A commodity market is a physical or virtual marketplace for buying, selling, and trading raw or primary products, known as commodities. With roots tracing back to the dawn of civilization, this market deals with the trade of base goods that are used as inputs in the production of other goods, or serve to fulfill basic human needs. Commodities, often homogeneous in nature, include products ranging from precious metals like gold and silver to everyday agricultural products such as wheat, corn, and cotton. The commodity market plays a pivotal role in global economic stability. It provides a platform where producers can hedge against price fluctuations, ensuring some level of financial security. Simultaneously, the market also serves as a barometer for global economic health, as prices often respond to shifts in supply and demand dynamics, influenced by factors like weather, geopolitical events, and economic policies. This broad group includes goods produced through farming activities such as grains (wheat, corn, and rice), softs (cotton, coffee, and sugar), and livestock (cattle, hogs, and poultry). Agricultural commodities form the basis of our food supply chain, making this market segment critical for global food security. Trading in agricultural commodities has been a cornerstone of commerce since ancient times. They are especially susceptible to weather conditions and pest infestations, factors that can severely impact crop yields and livestock health. Thus, the volatility inherent to this market presents opportunities for significant financial gains but equally, considerable risks. These encompass fuels that power the world, such as crude oil, natural gas, and coal, alongside renewable sources like solar, wind, and biofuels. As the backbone of modern industrialized economies, energy commodities have a profound impact on the global economic landscape. The energy commodities market is characterized by substantial price volatility driven by geopolitical tensions, regulatory changes, and advancements in energy technologies. Further, the global transition toward a more sustainable, carbon-neutral future continues to reshape this market, influencing demand for traditional fuels and renewable energy resources. The metals and minerals commodities sector hosts an array of elements critical for various industrial processes. Precious metals such as gold, silver, and platinum are coveted for their intrinsic value and role in wealth preservation. Meanwhile, base metals like iron, copper, and zinc are crucial for construction, manufacturing, and technology sectors. The value of metals and minerals often increases during periods of economic uncertainty, acting as a "safe haven" for investors. Their demand, however, can fluctuate based on trends in their respective end-use industries, making their markets equally vulnerable to volatility. There's a miscellany of other commodities that don't fit neatly into the previous categories. This includes items like lumber for construction, rubber for manufacturing, and even environmental commodities such as carbon credits. While not as widely traded as the other categories, these commodities serve vital roles in their respective markets and contribute to the overall ecosystem of the commodity market. These are the entities responsible for extracting, growing, or manufacturing commodities. Producers can range from multinational corporations in oil exploration, mining operations, to farmers growing crops or raising livestock. By trading commodities, producers can secure future selling prices, providing a cushion against potential market downturns. This practice, known as hedging, helps maintain operational sustainability and promotes overall market stability. Consumers utilize commodities in the production of goods and services. These include refineries using crude oil to produce gasoline, electric utilities burning natural gas or coal to generate power, and food companies needing wheat to make bread. Like producers, consumers also use commodity markets for hedging purposes. By locking in future purchase prices, they can mitigate the risk of price surges, thereby ensuring operational cost efficiency and predictability. Unlike producers and consumers who seek to mitigate price risks, speculators embrace these risks in pursuit of profits. They trade commodities based on expected price movements, aiming to buy low and sell high. While their activities can exacerbate market volatility, speculators also inject liquidity into the market, ensuring efficient price discovery and providing the capital needed for producers and consumers to hedge their price risks. Investors view commodities as an investment asset class, akin to stocks and bonds. These individuals or entities invest in commodities either directly, through physical possession or future contracts. It could also be indirectly, through commodity-focused exchange-traded funds (ETFs), mutual funds, or stocks of commodity-producing companies. Investors diversify their portfolios by including commodities, hoping to safeguard against inflation and economic downturns. This strategy is because commodities often exhibit a low correlation with other asset classes, offering a buffer during market volatility. Spot trading forms the most immediate and straightforward method. Spot trading involves the purchase or sale of a commodity for immediate delivery and payment. The "spot price" reflects the current market price for immediate transactions. It provides a snapshot of a commodity's current market value. However, it exposes participants to the risk of price fluctuations between the time of agreement and the time of actual delivery or payment. Futures contracts serve as an ingenious solution to the uncertainties of spot trading. A futures contract is a legal agreement to buy or sell a particular commodity at a predetermined price at a specified time in the future. By "locking in" prices, producers and consumers can hedge against potential future price swings. While futures contracts provide some price stability, they also carry their share of risk. If the spot price at the