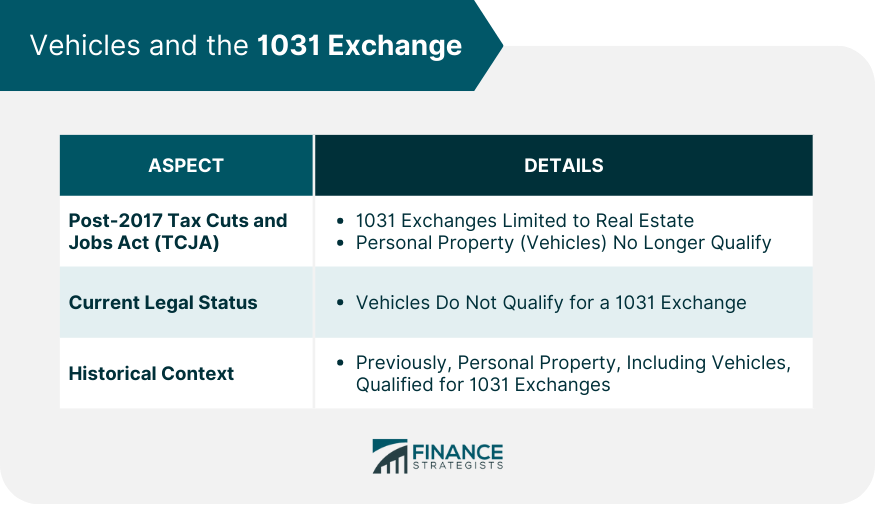

The 1031 exchange, also known as a like-kind or Starker exchange, is a tax strategy rooted in Section 1031 of the Internal Revenue Code. It enables an investor to defer capital gains taxes on a sold investment property if the profit is reinvested in another "like-kind" property. This tactic, in use for many years, provides significant tax benefits for property owners looking to reinvest profits from certain property sales. Prior to the 2017 Tax Cuts and Jobs Act, this rule encompassed both real and personal property, including vehicles, boats, planes, and other assets. The 1031 exchange aims to stimulate economic growth by encouraging investment. It allows for the immediate reinvestment of capital gains, delaying tax revenue for the government but potentially boosting long-term economic and tax growth. Since the enactment of the Tax Cuts and Jobs Act (TCJA) in 2017, the law surrounding 1031 exchanges has significantly changed. The TCJA limited the application of 1031 exchanges solely to real estate transactions. As such, personal property, including business vehicles or cars, no longer qualify for tax deferral under Section 1031. This was a significant shift from the previous rules, which allowed for the exchange of both real and personal properties. To directly answer the question, as of the current tax legislation, vehicles, and cars do not qualify for a 1031 exchange. Therefore, if you sell a business vehicle and purchase another, you will not be able to defer the capital gains taxes from the sale under Section 1031. Before the changes brought by the TCJA, personal property did qualify for 1031 exchanges. This included not only real estate but also assets such as artwork, collectibles, and, notably, vehicles. So, if a business decided to sell a company car and then reinvest in a new one, they were able to defer the capital gains tax due on the sale of the old car. The shift in legislation was part of a broader package of reforms aimed at simplifying the tax code and promoting economic growth. By limiting 1031 exchanges to real estate, the TCJA simplified the tax rules around these exchanges. It also helped to offset some of the cost of the tax cuts provided in other sections of the Act by increasing the immediate tax revenue from the sale of personal property. In order to qualify for a 1031 exchange, several conditions must be met. Firstly, the properties exchanged must be of "like-kind," which means they must be of the same nature, character, or class. Secondly, the property must be held for productive use in a trade or business or for investment. Thirdly, there is a strict timeline that must be adhered to. The replacement property must be identified within 45 days of selling the relinquished property, and the purchase of the replacement property must be completed within 180 days. 'Like-kind' is a somewhat loose term, and the IRS interpretation of what properties are considered 'like-kind' is quite broad. For example, an apartment building could potentially be swapped for raw land, or a ranch could be traded for a strip mall. However, since the TCJA, 'like-kind' property only applies to real estate. Personal properties, even if they are the same nature or character, are no longer eligible. While the change in law may have limited the use of 1031 exchanges for certain assets, other tax strategies might be suitable for depreciating assets like business vehicles. One alternative tax strategy is the Section 179 Deduction. This allows businesses to deduct the full purchase price of qualifying equipment purchased or financed during the tax year. This means that if you buy or lease a vehicle for your business, you can deduct the full purchase price from your gross income. Another tax benefit, known as bonus depreciation, allows businesses to take an additional depreciation deduction on certain qualifying property in the year it was placed in service. For vehicles, this applies to new and used vehicles acquired and put into use within the tax year. You may also want to consider capital gains tax strategies. For instance, if you use your vehicle solely for business purposes, you might be able to claim a capital loss when you sell it for less than your adjusted basis. Your adjusted basis generally includes the cost of the vehicle, as well as any improvements minus any depreciation deductions. Under current tax legislation, vehicles do not qualify for a 1031 exchange, a significant change brought about by the Tax Cuts and Jobs Act of 2017. This shift, part of broader tax reforms, has resulted in the limitation of 1031 exchanges to real estate transactions. Despite this, businesses and investors can still leverage other tax strategies for depreciating assets like vehicles, including Section 179 Deduction and Bonus Depreciation. Capital gains tax strategies may also provide avenues for tax relief. The nuances of tax law and its frequent amendments underscore the importance of professional consultation in planning tax strategy. Ultimately, while the landscape of tax-deferred exchanges has transformed significantly, opportunities remain to capitalize on certain tax advantages, stimulating continued economic growth. The advice and guidance of an experienced tax advisor can help ensure that you comply with all tax laws and regulations while minimizing your tax liability.Overview of 1031 Exchange

