returns Compared to Other Investments

Interest Rate Risk

Inflation Risk

Limited Capital Appreciation Potential

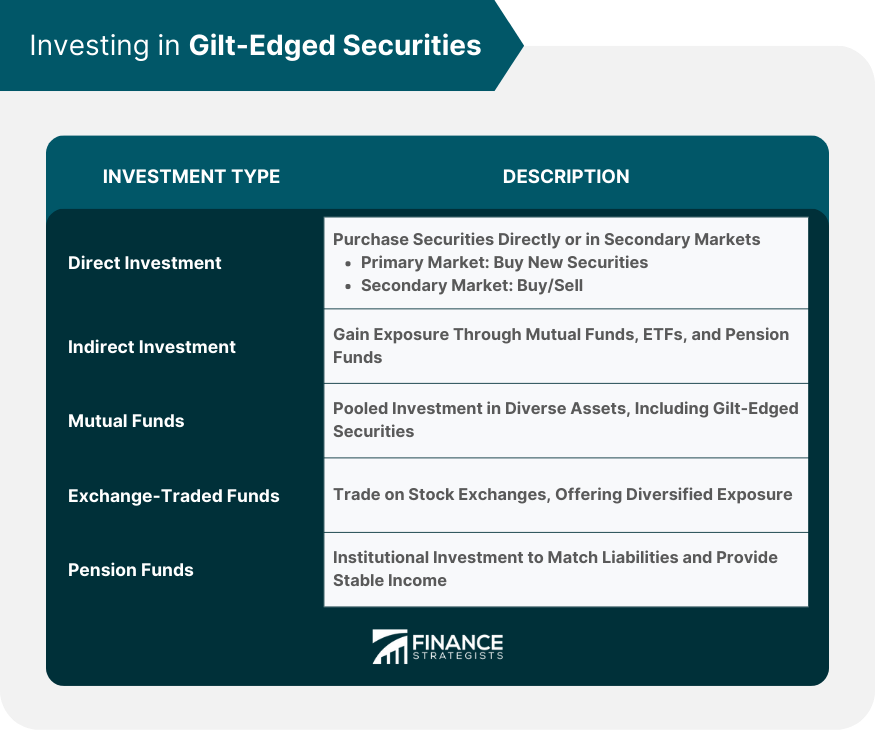

Investing in Gilt-Edged Securities

Direct Investment

Primary Market

Secondary Market

Indirect Investment

Mutual Funds

Exchange-Traded Funds (ETFs)

Pension Funds and Other Institutional Investments

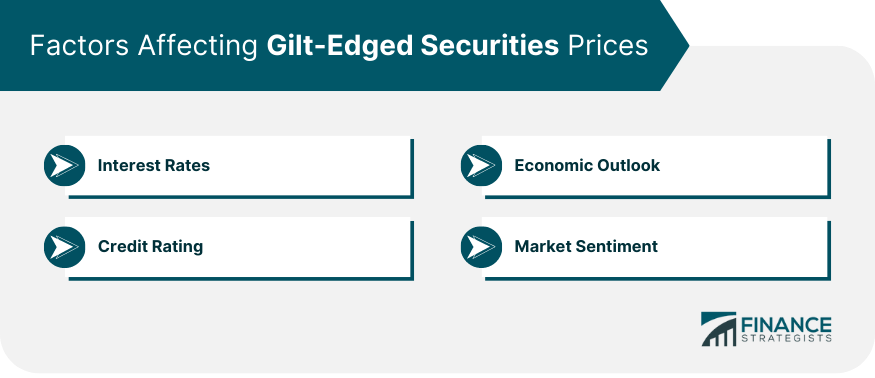

Factors Affecting Gilt-Edged Securities Prices

Interest Rates

Economic Outlook

Credit Rating

Market Sentiment

Role of Gilt-Edged Securities in Portfolio Management

Asset Allocation

Risk Management

Income Generation

Long-Term Financial Planning

Final Thoughts

Gilt-Edged Securities FAQs

Gilt-edged securities are high-quality debt instruments issued by governments or reputable corporations. They are considered low-risk investments because they are backed by financially stable entities with strong credit ratings, reducing the likelihood of default and providing a stable source of income.

Gilt-edged securities offer diversification benefits because they typically have a low correlation with other asset classes, such as equities. Including these securities in a portfolio can help reduce overall risk and protect investors from potential losses in other areas of their investments.

The main disadvantages of investing in gilt-edged securities include lower returns compared to other investments, interest rate risk, inflation risk, and limited capital appreciation potential. These factors may make them less suitable for investors seeking higher returns or capital growth.

Investors can invest in gilt-edged securities through direct investment, which involves purchasing the securities directly from the issuer or on secondary markets, or through indirect investment, which includes options such as mutual funds, exchange-traded funds (ETFs), and pension funds or other institutional investments focused on these securities.

Interest rates and economic outlook significantly influence the prices of gilt-edged securities. When interest rates rise, the market value of existing bonds with lower interest rates decreases, while improving economic conditions may lead investors to pursue higher-risk assets, reducing demand for gilt-edged securities and causing prices to fall. Conversely, falling interest rates and periods of economic uncertainty may increase demand for these low-risk investments, driving up their prices.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.