Land value refers to the financial worth of a piece of property. It is the estimated amount for which a plot of land should exchange on the date of valuation between a willing buyer and a willing seller in an arms-length transaction after proper marketing wherein the parties had each acted knowledgeably, prudently, and without compulsion. It is fundamental to a host of economic and financial activities, including real estate transactions, business valuations, municipal taxation, and public investment decisions. Land value plays a critical role in the functioning of the broader economic system. The valuation of land is not just a financial measure, but also an indicator of economic health and growth. Accurate land valuation allows for more informed decisions about development, investment, and resource allocation, thus contributing to sustainable economic development. The location of a piece of land is one of the primary factors influencing its value. Land that is located in developed areas or near popular points of interest, such as city centers, tourist attractions, and business districts, tends to have higher value due to its potential for commercial or residential development. Furthermore, land in proximity to amenities like schools, hospitals, and public transportation usually fetches a higher price as these conveniences make the area more attractive to potential buyers or developers. The size and shape of a piece of land also play a significant role in determining its value. Larger tracts of land often command higher prices because they offer more potential for development. However, the shape of the land can also impact its usability and, thus, its value. For instance, irregularly shaped plots may be less appealing to buyers or developers due to potential challenges or limitations in design and construction. The usability of a land parcel directly impacts its value. Land that is suitable for building or agricultural activities tends to be more valuable. Zoning laws also play a critical role as they determine what types of buildings or activities are permitted on the land. For example, land zoned for commercial use often has a higher value than residentially zoned land due to the potential for greater revenue generation. The demand and supply dynamics in the real estate market significantly affect land value. High demand coupled with limited supply can drive up land prices, and conversely, lower demand or an oversupply can lead to a decrease in land values. Market trends, including economic factors and population growth or decline, can also influence these dynamics. The presence and quality of local infrastructure, such as roads, utilities, and public services, can greatly impact land value. Land that has access to well-maintained infrastructure and public services like waste management, fire protection, and law enforcement is often more valuable due to the convenience and security these services provide. Finally, environmental conditions, including climate, soil quality, and the presence of natural resources, can significantly influence land value. For instance, land with fertile soil or access to water sources can be more valuable due to its potential for agricultural use. Similarly, land in areas with a favorable climate or beautiful natural scenery can command higher prices due to its appeal for residential or tourism developments. Conversely, land in areas prone to natural disasters or environmental hazards may have lower value due to the associated risks. In real estate, land value plays a critical role in determining the total value of a property. While the physical structure of the land, such as a house or building, may depreciate over time, land is a finite resource that can appreciate in value, especially in areas with high demand. Understanding the land value is also essential for developers and investors when assessing the potential return on investment of a development project. If the land value is high, the cost of a project increases, which might influence the expected return on investment. Land value is a key component of real estate prices. Typically, as the value of land increases, so does the price of real estate located on that land. This correlation exists because the land is a significant part of any real estate transaction – in some cases, the land can even be more valuable than the structures built upon it. For example, in densely populated urban areas, where the demand for land is high and supply is limited, the value of land can constitute a large portion of the total real estate price. This is particularly evident in cities like New York or Hong Kong, where high land values have led to skyrocketing real estate prices. One of the most significant factors influencing land value is its location and accessibility. Land located in areas with easy access to employment, good schools, shopping, recreation, and other amenities generally has a higher value than land in less accessible or desirable locations. Similarly, land in areas with developed infrastructure—such as well-maintained roads, reliable utilities, and high-quality public services—typically has a higher value. This is because these factors make the land more attractive for residential, commercial, and industrial use. For example, a plot of land in the heart of a bustling city is likely to have a higher value than a similar-sized plot in a rural area. This is due to the higher demand for centrally-located