Capital Gain Bonds are a type of financial instrument primarily issued by government or government-approved bodies. These bonds serve as a mechanism for investors to defer capital gains tax from the sale of an asset by reinvesting the gains into these bonds. The purpose of Capital Gain Bonds is two-fold: they provide investors with a means of tax planning, and the funds raised through these bonds are typically used for infrastructure and other development projects. Knowledge of these bonds assists in making informed investment decisions, thus impacting the financial wellbeing of investors. Interest rates have an inverse relationship with bond prices. When interest rates rise, the price of existing bonds falls, and vice versa. This is because as interest rates increase, newly issued bonds carry a higher yield than existing bonds, making the older ones less attractive. Capital gain bonds have a multifaceted impact on the economy. They assist in infrastructure development as funds raised through these bonds are used in government infrastructure projects. Additionally, they help balance the economy by providing a less risky investment avenue during volatile market conditions. Several determinants influence the price and yield of Capital Gain Bonds. First, interest rates play a crucial role: a rise in rates may depress bond prices, while a decline could inflate them. Second, inflation can impact bond yield; higher inflation often leads to lower demand, influencing prices. Economic growth also shapes the bond market, with robust growth usually bolstering demand and hence, prices. Government fiscal policy is another key factor: policy changes can alter market dynamics significantly. Lastly, the overarching factor of market demand, dictated by investors' sentiment and outlook, directly affects bond prices and yields. Capital gains refer to the increase in value of an investment or asset over time. When it comes to bonds, capital gains can occur if a bond is sold for more than its purchase price. Capital gain bonds are unique because they allow investors to defer the capital gains from the sale of an asset, thereby saving on capital gains tax. Capital gain bonds offer a way to save on capital gains tax under Section 54EC of the Income Tax Act. This exemption is available only if the capital gain bonds are held for a period of at least five years. Capital gain bonds play an integral part in tax planning for many investors. By investing the capital gains into these bonds, taxpayers can defer their tax liability and save a significant amount of money. Investing in capital gain bonds involves a few steps: 1. Identification of Suitable Bonds: Review the offerings of various issuers to identify the capital gain bonds that suit your investment needs. 2. Get Informed: Understand the terms and conditions of the bonds including rate of return, lock-in period, and tax implications. 3. Contact the Issuer/Broker: Get in touch with the bond issuer directly or through a registered broker. 4. Fill Out Application Form: Complete the application form for the bonds, providing necessary details such as name, address, PAN number, and investment amount. 5. Payment: Pay the required amount for the bonds via check, draft, or online transfer as per the guidelines provided by the issuer. 6. Wait for Allotment: Upon successful payment, wait for the bonds to be allotted. 7. Bond Receipt: Once the bonds are allotted, you will receive a bond certificate or dematerialized confirmation. 8. Hold or Sell: Depending on your investment strategy, you can either hold the bonds till maturity or sell them in the secondary market after the lock-in period. Like all investment instruments, they come with both benefits and risks that must be carefully considered. Tax Benefit: The most significant advantage of capital gain bonds is the opportunity they offer for deferring capital gains tax. Investors can reinvest capital gains from the sale of an asset into these bonds, avoiding immediate tax liability. This benefit is particularly appealing to investors with substantial capital gains. Fixed Return: Capital gain bonds offer a fixed rate of return over a specified period. This stability is beneficial, especially in an unstable or volatile market environment, offering a predictable income stream. Contribution to Infrastructure Development: Funds raised through these bonds are often used for infrastructure and development projects, contributing to national growth and progress. Interest Rate Risk: The fixed rate of return can be a double-edged sword. If market interest rates increase, the fixed return on these bonds may become less attractive, potentially leading to a decrease in their market price. Lock-in Period: Capital gain bonds come with a lock-in period, typically five years. This means that investors cannot sell these bonds before the end of this period, making them a less liquid investment compared to other instruments like stocks or mutual funds. Reinvestment Risk: Once the bond matures, investors face the risk of having to reinvest the proceeds at a lower rate if market interest rates have fallen in the meantime. Cap on Investment: There's also a limit on how much an investor can invest in these bonds in a financial year for tax-saving purposes. This cap may restrict investors seeking to invest larger amounts. Stocks represent ownership in a company and can provide high returns but come with higher risk. In contrast, capital gain bonds offer steady, though lower, returns and are safer. Mutual funds pool money from many investors to invest in a diversified portfolio of stocks, bonds, and other securities. While mutual funds offer diversification and professional management, capital gain bonds provide tax benefits on long-term capital gains. Real estate can offer substantial returns and a tangible asset. But it also comes with risks like property depreciation and market fluctuations. Capital gain bonds, on the other hand, provide stable returns and tax benefits. Capital Gain Bonds represent a significant opportunity for tax-efficient investing. Issued primarily by government bodies, these bonds allow investors to defer capital gains tax while contributing to vital infrastructural projects. These attributes, coupled with the stability of fixed returns, make these bonds an attractive instrument within a diversified investment portfolio. While associated with certain risks, including interest rate fluctuations and reinvestment concerns, the potential tax savings and financial stability they offer largely outweigh these challenges. Investors need to evaluate their financial goals and risk tolerance before incorporating these bonds into their portfolios. Emerging trends such as blockchain technology indicate a promising future for capital gain bonds, with potential enhancements in security, transparency, and efficiency of transactions. Staying informed about these trends, alongside changes in economic factors and tax laws, is crucial for navigating the dynamic landscape of capital gain bonds.What Are Capital Gain Bonds?

