A 1031 exchange for rental properties allows real estate investors to defer capital gains taxes by exchanging one rental property for another. It is authorized under Section 1031 of the Internal Revenue Code and enables investors to reinvest the proceeds from the sale of a rental property into a like-kind replacement property, thus preserving their investment capital. The primary purpose of a 1031 exchange is to incentivize reinvestment in the real estate market, stimulate economic growth, and promote property ownership. It offers a strategic tax planning tool for investors to optimize their real estate portfolios while deferring tax liabilities, enhancing cash flow, and diversifying investments. In a 1031 exchange for rental properties, the first critical step is identifying eligible replacement properties. Investors have a strict 45-day window from the sale of their relinquished property to identify potential replacements. During this period, investors must carefully evaluate and select properties that meet specific criteria to qualify for tax-deferred exchange treatment. The replacement property must be of "like-kind" to the relinquished property. In the context of real estate, like-kind refers to the nature or character of the properties rather than their grade or quality. This means that any type of investment property can be exchanged for another investment property, as long as they are both held for investment purposes. To be eligible, both the relinquished and replacement properties must be held for investment or used in a trade or business. Personal-use properties, such as a primary residence or vacation home, do not qualify for 1031 exchanges. The IRS mandates that investors involved in a 1031 exchange for rental properties must use a qualified intermediary (QI) to facilitate the exchange process. A QI is an independent third party who acts as an intermediary between the buyer and seller to ensure compliance with IRS regulations. The QI plays a crucial role in the exchange by holding the proceeds from the sale of the relinquished property. The investor never takes direct receipt of the funds to maintain the integrity of the tax-deferred exchange. The QI is responsible for coordinating the exchange timeline, ensuring that the 45-day identification period and the 180-day exchange completion period are strictly adhered to. They provide the necessary paperwork and documentation to facilitate a seamless exchange process. Once the eligible replacement property has been identified, investors have 180 days from the sale of the relinquished property to finalize the exchange. This period is known as the exchange period, during which the investor must complete the acquisition of the replacement property. Within the 180-day exchange period, the investor must close on the purchase of the replacement property. The QI facilitates the transfer of funds from the sale of the relinquished property to acquire the replacement property. The QI ensures that all aspects of the exchange meet the IRS requirements, including verifying that the replacement property is like-kind, held for investment, and used in a trade or business. Throughout the exchange process, the QI maintains meticulous documentation to substantiate the transaction's compliance with IRS regulations. This documentation is essential in the event of an IRS audit. When investors sell a rental property that has appreciated in value, they typically incur capital gains taxes on the profit. However, through a properly executed 1031 exchange, these taxes are postponed, allowing investors to reinvest their entire proceeds into a new property. By deferring capital gains taxes, investors can allocate the entire sale proceeds towards acquiring a more valuable replacement property. This reinvestment of funds allows them to maximize potential returns on their investments. By leveraging the full amount of the proceeds, investors can unlock greater appreciation potential and capitalize on the growth of the replacement property. The tax-deferred exchange enables investors to continually reinvest and upgrade their real estate holdings without losing a portion of their gains to taxes. Over time, this strategy fosters the growth of their real estate portfolio, increasing the overall value of their investment and creating a more substantial asset base. Another compelling benefit of a 1031 exchange for rental properties is the opportunity to diversify and consolidate one's real estate holdings. By exchanging properties in different locations or asset classes, investors can enhance financial stability and mitigate risk. Diversifying one's real estate holdings across multiple properties or markets helps spread risk. Different properties may have varying market cycles and risk profiles, and by diversifying, investors can protect their portfolio from localized market fluctuations. A 1031 exchange allows investors to consolidate multiple smaller properties into a single larger one or vice versa. This can lead to operational efficiencies and better economies of scale. Moreover, consolidating properties into a more desirable asset class can improve the overall quality and performance of the portfolio. Utilizing a 1031 exchange for rental properties can lead to enhanced wealth building and increased cash flow, providing investors with the means to achieve long-term financial goals. By deferring capital gains taxes and reinvesting the proceeds into a potentially higher-performing replacement property, investors may experience increased cash flow. Higher rental income from the upgraded property can boost overall cash flow, providing more resources for additional investments or personal use. A well-executed 1031 exchange strategy empowers investors to continually upgrade their real estate holdings, capitalizing on market opportunities, and optimizing returns. Over time, this disciplined approach to wealth-building can lead to significant long-term wealth accumulation, supporting retirement plans or other financial objectives. The success of a 1031 exchange for rental properties hinges on strict adherence to IRS regulations. Failure to comply with these guidelines can lead to disqualification of the exchange and immediate tax liabilities. To