Equity, often used interchangeably with "stocks" or "shares," represents ownership interest in a company. By purchasing equity, you buy a small fraction of the company, which entitles you to a share in the company's profits, typically in the form of dividends, and voting rights at shareholder meetings. Commodities, on the other hand, are basic goods or raw materials used in commerce. These can be agricultural products like corn and wheat, energy resources such as oil and gas, or precious metals like gold and silver. Trading in commodities involves buying, selling, or trading these raw materials. Equities and commodities, while both viable investment options, differ significantly in nature, risks, returns, and the factors influencing their prices. While equities offer an ownership stake in a company along with potential dividend income and capital appreciation, commodities provide an avenue for diversification, an inflation hedge, and potential returns based on global demand-supply dynamics. Equity is a type of security that signifies ownership in a corporation. It represents a claim on part of the corporation's assets and earnings. When you buy equity or shares in a company, you become a part-owner of that company. Equities are characterized by their potential for capital appreciation, their provision of dividends, and the voting rights they confer to shareholders. They can be classified into common shares, preferred shares, and treasury shares, each with different rights and benefits. When a company performs well and its earnings grow, the value of its stock usually rises. Therefore, as a shareholder, you stand to benefit from the increase in the company's value. Additionally, capital appreciation can be substantial over the long term, making equities an attractive investment for long-term growth. Over time, well-performing companies can provide returns that significantly outpace inflation, protecting your purchasing power and increasing your wealth. Another advantage of investing in equity is the possibility of earning dividend income. Many companies distribute a portion of their earnings to shareholders in the form of dividends. These payments can provide a steady stream of income, particularly attractive to income-focused investors. The dividend yield, which is the annual dividend payment divided by the stock's price, can be an important factor for investors seeking income from their investments. Investing in equity also gives investors ownership rights in the company, including voting rights at shareholder meetings. This allows investors to influence company decisions and corporate policy, particularly in larger strategic decisions such as mergers and acquisitions. Shareholders' voting rights can also ensure management accountability, as shareholders can vote on the appointment of directors and executive compensation. Equity prices can fluctuate widely in response to various factors, including changes in the company's financial health, economic conditions, market sentiment, and geopolitical events. This volatility can result in substantial investment losses, particularly for short-term investors. However, for long-term investors, the impact of short-term volatility can be mitigated by the long-term trend of capital appreciation. Equity investments are also exposed to business and industry risk. Business risk relates to the operational and financial risks inherent in running a company, such as management effectiveness, competitiveness, and profitability. Industry risk involves risks associated with specific sectors or industries. For example, the tech sector might be affected by new regulations on data privacy, while the oil and gas industry might be influenced by changes in global oil prices. Another significant risk associated with equity investment is systematic risk, also known as market risk. This is the risk that affects all companies and is associated with broader economic events such as recessions, interest rate changes, political instability, or natural disasters. Systematic risk is unavoidable and cannot be eliminated through diversification, making it a fundamental risk for all equity investors. A commodity is a basic good used in commerce that is interchangeable with other commodities of the same type. Commodities are most often used as inputs in the production of other goods or services. They can be categorized into four types: agricultural, energy, metals, and environmental commodities. Commodities are characterized by their physical nature, their use in production, and their global trade. The prices of commodities are usually determined by global supply and demand dynamics, with changes in these factors leading to price fluctuations. One of the key advantages of investing in commodities is the opportunity for portfolio diversification. Commodities often have a low or negative correlation with other asset classes like equities and bonds, meaning they tend to perform well when these assets are performing poorly. By including commodities in a portfolio, investors can potentially reduce portfolio volatility and enhance returns, improving the risk-return trade-off. Commodities are also often seen as an effective hedge against inflation. When inflation rises, the value of money decreases, leading to higher costs for goods and services. However, during inflationary periods, the price of commodities often increases, as the cost to produce these goods rises. Therefore, by investing in commodities, investors can potentially protect their purchasing power and earn a real return during inflationary periods. The global nature of commodity markets offers another advantage for investors. Commodity prices are largely influenced by global demand and supply dynamics, creating opportunities for investors to profit from trends in global economic growth. For instance, growing demand from emerging economies for commodities like oil, metals, and agricultural products can drive commodity prices higher, providing opportunities for profit. Just as with equities, commodities are subject to price volatility. Commodity prices can fluctuate significantly in response to changes in supply and demand. These changes can be due to a variety of factors, including weather conditions, geopolitical events, economic data, and changes in market sentiment. These price fluctuations can result in substantial investment losses, particularly for those who invest directly in commodities via futures contracts. Unlike equities, commodities do not generate income. While equity investors can earn dividends, commodity investors rely solely on price appreciation for returns. This can be a disadvantage, particularly for income-focused