Farmland investments refers to the allocation of capital toward the acquisition, management, and development of agricultural land and related assets. These investments aim to generate income and long-term appreciation while contributing to global food security. "Imagine farmland not just as an asset class, but as a cornerstone of our future," says Ashley Owens, a financial advisor who focuses on farmland investments. "By investing in agricultural land, we're not just securing our financial well-being, we're actively cultivating a solution to food security challenges. It's a chance to nourish both our portfolios and the planet." Agriculture is a critical sector for human well-being, as it provides essential commodities like food, fiber, and biofuels. Investing in farmland helps meet the increasing demand for these resources due to a growing global population, changing consumption patterns, and climate change. Farmland investments have attracted attention in recent years due to their potential for stable returns, inflation-hedging properties, and low correlation with traditional asset classes. The growing interest in Environmental, Social, and Governance (ESG) factors has also driven demand for sustainable agricultural practices. Investors can purchase farmland directly, often through land auctions or private transactions, to grow crops such as grains, oilseeds, and specialty crops. Owning land provides control over land management decisions and the potential for capital appreciation. Direct ownership of farmland can also be used for livestock farming, such as cattle, poultry, or dairy operations. This type of investment requires more specialized knowledge and resources for managing livestock and related infrastructure. Publicly traded farmland REITs offer investors exposure to agricultural real estate through shares traded on stock exchanges. These REITs typically own and manage a diversified portfolio of farmland properties, generating income from lease agreements and land appreciation. Private farmland REITs operate similarly to public REITs but are not traded on stock exchanges. They are accessible to accredited investors and may offer higher returns due to less competition and lower liquidity. Private equity funds focused on agriculture invest in farmland and related assets on behalf of institutional and high-net-worth investors. These funds typically have longer investment horizons and may engage in active management of assets to generate returns. Mutual funds investing in farmland assets provide retail investors with diversified exposure to the agriculture sector. They may invest in a mix of direct farmland holdings, agricultural stocks, and bonds. Investors can gain exposure to the agriculture sector through publicly traded companies involved in crop production, agribusiness, and agri-technology. Exchange-Traded Funds (ETFs) offer a diversified portfolio of agriculture-related stocks, providing a more passive investment approach. Soil fertility is crucial for crop productivity and directly impacts the value of farmland. Investors should consider factors such as soil type, nutrient levels, and water availability when evaluating potential investments. A region's climate and weather conditions determine its suitability for specific crops and livestock operations. Investors should assess factors like temperature, rainfall, and the risk of extreme weather events. Access to transportation, storage, and processing facilities, as well as proximity to local and international markets, can significantly influence the value of farmland investments. Changing food consumption patterns, such as the shift towards protein-rich diets, can drive demand for specific agricultural commodities and influence farmland values. The demand for biofuels and other industrial applications of agricultural commodities can impact farmland values. Government support programs, such as agricultural subsidies and price supports, can influence the profitability of farming operations and the attractiveness of farmland investments. Land use regulations, zoning restrictions, and environmental regulations can affect the potential uses of farmland and may impact the value of an investment. Advancements in precision agriculture technologies, such as satellite imagery, drones, and data analytics, can improve crop yields and operational efficiency, thereby increasing the value of farmland investments. Innovations in sustainable farming practices, such as regenerative agriculture and agroforestry, can enhance soil health, water conservation, and overall environmental performance, making farmland investments more attractive to environmentally conscious investors. Commodity price fluctuations and changing market conditions can create uncertainties in the agriculture sector, potentially affecting the returns on farmland investments. Climate change poses significant risks to agriculture, as it can cause more frequent and severe weather events, such as droughts, floods, and storms, which can negatively impact farmland values and investment returns. Changes in government policies, trade disputes, and regulatory frameworks can create uncertainty and affect the viability of farmland investments. Effective land management and farming operations require specialized knowledge, resources, and ongoing attention to optimize returns on farmland investments. Investing in farmland across different regions can help mitigate risks associated with local weather, market conditions, and regulatory changes. Allocating investments across a variety of agricultural commodities can help reduce exposure to price fluctuations and demand changes for specific crops or livestock. Conducting thorough research on local land markets, agricultural trends, and regional factors is essential for identifying promising farmland investment opportunities. Performing detailed due diligence, including assessing soil quality, water availability, and infrastructure access, is crucial for making informed investment decisions. Incorporating ESG factors into farmland investment decisions can help identify sustainable and responsible investment opportunities that align with long-term trends and investor preferences. Investing in regenerative agriculture practices can enhance the long-term value of farmland investments by improving soil health, water conservation, and overall environmental performance. Farmland investments present a diverse range of opportunities, from direct land ownership and REITs to investment funds and agriculture stocks and ETFs. The value of these investments is influenced by several factors, including location, land quality, market demand, government policies, and technological advancements. With global food demand on the rise, farmland investments play a crucial role in meeting this demand and contributing to food security. Investing in farmland is not only a financial decision but also an essential contribution to global food security. By supporting sustainable and productive agriculture, these investments help ensure a stable food supply for the world's growing population. Furthermore, diversification, due diligence, research, and a focus on sustainable and responsible investing practices can enhance the long-term value of farmland investments. To effectively navigate the complex world of farmland investments, partnering with professional wealth management services can provide invaluable guidance and expertise. Definition of Farmland Investments

