A reverse 1031 exchange is a powerful tax-deferral strategy that enables real estate investors to acquire a replacement property before selling their relinquished property. This reversal of the typical 1031 exchange timeline allows investors to take advantage of lucrative investment opportunities without facing immediate capital gains tax liabilities. Reverse 1031 exchanges are employed when investors find an ideal replacement property they don't want to miss out on, but they haven't yet sold their existing property. It offers greater flexibility in property acquisition, especially in competitive markets where valuable properties quickly disappear. The QI acts as a neutral third party, assisting investors in navigating the intricacies of the transaction and ensuring compliance with IRS regulations. The QI takes on the responsibility of facilitating the exchange, coordinating with all parties involved, and overseeing the proper execution of the exchange process. Their expertise ensures a smooth and legally compliant transaction. In a reverse exchange, the QI temporarily holds title to either the relinquished or replacement property. This is essential because IRS regulations prohibit investors from directly owning both properties simultaneously during the exchange. Investors must identify a suitable replacement property before selling their relinquished property. To facilitate the identification and acquisition of the replacement property, investors utilize an Exchange Accommodation Titleholder (EAT). The EAT is an entity separate from the investor and acts as the temporary holder of the replacement property's title until the exchange is completed. The investor must acquire the replacement property within the specified time frame, typically 180 days from the initiation of the exchange. The EAT holds the title during this period, ensuring that the investor complies with IRS guidelines. After securing the replacement property, the investor has a limited window to sell their relinquished property. The investor must identify the relinquished property for sale within 45 days of acquiring the replacement property. This timeline is critical, as failure to identify within the stipulated period can result in disqualification of the exchange. The exchange must be completed within 180 days from the acquisition of the replacement property. This deadline ensures that the investor promptly sells the relinquished property, finalizing the exchange. Once the investor sells the relinquished property, the QI facilitates the final steps of the reverse 1031 exchange. The QI oversees the transfer of the replacement property's title from the EAT to the investor, completing the exchange process. This title transfer allows the investor to take full ownership of the replacement property. By successfully completing the exchange, the investor can now enjoy the tax deferral benefits, postponing capital gains taxes that would otherwise be due if a standard sale had taken place. A reverse 1031 exchange provides investors with unparalleled flexibility when acquiring replacement properties. In traditional 1031 exchanges, investors must first sell their relinquished property before identifying and purchasing the replacement property. This sequential process often poses challenges, especially in dynamic real estate markets with rapidly changing property values. Moreover, in markets where the availability of high-quality properties is limited, a reverse 1031 exchange offers a strategic advantage. In bustling real estate markets, competition for prime investment properties can be fierce. Buyers often find themselves in bidding wars, leading to inflated property prices and heightened risks. A reverse exchange mitigates these risks by empowering investors to lock in the perfect property immediately, effectively sidestepping bidding wars. Furthermore, by ensuring they have secured the replacement property beforehand, investors can negotiate from a position of strength during the sale of their relinquished property. A reverse 1031 exchange empowers investors to strike when market conditions are favorable, without being constrained by the traditional 1031 exchange timeline. In a booming market or during a period of low-interest rates, investors can act swiftly to acquire the replacement property, capitalizing on the current favorable conditions. This proactive approach enables them to optimize their returns and position their real estate portfolio strategically. Moreover, a reverse exchange allows investors to take calculated risks and capitalize on potential future growth. By securing a promising replacement property before selling their relinquished property, investors can benefit from long-term appreciation and capitalize on favorable market trends. Reverse 1031 exchanges are subject to rigorous IRS regulations, and non-compliance can have serious consequences. The IRS has established specific guidelines to ensure the legitimacy of these exchanges and prevent abuse. Any deviation from the rules could jeopardize the exchange's tax-deferred status, leading to immediate tax liabilities on capital gains. Investors must adhere meticulously to the IRS requirements, including the identification and acquisition timelines, the involvement of a qualified intermediary, and the proper structuring of the exchange. Reverse 1031 exchanges often incur higher costs and expenses compared to standard exchanges. These additional expenses are attributed to the complexities and intermediary involvement inherent in the process. Engaging a qualified intermediary, Exchange Accommodation Titleholder (EAT), and legal advisors all contribute to the increased financial burden. Despite the higher expenses, the benefits of tax deferral and the ability to acquire valuable properties make reverse exchanges a worthwhile investment strategy for many. In a reverse exchange, investors face tight timelines for both property identification and completion of the exchange. The 45-day identification period and the 180-day exchange period demand swift and decisive action. Quick decision-making is crucial to identifying and acquiring the right replacement property within the specified period. Investors must be prepared to evaluate potential properties efficiently and make well-informed choices to meet the strict time constraints of the reverse exchange. Securing financing for a reverse exchange can be more challenging compared to traditional purchases. Lenders may perceive the process as riskier due to the added complexity of the