investors. In addition, commodities do not have a long-term upward trend like equities do, meaning the potential for capital appreciation is often more uncertain and dependent on market conditions. Another risk associated with commodity investments relates to the physical nature of these assets. Owning physical commodities can involve significant storage and transportation costs, which can eat into potential returns. This is particularly the case for commodities like oil and precious metals, which require specialized storage facilities. However, these costs can be avoided by investing in commodity futures or other financial instruments that track commodity prices. Investing in equities involves buying a share of a company, which comes with ownership rights and the possibility of earning dividends. In contrast, investing in commodities involves trading in raw materials, with returns dependent on price fluctuations. Equities represent a claim on future earnings and cash flows of a company, whereas commodities do not have cash flows and their prices are solely dependent on market supply and demand. Market dynamics and volatility also vary between equities and commodities. Equity prices are influenced by a variety of factors, including a company's financial performance, economic conditions, and investor sentiment. Commodity prices, on the other hand, are determined by global supply and demand dynamics. This can lead to significant price volatility, particularly when there are sudden changes in supply or demand due to weather conditions, geopolitical events, or economic changes. Equity prices are largely driven by corporate earnings, interest rates, and economic indicators. Investor sentiment and expectations about future earnings can also have a significant impact. Commodity prices are influenced by global supply and demand dynamics, weather conditions, geopolitical events, and changes in currency values. Commodity prices can often be more volatile than equity prices, reflecting the unpredictability of some of these factors. Both equities and commodities can play a role in portfolio diversification, but in different ways. Equities can provide diversification through exposure to different sectors and geographical regions. They can also offer income diversification through dividends. Commodities, on the other hand, can provide diversification by offering exposure to different asset classes that are often negatively correlated with equities and bonds. This can help reduce overall portfolio volatility and enhance returns. Both equities and commodities can be accessed through a variety of investment vehicles. Equities can be bought and sold through stock exchanges, and they are also available through mutual funds, exchange-traded funds (ETFs), and derivatives like options and futures. Similarly, commodities can be traded via commodity futures, and there are also commodity-focused mutual funds and ETFs available. Derivatives like commodity options and swaps also offer exposure to commodity prices. Both equities and commodities are exposed to market fluctuations and carry the risk of substantial price volatility. For equities, factors such as changes in corporate earnings, economic indicators, and market sentiment can lead to price changes. For commodities, price changes can be driven by global supply and demand dynamics, weather conditions, geopolitical events, and currency fluctuations. This exposure to market fluctuations means both equity and commodity investors need to manage their risk carefully. Both equities and commodities can play a role in hedging strategies. For equities, certain sectors or types of stocks can serve as a hedge against various risks. For example, defensive stocks, which tend to perform well during economic downturns, can provide a hedge against economic risk. Commodities can also play a key role in hedging strategies. They can serve as a hedge against inflation, as commodity prices often rise when inflation increases. Certain commodities, like gold, can also act as a hedge against geopolitical risk or market instability. Equities can offer the potential for substantial capital appreciation and income from dividends, but they also come with significant risks, including market volatility and company-specific risks. Commodities can offer portfolio diversification and an inflation hedge, but they also come with their own set of risks, including price volatility and lack of income. Therefore, an investor's decision should be aligned with their risk tolerance and long-term investment goals. Market conditions and the economic outlook also play a critical role in choosing between equities and commodities. During periods of economic growth and stable market conditions, equities often perform well as corporate earnings grow. On the other hand, commodities may perform better during periods of inflation or economic uncertainty, as they can provide an inflation hedge and diversification benefits. Therefore, investors should consider the current and expected market and economic conditions when making their decision. Investors should also consider historical performance and long-term trends when choosing between equities and commodities. While past performance is not indicative of future results, it can provide insight into how these assets have performed under different market conditions and over the long term. For example, over the long term, equities have generally provided higher returns than commodities. However, during certain periods, particularly during times of high inflation or economic uncertainty, commodities have outperformed equities. Equity and commodity investments offer distinct advantages and risks, catering to different investment preferences and goals. Equities provide ownership in companies, potential capital appreciation, dividend income, and voting rights, making them suitable for long-term growth and income-seeking investors. Conversely, commodities serve as a diversification tool, an inflation hedge, and an avenue to capitalize on global demand-supply dynamics, attracting investors looking to protect against inflation and enhance portfolio returns. Both asset classes face risks, such as market volatility, business and industry risks for equities, and price volatility, lack of income, and storage costs for commodities. Deciding between equity and commodity investments requires considering risk tolerance, investment objectives, prevailing market conditions, and historical performance. A balanced and diversified portfolio may incorporate both equity and commodity exposures to optimize risk-reward trade-offs and withstand varying market environments. Overview of Equity and Commodity

