Commodities are fundamental to the functioning of societies worldwide. These raw materials or primary agricultural products can be bought, sold, and exchanged for each other. They underpin several industrial sectors, influence international trade policies, and impact our daily lives in more ways than one. In fact, fluctuations in commodity prices can lead to significant changes in the economy, affecting everything from the cost of goods to the rate of inflation. Consequently, the commodities market serves as a leading indicator of economic health and future trends. Additionally, by tracking and analyzing commodities, investors, and businesses can strategize and hedge against potential risks, contributing to overall economic stability. Often referred to as "black gold," crude oil is, without a doubt, one of the most important commodities globally. It forms the backbone of several economies and plays a vital role in sustaining modern lifestyles. Crude oil is a naturally occurring, unrefined petroleum product. It's a fossil fuel, meaning it's formed from the remains of ancient marine plants and animals. Crude oil is predominantly used to produce fuel for cars, trucks, airplanes, trains, and ships. Additionally, it's also used in petrochemical industries to manufacture products such as plastics, solvents, synthetic fibers, and even medications. The economic importance of crude oil cannot be overstated. Countries with oil reserves have the potential to boost their economies significantly through oil extraction and export. Moreover, the fluctuation in crude oil prices can have far-reaching effects, affecting industries far beyond the oil sector and impacting inflation, trade balances, and currency rates. Natural gas is another fossil fuel that holds great significance in the global commodities market. It is cleaner, more efficient, and is gaining more preference for electricity generation. Natural gas is composed mainly of methane and occurs alongside coal beds and oil fields. It's widely used for heating and cooking in homes, generating electricity, and as fuel for vehicles. Additionally, it plays a critical role in the industrial sector, where it's used to produce chemicals, fertilizers, and hydrogen. Moreover, natural gas is also used in the production of plastics and other commercially important organic chemicals. Natural gas plays a key role in world's energy supply, providing about 22% of the world's energy. It's less polluting than other fossil fuels, making it a popular choice in countries working towards cleaner energy sources. The availability and price of natural gas can influence industrial production, electricity prices, and even geopolitical dynamics. Coal is another commodity that has played an integral role in global energy production. It has fueled industrial revolutions and remains a crucial part of the global energy mix. Coal is a fossil fuel extracted from the ground through coal mining. Historically, coal has been used for a variety of industrial processes, including steel production, cement manufacturing, and as a key fuel source for power plants generating electricity. Furthermore, it's used in producing heat for industrial processes and in cement manufacturing. Despite environmental concerns, coal remains a significant contributor to the world's energy mix, especially in developing economies where it's abundant and cheaper compared to other energy sources. It has provided an affordable and stable source of energy during periods of oil and gas price volatility. Countries with large coal reserves have often been able to protect their economies from fluctuating energy prices, gaining economic stability. Agricultural commodities, too, hold a prominent place in the global economy. They not only sustain life but also serve as significant trade commodities. Agricultural commodities include products like wheat, corn, soybeans, and livestock. These are crucial for global food security, providing sustenance for billions of people. These commodities also form the raw materials for various industries, including food processing, textiles, and biofuels. Agriculture is the primary source of livelihood for many people globally, particularly in developing economies. Fluctuations in the price and yield of these commodities can affect food prices, inflation rates, and government policy. Furthermore, these commodities play a vital role in international trade, contributing significantly to export earnings for many countries. The role of fertilizers in the global commodities market is often overlooked, but they are critical to global agricultural productivity. Fertilizers are substances added to soils to enhance their fertility and promote plant growth. They primarily provide nitrogen, phosphorous, and potassium, essential nutrients for plant growth. Apart from improving crop yield, they also enhance the quality of produce, making fruits, grains, and vegetables more nutritious. Fertilizers play a critical role in improving crop yields, thereby ensuring food security for a growing global population. The fertilizer industry also represents a significant economic sector in several countries, contributing to their GDP and employment. Fluctuations in fertilizer prices can impact the cost of food production, influencing global food prices. Base metals such as copper, zinc, and nickel are vital commodities in the global economy. They form the backbone of the industrial sector, with a wide range of applications. Base metals are common metals that are essential in construction, manufacturing, and technology. For example, copper is extensively used in electrical equipment and infrastructure due to its excellent conductivity, while zinc is used predominantly for galvanizing steel. Nickel, on the other hand, is a key component of stainless steel. The demand for base metals is strongly correlated with global industrial activity. As such, these metals are often seen as economic health indicators. Fluctuations in base metal prices can reflect changes in economic growth prospects, thereby influencing investment decisions across sectors. Precious metals, notably gold, silver, and platinum, are significant commodities with a different set of economic dynamics. Precious metals are rare, naturally occurring metallic elements. They're primarily used in jewelry, art, and coinage due to their luster and durability. However, they also have industrial uses, particularly in electronics and dentistry, due to their exceptional conductivity and resistance to corrosion and tarnish. Precious metals, especially gold, have historically been used as a store of value and safe-haven assets. During times of economic uncertainty, investors often flock to precious metals, increasing their demand and price. Additionally, the mining of these metals can have substantial economic impacts on countries rich in these resources. The commodities market operates much like other markets, with buyers and sellers trading based on price, quality, and quantity. However, commodities trading often involves future contracts, agreements to buy or sell a specific commodity at a set price on a future date. These markets are also influenced by speculators, who trade contracts with the hope of profiting from future price changes. Supply and demand dynamics significantly influence commodity prices. Factors such as weather, geopolitical events, and economic health can affect commodity supply and demand, leading to price fluctuations. Additionally, technological advancements that improve extraction or production efficiency can also impact the supply of commodities, thereby influencing their prices. Commodities can serve as a valuable diversification tool within an investment portfolio. Since commodity prices often move in different directions than stocks and bonds, they can help reduce risk and potentially enhance returns. Furthermore, investing in different commodities can offer even more diversification, as price movements across commodities may not always correlate. Additionally, commodities can act as a hedge against inflation. As the cost of goods rises, the prices of commodities used to produce these goods often increase, providing an effective hedge for investors. This characteristic makes commodities an attractive investment during times of high or expected inflation. Commodities, as raw materials or primary agricultural products, underpin industrial sectors, influence international trade, and serve as indicators of economic health. Key commodities such as crude oil, natural gas, coal, agricultural products, fertilizers, base metals, and precious metals each have distinctive uses and economic impacts. For instance, crude oil and natural gas significantly influence economies, trade balances, and inflation rates, while agriculture and fertilizers impact global food security and prices. Base metals reflect global industrial activity and precious metals serve as safe-haven assets in uncertain times. The commodities market, dictated by supply and demand dynamics and technological advancements, provides strategic opportunities for wealth management. By serving as diversification tools and hedges against inflation, commodities can mitigate risk and enhance returns, proving their indispensable role in global economies and investment portfolios.Understanding Commodities

