Convertible bonds are a type of hybrid financial instrument that combines the features of both debt and equity securities. They are issued by corporations as a means of raising capital and offer investors the right to convert their bonds into a predetermined number of shares of the issuing company's stock at a specific price and within a specified period. This unique feature allows investors to benefit from potential capital appreciation of the underlying stock while still enjoying the regular interest payments of a bond. Convertible bonds are an attractive financing option for companies seeking to raise capital, providing lower interest rates than traditional bonds and the flexibility to manage the dilution of existing shareholders' ownership. For investors, convertible bonds offer a regular income stream, capital appreciation potential, downside protection, and diversification benefits. The convertible bond market comprises various participants, including issuing corporations, institutional and retail investors, investment banks, brokers, and regulators. Mandatory convertible bonds require the bondholder to convert the bond into equity at a predetermined date or under specific conditions. This type of bond is often used by companies to manage their balance sheets and dilution effects more effectively. Contingent convertible bonds, also known as CoCos, are issued by financial institutions and automatically convert into equity when certain pre-specified triggers, such as a decline in the issuer's capital ratio, are met. These bonds are designed to improve the capital structure of banks and absorb losses during times of financial stress. Reverse convertible bonds are a structured product that combines a bond with a short put option on an underlying asset, usually a company's stock. The bond's principal is at risk if the underlying asset's price falls below a certain level, resulting in the bond being converted into the underlying asset at a predetermined conversion rate. Vanilla convertible bonds are the most straightforward and common type of convertible bond, offering bondholders the option to convert their bonds into shares of the issuing company's stock at a predetermined conversion price during a specified period. Exchangeable bonds are similar to convertible bonds; however, they give bondholders the option to convert their bonds into shares of a different company, usually a subsidiary or an affiliated company, rather than the issuer's stock. The conversion ratio refers to the number of shares an investor can receive upon converting their convertible bond into the underlying stock. The ratio is usually determined at the time of issuance and is expressed as a number of shares per bond. The conversion price is the predetermined price at which the bondholder can convert their bond into the underlying stock. The conversion price is typically set at a premium to the stock's market price at the time of issuance, providing an incentive for investors to hold the bond rather than immediately convert it. The conversion premium represents the difference between the conversion price and the current market price of the underlying stock, expressed as a percentage. A higher conversion premium indicates that the bondholder would need a more significant increase in the stock price to profit from the conversion. The conversion period refers to the time frame during which bondholders can exercise their conversion option. It usually begins after a predetermined lock-up period following the bond's issuance and lasts until the bond's specified call or maturity date. Call provisions allow the issuer to redeem the convertible bond before its maturity date under specific conditions, such as a rise in the underlying stock price above a certain threshold. This provision allows the issuer to manage its capital structure and reduce interest expenses. Put provisions grant bondholders the right to sell their convertible bond back to the issuer at a predetermined price and date. This provision offers bondholders an exit option and protects them from potential bond value declines. The credit quality of a convertible bond depends on the issuer's financial health, as assessed by credit rating agencies. The rating assigned to a convertible bond affects its yield, price, and the investor's perception of its risk level. The pricing of convertible bonds depends on various factors, including the underlying stock price, conversion premium, interest rates, credit quality, and market volatility. Traditional bond valuation techniques, such as discounted cash flow analysis, can be used to estimate the bond component's value by discounting the future interest payments and principal repayment to the present value. Option pricing models, such as the Black-Scholes model, can be used to value the embedded conversion option by considering the underlying stock price, conversion