Can Vehicles Qualify for a 1031 Exchange?

Impact of the Tax Cuts and Jobs Act on 1031 Exchanges for Vehicles

Current Legal Status of Vehicles and 1031 Exchange

History of Vehicles and the 1031 Exchange

Previous Allowance for Personal Property in 1031 Exchanges

Reasons for Change in Legislation

Nuances of 1031 Exchanges

Eligibility Criteria for 1031 Exchange

Understanding 'Like-Kind' Property in the Context of 1031 Exchanges

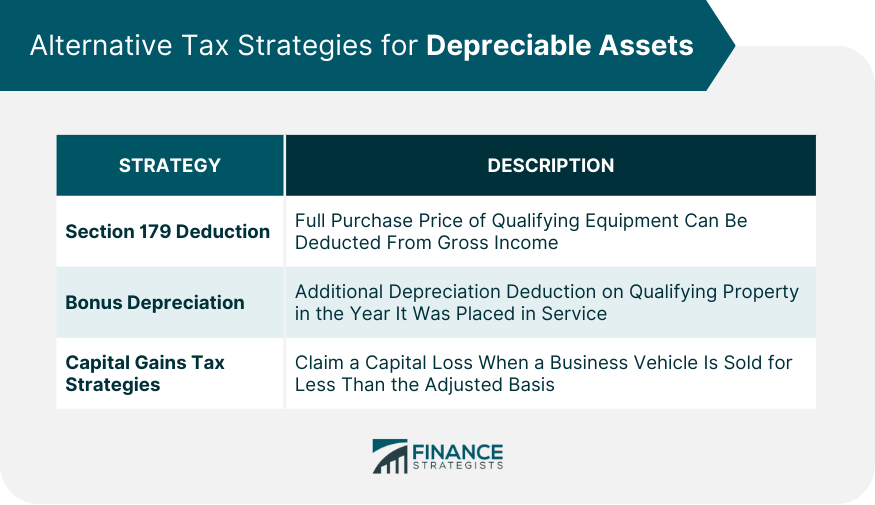

Alternative Tax Strategies for Depreciable Assets

Section 179 Deduction

Bonus Depreciation

Capital Gains Tax Strategies

Bottom Line

Do Vehicles Qualify for a 1031 Exchange? FAQs

No, the Tax Cuts and Jobs Act of 2017 limits 1031 exchanges to real estate only. Vehicles do not qualify.

A 1031 exchange is intended to stimulate economic growth by allowing investors to defer capital gains taxes when reinvesting in similar properties.

The Act restricted 1031 exchanges to real estate, eliminating the inclusion of personal property such as vehicles.

'Like-kind' refers to properties of the same nature, character, or class. Post the 2017 Act, 'like-kind' applies only to real estate.

Alternatives include Section 179 Deduction, bonus depreciation, and capital gains tax strategies.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.