contract's expiration is better than the agreed-upon price, the holder may incur an opportunity cost. Options contracts represent another sophisticated instrument within the commodity market. An options contract gives the holder the right, but not the obligation, to buy (call option) or sell (put option) a commodity at a specified price within a set time period. This allows traders to speculate on price movements without the same level of risk as futures contracts. However, options contracts come with their own drawbacks. They require an upfront payment, or "premium," which may be forfeited if the holder chooses not to exercise the option. Supply and demand dynamics form the cornerstone. Prices rise when demand outstrips supply and fall when supply exceeds demand. Various factors, including economic growth, technological advancements, and changes in consumption patterns, can alter these dynamics, causing price fluctuations. It's worth noting that commodities are finite resources, and their supply can be influenced by factors such as extraction costs, environmental regulations, and discovery of new reserves. Understanding these dynamics is crucial for market participants looking to navigate the ebb and flow of commodity prices. Commodity markets, particularly agricultural and energy, are acutely sensitive to weather and seasonal patterns. Droughts, floods, heatwaves, or frost can severely impact crop yields or disrupt energy production, causing sudden supply shortfalls and consequent price hikes. Conversely, mild winters can suppress demand for heating fuels, while good growing conditions can boost agricultural yields, both leading to potential price declines. Thus, weather forecasts and seasonal trends are closely watched by commodity traders. Geopolitical events, such as wars, trade disputes, and policy changes, can also impact commodity prices. These events can disrupt supply chains, alter trade flows, and provoke uncertainty, causing price volatility. For instance, oil prices are often susceptible to tensions in the Middle East, while agricultural commodities can be affected by trade policies. Engaging in commodity markets, therefore, requires an awareness of the geopolitical landscape and the ability to assess potential risks and opportunities that may arise. Since commodities are typically priced in US dollars on international markets, a weaker dollar can make commodities cheaper for foreign buyers, potentially boosting demand and driving up prices. Conversely, a stronger dollar can dampen global demand, leading to price declines. Therefore, currency trends and monetary policies, particularly those related to the US dollar, are critical factors to monitor when engaging in commodity markets. Investing in commodities offers a means of diversifying investment portfolios, reducing overall risk. Commodities often have a low correlation with traditional financial assets like stocks and bonds, making them a valuable addition to an investment strategy. During periods of economic uncertainty or market downturns, commodities can act as a hedge against inflation and protect against potential losses in other asset classes. Commodities, particularly precious metals like gold and silver, are often viewed as a hedge against inflation. As the value of currencies declines due to rising inflation, the price of commodities tends to rise, preserving the purchasing power of investors' wealth. This characteristic makes commodities a preferred choice for safeguarding assets during times of economic instability. The commodity market provides ample opportunities for speculators seeking significant returns. Price volatility in commodity markets can create short-term trading opportunities for skilled traders and investors. While this heightened volatility also carries increased risk, those who can effectively analyze market trends and factors influencing commodity prices stand a chance to generate substantial profits. Commodity prices are inherently volatile and can experience sharp and unpredictable fluctuations. Factors such as weather conditions, geopolitical events, and changes in demand and supply dynamics can lead to significant price swings, exposing investors and traders to substantial risks and potential losses. Disruptions in supply due to factors like natural disasters or geopolitical tensions can lead to scarcity and price spikes, while weak demand can lead to oversupply and price declines. Participants in the commodity market must closely monitor these imbalances and anticipate their impacts on prices. Commodities are often subject to geopolitical risks, such as trade disputes, sanctions, or political unrest, which can disrupt supply chains and influence prices. Additionally, environmental risks, such as climate change and natural disasters, can severely impact commodity production and transportation, causing supply shortages and price instability. Managing and mitigating these risks are critical aspects of engaging in the commodity market. The commodity market is a physical or virtual marketplace where raw or primary products, known as commodities, are bought, sold, and traded. It serves as a fundamental pillar of the global economy, providing a platform for the trade of raw and essential products that play a vital role in our daily lives. From precious metals and agricultural goods to energy resources and industrial metals, the diverse range of commodities contributes to economic stability and growth. Commodity markets provide investors portfolio diversification, inflation hedge, and speculative opportunities. Producers hedge against price fluctuations for financial security. Consumers hedge against rising input costs for predictability and cost efficiency. Engaging in commodity markets also comes with inherent risks, such as price volatility driven by factors like weather, geopolitical events, and economic policies. Understanding supply and demand dynamics, weather patterns, geopolitical landscapes, and currency fluctuations is crucial for participants to navigate the complexities of commodity trading effectively.What Is a Commodity Market?