qualify for tax deferral, investors must hold both the relinquished and replacement properties for specific periods. The relinquished property must be held for at least 12 months before the exchange, while the replacement property must be held for a minimum of 12 months after the exchange. Exchanging properties with related parties, such as family members or entities with common ownership, adds complexity to the process. The IRS imposes stringent related party rules to prevent abuse or misuse of the exchange. Investors must carefully assess the relationship between parties to ensure compliance. Investors have a narrow 45-day window to identify potential replacement properties and a total of 180 days from the sale of the relinquished property to complete the exchange. These strict timelines create time pressure and require careful planning to find suitable replacement properties. The time constraints imposed by the IRS for identifying and acquiring replacement properties can pose significant challenges for investors undertaking a 1031 exchange for rental properties. Within 45 days of selling their relinquished property, investors must pinpoint potential replacement properties. This limited timeframe demands prompt decision-making and thorough market research to identify suitable investments. After identifying replacement properties, investors have 180 days to complete the exchange. Finding, negotiating, and closing on a new property within this timeframe can be demanding, especially in competitive real estate markets. Exchanging properties with related parties introduces additional complexities and scrutiny from the IRS, necessitating a thorough understanding of related party rules. Related party exchanges must meet stringent requirements to avoid disqualification. The IRS scrutinizes transactions involving related parties to ensure they are conducted at fair market value and not for tax avoidance purposes. Investors engaged in related party exchanges may be required to provide additional documentation to substantiate the legitimacy of the transaction. This includes appraisals, financial statements, and other supporting documents. Careful planning and timing are paramount for a successful 1031 exchange for rental properties. Investors should initiate the planning process well in advance to allow sufficient time for property identification and preparation. Investors should begin exploring potential replacement properties before selling the relinquished property. This proactive approach ensures that suitable replacement options are readily available, minimizing the risk of being unable to find a suitable replacement within the 45-day identification period. Working closely with a qualified intermediary (QI), tax advisors, and real estate experts is essential during the planning phase. These professionals can provide valuable insights into market conditions, property valuations, and tax implications, helping investors make informed decisions. Planning for a smooth transition between the sale of the relinquished property and the acquisition of the replacement property can help minimize vacancy periods and rental income disruptions. This contributes to maintaining steady cash flow during the exchange process. A comprehensive understanding of the financial implications and tax consequences is crucial for effective tax planning in a 1031 exchange for rental properties. While a 1031 exchange allows for tax deferral on capital gains, investors must be aware of potential depreciation recapture and other tax liabilities associated with the exchange. Understanding these tax consequences is essential for making informed decisions and budgeting for future tax obligations. Investors should conduct a thorough cash flow analysis to ensure that the replacement property aligns with their financial goals. Evaluating rental income, operating expenses, and potential financing costs can help determine if the replacement property offers favorable financial prospects. A 1031 exchange presents an opportunity to align real estate investments with long-term financial goals. Understanding how the exchange fits into the broader investment strategy allows investors to make choices that contribute to wealth accumulation and portfolio growth. Maintaining accurate and organized documentation throughout the exchange process is crucial for IRS compliance and audit preparedness. Investors must retain documentation that demonstrates the identification of potential replacement properties within the 45-day identification period. This may include written notices to the qualified intermediary or other parties involved in the exchange. Keeping a record of all purchase and sale agreements for both the relinquished and replacement properties is essential. These agreements serve as evidence of compliance with the IRS timelines and requirements. Maintaining financial records related to the exchange, such as property appraisals, settlement statements, and financing documents, provides a comprehensive audit trail and supports the legitimacy of the exchange. A 1031 exchange for rental properties allows real estate investors to defer capital gains taxes by exchanging one rental property for another, authorized under Section 1031 of the Internal Revenue Code. The primary purpose is to incentivize reinvestment in real estate, stimulate economic growth, and promote property ownership. By reinvesting the proceeds into a like-kind replacement property, investors preserve their capital and optimize their real estate portfolios. To qualify, the replacement property must be of "like-kind" and held for investment or business purposes. Engaging a qualified intermediary is mandatory to facilitate the exchange, ensuring compliance with IRS regulations and adhering to strict timelines. Benefits include tax deferral, maximizing returns, growing the real estate portfolio, and diversifying investments. However, drawbacks include IRS compliance complexities, holding periods, relatedness rules, and limited identification and acquisition timeframes. Careful planning, understanding financial implications, and maintaining thorough documentation are essential for a successful 1031 exchange.Overview of 1031 Exchange for Rental Properties

