A commodity trader is a professional or individual investor who buys, sells, and trades in commodities. These commodities can be tangible or intangible, and range from traditional products like gold, oil, and agricultural goods, to more complex financial derivatives and instruments. These professionals operate in a fast-paced and dynamic global market environment, aiming to profit from price fluctuations by employing a variety of trading strategies. Commodity traders often work for trading firms, hedge funds, and financial institutions. However, with the evolution of technology and increased accessibility to global markets, many individuals can now participate in commodity trading. Regardless of the trading context, the primary goal of commodity traders is to make accurate market predictions and implement trades that yield a profit. For a commodity trader, market analysis and research form the bedrock of successful trading. Traders continually study market trends, pricing dynamics, and global economic indicators to identify potential trading opportunities. They analyze historical price patterns, global supply and demand dynamics, geopolitical events, and even weather patterns, as these factors can significantly influence commodity prices. Moreover, they scrutinize reports from entities like the Commodities Futures Trading Commission (CFTC) and other international regulatory bodies. This data-driven approach enables traders to develop informed insights about market direction, which subsequently guide their trading decisions. The development of trading strategies is a critical task for commodity traders. The strategies incorporate the trader's market insights, risk tolerance, and financial objectives. These strategies may focus on a single commodity or a basket of commodities and often involve both long and short positions to capitalize on market volatility. A good trading strategy integrates the trader's analysis of market trends, understanding of price momentum, and assessment of market sentiment. Traders continually refine their strategies based on ongoing market dynamics and their own performance feedback, creating a continuous cycle of learning and improvement. No trading decision is without risk, and thus traders need to implement measures to protect themselves against potential losses. This typically involves setting stop-loss orders, which automatically close positions if losses reach a predetermined level. Moreover, commodity traders also employ hedging strategies. They take offsetting positions in related commodities or derivative instruments to reduce the risk of adverse price movements. By doing so, they seek to insulate their portfolios from unexpected market events while maintaining the potential for profits. Commodity traders are also responsible for the actual execution of trades. This involves choosing the right trading platforms, placing trades at the optimal time, and monitoring these trades until they are closed. The efficiency of trade execution can significantly influence profitability, as even small delays or errors can lead to substantial financial losses in a volatile market. Traders also have to consider transaction costs and tax implications during trade execution. Advanced trading platforms provide various tools and features that facilitate efficient trade execution, including automated trading systems, real-time data feeds, and analytical tools. Speculators are commodity traders who aim to profit from price fluctuations. They do not seek to own the commodities; instead, they try to predict future price movements and execute trades based on these predictions. Speculators contribute to the liquidity of commodity markets and assume a higher level of risk compared to other types of traders. They often use leverage, a tool that allows them to trade larger amounts than their actual capital. However, while leverage can amplify profits, it can also exacerbate losses. Therefore, speculation requires careful risk management and a sound understanding of market dynamics. Hedgers are commodity traders who use the markets to reduce their exposure to adverse price movements in their business operations. These could include farmers, mining companies, oil producers, or any other businesses whose profits are affected by commodity prices. For example, an oil producer might sell futures contracts to lock in a certain price for its future production, thereby insulating itself from potential price drops. Similarly, a food manufacturer might buy futures contracts for a key ingredient to protect itself against price increases. By hedging their risks in this way, businesses can ensure more predictable financial outcomes. Arbitrageurs are commodity traders who capitalize on price discrepancies across different markets or commodities. They purchase a commodity at a lower price in one market and simultaneously sell it at a higher price in another, thus profiting from the price differential. Arbitrage opportunities can arise due to factors like timing differences, geographical price variations, or discrepancies between spot and futures prices. These traders play a crucial role in maintaining market efficiency as their activities help to correct price anomalies. Commodity trading is a data-driven activity that requires strong analytical skills. Traders need to interpret complex datasets, derive insights from these data, and apply these insights in their trading decisions. This requires abilities in areas such as statistical analysis, financial modeling, and economic forecasting. In addition to quantitative analysis, commodity traders also need qualitative analytical skills. They must be able to understand and assess the implications of geopolitical events, regulatory changes, and market sentiment on commodity prices. Commodity traders must have deep knowledge of the markets in which they operate. They need to understand the forces that drive commodity prices, including global economic trends, supply-demand dynamics, and geopolitical factors. Moreover, they must be familiar with the workings of commodity exchanges, contract specifications, and trading procedures. To acquire and maintain this knowledge, traders must continually conduct market research and stay updated on relevant news and developments. They also need to understand the characteristics and risks associated with different types of commodity contracts, such as futures, options, and swaps. Financial modeling and technical analysis are essential skills for commodity traders. They use financial models to analyze historical data, forecast future price trends, and evaluate different trading strategies. These models can help