Entertainment Industry-Specific Tax Planning is a specialized area of tax planning that focuses on the unique financial and tax considerations faced by individuals and businesses in the entertainment industry. Professionals in this industry, including actors, musicians, producers, and directors, often have complex and fluctuating income streams, such as royalties, residuals, and performance fees. Additionally, they may incur a wide range of deductible expenses related to their work, such as travel, wardrobe, equipment, and professional fees. Given these complexities, entertainment professionals must engage in strategic tax planning to optimize deductions, minimize tax liabilities, and ensure compliance with tax regulations. To address these unique challenges, Entertainment Industry-Specific Tax Planning involves identifying and maximizing industry-specific deductions, navigating multi-state tax filings, and managing contracts and agreements with various stakeholders. Actors and actresses often face unique financial challenges, including fluctuating income, multiple employers, and expenses related to their profession. Tax planning for these individuals should include strategies for managing income, determining deductions, and understanding the tax implications of various income sources, such as residuals and royalties. In addition, actors and actresses may work as independent contractors or as employees, which can impact their tax liability. Understanding the tax implications of these different employment classifications is crucial for minimizing the overall tax burden and ensuring compliance with tax laws. Directors and producers oversee and manage various aspects of film, television, or theater productions. Their income may be derived from multiple sources, including fees, royalties, and profit participation. Directors and producers need to understand the tax implications of these income streams and identify opportunities for deductions and credits. Furthermore, directors and producers may choose to establish their own production companies, which can provide additional tax benefits. Selecting the appropriate business entity for their production company, such as a limited liability company (LLC) or corporation, can significantly impact their tax liability and overall financial well-being. Screenwriters and playwrights create scripts and other written materials for film, television, or theater productions. They may receive income through advances, royalties, or option payments with unique tax implications. These professionals need to understand the tax treatment of their income and identify deductions and credits available to them. As with other entertainment professionals, screenwriters and playwrights may work as employees or independent contractors. Understanding the tax implications of these different employment classifications and selecting the appropriate business entity for their writing endeavors is crucial for minimizing their tax burden and ensuring compliance with tax laws. Musicians and composers create and perform music for various purposes, including film, television, and live performances. Their income may be derived from various sources, such as performance fees, royalties, and merchandise sales. Understanding the tax implications of these income streams is crucial for musicians and composers to minimize their tax burden and maximize deductions and credits. In addition to understanding their income sources, musicians and composers should consider the tax benefits of establishing a business entity for their music endeavors. Selecting the appropriate entity, such as an LLC or corporation, can provide additional tax benefits and protect their personal assets from business-related liabilities. Visual artists and designers create artwork, graphics, and other visual elements for film, television, theater, and digital media projects. These professionals may earn income through commissions, sales, royalties, or licensing agreements. Understanding the tax implications of these income sources is crucial for visual artists and designers to minimize their tax burden and identify deductions and credits available to them. As with other entertainment professionals, visual artists and designers may choose to establish a business entity for their creative endeavors. Selecting the appropriate entity, such as an LLC or corporation, can provide additional tax benefits and protect their personal assets from business-related liabilities. Agents and managers represent and negotiate on behalf of entertainment professionals, securing contracts and managing various aspects of their clients' careers. They typically earn income through commissions or fees based on their client's earnings. Agents and managers need to understand the tax implications of their income sources and identify deductions and credits available to them. As with other entertainment professionals, agents and managers may choose