exchange. Some financial institutions may be reluctant to provide funding for reverse exchanges, or they may impose more stringent lending requirements. In a reverse 1031 exchange, identifying the right replacement property is a critical aspect that demands careful consideration. Unlike a standard exchange where the relinquished property is sold first, investors must identify the replacement property upfront. Conducting thorough research and due diligence is essential to select a replacement property that aligns with the investor's investment goals, risk tolerance, and long-term strategy. The fundamental distinction between a reverse 1031 exchange and a standard exchange lies in the timing of property acquisition and sale. In a standard 1031 exchange, investors first sell their relinquished property and then identify and acquire the replacement property within specific timeframes. This sequential process ensures compliance with IRS regulations and qualifies for tax deferral on capital gains. Conversely, a reverse exchange flips the timeline, allowing investors to acquire the replacement property before selling the relinquished property. This timing reversal presents a unique advantage by giving investors the opportunity to secure a valuable replacement property immediately, regardless of market conditions. By acquiring the replacement property first, investors can avoid the risk of losing out on ideal investment opportunities that might not be available later. A critical element of the reverse 1031 exchange process is the involvement of an Exchange Accommodation Titleholder (EAT). The EAT is an independent third party that temporarily holds title to either the relinquished or replacement property on behalf of the investor. This holding structure is unique to reverse exchanges and is essential for IRS compliance. The IRS prohibits investors from holding title to both the relinquished and replacement properties simultaneously during the exchange. By entrusting the EAT with temporary property title, investors can proceed with confidence, knowing that the reverse exchange adheres to IRS regulations. The EAT's involvement ensures the integrity and tax-deferral eligibility of the exchange, providing investors with peace of mind during the transaction. In a standard 1031 exchange, investors typically identify the replacement property after selling the relinquished property. This sequential approach aligns with the traditional rules set by the IRS to ensure the successful execution of the exchange and tax deferral benefits. In a reverse exchange, the identification and acquisition order is reversed. Investors must first identify and acquire the replacement property before selling the relinquished property. This upfront identification presents investors with the advantage of securing a desired property promptly, regardless of market fluctuations. However, the reverse order demands swift and well-informed decision-making. Investors must proactively identify the replacement property within the 45-day identification period, and they must be ready to proceed with the acquisition swiftly to meet the 180-day exchange period. To provide clarity and guidelines for reverse exchanges, the IRS issued Revenue Procedure 2000-37. This important document outlines safe harbor guidelines and procedures that investors must follow to ensure the validity of the reverse exchange for tax purposes. The Revenue Procedure sets forth specific requirements, including the timeframes for identifying and acquiring the replacement property, holding periods, and the involvement of the qualified intermediary (QI). Investors must meticulously follow these rules to ensure that the reverse exchange complies with IRS regulations. When undertaking a reverse 1031 exchange, investors must carefully assess the tax implications, particularly regarding depreciation recapture and capital gains taxes. During the ownership of the relinquished property, investors may have claimed depreciation deductions, which can trigger depreciation recapture upon the subsequent sale of the replacement property. This recapture could result in higher tax liabilities for the investor. Additionally, when the replacement property is eventually sold, any accumulated capital gains may become taxable. Investors should be aware of the potential tax burden and engage in effective tax planning to manage these consequences. Engaging a qualified intermediary (QI) is a fundamental requirement in a reverse 1031 exchange. The QI assumes critical roles and responsibilities throughout the exchange process. They act as a neutral third party, facilitating the transaction and ensuring compliance with IRS rules. The QI plays a crucial role in holding property titles, both for the relinquished and replacement properties. Since the IRS prohibits investors from directly owning both properties during the exchange, the QI's involvement is vital in maintaining the integrity of the transaction. Furthermore, the QI manages the funds involved in the exchange, ensuring that the proceeds from the relinquished property sale are properly applied to acquire the replacement property. Their expertise and experience in navigating reverse exchanges safeguard the investor's interests and contribute to a successful and compliant transaction. A reverse 1031 exchange is a tax-deferral strategy that allows real estate investors to acquire a replacement property before selling their relinquished property. This reversal of the typical 1031 exchange timeline provides flexibility in property acquisition and mitigates risks in competitive markets. By securing the replacement property first, investors can take advantage of favorable market conditions and avoid missing out on lucrative opportunities. However, reverse exchanges come with challenges, including strict IRS regulations, higher costs, limited timeframes, financing considerations, and the need to identify the right replacement property upfront. To execute a reverse 1031 exchange, investors engage a qualified intermediary (QI) who facilitates the transaction, holds property titles, and ensures compliance with IRS rules. The process involves adhering to specific timeframes, as outlined in IRS Revenue Procedure 2000-37, to maintain the exchange's tax-deferral status. Depreciation recapture and capital gains implications should also be carefully considered during the exchange. Proper tax planning and the expertise of the QI are crucial for a successful and compliant reverse 1031 exchange.What Is a Reverse 1031 Exchange?