traders to quantify risks, determine fair value, and assess the potential impact of various market scenarios on their portfolios. Technical analysis involves studying past price patterns and trading volumes to predict future price movements. It relies on various charting tools and indicators, such as moving averages, trendlines, and oscillators. Traders use these techniques to identify trading signals, such as entry and exit points, and to gauge market sentiment. Commodity trading often involves making quick decisions under pressure. Prices can change rapidly, and traders must react promptly to capitalize on trading opportunities or to limit losses. This requires a high level of mental agility, stress resilience, and emotional control. Traders also need to maintain discipline and stick to their trading plans, even in the face of unexpected market events or losses. They must be able to manage their emotions and avoid impulsive decisions, which can lead to costly mistakes. Trend following is a popular trading strategy among commodity traders. It is based on the principle that commodity prices tend to move in trends, either upwards (bullish) or downwards (bearish). Traders using this strategy aim to identify these trends early and ride them until they reverse. Trend-following strategies rely on technical analysis tools, such as moving averages and trendlines, to identify trends and generate trading signals. However, they require patience and discipline, as trends can often take time to develop and may experience temporary reversals. Mean reversion is a trading strategy based on the assumption that commodity prices tend to revert to their mean or average level over time. This strategy involves buying commodities that are perceived as underpriced (below their mean) and selling those that are seen as overpriced (above their mean). Traders use statistical tools, such as standard deviation and Z-scores, to identify overbought and oversold conditions. However, this strategy can be risky, as prices can remain above or below their mean for extended periods, leading to potential losses. Spread trading is a strategy that involves taking simultaneous long and short positions in related commodities. The aim is to profit from the price differential between the two positions, rather than from the absolute price movement of a single commodity. Common types of spreads include inter-commodity spreads (between different but related commodities) and intra-commodity spreads (between different contract months of the same commodity). Spread trading can offer lower risk compared to outright long or short positions, as it depends on relative rather than absolute price movements. Seasonal trading is a strategy that exploits recurring patterns in commodity prices caused by seasonal factors. These factors include weather changes, harvest cycles, and demand fluctuations related to holidays or events. For example, natural gas prices often rise in winter due to increased heating demand, while grain prices may be affected by planting and harvest cycles. Traders use historical price data and seasonal charts to identify and trade these patterns. However, this strategy requires a deep understanding of the commodity's supply-demand dynamics and the factors that drive its seasonal patterns. They provide the interface for executing trades, monitoring market prices, analyzing data, and managing trading accounts. Some platforms also offer advanced features, such as automated trading systems, backtesting capabilities, and customizable charting tools. Different platforms cater to different trading styles and needs. Some are designed for high-frequency, intraday trading, while others are better suited for longer-term, swing or position trading. Traders must choose platforms that best fit their trading strategies and offer reliable, real-time data feeds. Access to real-time data and market news is crucial for commodity traders. They rely on these sources for price quotes, trading volumes, economic indicators, and news events that can affect commodity prices. Many trading platforms provide real-time data feeds, along with news and analysis services. Traders also use specialized financial news services, economic calendars, and social media feeds to stay updated on market developments. In today's digital age, information moves fast, and having timely, accurate information can be a key determinant of trading success. Risk management tools are essential components of a commodity trader's toolbox. These tools help traders to measure and manage their exposure to financial risks, such as market risk, liquidity risk, and credit risk. These tools include stop-loss orders, which automatically close positions when losses reach a certain level. Other risk management tools include position sizing calculators, risk-reward ratio calculators, and portfolio analytics software that can analyze the risk characteristics of a trading portfolio. By using these tools, traders can limit their potential losses and ensure that they trade within their risk tolerance levels. Performance tracking software allows traders to monitor and analyze their trading performance. It can track a variety of metrics, such as profit and loss, return on investment, win rate, and drawdown. By analyzing these metrics, traders can identify their strengths and weaknesses, assess the effectiveness of their trading strategies, and make necessary adjustments. Some performance tracking software also provides journaling features, which allow traders to record their thoughts, observations, and learning points from each trade. This can be a valuable tool for self-reflection and continuous learning, which are key to improving trading performance over time. A commodity trader is a professional or individual investor who buys, sells, and trades commodities in a dynamic global market environment. They play diverse roles as speculators, hedgers, or arbitrageurs, aiming to profit from price fluctuations. To excel in this field, traders require key skills such as analytical abilities, market knowledge, financial modeling, and decision-making under pressure. They must also develop effective trading strategies like trend following, mean reversion, spread trading, and seasonal trading. Commodity traders employ various tools, including trading platforms, real-time data sources, risk management tools, and performance tracking software, to enhance their trading success. By constantly researching and staying informed about market trends and developments, commodity traders can make accurate market predictions and implement trades that yield profitable outcomes.What Is a Commodity Trader?

