The Foreign Tax Credit (FTC) is a tax provision that allows U.S. taxpayers to reduce their U.S. income tax liability by the amount of foreign taxes paid or accrued on income earned outside the United States. The main purpose of the FTC is to prevent double taxation of income by both the U.S. and the foreign country where the income is sourced. The FTC helps U.S. taxpayers who have foreign income avoid double taxation and ultimately lowers their overall tax burden. By claiming the FTC, taxpayers can offset the foreign taxes paid against their U.S. income tax liability, reducing the amount of taxes they owe to the United States. To be eligible for the FTC, taxpayers must have foreign-sourced income that is subject to foreign tax and meet certain requirements regarding the type of foreign tax paid or accrued. Not all foreign taxes are eligible for the FTC. Eligible foreign taxes include income, war profits, and excess profits taxes imposed by a foreign country or U.S. possession. The taxes must also be compulsory and meet specific requirements defined by the Internal Revenue Code and related regulations. To qualify for the FTC, the income must be subject to foreign tax and considered foreign-sourced. Foreign-sourced income can include wages, salaries, interest, dividends, royalties, rents, and business income earned outside the United States. The FTC is subject to certain limitations, which ensure that the credit does not exceed the taxpayer's U.S. tax liability on their foreign-sourced income. The limitation is calculated based on the taxpayer's foreign income, U.S. tax liability, and the foreign taxes paid or accrued. To calculate the FTC, taxpayers must first determine the amount of foreign taxes paid or accrued on their foreign-sourced income. This can include withholding taxes on wages, estimated tax payments, and taxes paid when filing a foreign tax return. Proper sourcing of income is crucial for determining the FTC. Taxpayers must allocate their income between U.S. and foreign sources based on specific sourcing rules. For example, compensation for personal services is generally sourced where the services are performed, while dividends are sourced based on the residence of the payer corporation. The FTC limitation is calculated to ensure that the credit does not exceed the taxpayer's U.S. tax liability on their foreign-sourced income. The limitation is calculated by multiplying the taxpayer's total U.S. tax liability by a fraction, the numerator of which is the taxpayer's foreign-sourced taxable income, and the denominator is the taxpayer's total taxable income from all sources. If the taxpayer's foreign taxes paid or accrued exceed the FTC limitation, they can carry over the excess foreign taxes to future tax years or carry them back to prior tax years. Excess foreign taxes can be carried back one year and carried forward ten years. To claim the FTC, taxpayers must file Form 1116 (Foreign Tax Credit) with their U.S. individual income tax return (Form 1040 or Form 1040-SR). Form 1116 requires taxpayers to provide detailed information about their foreign-sourced income and foreign taxes paid or accrued. When claiming the FTC, taxpayers should be prepared to provide documentation to support the foreign taxes paid or accrued, such as foreign tax returns, withholding statements, and payment receipts. Keeping thorough records can help ensure a smoother process when filing tax returns and provide documentation in case of an IRS audit. Taxpayers must report the FTC on their individual income tax return (Form 1040 or Form 1040-SR) and include the amount of the credit on the appropriate line. This will reduce their U.S. income tax liability, potentially resulting in a lower tax bill or a larger refund. While both