Commodity trading is an activity that involves buying, selling, or trading in commodities. Commodities are raw materials or primary agricultural products that can be bought and sold, such as gold, oil, wheat, or sugar. They are essential for life and play a vital role in the global economy. Commodity trading dates back to ancient civilizations. Today, it takes place on a large scale in commodity markets where buyers and sellers trade contracts based on commodities. The aim is to profit from price fluctuations, hedge against price changes, or secure a future supply of a commodity. Commodity trading involves the exchange of goods in raw or primary form. Trading takes place at commodity exchanges, where traders buy and sell futures contracts. These contracts represent an agreement to buy or sell a specific quantity of a commodity at a future date and at a predetermined price. The goal of commodity trading is to profit from price fluctuations. Traders speculate on the future direction of commodity prices. If a trader expects a commodity's price to rise, they will buy futures contracts. If they expect the price to fall, they will sell futures contracts. Soft commodities refer to goods that are grown rather than mined or extracted. They include agricultural products such as wheat, coffee, cotton, and sugar. Trading in soft commodities is subject to factors like weather conditions, pests, and planting decisions, which can cause prices to be volatile. On the commodity exchanges, soft commodities are traded through futures contracts. These contracts are a way for producers and consumers of these commodities to manage risks associated with price fluctuations. Hard commodities are natural resources that need to be extracted or mined. They include items such as gold, oil, and natural gas. The extraction process of hard commodities is often more complex and costlier than that of soft commodities, and geopolitical factors can significantly impact their supply and prices. Trading in hard commodities is often used as a hedge against inflation since the prices of these commodities usually rise when inflation is high. Derivatives are financial instruments that derive their value from an underlying asset, such as a commodity. The most common type of derivative in commodity trading is a futures contract. These contracts are standardized agreements to buy or sell a particular commodity at a specified price at a future date. Futures trading allows commodity producers to secure a future selling price for their production, and consumers to secure a future buying price. It also allows speculators to profit from price changes. In fundamental analysis, traders consider various factors that can affect commodity prices. These factors include supply and demand dynamics, geopolitical events, weather conditions, and economic indicators. For example, a drought could reduce the supply of wheat, which could cause wheat prices to rise. Or, an increase in construction activity could increase demand for copper, potentially causing copper prices to rise. Supply and demand data is crucial in fundamental analysis. Traders use this data to predict how supply and demand dynamics will affect commodity prices. For instance, if data shows a decrease in the supply of a commodity but demand remains steady, this could indicate that the commodity's price will increase. Conversely, if supply is increasing but demand is decreasing, this could signal that the commodity's price will decrease. Technical analysis involves studying price patterns and trends on commodity price charts. Traders use various chart patterns such as triangles, channels, and head and shoulders to predict future price movements. For example, a breakout from a chart pattern could signal a significant price move in the direction of the breakout. By identifying these patterns, traders can make informed trading decisions. Moving averages and oscillators are popular tools in technical analysis. Moving averages smooth out price data to identify trends over specific periods, while oscillators help traders identify overbought or oversold conditions. For instance, when the price of a commodity crosses above its moving average, this could signal a potential uptrend. Similarly, when an oscillator reaches an extreme value, this could indicate a potential price reversal. Commodities have different price drivers than stocks and bonds, so adding commodities to a portfolio can reduce overall risk. For instance, during periods of high inflation, commodity prices often increase, while stock prices may decline. By having commodities in a portfolio, investors can offset potential losses from their stock holdings. Commodities can act as a hedge against inflation. During periods of high inflation, the prices of commodities often rise. This is because as the general price level increases, the prices of raw materials used to produce goods and services also increase. Therefore, by trading commodities, investors can potentially profit from inflationary periods. Commodity trading can offer the potential for high returns. Commodity prices can be volatile due to factors such as supply and demand imbalances, geopolitical events, and changes in economic indicators. Traders who correctly predict these price movements can earn substantial profits. However, the potential for high returns comes with a high level of risk. Prices can be volatile, and traders can lose more than their initial investment, particularly if they use leverage. Leverage allows traders to control large amounts of a commodity with a relatively small amount of capital, amplifying potential profits but also potential losses. For example, if a trader uses leverage to buy a commodity and the commodity's price decreases, the trader could lose more than the amount they initially invested. Successful commodity trading requires a deep understanding of the commodity markets, including the factors that influence commodity prices. It requires knowledge of trading techniques and strategies, as well as the ability to analyze market data and trends. Without this knowledge and expertise, traders may make poor trading decisions and potentially incur significant losses. Commodity trading can be capital intensive. Trading in futures contracts, for example, requires a significant amount of capital. Traders must also be able to meet margin calls if their trades move against them. This can make commodity trading inaccessible for some individual investors and potentially limit their ability to diversify their portfolios. Supply and demand dynamics are the most fundamental factors affecting commodity trading. If supply exceeds demand, prices may fall. Conversely, if demand exceeds supply, prices may rise. Traders monitor changes in supply and demand to predict future price movements. For example, if a drought reduces the supply of a commodity like wheat, and demand remains steady, the price of wheat may rise. Traders who correctly anticipate this price movement can potentially profit from it. Geopolitical and economic factors can have significant impacts on commodity trading. Events such as wars, political unrest, economic crises, and changes in government policies can affect supply and demand, and therefore commodity prices. For instance, sanctions against a major oil-producing country can reduce the global supply of oil and cause oil prices to rise. Traders who anticipate such events can position themselves to profit from these price movements. Weather and environmental conditions play a critical role in commodity trading, especially for agricultural commodities. Weather conditions can affect crop yields and livestock production, influencing supply and demand. For instance, a severe drought can reduce crop yields, leading to a decrease in supply and potential increase in prices. Similarly, a harsh winter can affect livestock production, influencing the supply and demand dynamics of meat commodities. Commodity trading refers to the activity of buying, selling, or trading in raw materials and primary agricultural products. It encompasses various types, including soft commodities, hard commodities, and derivatives and futures trading, each with its unique characteristics and market dynamics. Implementing effective strategies, such as fundamental and technical analysis, is crucial for traders to navigate the market and capitalize on price fluctuations successfully. The advantages of commodity trading include diversification benefits, acting as a hedge against inflation, and the potential for high returns. However, commodity trading comes with its share of disadvantages, including high risk and leverage, the need for specialized market knowledge, and the capital-intensive nature of certain trades. Factors influencing commodity trading encompass supply and demand dynamics, geopolitical and economic events, as well as weather and environmental conditions. Successful traders carefully analyze these factors to anticipate price movements and make informed decisions.What Is Commodity Trading?

