Yes, real estate professionals can indeed facilitate a 1031 exchange. Their role often revolves around advising their clients on the eligibility and potential benefits of a 1031 exchange. Their understanding of the local property market, paired with their knowledge of the client's investment goals, places them in a unique position to identify potential properties for the exchange. The role of a real estate professional in a 1031 exchange is multifaceted. They advise clients on the process, help them identify potential replacement properties, liaise with qualified intermediaries, and ensure that all the transactions meet the strict IRS rules. They do not, however, hold or manage funds during the exchange process – that responsibility lies with the qualified intermediary. While real estate professionals play a crucial role in the process, they must be careful not to overstep their boundaries. They should not act as a Qualified Intermediary unless they are fully licensed and accredited to do so. Giving legal or tax advice, which they are not qualified to give, can lead to serious legal repercussions. Their role is primarily advisory and facilitative. One of the key duties of a real estate professional in a 1031 exchange is to advise their clients on whether their property is eligible for the exchange and to outline the potential benefits and drawbacks. It is essential that they are aware of the specific requirements for a property to be considered "like-kind" and are able to guide their clients through the complex process of a 1031 exchange. Another important role of a real estate professional in a 1031 exchange is to facilitate communication with the qualified intermediary, the person or company that holds the proceeds from the sale of the initial property until the replacement property is purchased. The real estate professional can help prepare the necessary documentation and ensure all the required timelines are met. Identifying suitable properties is arguably the most critical aspect of a 1031 exchange. Given their knowledge of the property market, real estate professionals are ideally suited to help clients identify potential replacement properties. In a 1031 exchange, the taxpayer has 45 days from the date of selling the relinquished property to identify potential replacement properties. The real estate professional can use their expertise to identify suitable properties within this timeframe, bearing in mind the client's investment goals and the requirements of a "like-kind" exchange. Real estate professionals can use a variety of strategies to identify potential replacement properties. These may include analyzing market trends, leveraging industry connections, and utilizing advanced search tools and software. These professionals can provide an invaluable service by helping investors find suitable properties quickly and efficiently. Understanding and navigating the timeline for a 1031 exchange is another crucial area where real estate professionals add value. In addition to the 45-day identification period, there is a 180-day period within which the replacement property must be purchased. Real estate professionals can help clients keep track of these crucial dates and ensure they meet all IRS requirements. Beyond identifying suitable properties and facilitating transactions, real estate professionals play a critical role in ensuring compliance with all IRS rules regarding 1031 exchanges. They can help their clients understand these rules and guide them in meeting all requirements. A qualified intermediary plays a crucial role in a 1031 exchange, holding and managing the funds from the sale of the relinquished property until the replacement property is acquired. It is imperative to choose a trustworthy and experienced intermediary. The collaboration between real estate professionals and qualified intermediaries is essential in a 1031 exchange. These professionals work together to coordinate transactions, ensuring a smooth exchange process. Ensuring proper documentation is another aspect where collaboration between real estate professionals and qualified intermediaries becomes crucial. From the initial sales contract to closing documents for the replacement property, these professionals ensure all documentation is in order and complies with IRS rules. There are several misconceptions about 1031 exchanges. One common myth is that any property can be swapped for any other in a 1031 exchange. However, the IRS has specific guidelines about what constitutes "like-kind" properties. While real estate professionals play an essential role in a 1031 exchange, it's crucial to understand their capabilities and limitations. The role of real estate professionals in facilitating a 1031 exchange is significant yet limited by certain boundaries. They are well-placed to provide advice on eligibility and benefits, identify suitable replacement properties, and coordinate with qualified intermediaries. Importantly, they are also instrumental in helping their clients navigate the strict IRS timeline and rules for a 1031 exchange. Despite their pivotal role, it's crucial to note that real estate professionals cannot act as qualified intermediaries unless licensed to do so and should not provide legal or tax advice. The successful completion of a 1031 exchange largely depends on a collaborative effort between the investor, the real estate professional, and the qualified intermediary. Understanding and respecting these roles and guidelines ensures a smoother, more efficient exchange process, maximizing the potential benefits of this tax-deferral strategy.Can Real Estate Professionals Complete a 1031 Exchange?