to establish a business entity for their representation or management endeavors. Selecting the appropriate entity, such as an LLC or corporation, can provide additional tax benefits and protect their personal assets from business-related liabilities. Technical crew members work behind the scenes in film, television, or theater productions, providing services such as lighting, sound, set design, and special effects. Their income may be derived from various sources, such as hourly wages, project fees, or royalties. Understanding the tax implications of these income streams is crucial for technical crew members to minimize their tax burden and identify deductions and credits available to them. In addition to understanding their income sources, technical crew members should consider the tax benefits of establishing a business entity for their services. Selecting the appropriate entity, such as an LLC or corporation, can provide additional tax benefits and protect their personal assets from business-related liabilities. Entertainment professionals may work as W-2 employees or independent contractors, which can impact their tax liability. W-2 employees have taxes withheld from their paychecks and may be eligible for certain benefits, such as health insurance and retirement plans. On the other hand, independent contractors are responsible for paying their own taxes, including self-employment tax, and are generally not eligible for employer-provided benefits. Understanding the tax implications of these different employment classifications is crucial for entertainment professionals, as it can significantly impact their overall tax liability and financial well-being. Working with a tax professional can help individuals navigate these complex issues and ensure compliance with tax laws and regulations. Entertainment professionals may choose to establish a business entity for their creative or professional endeavors. The type of entity they select can significantly impact their tax liability and overall financial well-being. The main types of business entities include: A sole proprietorship is the simplest business structure, where the owner and the business are considered the same entity for tax purposes. The owner reports business income and expenses on their personal tax return and is personally responsible for business debts and liabilities. While this structure is easy to set up and requires minimal paperwork, it does not provide any liability protection for the owner's personal assets. A partnership is a business entity with two or more owners who share in the profits and losses of the business. Partnerships are pass-through entities, meaning the income and losses of the business are passed through to the partners' personal tax returns. Partners are personally responsible for the business's debts and liabilities, and the partnership itself does not pay taxes. An LLC is a hybrid business structure that combines a corporation's limited liability protection with a partnership's pass-through taxation. Owners, known as members, report their share of the LLC's income and losses on their personal tax returns. The LLC itself does not pay taxes, and members are protected from personal liability for the business's debts and liabilities. A corporation is a separate legal entity from its owners, known as shareholders. Corporations provide limited liability protection for shareholders and can raise capital through stock sale. However, corporations are subject to double taxation, as they must pay taxes on their income, and shareholders must also pay taxes on dividends received. There are two main types of corporations: C corporations and S corporations. S corporations have pass-through taxation, similar to partnerships and LLCs, which can help avoid double taxation. When selecting a business entity, entertainment professionals should consider factors such as liability protection, tax implications, and administrative requirements. Consulting with a tax professional or attorney can help individuals make informed decisions based on their specific circumstances. Entertainment professionals may earn both passive and active income. Passive income is derived from sources such as royalties, rental properties, or investments, while active income includes wages, salaries, and fees earned for services provided. The distinction between passive and active income is important for tax purposes, as passive income is subject to different tax rules and rates. Understanding the tax implications of passive and active income can help entertainment professionals develop effective tax planning strategies and ensure compliance with tax laws and regulations. Royalties and residual income are common sources of income for entertainment professionals. Royalties are payments made to creative professionals for the use of their work, such as licensing fees for music or payments for book sales. Residual income is earned by actors, directors, and