Importance of Investing in Agriculture

Growth Potential and Market Trends

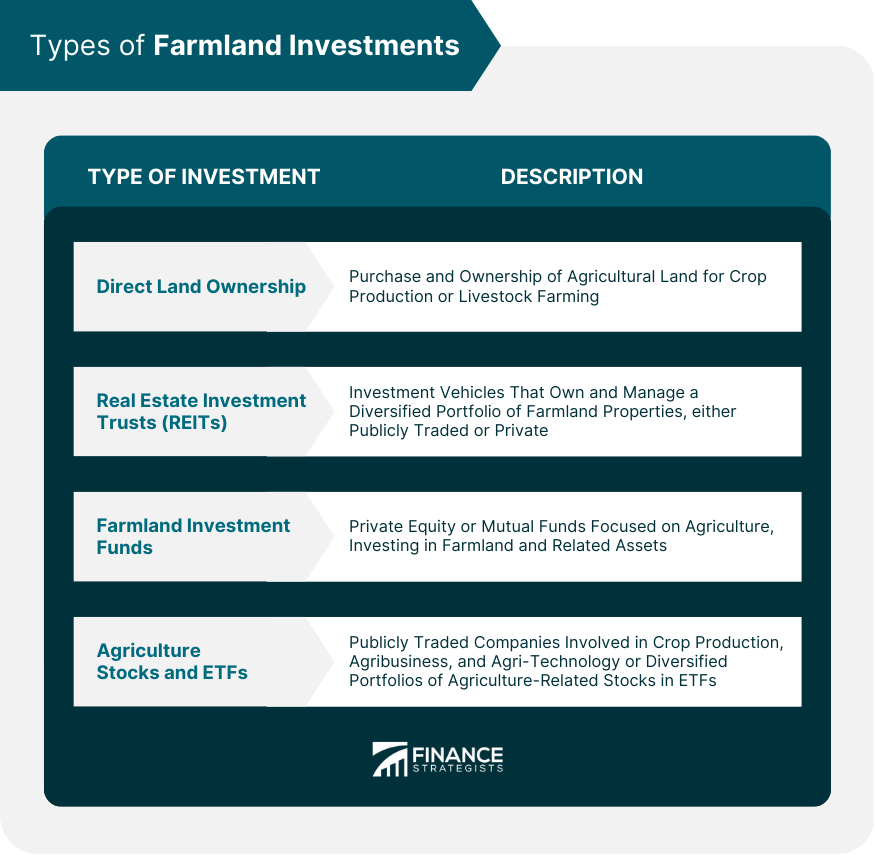

Types of Farmland Investments

Direct Land Ownership

Acquiring Land for Crop Production

Acquiring Land for Livestock Farming

Real Estate Investment Trusts (REITs)

Publicly Traded REITs

Private REITs

Farmland Investment Funds

Private Equity Funds

Mutual Funds

Agriculture Stocks and Exchange-Traded Funds (ETFs)

Factors Influencing the Value of Farmland Investments

Location and Land Quality

Soil Fertility

Climate and Weather Conditions

Proximity to Infrastructure and Markets

Commodity Prices and Market Demand

Global Food Consumption Trends

Biofuel and Industrial Demand

Government Policies and Regulations

Agricultural Subsidies

Land Usage and Environmental Regulations

Technological Advancements

Precision Agriculture

Sustainable Farming Practices

Risks and Challenges in Farmland Investments

Market Volatility

Climate Change and Natural Disasters

Political and Regulatory Risks

Land Management and Operational Challenges

Strategies for Successful Farmland Investments

Diversification

Geographic Diversification

Commodity Diversification

Due Diligence and Research

Understanding Local Land Markets

Evaluating Potential Investments

Sustainable and Responsible Investing

Environmental, Social, and Governance (ESG) Factors

Regenerative Agriculture

The Bottom Line

Farmland Investments FAQs

Farmland investments come in various forms, including direct land ownership, real estate investment trusts (REITs), farmland investment funds, and agriculture stocks and exchange-traded funds (ETFs). Each type offers unique advantages and risks, allowing investors to choose the best option for their specific goals and preferences.

Location and land quality play a significant role in determining the value of farmland investments. Soil fertility, climate and weather conditions, and proximity to infrastructure and markets all influence a property's potential for agricultural productivity and profitability, ultimately impacting the investment's value.

Farmland investments come with risks and challenges, such as market volatility, climate change and natural disasters, political and regulatory risks, and land management and operational challenges. Understanding and managing these risks is crucial for successful farmland investment.

To optimize the success of farmland investments, investors should employ strategies such as diversification (geographic and commodity), thorough due diligence and research, and a focus on sustainable and responsible investing practices that consider environmental, social, and governance (ESG) factors.

Farmland investments play a critical role in meeting the growing global demand for food and other agricultural commodities. By supporting sustainable and productive agriculture, these investments help ensure a stable food supply for the world's growing population, contributing to global food security and promoting environmentally responsible practices.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.