the FTC and the Foreign Earned Income Exclusion (FEIE) provide tax relief for U.S. taxpayers with foreign income, there are key differences between the two provisions. The FTC is a nonrefundable credit that reduces U.S. income tax liability by the amount of eligible foreign taxes paid or accrued, while the FEIE allows taxpayers to exclude a certain amount of foreign earned income from their U.S. taxable income. Taxpayers with foreign income should consider several factors when deciding whether to claim the FTC, the FEIE, or both. Factors to consider include the amount of foreign income, the foreign tax rate, the taxpayer's U.S. tax rate, and the potential tax savings from each provision. In some cases, taxpayers may benefit from claiming both the FTC and the FEIE to minimize their overall tax liability. Claiming both the FTC and the FEIE can offer tax advantages for U.S. taxpayers with foreign income, as it allows them to exclude a portion of their foreign earned income from U.S. taxation while also reducing their U.S. tax liability with the credit for foreign taxes paid. However, taxpayers must carefully consider the eligibility requirements and limitations of both provisions to ensure compliance with U.S. tax laws. Navigating the complexities of the FTC and other international tax provisions can be challenging for taxpayers. It is advisable to consult with a tax professional who has expertise in international taxation to ensure compliance with U.S. tax laws and to maximize tax savings. Taxpayers should keep detailed records of all foreign taxes paid, including foreign tax returns, withholding statements, and payment receipts. Maintaining organized records can help simplify the process of claiming the FTC and provide documentation in case of an IRS audit. Tax laws and credit limitations may change from year to year. Staying informed about these changes can help taxpayers make the most of the FTC and ensure they are compliant with current tax regulations. The Foreign Tax Credit plays a crucial role in providing tax relief to U.S. taxpayers with foreign-sourced income by mitigating the effects of double taxation. A solid understanding of the eligibility requirements, credit calculation, and claiming process is essential for taxpayers to make the most of this valuable tax provision. As the global economy continues to evolve, U.S. taxpayers with foreign income sources may find themselves navigating an increasingly complex landscape of international tax laws and regulations. In such a scenario, staying informed about changes to tax laws and credit limitations is more important than ever. Regularly reviewing the Foreign Tax Credit rules and guidelines can help taxpayers adapt to any changes and ensure they remain compliant with U.S. tax laws. Consulting with a tax professional who specializes in international taxation is highly recommended for taxpayers with foreign income. A tax professional can provide guidance on the most advantageous strategies for utilizing the Foreign Tax Credit, as well as other tax provisions like the Foreign Earned Income Exclusion and Foreign Housing Exclusion. By combining these provisions, taxpayers can optimize their overall tax savings while ensuring compliance with U.S. and foreign tax laws. In conclusion, the Foreign Tax Credit is a vital tool for U.S. taxpayers with foreign income, providing them with the means to reduce their overall tax liability and avoid double taxation. By keeping abreast of tax law changes, maintaining organized records of foreign taxes paid, and seeking the guidance of a tax professional, taxpayers can maximize the benefits offered by the Foreign Tax Credit and successfully navigate the complexities of international taxation.Definition of Foreign Tax Credit