other professionals for the ongoing use of their work in film, television, or theater productions. Both royalties and residual income have unique tax implications, and entertainment professionals need to understand the tax treatment of these income sources. Reporting and accounting for royalties and residual income can help minimize tax liability and maximize deductions and credits. Entertainment professionals often incur travel expenses related to their work, such as transportation, lodging, and meals. Many of these expenses can be deducted from their tax returns, provided they are ordinary and necessary for their profession. Keeping detailed records of travel expenses, including receipts and documentation of the business purpose, is crucial for claiming these deductions. Many entertainment professionals invest in training and education to hone their skills and advance their careers. Expenses related to work-related training and education, such as tuition, books, and supplies, may be deductible on their tax returns. However, the IRS has specific rules for what qualifies as deductible education expenses, so it is essential to consult with a tax professional to determine eligibility. Entertainment professionals often need to purchase or rent costumes, props, and equipment for their work. These expenses may be deductible if they are ordinary and necessary for the individual's profession. Proper documentation and record-keeping are essential for claiming these deductions, as the IRS may require proof of the expenses and their business purpose. Promoting one's work and brand is essential to many entertainment professions. Expenses related to promotional activities, such as advertising, marketing materials, and public relations, may be deductible on tax returns. As with other deductions, it is crucial to maintain detailed records of these expenses and their business purpose. Entertainment professionals who work from home may be eligible to deduct home office expenses on their tax returns. To qualify for this deduction, the home office must be used regularly and exclusively for business purposes. Expenses that may be deductible include a portion of rent or mortgage interest, utilities, and maintenance costs. Consultation with a tax professional can help determine eligibility and proper calculation of this deduction. Many entertainment professionals are members of unions or professional associations related to their field. Dues and fees paid to these organizations may be deductible on their tax returns, as they are considered ordinary and necessary business expenses. Maintaining records of these payments and their relationship to the individual's profession is essential. Entertainment professionals often incur legal and professional service fees, such as attorney, accountant, or agent commissions. These expenses may be deductible on their tax returns, provided they are ordinary and necessary for the individual's profession. Proper documentation and record-keeping are essential for claiming these deductions, as the IRS may require proof of the expenses and their business purpose. The federal government offers several tax incentives to encourage investment in film, television, and theater productions. These incentives include: Section 181 allows producers to deduct production costs for qualifying film and television projects in the year they are incurred rather than having to capitalize and amortize these costs over time. This incentive can significantly reduce the tax burden for producers and encourage investment in film and television projects. The NMTC program encourages investment in economically distressed communities by providing a tax credit to investors who invest in qualifying projects, including film, television, and theater productions. The credit is equal to a percentage of the investment and can be claimed over a seven-year period. Entertainment productions may qualify for R&D tax credits if they involve the development of new technologies or techniques. These credits can offset a portion of the costs associated with research and development activities, encouraging innovation in the industry. Many states offer tax incentives to encourage film, television, and theater productions within their borders. These incentives can take various forms, such as film production tax credits, digital media tax credits, and live theater tax incentives. Each state has its eligibility requirements and application process, so entertainment professionals must research and understand the incentives available in their specific location. Countries worldwide offer tax incentives to attract film, television, and theater productions. These incentives can include tax credits, rebates, or grants and can provide significant financial benefits for entertainment professionals. Understanding the international tax landscape and the incentives available in different countries can help producers and other