A 1031 Exchange Specialist is a professional with extensive knowledge in handling 1031 exchanges, a provision under the U.S. Internal Revenue Code that allows investors to defer capital gains tax when selling an investment property and reinvesting in a "like-kind" property. This specialist guides clients through the complex rules and strict timelines of 1031 exchanges to ensure a successful transaction. They also help identify potential replacement properties that align with the investor's financial goals. Their expertise can significantly reduce the risk of tax penalties, making them an essential asset for investors looking to leverage the benefits of 1031 exchanges. The specialist explains the entire process of the 1031 exchange, helping the client understand the stringent rules, strict timelines, and the concept of "like-kind" properties. A key role of the 1031 Exchange Specialist is to assist in identifying suitable replacement properties. They leverage their market knowledge to find properties that align with the client's objectives. Adhering to the 45-day and 180-day rules in 1031 exchanges is critical. The specialist ensures all transactions are conducted within these timelines to qualify for tax deferral. The 1031 Exchange Specialist collaborates with other professionals like tax advisors, real estate agents, and attorneys to ensure a successful exchange. This coordination is vital for navigating potential legal and financial pitfalls. An intimate understanding of Section 1031 of the U.S. Internal Revenue Code is crucial. This includes the strict timelines for identifying and purchasing like-kind properties and the criteria for what constitutes a like-kind property. A 1031 Exchange Specialist needs to have a strong financial acumen. They should be well-versed in capital gains tax, tax deferment, and how these financial elements can impact an investor's strategy and bottom line. Communication skills are crucial as the specialist will need to clearly explain complex tax laws and property regulations to clients, ensuring they understand the process and the potential outcomes of their investment decisions. The strict rules and tight timelines of 1031 exchanges require a meticulous and detail-oriented approach. A specialist must be able to keep track of multiple deadlines and ensure all paperwork is filed accurately and promptly to avoid any potential issues. The real estate market offers various opportunities for niche careers, one of which is becoming a 1031 Exchange Specialist. With the demand for tax-saving strategies among property investors, the role of a specialist in 1031 exchanges is vital. Anyone aspiring to become a 1031 Exchange Specialist should start with a strong foundation in finance or real estate. A bachelor's degree in these fields can be beneficial. Afterward, acquiring a Certified Exchange Specialist® (CES®) designation can add credibility to your professional profile. This certification validates your competence in handling 1031 exchanges and typically requires passing an examination. Practical experience is essential in this profession. Work in a related field, such as real estate or tax law, to understand the intricacies of property transactions and tax implications. Over time, this experience will provide the expertise needed to navigate the complex 1031 exchange process. The tax and real estate landscapes are continually evolving. Therefore, a 1031 Exchange Specialist must stay updated with the latest industry trends, court rulings, and changes in the tax code. Regularly attending seminars, workshops, and courses can help in maintaining competence in this field. Lastly, a successful 1031 Exchange Specialist should establish strong connections with real estate agents, attorneys, and CPAs, among others. These relationships can lead to referrals and collaboration opportunities, thus expanding your client base. Experience: The specialist should have substantial experience handling 1031 exchanges. The knowledge garnered from years of practice is invaluable. Track Record: Check the specialist's track record. A history of successful transactions indicates competence and reliability. Knowledge: An in-depth understanding of the Internal Revenue Code and real estate market trends is crucial. This knowledge will help in navigating the complexities of 1031 exchanges. Communication: Good communication is vital. The specialist should be able to explain complicated tax laws in a simple, understandable way. Recommendations: Consider recommendations from previous clients or industry professionals. Positive testimonials can attest to the specialist's professionalism and expertise. Regulatory Compliance: Ensure the specialist is in good standing with regulatory authorities. This helps to prevent potential legal issues down the line. Client reviews and testimonials offer valuable insights into a specialist's performance and reliability. They often highlight the specialist's strengths and areas for improvement. A pattern of positive reviews can indicate a high level of client satisfaction, which is a significant indicator of the specialist's competence and credibility. The role of a 1031 Exchange Specialist is crucial for investors seeking to maximize the benefits of a 1031 exchange. They navigate complex tax codes, guide investors through strict deadlines, and identify fitting replacement properties. Their understanding of tax laws and investment strategies is paramount. Aspiring specialists need relevant education, certifications, and, importantly, experience. When choosing a specialist, it's essential to consider their track record, knowledge, communication skills, recommendations, and regulatory compliance. Client reviews and testimonials serve as vital indicators of their performance and reliability. With the right specialist, investors can successfully leverage 1031 exchanges, deferring capital gains tax, and enhancing their wealth accumulation strategies.What Is a 1031 Exchange Specialist?