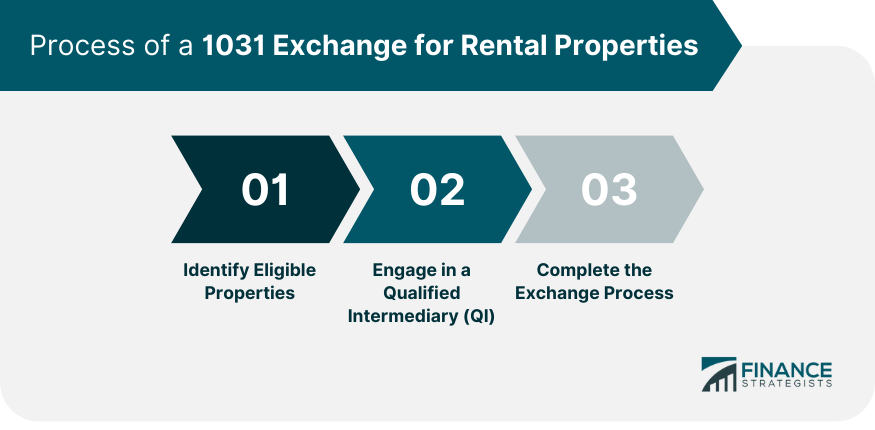

Process of a 1031 Exchange for Rental Properties

Identify Eligible Properties

Like-Kind Requirement

Held for Investment or Used in a Trade or Business

Engage in a Qualified Intermediary (QI)