entertainment professionals make informed decisions about where to produce their projects. Entertainment professionals who work in foreign countries may be eligible for the Foreign Earned Income Exclusion, which allows them to exclude a portion of their foreign-earned income from their U.S. tax return. This exclusion can minimize the tax burden for individuals working abroad and ensure compliance with international tax laws. Entertainment professionals who pay taxes in foreign countries may be eligible for the Foreign Tax Credit, which allows them to offset their U.S. tax liability by the amount of taxes paid in the foreign country. This credit can help prevent double taxation and ensure that taxes do not overburden individuals in multiple jurisdictions. The United States has tax treaties with many countries that can affect the tax treatment of income earned by entertainment professionals working abroad. These treaties may reduce withholding tax rates on royalties, interest, and other types of income, providing tax benefits for individuals working in foreign countries. Understanding the tax treaty landscape and the implications for their specific situation is essential for entertainment professionals working internationally. Entertainment professionals working internationally may face double taxation, where their income is subject to taxes in both the United States and foreign countries. Developing strategies to minimize tax liability, such as claiming the Foreign Earned Income Exclusion or Foreign Tax Credit, can help individuals avoid excessive taxation and ensure compliance with international tax laws. Individual Retirement Accounts (IRAs) are tax-advantaged savings vehicles that can help entertainment professionals save for retirement. Traditional IRAs allow individuals to contribute pre-tax dollars, which can lower their taxable income in the year of contribution. Taxes on the contributions and earnings are deferred until withdrawals are made in retirement. On the other hand, Roth IRAs allow individuals to contribute after-tax dollars, with the benefit of tax-free withdrawals in retirement, provided certain conditions are met. Entertainment professionals should carefully consider their unique financial situation and tax outlook when deciding between a Traditional or Roth IRA. Factors such as the current tax bracket, projected future tax bracket, and the individual's overall financial goals should be considered when making this decision. Entertainment professionals who work as employees may have access to a 401(k) plan through their employer. These plans allow individuals to contribute pre-tax dollars to a retirement account, with taxes deferred until withdrawals are made in retirement. Some employers also offer a Roth 401(k) option, which allows for after-tax contributions with tax-free withdrawals in retirement. A Solo 401(k) plan may be an attractive retirement savings option for entertainment professionals who work as independent contractors or own their own businesses. Solo 401(k) plans offer the same tax advantages as traditional 401(k) plans. Still, they are designed specifically for self-employed individuals or small business owners with no employees other than themselves and their spouses. Simplified Employee Pension (SEP) IRAs and Savings Incentive Match Plans for Employees (SIMPLE) IRAs are retirement savings options designed for small business owners and self-employed individuals. Both plans allow for tax-deductible contributions and tax-deferred growth, with taxes due upon withdrawal in retirement. SEP IRAs allow employers to make contributions on behalf of employees, with the contributions being immediately vested. On the other hand, SIMPLE IRAs allow employers and employees to make contributions, with employers required to make either matching or non-elective contributions. Entertainment professionals who own businesses or work as independent contractors should carefully consider their retirement savings options and consult with a financial professional to determine the best plan for their situation. Tax planning for entertainment professionals is multifaceted, encompassing various aspects such as income classification, business entity selection, industry-specific deductions, and retirement planning. Individuals in the entertainment industry must understand the tax implications of different income sources and the benefits of choosing the right business structure. Awareness of tax incentives and credits available to entertainment productions and international tax considerations can help optimize financial outcomes. Planning for retirement is an essential aspect of financial well-being for entertainment professionals. Engaging with a tax services professional experienced in the entertainment industry can provide valuable insights and guidance, ensuring compliance with tax laws and maximizing financial benefits.Overview of Entertainment Industry-Specific Tax Planning