Types of Commodity Markets

Agricultural Commodities

Energy Commodities

Metals and Minerals Commodities

Other Commodities

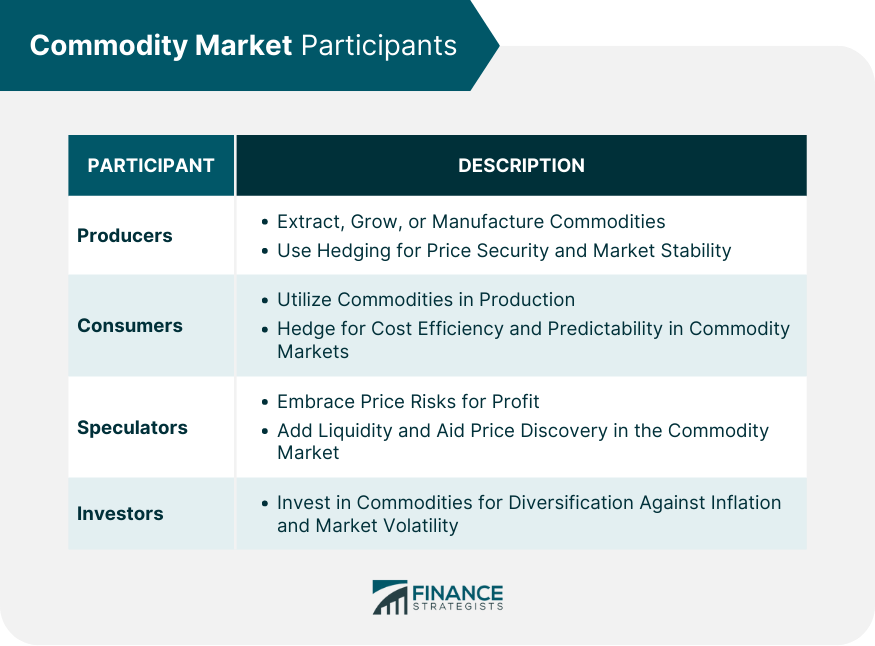

Commodity Market Participants

Producers

Consumers

Speculators

Investors

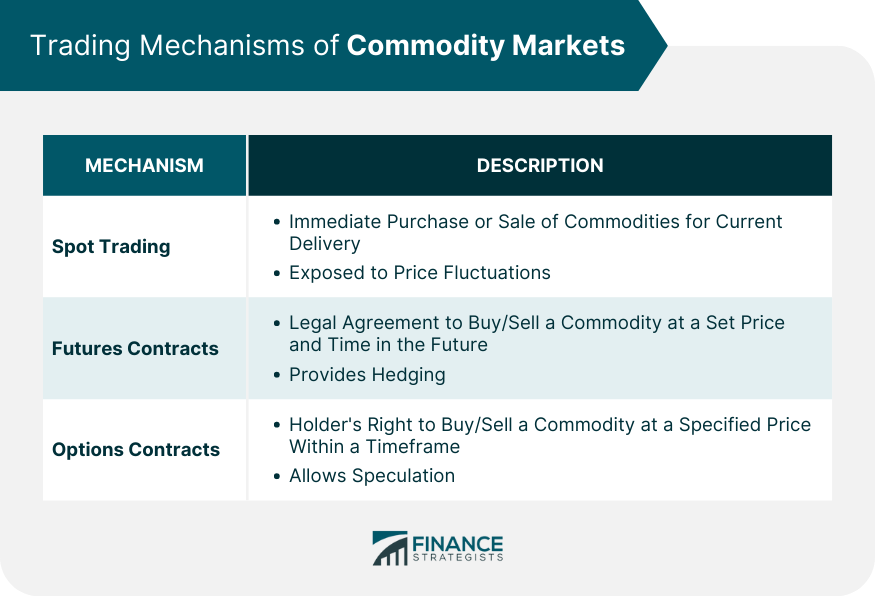

Trading Strategies of Commodity Markets

Spot Trading

Futures Contracts

Options Contracts

Factors Affecting Commodity Market Prices

Supply and Demand Dynamics

Weather and Seasonal Influences

Geopolitical Events

Currency Fluctuations

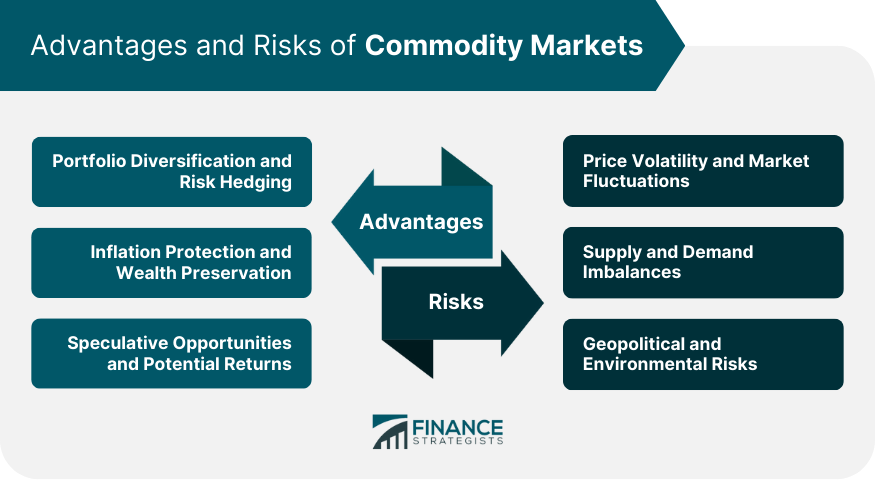

Advantages of a Commodity Market

Portfolio Diversification and Risk Hedging

Inflation Protection and Wealth Preservation

Speculative Opportunities and Potential Returns

Risks of a Commodity Market

Price Volatility and Market Fluctuations

Supply and Demand Imbalances

Geopolitical and Environmental Risks

Conclusion

Commodity Market FAQs

A commodity market is a physical or virtual marketplace for buying, selling, and trading raw or primary products, known as commodities. Commodities include products like precious metals, agricultural goods, energy resources, and more.

The main participants in a commodity market are producers (those who extract, grow, or manufacture commodities), consumers (those who use commodities in the production of goods and services), speculators (those who trade commodities based on expected price movements), and investors (those who view commodities as an investment asset class).

Spot trading involves the immediate purchase or sale of a commodity, while futures trading involves a legal agreement to buy or sell a commodity at a predetermined price at a specified time in the future.

Weather and seasonal patterns can impact the supply and demand dynamics of commodities, especially agricultural and energy commodities. Extreme weather conditions can disrupt production and cause sudden supply shortfalls, leading to price hikes.

Since commodities are typically priced in US dollars on international markets, a weaker dollar can make commodities cheaper for foreign buyers, boosting demand and driving up prices. Conversely, a stronger dollar can dampen global demand, leading to price declines.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.