Role of the QI

Timing and Coordination

Complete the Exchange Process

Closing on the Replacement Property

Ensuring IRS Compliance

Reporting and Documentation

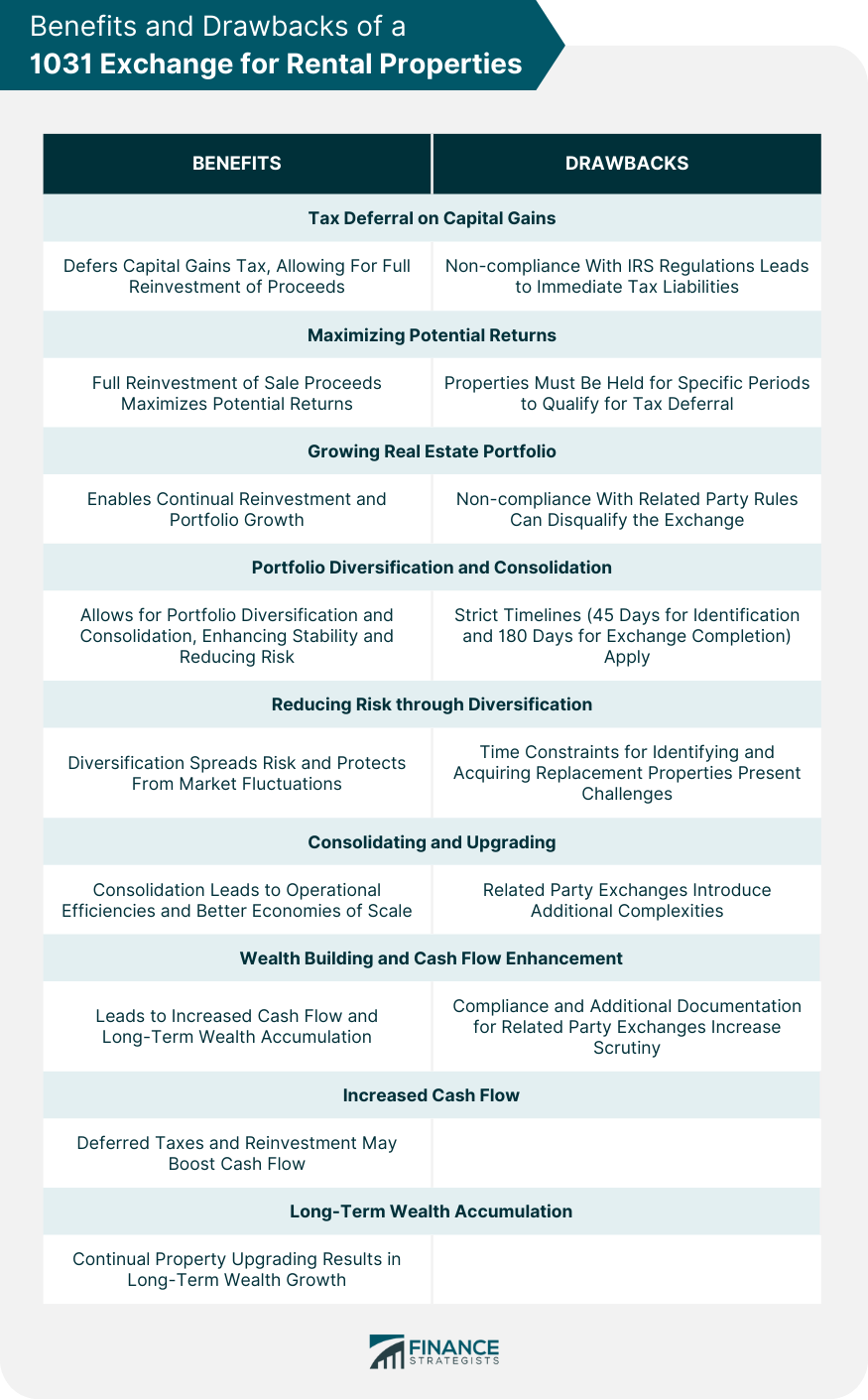

Benefits of a 1031 Exchange for Rental Properties

Tax Deferral on Capital Gains

Maximizing Potential Returns

Growing Real Estate Portfolio

Portfolio Diversification and Consolidation

Reducing Risk Through Diversification

Consolidating and Upgrading

Wealth Building and Cash Flow Enhancement

Increased Cash Flow

Long-Term Wealth Accumulation

Drawbacks of a 1031 Exchange for Rental Properties

Strict IRS Regulations and Compliance

Holding Periods

Relatedness Rules

Identification and Acquisition Timelines

Limited Timeframes for Identification and Acquisition

Identifying Replacement Properties

Acquiring Replacement Properties

Related Party Exchanges Complexities (If Applicable)

Compliance Requirements

Additional Documentation

Tips for a Successful 1031 Exchange for Rental Properties

Careful Planning and Timing

Advance Preparation

Coordination With Professionals

Minimizing Vacancy Periods

Understanding Financial Implications and Tax Consequences

Potential Tax Liabilities

Cash Flow Analysis

Long-Term Investment Strategy

Maintaining Thorough Documentation and Records

Proof of Identification

Purchase and Sale Agreements

Financial Records

Conclusion

1031 Exchange for Rental Properties FAQs

A 1031 exchange for rental properties allows real estate investors to defer capital gains taxes by exchanging one rental property for another of like-kind, thus preserving their investment capital and maximizing potential returns.

In a 1031 exchange, investors must identify eligible replacement properties within 45 days of selling their relinquished property. They then have 180 days to close on the replacement property through the use of a qualified intermediary (QI) to facilitate the exchange process.

No, a 1031 exchange is only applicable to investment or business properties. Primary residences or personal-use properties do not qualify for tax-deferred exchanges.

Yes, investors have strict timelines to adhere to in a 1031 exchange. The identification of replacement properties must occur within 45 days, and the exchange process must be completed within 180 days from the sale of the relinquished property.

A 1031 exchange offers several advantages, including tax deferral on capital gains, portfolio diversification, wealth building, and the ability to upgrade properties and locations without immediate tax consequences.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.