Most Important Commodities in the World

Crude Oil

Overview and Uses

Economic Impact and Importance

Natural Gas

Overview and Uses

Economic Impact and Importance

Coal

Overview and Uses

Economic Impact and Importance

Agriculture

Overview of Major Agricultural Commodities

Economic Impact and Importance

Fertilizers

Overview and Uses

Economic Impact and Importance

Base Metals

Overview and Uses

Economic Impact and Importance

Precious Metals

Overview and Uses

Economic Impact and Importance

Exploring the Commodities Market

How the Commodities Market Operates

Influence of Supply and Demand

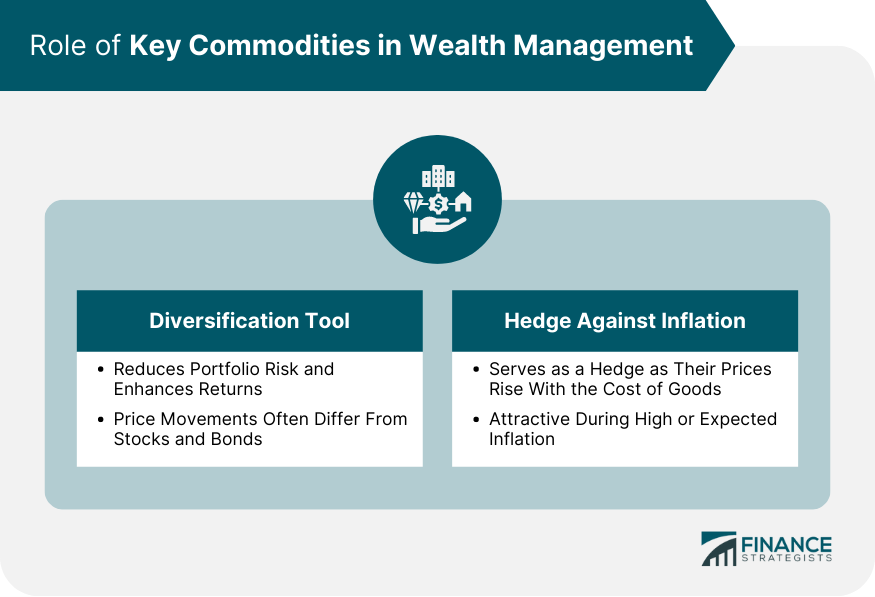

Role of Key Commodities in Wealth Management

Diversification Tool

Hedge Against Inflation

Bottom Line

Most Important Commodities in the World FAQs

Crude oil fuels several economies, influencing industries beyond the oil sector and affecting inflation, trade balances, and currency rates.

Natural gas provides about 22% of the world's energy, influencing industrial production, electricity prices, and geopolitical dynamics.

They influence food prices, inflation rates, and government policies and contribute significantly to export earnings in many countries.

Base metals are essential in industries like construction, manufacturing, and technology, and their demand often indicates economic health.

Precious metals, especially gold, serve as a store of value and safe-haven asset, attracting investors during times of economic uncertainty.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.