land, as well as the benefits of having access to city services and amenities. There are three primary methods used by appraisers to determine the value of land: the sales comparison approach, the income approach, and the cost approach. The sales comparison approach is the most common method. It involves comparing the subject land to similar properties that have recently sold in the same market. Adjustments are made for differences between the properties, and the adjusted sale prices of the comparable properties are used to estimate the value of the subject land. The income approach is typically used when the land generates income, such as rental income. This approach values the land based on the net income it can produce, capitalized into a value estimate by using a rate of return required by investors. The cost approach is often used when the land is vacant or when it’s improved with buildings or other structures that contribute significantly to the total value of the property. This approach estimates what it would cost to recreate the property, including the cost of acquiring similar land and constructing the improvements, less depreciation. The land appraisal process starts with the appraiser defining the problem to be solved, including the purpose of the appraisal, the type of value to be estimated, and the property rights to be valued. Next, the appraiser gathers data related to the subject land and comparable properties. This data can include sales data, income and expense data, and cost data. The appraiser then analyzes the data, using one or more of the land appraisal methods described above, to arrive at an estimate of the value of the land. Finally, the appraiser prepares a report detailing the analysis and conclusions. Appraising land value can be challenging for several reasons. First, it can be difficult to find truly comparable sales to use in the sales comparison approach. Even when comparable sales are available, there can be significant differences between the properties that require careful adjustment. Second, the income approach relies on estimates of future income and expenses, which are inherently uncertain. Similarly, the cost approach depends on estimates of construction costs and depreciation, which can also be uncertain. Finally, land value appraisal can be influenced by changes in the real estate market and wider economic conditions. For example, during a real estate boom, land values may increase rapidly, while during a downturn, they may fall. Land value tax (LVT) is a levy on the unimproved value of land. Unlike property taxes, which are taxes on the total value of real estate (including buildings and other improvements), LVT disregards the value of buildings, personal property, and other improvements to real estate. The purpose of LVT is to encourage efficient use of land. By taxing only the land and not the improvements, LVT discourages land speculation and incentivizes landowners to develop or sell vacant and underused land. LVT has several advantages. First, it promotes efficient land use, as landowners are encouraged to develop or sell rather than hold unused or underused land. Second, it is difficult to evade, as land cannot be hidden or moved. Third, it does not discourage investment or improvement of land, as these activities do not increase the tax. However, LVT also has several disadvantages. It can be challenging to administer due to the difficulty in accurately assessing land values. It may also be perceived as unfair, as it does not take into account the ability of landowners to pay the tax. Finally, it can lead to higher housing costs if the tax is passed on to tenants. Land Value Capture (LVC) is a policy approach that enables communities to recover and reinvest the land value increments that result from public investment and other government actions. Essentially, LVC is a financing method that recoups some or all of the value that public infrastructure generates for private landowners. There are various methods to implement LVC, such as property taxes, special assessments, tax increment financing, development charges, negotiated exactions, and joint developments. The choice of LVC method largely depends on the legal, institutional, and market context in a specific region or country. For example, tax increment financing is a method that uses future gains in taxes to finance current improvements. Development charges, on the other hand, are fees collected from developers to pay for infrastructure needs created by new development. Land value plays a pivotal role in urbanization. As cities expand and develop, the demand for centrally located land increases, often resulting in increased land values. High land values can stimulate further development and redevelopment, as landowners and developers seek to maximize the return on their investment. Conversely, declining land values may indicate problems such as lack of investment, poor planning, or adverse economic conditions, signaling the need for policy interventions. Urban planning has a significant influence on land value. Zoning regulations, infrastructure development, public services provision, and other planning decisions can affect land value. For example, zoning changes that allow for higher-density uses or the addition of a new transit line can significantly increase land values in an area. Urban development can lead to changes in land value, typically an increase due to enhanced accessibility, improved