What Is Equity?

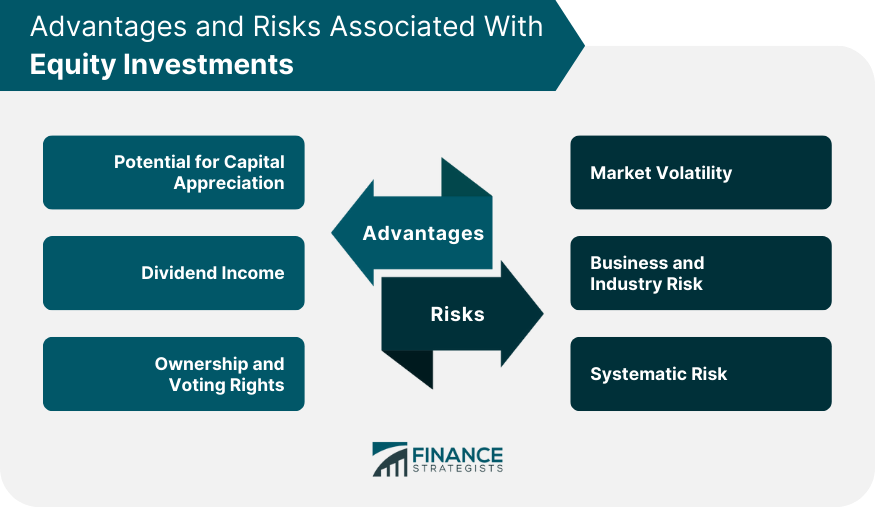

Advantages of Investing in Equity

Potential for Capital Appreciation

Dividend Income

Ownership and Voting Rights

Risks Associated With Equity Investments

Market Volatility

Business and Industry Risk

Systematic Risk

What Is a Commodity?