Purpose and Benefits for US Taxpayers With Foreign Income

Eligibility Requirements

Qualifying for Foreign Tax Credit

Types of Foreign Taxes Eligible for the Credit

Income Subject to Foreign Tax

Limitations on Creditable Foreign Taxes

Calculating Foreign Tax Credit

Determining Foreign Tax Paid or Accrued

Sourcing of Income

Foreign Tax Credit Limitation Calculation

Carryover and Carryback Provisions

Claiming Foreign Tax Credit

Filing Form 1116 (Foreign Tax Credit)

Providing Necessary Documentation

Reporting Credit on Individual Income Tax Return

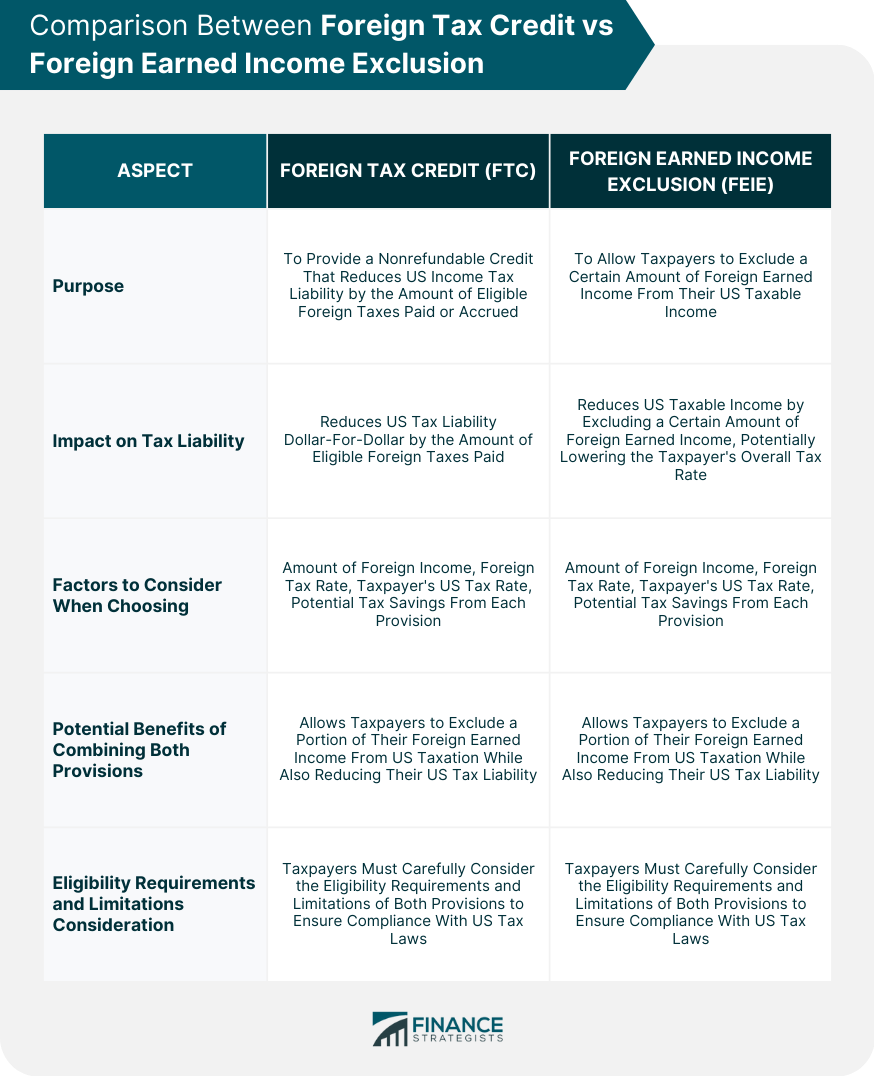

Foreign Tax Credit vs Foreign Earned Income Exclusion

Key Differences and Their Impact on Tax Liability

Factors to Consider When Choosing Between the Two

Potential Benefits of Combining Both Provisions

Tips and Best Practices

Consulting With a Tax Professional

Keeping Thorough Records of Foreign Taxes Paid

Monitoring Changes in Tax Laws and Credit Limitations

Conclusion

Foreign Tax Credit FAQs

The foreign tax credit is a tax credit that allows U.S. taxpayers to offset their U.S. tax liability on foreign-sourced income by the amount of foreign income taxes paid or accrued. It works by reducing the amount of U.S. tax owed on foreign-sourced income dollar-for-dollar by the amount of foreign taxes paid.

U.S. taxpayers who have paid or accrued foreign income taxes on foreign-sourced income and have U.S. tax liability on that same income are generally eligible for the foreign tax credit.

Foreign income taxes, foreign property taxes, and foreign sales taxes on personal property are generally eligible for the foreign tax credit. Other taxes, such as foreign value-added taxes (VAT) and foreign social security taxes, may also be eligible under certain circumstances.

Yes, there are limits to the amount of foreign taxes that can be claimed for the foreign tax credit. The credit is limited to the amount of U.S. tax that would be due on the foreign-sourced income, multiplied by the ratio of foreign-sourced income to worldwide income.

The foreign tax credit is claimed by filing Form 1116, Foreign Tax Credit, with the U.S. tax return. Taxpayers must provide documentation to support the amount of foreign taxes paid or accrued, including foreign tax returns or other evidence of payment.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.