amenities, and increased demand for land in the newly developed areas. However, not all development leads to increased land value. Poorly planned or executed development can lead to declines in land value if it results in increased congestion, loss of open space, or other negative impacts. Environmental factors significantly impact land value. Natural amenities such as water bodies, views, and green spaces can increase land value, as can a clean, healthy environment. Conversely, environmental hazards such as flooding, pollution, or noise can decrease land value. Land value can play a role in environmental preservation. Higher land values can provide an incentive for conservation if landowners can realize financial benefits from preserving natural amenities or ecosystem services that contribute to land value. Conversely, high land values can also create pressure for development that could harm the environment, particularly in the absence of regulations or incentives for preservation. Land is a popular investment asset because of its potential for appreciation in value and its durability. Unlike other investments, land does not depreciate and cannot be destroyed or stolen. Moreover, with the finite supply of land, especially in high-demand areas, its value is likely to increase over time, providing potential capital gains for the investor. While land can offer substantial returns, it also comes with risks. The value of land can fluctuate due to changes in the real estate market, zoning laws, environmental regulations, and economic conditions. Moreover, land does not generate income unless it is rented out or developed, and it requires ongoing costs for taxes, maintenance, and possibly mortgage payments. Despite these risks, the potential returns from land investment can be high. These returns can come from appreciation in land value over time, rental income if the land is leased, or profits from developing or selling the land. The first step to maximizing land value in investments is to pinpoint potential growth areas. Investors should conduct thorough market research to determine areas likely to witness growth or development in the future. Factors such as demographic trends, existing infrastructural projects, economic indicators, and real estate trends can shed light on these potential growth hotspots. Investing in such areas can lead to significant appreciation in land values as demand increases. Another potent strategy is to actively add value to the land investment. This can be done in several ways: Securing planning permission for a specific use can significantly elevate the land's value. Depending on the permitted use - such as residential, commercial, or industrial - the land's value may see a substantial increase. This strategy, however, requires a clear understanding of local planning and zoning laws. Investors can also increase the value of the land by initiating development. Constructing homes, commercial buildings, or other structures can make the land more attractive to potential buyers, hence driving up its value. This method requires substantial investment and is contingent on various factors such as the economic viability of the development, securing necessary permits, and managing construction costs and timelines. LVC strategies offer another avenue for maximizing land value. LVC is a policy approach where increases in private land values generated by public investments or policy changes are captured by the public sector. Landowners who are able to foresee such changes can stand to benefit from the resulting value increase. This involves understanding and tracking public policy and infrastructural investment trends that might impact land value. All the above strategies involve varying degrees of risk and require meticulous research, planning, and possibly expert advice. Before jumping into land investments, investors need to: Investing in land can be risky. Market conditions can fluctuate, and anticipated growth might not materialize. Therefore, understanding one's risk tolerance is crucial. Clearly defining investment goals can guide the selection of appropriate strategies. Whether the aim is short-term profit or long-term wealth accumulation, the investment strategies will differ. Having a clear understanding of current market conditions can help investors gauge the potential return on investment. This involves studying property trends, economic indicators, and potential changes to local regulations and policies. Land value is the worth of a piece of land, defined by various factors such as location, size, accessibility, and local infrastructure. Appraising land value requires careful consideration of these factors and involves specific methodologies like sales comparison, income, and cost approaches. Land can also serve as a strategic investment asset due to its durability and potential for appreciation. However, as with any investment, understanding the associated risks and market conditions is vital. Strategies such as buying in anticipated growth areas, improving the land, or leveraging public policy changes can help in maximizing the value of land investments. Given the complexity of land value assessment and its influence on wealth creation, it can be beneficial to seek expert advice. Wealth management services can provide professional guidance on land investments, helping you make informed decisions and maximize your investment returns.What Is Land Value?