Role of a Real Estate Professional in a 1031 Exchange

Understanding Legal Implications for Real Estate Professionals

Essential Duties of Real Estate Professionals in 1031 Exchanges

Advise Clients on Eligibility and Benefits

Communicate With Qualified Intermediaries

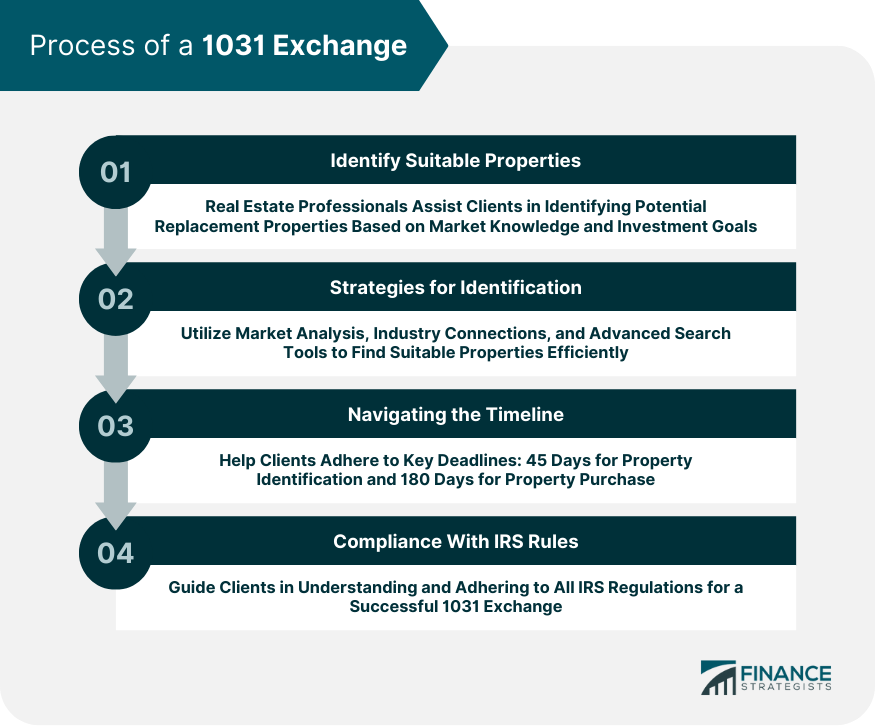

Process of a 1031 Exchange

Identify Suitable Properties

Role of a Real Estate Professional in Property Identification

Strategies for Identifying Replacement Properties

Navigating the 1031 Exchange Timeline

Key Deadlines and Dates

Compliance With 1031 Exchange Rules

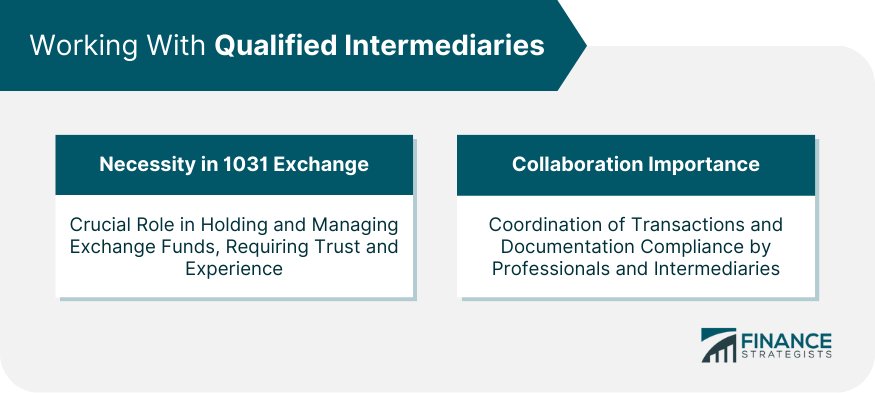

Working With Qualified Intermediaries

Necessity of Qualified Intermediaries in a 1031 Exchange

Collaboration Between Real Estate Professionals and Qualified Intermediaries

Coordinating Transactions

Ensuring Proper Documentation

Common Misconceptions About 1031 Exchanges and Real Estate Professionals

Addressing Myths About 1031 Exchanges

Clarifying the Role and Capabilities of Real Estate Professionals in 1031 Exchanges

They can provide invaluable advice and guidance, but they cannot provide legal or tax advice, and they cannot act as qualified intermediaries unless they are accredited to do so.Bottom Line

Can a Real Estate Professional Complete a 1031 Exchange? FAQs

A 1031 exchange is a provision in the U.S. tax code that allows investors to defer paying capital gains taxes on an investment property when it is sold as long as another "like-kind" property is purchased with the profit gained from the sale.

Yes, real estate professionals can facilitate a 1031 exchange. Their role often involves advising their clients on the eligibility and potential benefits of a 1031 exchange, identifying potential properties for the exchange, and liaising with the qualified intermediary.

There are two critical deadlines in a 1031 exchange. The first is a 45-day period from the date of sale of the initial property, during which the investor must identify potential replacement properties. The second deadline is a 180-day period within which the replacement property must be purchased.

A qualified intermediary plays a vital role in a 1031 exchange, holding and managing the proceeds from the sale of the initial property until the replacement property is acquired. They ensure the exchange is executed according to IRS rules, and they handle all necessary documentation.

A common myth about 1031 exchanges is that any property can be swapped for any other property. In reality, the IRS has specific guidelines about what constitutes "like-kind" properties. Another misconception is that real estate professionals can act as qualified intermediaries or provide legal or tax advice, which they cannot unless they are fully licensed and accredited to do so.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.