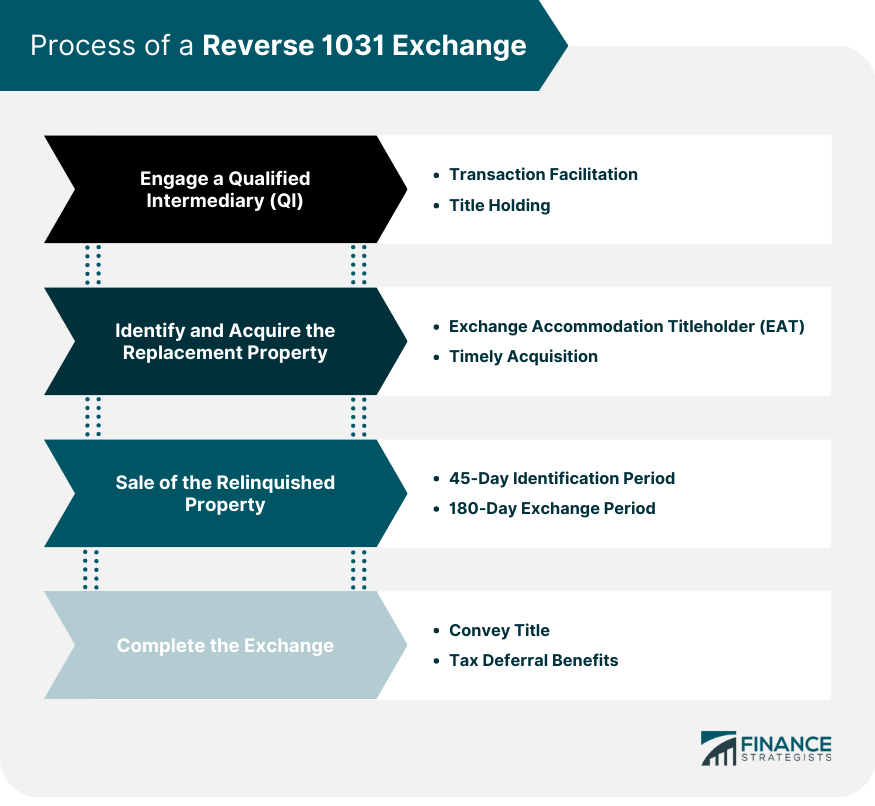

How Does a Reverse 1031 Exchange Work?

Engage Qualified Intermediary (QI)

Transaction Facilitation

Title Holding

Identify and Acquire the Replacement Property

Exchange Accommodation Titleholder (EAT)