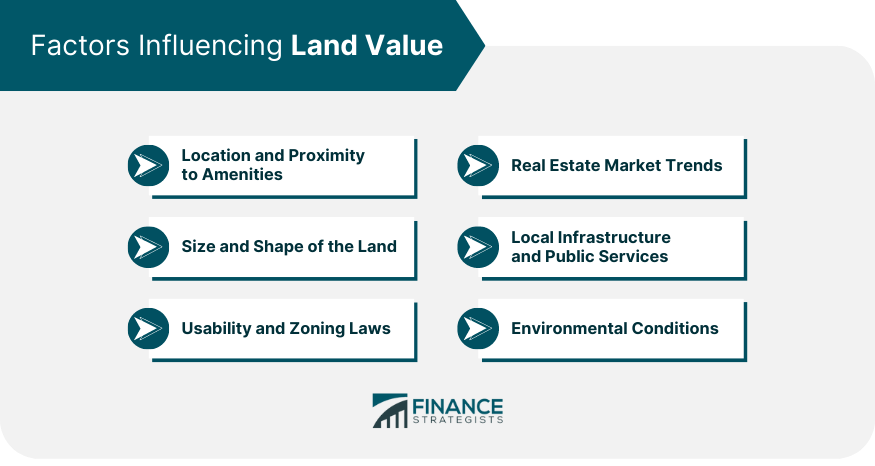

Factors Influencing Land Value

Location and Proximity to Amenities

Size and Shape of the Land

Usability and Zoning Laws

Real Estate Market Trends

Local Infrastructure and Public Services

Environmental Conditions

Understanding Land Value in Real Estate

Importance of Land Value in Real Estate

How Land Value Affects Real Estate Prices

Role of Location and Accessibility in Land Value

Appraisal of Land Value

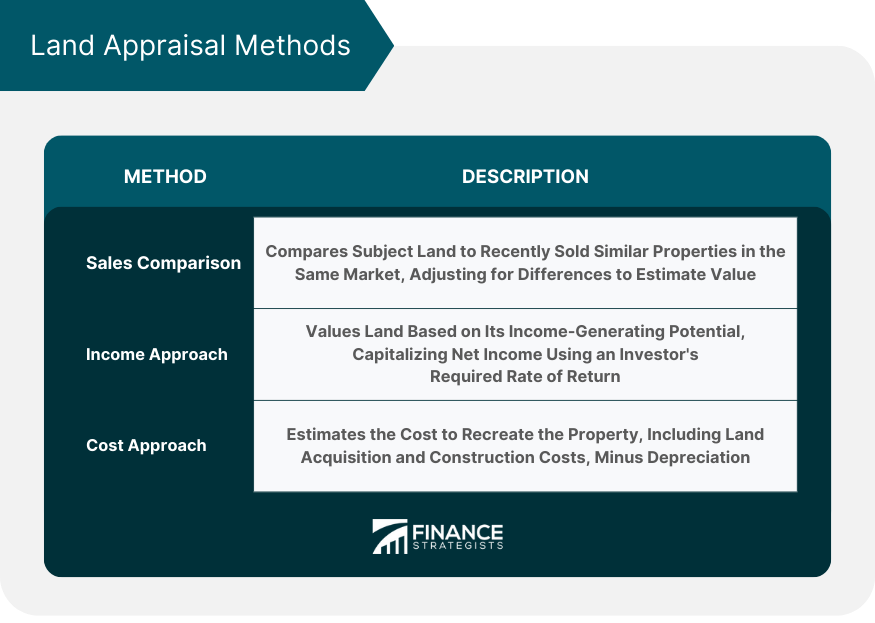

Land Appraisal Methods

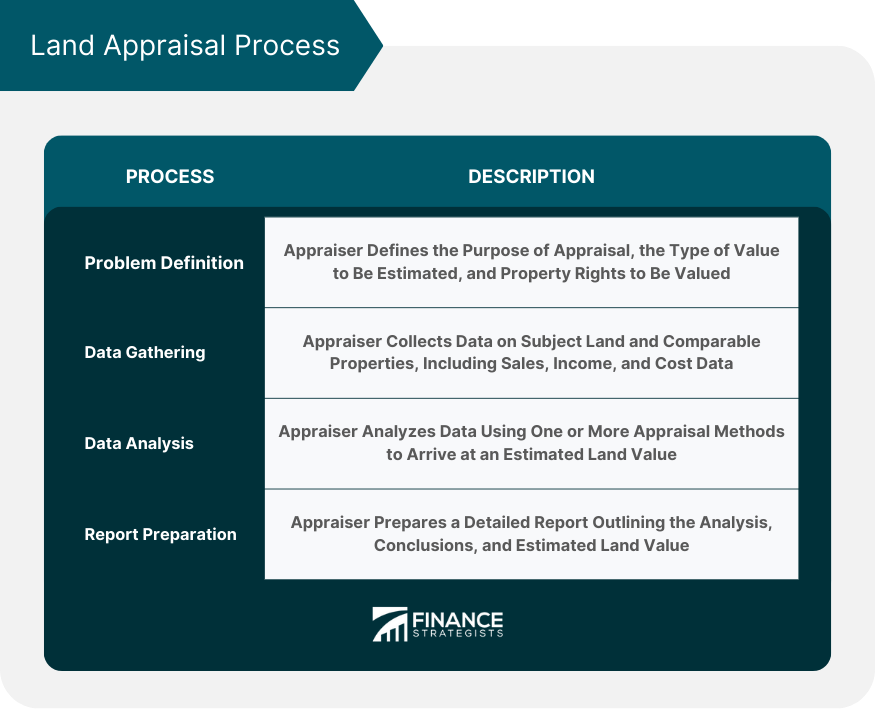

Process of Land Appraisal

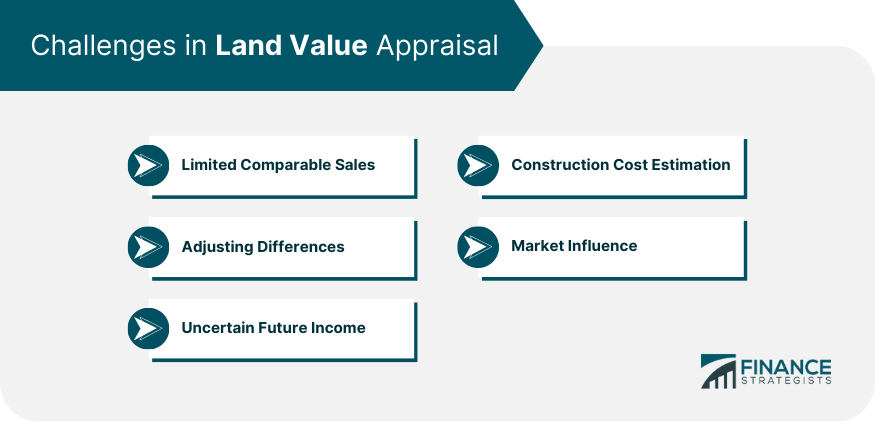

Challenges in Land Value Appraisal

Land Value Taxation

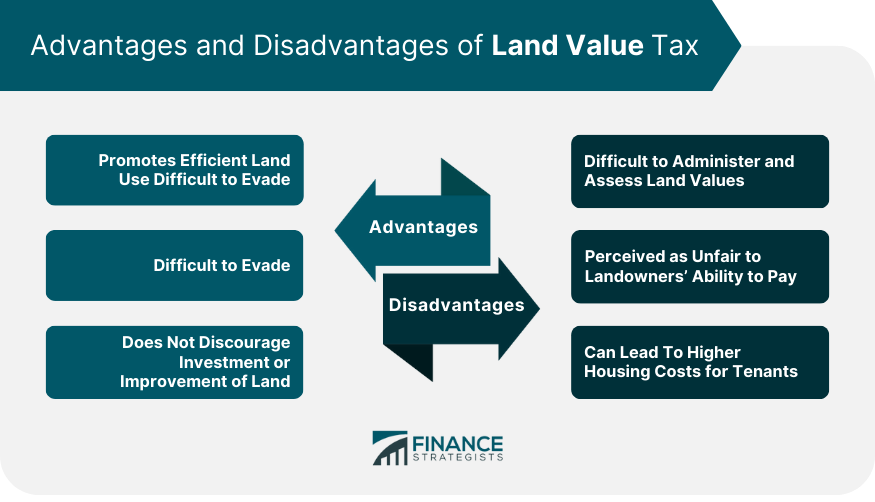

Advantages and Disadvantages of Land Value Tax

Land Value Capture

Methods of Implementing Land Value Capture

Land Value and Urban Development

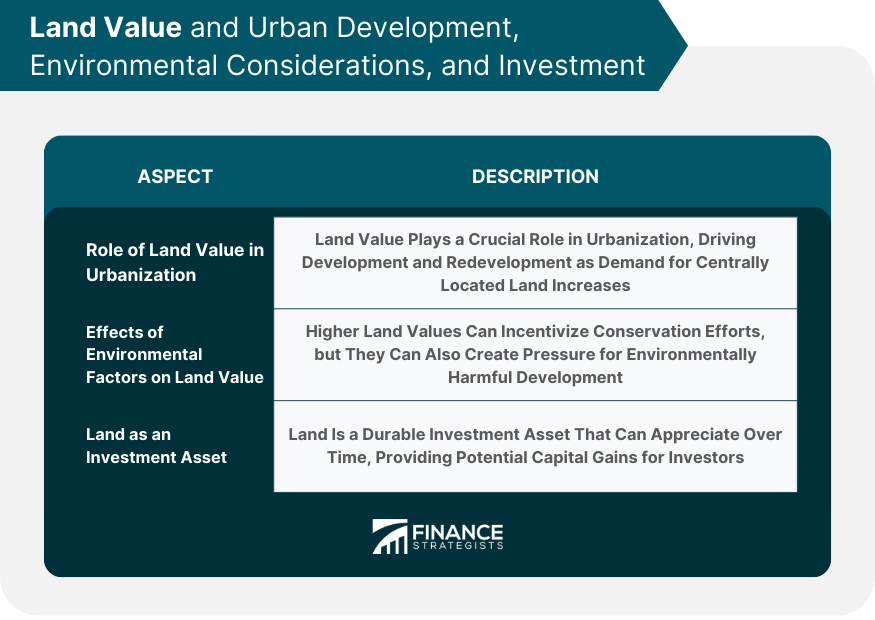

Role of Land Value in Urbanization