How Commodity Trading Works

Types of Commodity Trading

Soft Commodities Trading

Hard Commodities Trading

Derivatives and Futures Trading

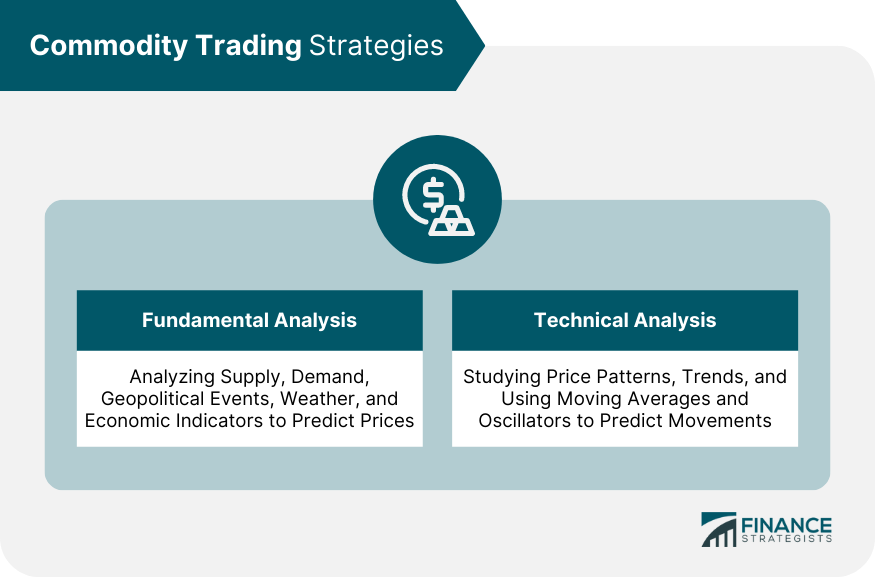

Commodity Trading Strategies

Fundamental Analysis

Technical Analysis

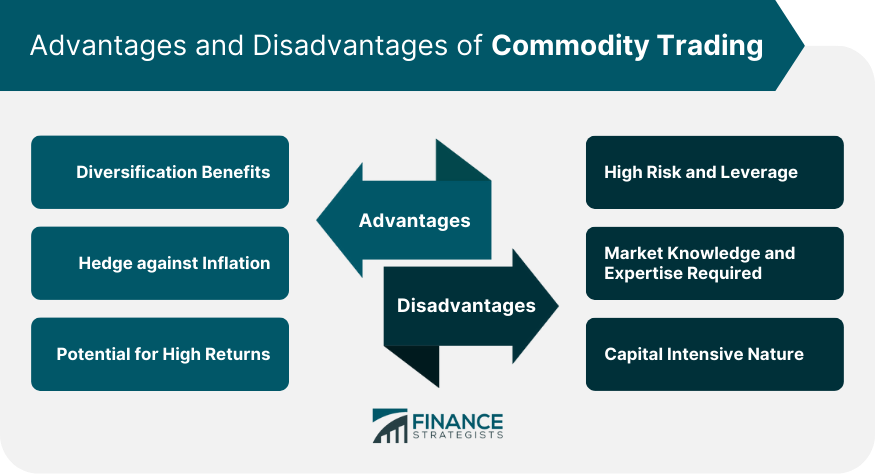

Advantages of Commodity Trading

Diversification Benefits

Hedge Against Inflation

Potential for High Returns

Disadvantages of Commodity Trading

High Risk and Leverage

Market Knowledge and Expertise Required

Capital Intensive Nature

Factors that Affect Commodity Trading

Supply and Demand Dynamics

Geopolitical and Economic Factors

Weather and Environmental Conditions

Conclusion

Commodity Trading FAQs

Commodity trading is the buying, selling, or trading of commodities, which are raw materials or primary agricultural products.

Commodity trading can involve trading in soft commodities like agricultural products, hard commodities like natural resources, and financial derivatives like futures contracts.

Commodity trading strategies can include fundamental analysis, which involves analyzing factors that affect commodity prices, and technical analysis, which involves studying price patterns and trends on commodity price charts.

Advantages of commodity trading can include the potential for high returns, diversification benefits, and a hedge against inflation.

Disadvantages of commodity trading can include a high level of risk, the need for market knowledge and expertise, and the capital-intensive nature of trading.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.