price, time to expiration, interest rates, and market volatility. Hybrid valuation models, such as the binomial model and the Monte Carlo simulation, combine the traditional bond valuation techniques and option pricing models to estimate the convertible bond's fair value by considering both its debt and equity components. Convertible arbitrage is a strategy that involves simultaneously buying convertible bonds and short-selling the underlying stock to profit from pricing inefficiencies between the bond and the stock. Directional investing in convertible bonds involves taking a view on the direction of the underlying stock price and the bond's credit quality, with the aim of profiting from potential price appreciation or yield enhancement. Balanced investing in convertible bonds focuses on achieving a balance between the bond's fixed income and equity components to optimize risk-adjusted returns and diversification benefits. Hedging strategies can be employed by investors to manage the various risks associated with convertible bonds, such as interest rate risk, credit risk, and conversion risk, by using options, futures, or other derivative instruments. Issuers of convertible bonds can benefit from lower interest rates compared to traditional bonds due to the conversion option's added value to investors. Convertible bonds allow companies to defer equity dilution by setting the conversion price at a premium to the current stock price, thereby reducing the immediate dilution effect on existing shareholders. Convertible bonds provide issuers with the flexibility to manage their capital structure, as they can call the bonds if the underlying stock price rises significantly or issue new shares if the stock price falls. Convertible bonds offer investors a regular income stream in the form of periodic interest payments, similar to traditional bonds. The embedded conversion option allows investors to benefit from the potential capital appreciation of the underlying stock if the stock price rises above the conversion price. Convertible bonds can provide diversification benefits to investors by offering exposure to both the fixed-income and equity markets. Convertible bonds offer downside protection compared to investing directly in the underlying stock, as bondholders have priority over shareholders in the event of liquidation. Credit risk refers to the risk of the issuer defaulting on its interest payments or failing to repay the principal amount upon maturity. Convertible bonds are sensitive to changes in interest rates, which can affect their prices, yields, and the value of the embedded conversion option. Conversion risk arises when the underlying stock price fails to rise above the conversion price, making the conversion option less attractive for investors. Call risk refers to the possibility that the issuer redeems the convertible bond before its maturity date, potentially causing investors to lose out on future interest payments and limiting the potential for capital appreciation through the conversion option. Liquidity risk is the risk of being unable to sell the convertible bond in the secondary market at a reasonable price, potentially resulting in losses for investors. The issuance, trading, and disclosure requirements for convertible bonds are subject to various regulations, depending on the jurisdiction in which the bonds are issued and traded. Key regulators include the Securities and Exchange Commission (SEC) in the United States and the European Securities and Markets Authority (ESMA) in the European Union. Tax treatment of convertible bonds varies depending on the jurisdiction and the specific features of the bond. Issuers may be able to deduct interest payments on convertible bonds for tax purposes, while investors may be subject to taxes on interest income, capital gains or dividends, depending on the bond's structure and the investor's tax status. Convertible bonds are a hybrid financial instrument combining debt and equity securities features, offering unique benefits and risks for both issuers and investors. Various types, features, and strategies are associated with convertible bonds, and understanding these aspects is crucial for market participants to make informed decisions. The convertible bond market is expected to evolve in response to changing market conditions, regulatory frameworks, and investor preferences. Key trends include the growth of green and sustainable convertible bonds, the increasing use of digital platforms for bond issuance and trading, and the development of innovative structures to meet issuers' and investors' needs. If you are interested in wealth management, it may be beneficial to consider availing wealth management services from professionals who can provide you with valuable insights and guidance on how to navigate the convertible bond market.What Are Convertible Bonds?