Land Value and Urban Planning

Impact of Urban Development on Land Value

Land Value and Environmental Considerations

Effects of Environmental Factors on Land Value

Role of Land Value in Environmental Preservation

Land Value and Investment

Land as an Investment Asset

Risks and Returns of Land Investments

Strategies for Maximizing Land Value in Investments

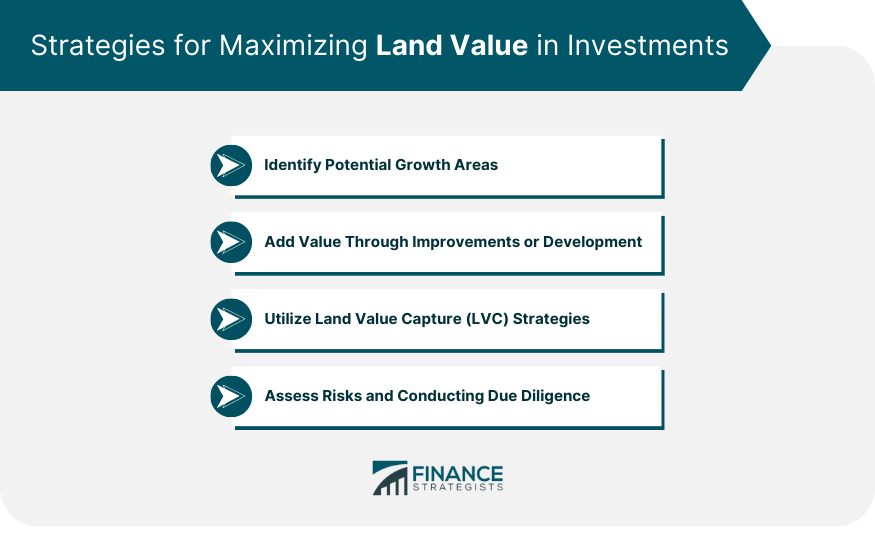

Identifying Potential Growth Areas

Adding Value Through Improvements or Development

Obtaining Planning Permission

Land Development

Utilizing Land Value Capture (LVC) Strategies

Assessing Risks and Conducting Due Diligence

Evaluate Risk Tolerance

Define Investment Goals

Understand Market Conditions

Final Thoughts

Land Value FAQs

Land value refers to the monetary worth of a piece of land. It's determined by various factors including location, size, usability, local infrastructure, and the current real estate market conditions.

Land value is appraised using several methodologies, including the sales comparison approach, the income approach, and the cost approach. These methods involve analyzing comparable sales, future income potential, and construction costs, respectively.

Land value is a key component of real estate prices. As the value of land increases, so does the price of the real estate on that land, especially in areas with high demand and limited supply.

Land can be a good investment due to its potential for appreciation in value and its durability. However, like any investment, it comes with risks, and these must be carefully considered before investing.

Strategies to maximize the value of land investments include buying land in growth areas, improving the land or obtaining planning permissions, and leveraging public investments or policy changes that increase land value.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.