Tax Considerations for Different Types of Entertainment Professionals

Actors and Actresses

Directors and Producers

Screenwriters and Playwrights

Musicians and Composers

Visual Artists and Designers

Agents and Managers

Technical Crew Members

Income Classification and Tax Implications

W-2 Employees Versus Independent Contractors

Business Entity Selection for Entertainment Professionals

Sole Proprietorships

Partnerships

Limited Liability Companies (LLCs)

Corporations

Passive Versus Active Income

Royalties and Residual Income

Entertainment Industry-Specific Deductions

Travel Expenses

Training and Education Costs

Costumes, Props, and Equipment

Promotional Expenses

Home Office Expenses

Union Dues and Professional Association Fees

Legal and Professional Service Fees

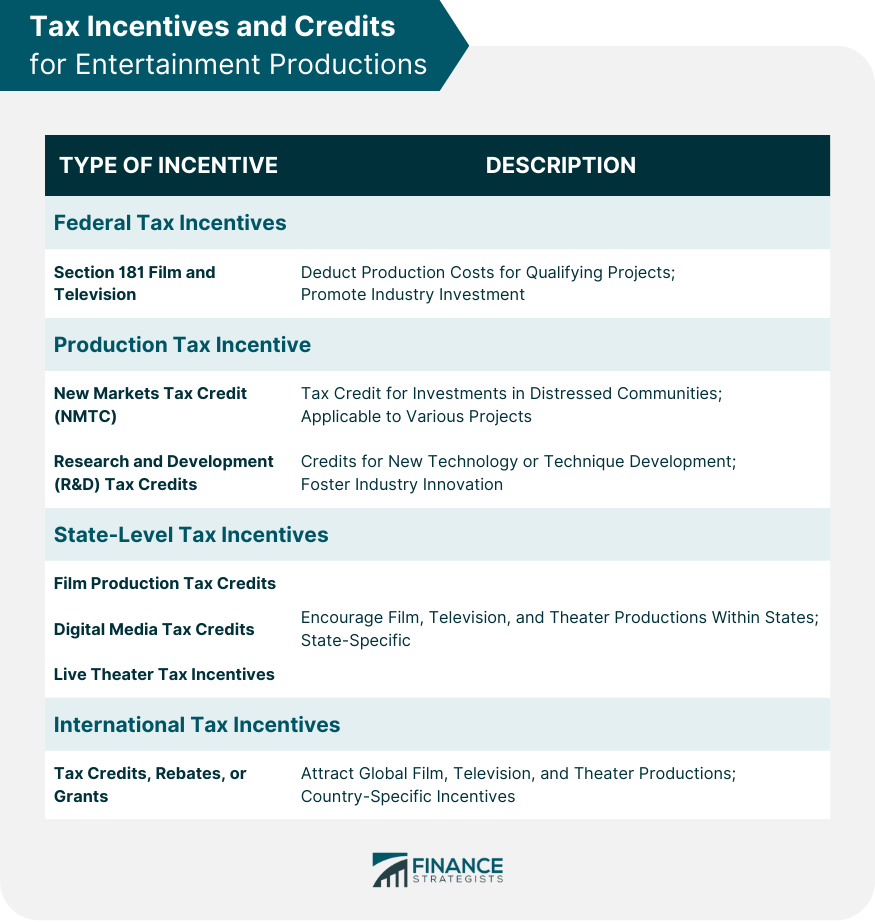

Tax Incentives and Credits for Entertainment Productions

Federal Tax Incentives

Section 181 Film and Television Production Tax Incentive

New Markets Tax Credit (NMTC)

Research and Development (R&D) Tax Credits

State-Level Tax Incentives

International Tax Incentives

International Tax Considerations for Entertainment Professionals

Foreign Earned Income Exclusion

Foreign Tax Credit

Tax Treaties and Withholding Tax Rates

Double Taxation and Strategies to Minimize Tax Liability

Retirement Planning for Entertainment Professionals

Traditional and Roth IRAs

401(k) and Solo 401(k) Plans

SEP IRAs and SIMPLE IRAs

Conclusion

Entertainment Industry-Specific Tax Planning FAQs

Entertainment Industry-Specific Tax Planning refers to the process of optimizing tax strategies and minimizing tax liabilities for individuals and businesses in the entertainment industry. It is important because it helps entertainment professionals manage their unique financial situations, maximize deductions, and comply with tax regulations.

Common tax deductions available through Entertainment Industry-Specific Tax Planning include business travel, costumes, and wardrobe expenses, agent and manager fees, union dues, professional development, and equipment purchases. These deductions help reduce taxable income and lower overall tax liability.

Entertainment Industry-Specific Tax Planning is tailored to the unique needs and circumstances of individuals and businesses in the entertainment industry. It considers industry-specific deductions, income streams (such as royalties and residuals), and tax regulations that may not apply to other industries.

Challenges faced by entertainment professionals in Entertainment Industry-Specific Tax Planning include fluctuating income, complex contracts, multi-state tax filings, and the need to track and document a wide range of deductible expenses. Working with a tax professional specializing in the entertainment industry can help address these challenges.

Entertainment professionals can find a tax advisor who specializes in Entertainment Industry-Specific Tax Planning by seeking referrals from industry peers, contacting professional organizations (such as the Screen Actors Guild or the Producers Guild of America), or searching online directories of certified public accountants (CPAs) with expertise in the entertainment industry. Verifying the advisor's credentials and experience before engaging in their services is important.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.