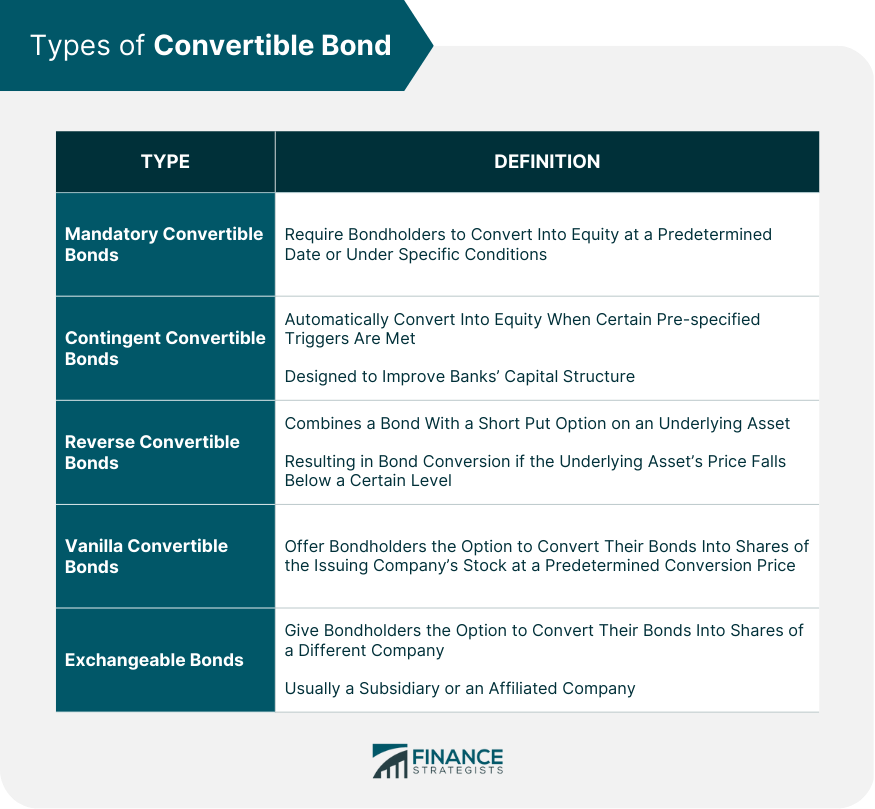

Types of Convertible Bonds

Mandatory Convertible Bonds

Contingent Convertible Bonds

Reverse Convertible Bonds

Vanilla Convertible Bonds

Exchangeable Bonds

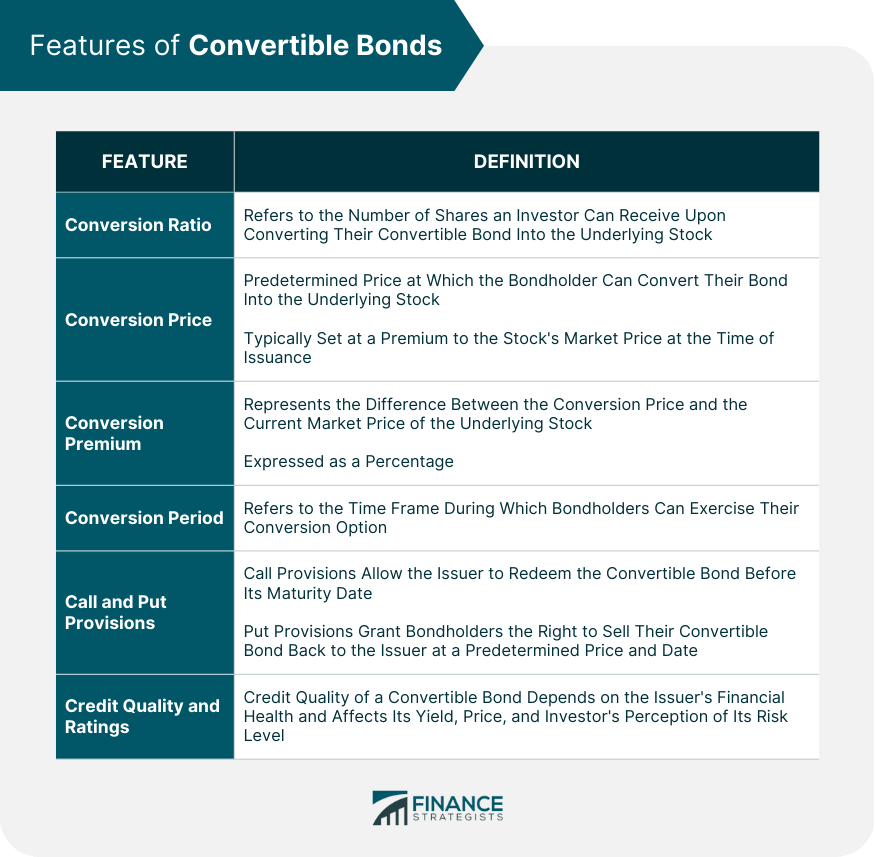

Features of Convertible Bonds

Conversion Ratio

Conversion Price

Conversion Premium

Conversion Period

Call and Put Provisions

Credit Quality and Ratings

Valuation of Convertible Bonds

Factors Affecting Convertible Bond Pricing

Traditional Bond Valuation Techniques

Option Pricing Models

Hybrid Valuation Models

Convertible Bond Strategies

Convertible Arbitrage

Directional Investing

Balanced Investing

Hedging Strategies

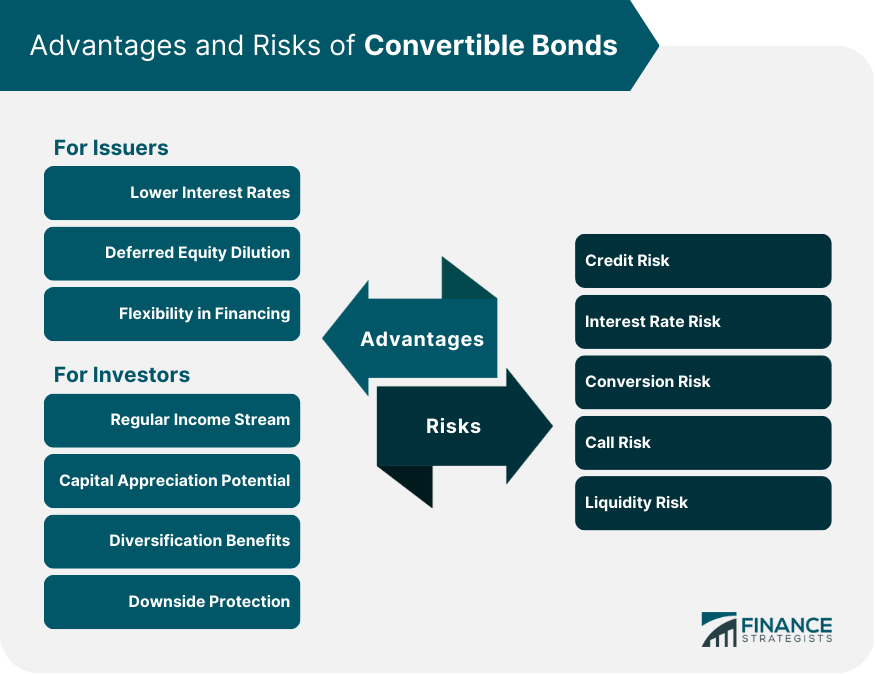

Advantages of Convertible Bonds

For Issuers

Lower Interest Rates

Deferred Equity Dilution

Flexibility in Financing

For Investors

Regular Income Stream

Capital Appreciation Potential

Diversification Benefits

Downside Protection

Risks Associated With Convertible Bonds

Credit Risk

Interest Rate Risk

Conversion Risk

Call Risk

Liquidity Risk

Regulation and Taxation of Convertible Bonds

Regulatory Framework

Tax Considerations for Issuers and Investors

Final Thoughts

Convertible Bonds FAQs

Convertible bonds are a type of hybrid financial instrument that combines the features of both debt and equity securities, offering investors the right to convert their bonds into a predetermined number of shares of the issuing company's stock at a specific price and within a specified period.

Investing in convertible bonds can provide investors with a regular income stream, capital appreciation potential, diversification benefits, and downside protection compared to investing directly in the underlying stock.

The conversion premium represents the difference between the conversion price and the current market price of the underlying stock, expressed as a percentage. A higher conversion premium indicates that the bondholder would need a more significant increase in the stock price to profit from the conversion.

Investors can manage the various risks associated with convertible bonds, such as interest rate risk, credit risk, and conversion risk, by employing hedging strategies using options, futures, or other derivative instruments.

Convertible arbitrage is a strategy that involves simultaneously buying convertible bonds and short-selling the underlying stock to profit from pricing inefficiencies between the bond and the stock.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.