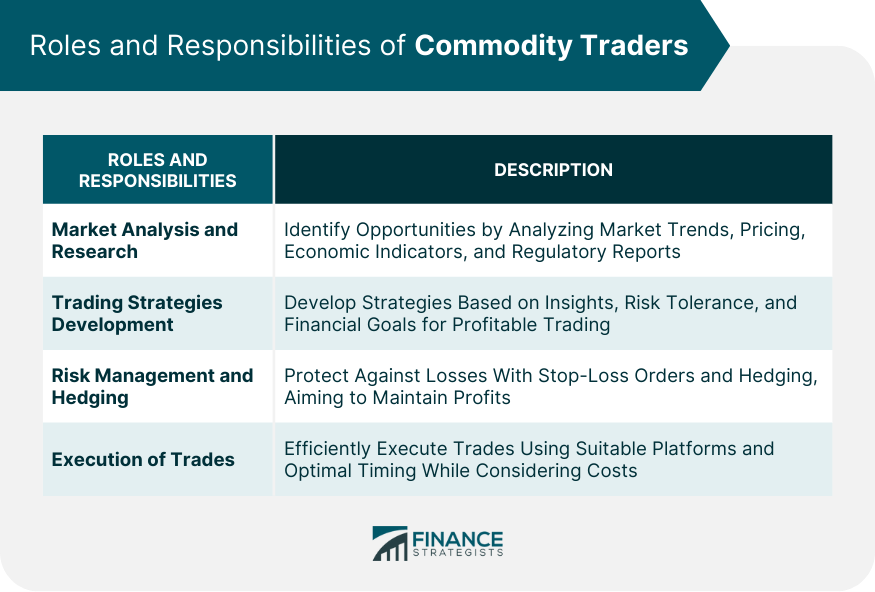

Roles and Responsibilities of a Commodity Trader

Market Analysis and Research

Trading Strategies Development

Risk Management and Hedging

Execution of Trades

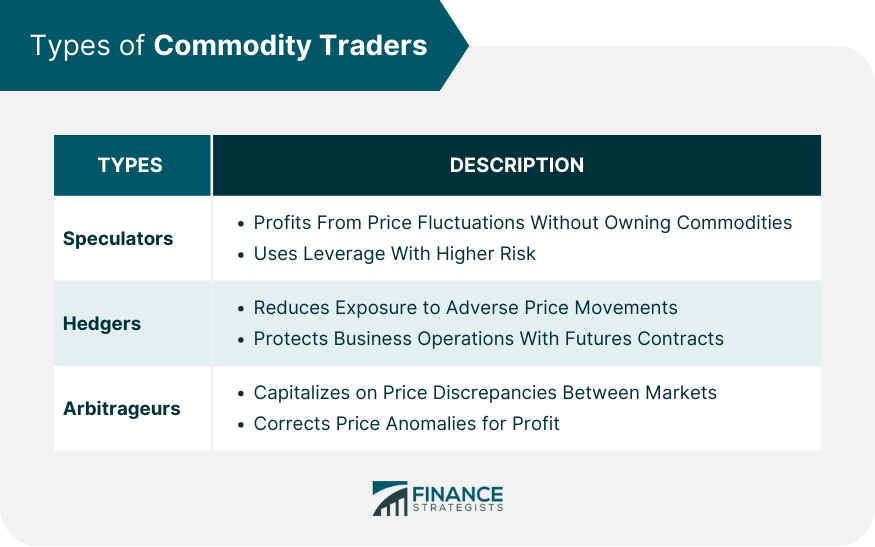

Types of Commodity Traders

Speculators

Hedgers

Arbitrageurs

Key Skills and Qualifications for Commodity Traders

Analytical Skills

Market Knowledge and Research Abilities

Financial Modeling and Technical Analysis

Decision-Making Under Pressure

Trading Strategies for Commodity Traders

Trend Following

Mean Reversion

Spread Trading

Seasonal Trading

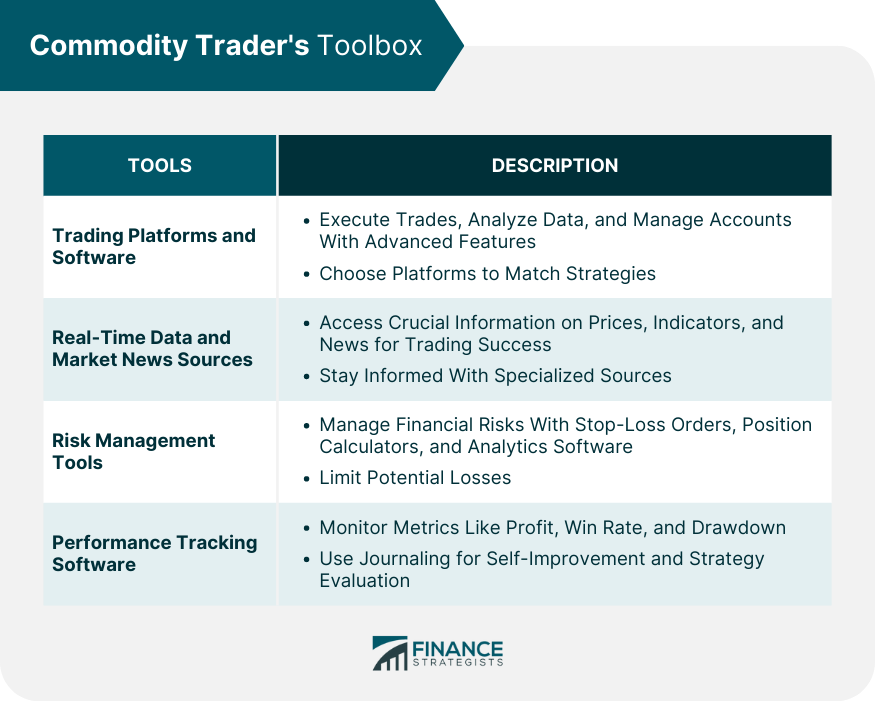

Commodity Trader's Toolbox

Trading Platforms and Software

Real-Time Data and Market News Sources

Risk Management Tools

Performance Tracking Software

Conclusion

Commodity Trader FAQs

A commodity trader is a professional or individual investor who buys, sells, and trades in commodities with the aim to profit from price fluctuations.

The main types of commodity traders are speculators, hedgers, and arbitrageurs. Speculators aim to profit from price movements, hedgers seek to protect against price volatility, and arbitrageurs capitalize on price discrepancies.

Key skills for commodity trading include strong analytical abilities, deep market knowledge, proficiency in financial modeling and technical analysis, and the ability to make quick decisions under pressure.

Common trading strategies in commodity trading include trend following, mean reversion, spread trading, and seasonal trading. Each of these strategies has its own advantages and risks, and traders typically choose strategies based on their market insights, risk tolerance, and financial goals.

Commodity traders use a range of tools, including trading platforms and software for executing trades and analyzing data, real-time data and news sources for market information, risk management tools for controlling financial risks, and performance tracking software for monitoring and improving their trading performance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.