Timely Acquisition

Sale of the Relinquished Property

45-Day Identification Period

180-Day Exchange Period

Complete the Exchange

Conveying Title

Tax Deferral Benefits

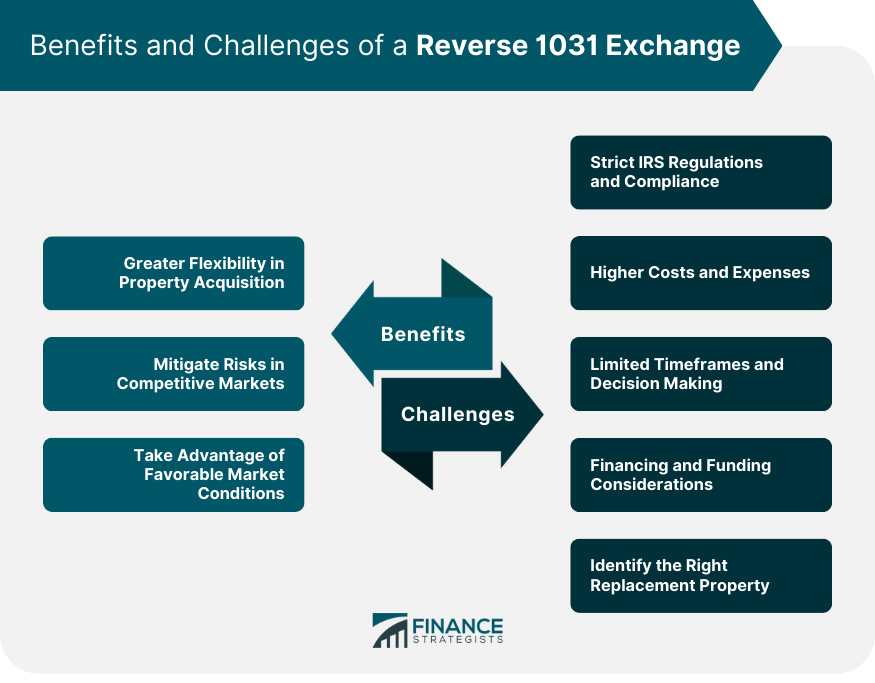

Benefits of a Reverse 1031 Exchange

Greater Flexibility in Property Acquisition

Mitigate Risks in Competitive Markets

Take Advantage of Favorable Market Conditions

Challenges of a Reverse 1031 Exchange

Strict IRS Regulations and Compliance

Higher Costs and Expenses

Limited Timeframes and Decision Making

Financing and Funding Considerations

Identify the Right Replacement Property

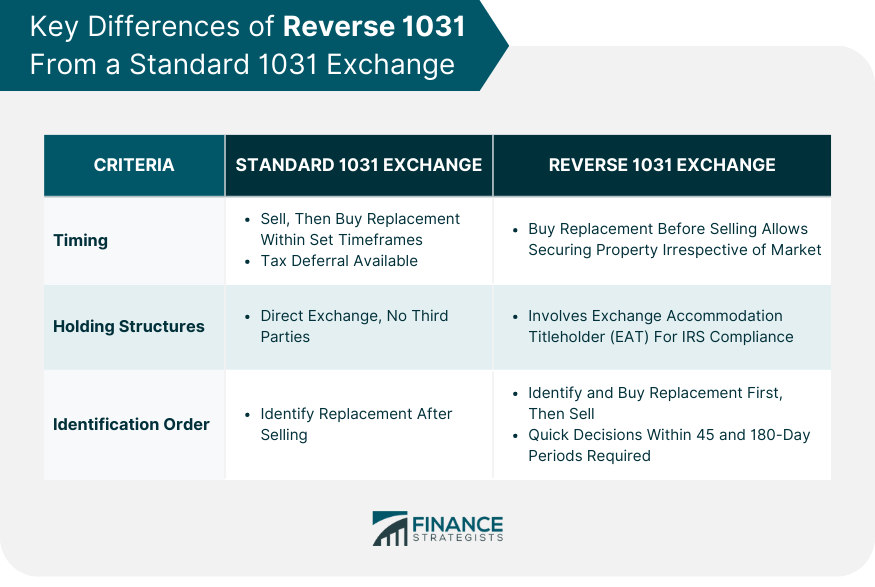

Key Differences From a Standard 1031 Exchange

Timing Reversal and Impact on Tax Deferral

Property Holding Structures

Identification and Acquisition Order

Legal and Tax Implications

IRS Revenue Procedure 2000-37

Depreciation and Capital Gains Implications

Qualified Intermediary Roles and Responsibilities

Conclusion

Reverse 1031 Exchange FAQs

A Reverse 1031 Exchange is a real estate transaction where an investor acquires a replacement property before selling their relinquished property, inverting the typical order of a standard 1031 exchange.

In a Reverse 1031 Exchange, the investor acquires the replacement property before selling the relinquished property, while in a Standard 1031 Exchange, the relinquished property is sold first, followed by the identification and acquisition of the replacement property.

The IRS has provided guidelines under Revenue Procedure 2000-37 to ensure compliance with Reverse 1031 Exchanges. Following these rules is crucial to qualifying for tax deferral benefits and avoiding potential disqualification.

A Qualified Intermediary (QI) plays a critical role in a Reverse 1031 Exchange. They act as a neutral third party, holding property titles, and managing funds during the exchange process, ensuring compliance with IRS regulations.

Investors must be aware of depreciation recapture and potential capital gains taxes in a Reverse 1031 Exchange. Proper tax planning with a tax professional is essential to manage these tax consequences effectively.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.