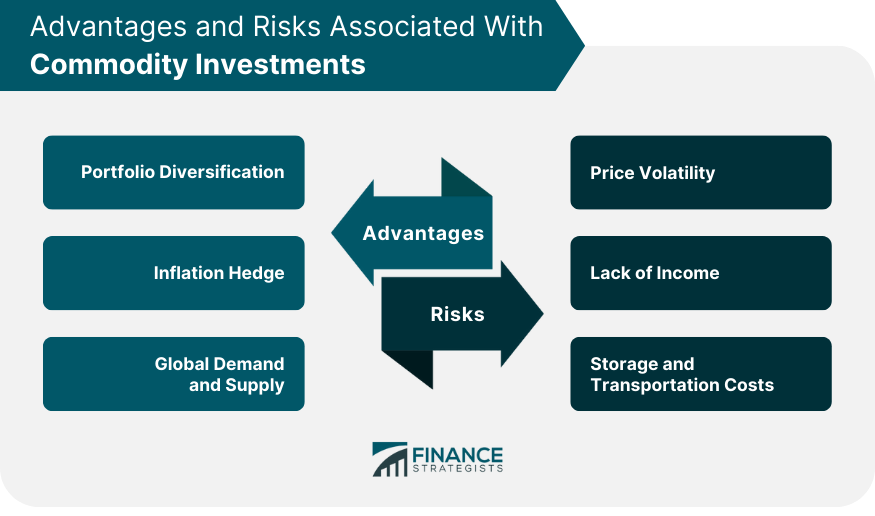

Advantages of Investing in Commodities

Portfolio Diversification

Inflation Hedge

Global Demand and Supply

Risks Associated With Commodity Investments

Price Volatility

Lack of Income

Storage and Transportation Costs

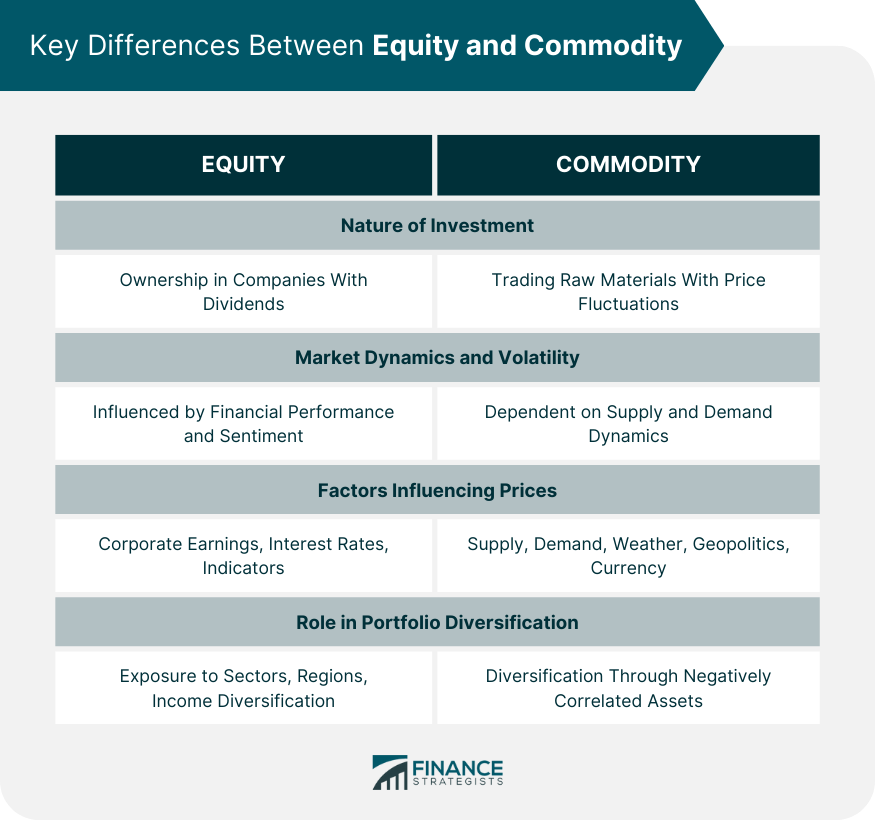

Key Differences Between Equity and Commodity

Nature of Investment

Market Dynamics and Volatility

Factors Influencing Prices

Role in Portfolio Diversification

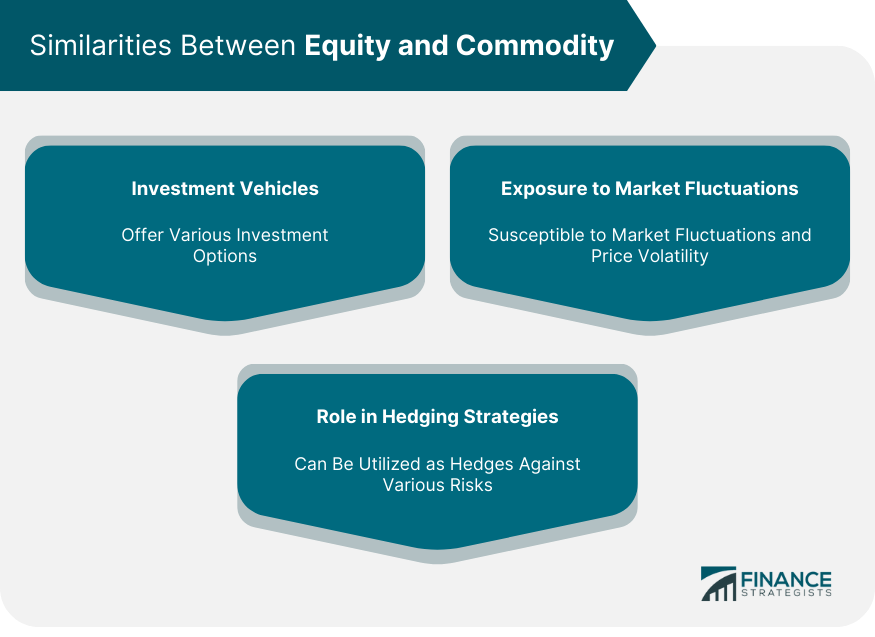

Similarities Between Equity and Commodity

Investment Vehicles

Exposure to Market Fluctuations

Role in Hedging Strategies

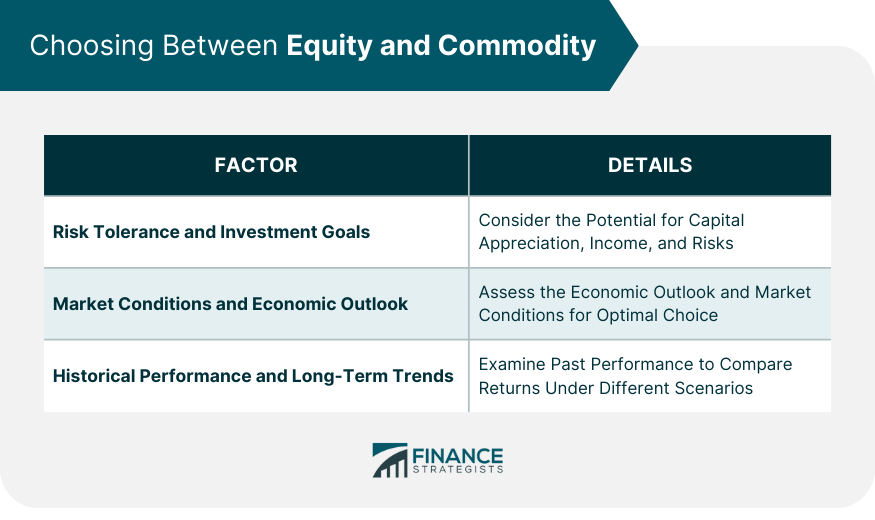

Choosing Between Equity and Commodity

Risk Tolerance and Investment Goals

Market Conditions and Economic Outlook

Historical Performance and Long-Term Trends

Conclusion

Equity vs Commodity FAQs

The main differences lie in the nature of the investment, the factors influencing prices, and the associated risks and returns. Equities represent ownership in a company and have the potential for capital appreciation and dividends. Commodities are basic goods traded primarily on the basis of global supply and demand dynamics, offering portfolio diversification and an inflation hedge.

No, unlike equities, commodities do not provide income in the form of dividends. Returns from commodity investments are primarily driven by price changes.

Investors can gain exposure to commodities without owning physical assets through financial instruments like commodity futures, commodity-focused mutual funds, exchange-traded funds (ETFs), and commodity derivatives.

Equities can offer some protection against inflation, as companies can often pass on higher costs to customers through price increases, potentially leading to higher earnings. However, commodities are generally seen as a more direct hedge against inflation.

Equities can provide diversification through exposure to different sectors and geographic regions, while commodities can provide diversification by offering exposure to a different asset class with a low or negative correlation to equities and bonds. This can help reduce overall portfolio risk and enhance returns.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.