Economics of Capital Gain Bonds

Relationship Between Capital Gain Bonds and Interest Rates

How Capital Gain Bonds Affect the Economy

Factors Affecting the Price and Yield of Capital Gain Bonds

Capital Gain Bonds and Tax Implications

Understanding Capital Gains and Its Relation to Bonds

Taxation on Capital Gain Bonds: Laws and Regulations

Role of Capital Gain Bonds in Tax Planning

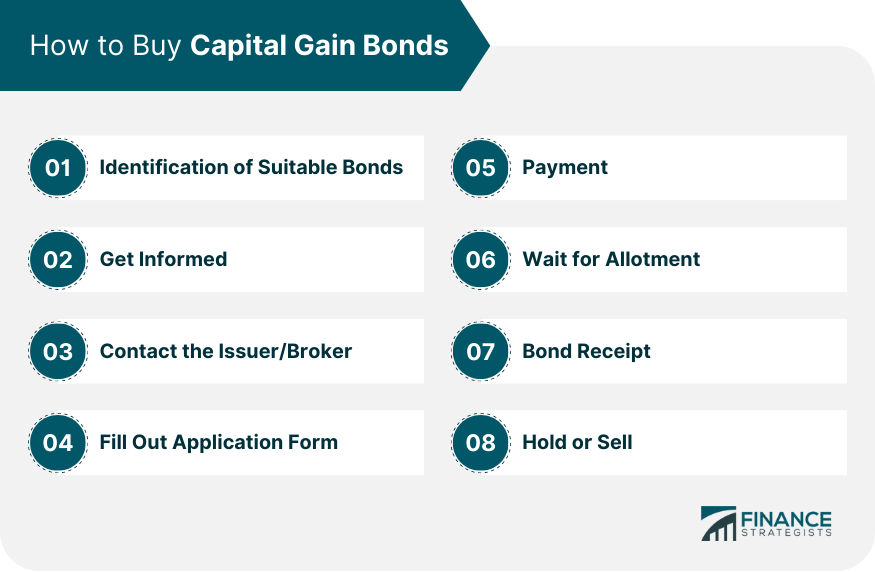

Steps in Buying Capital Gain Bonds

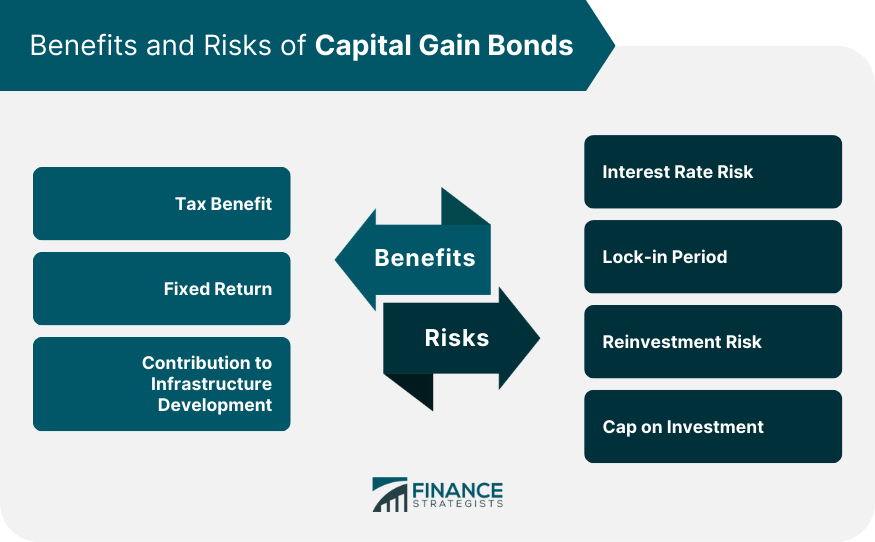

Benefits and Risks of Capital Gain Bonds

Benefits

Risks

Comparison of Capital Gain Bonds With Other Financial Instruments

Capital Gain Bonds vs Stocks

Capital Gain Bonds vs Mutual Funds

Capital Gain Bonds vs Real Estate

Conclusion

Capital Gain Bonds FAQs

Capital Gain Bonds are financial instruments issued primarily by government bodies. They allow investors to defer capital gains tax from the sale of an asset by reinvesting the gains into these bonds. They provide a fixed return and contribute to infrastructure development projects.

The primary benefits of investing in Capital Gain Bonds include deferring capital gains tax, receiving a fixed return, and contributing to national infrastructure and development projects.

Capital Gain Bonds carry risks such as interest rate risk, where the bond's value may decrease if market interest rates rise. They also have a lock-in period, making them less liquid compared to other investments. There's a reinvestment risk at maturity, and a cap on the amount that can be invested for tax-saving purposes.

Interest rate risk impacts the value of Capital Gain Bonds inversely. If market interest rates rise, the fixed return on these bonds becomes less attractive, potentially causing a decrease in their market price.

No, Capital Gain Bonds come with a lock-in period, typically of five years. Investors cannot sell these bonds before the end of this period, which restricts their liquidity. This aspect is an important risk to consider before investing in these bonds.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.