Duties and Responsibilities of a 1031 Exchange Specialist

Guides Through the Exchange Process

Identifies Replacement Properties

Manages Deadlines

Coordinates With Other Professionals

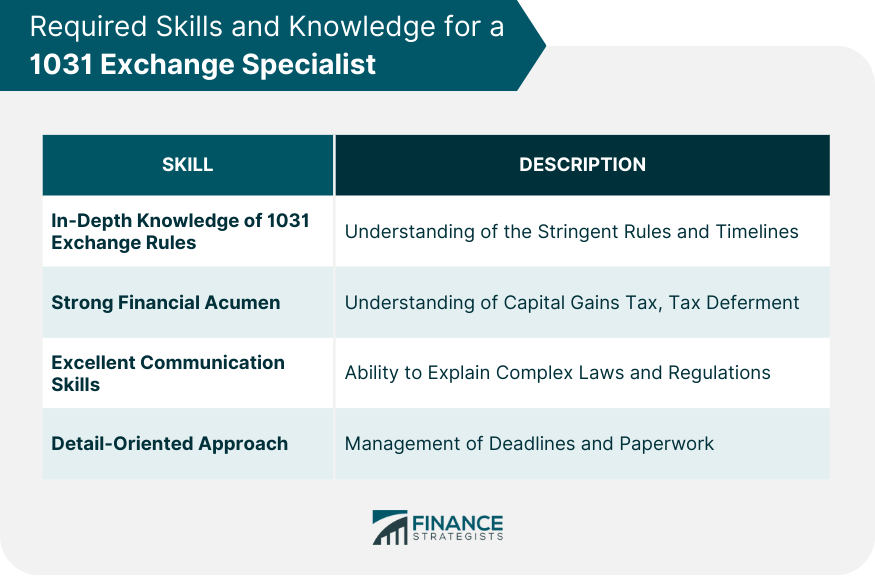

Required Skills and Knowledge for a 1031 Exchange Specialist

In-Depth Knowledge of 1031 Exchange Rules

Strong Financial Acumen

Excellent Communication Skills

Detail-Oriented Approach

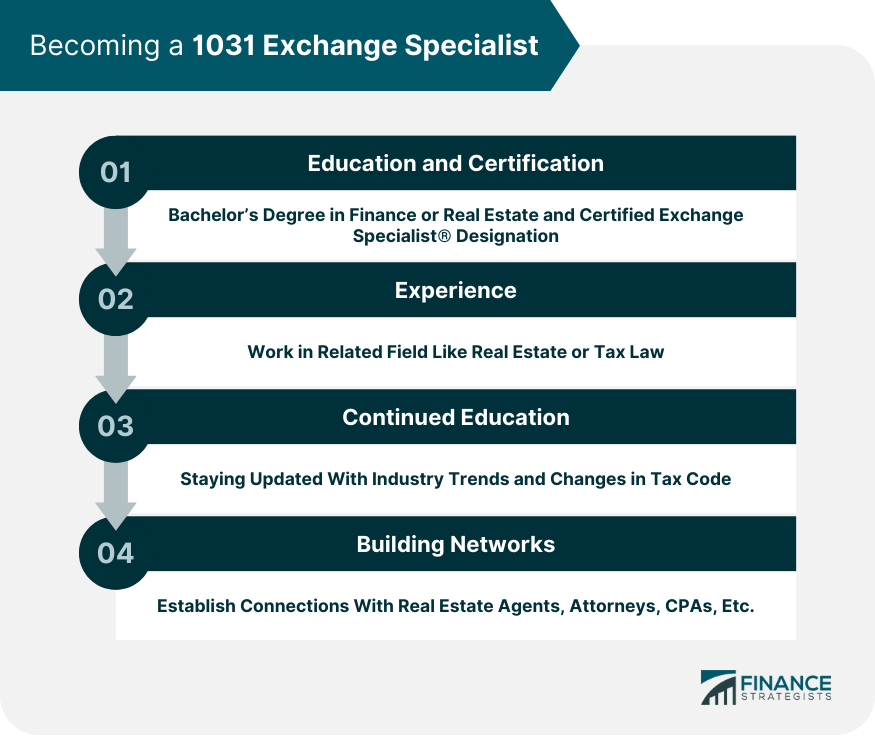

Becoming a 1031 Exchange Specialist

Identifying the Need for Specialization

Education and Certification

Experience

Continued Education

Building Networks

Criteria for Choosing a 1031 Exchange Specialist

Importance of Reviews and Testimonials

Conclusion

1031 Exchange Specialist FAQs

A 1031 Exchange Specialist guides investors through the process of a 1031 exchange, which involves selling an investment property and reinvesting the proceeds into a "like-kind" property to defer capital gains tax. Their expertise helps ensure that the strict rules and timelines associated with 1031 exchanges are adhered to, thereby minimizing the risk of tax penalties.

A 1031 Exchange Specialist needs a deep understanding of the 1031 exchange rules, as well as solid knowledge of real estate markets and investment strategies. They should be able to guide clients through complex transactions and help identify suitable replacement properties that align with their investment goals.

When hiring a 1031 Exchange Specialist, look for a degree in finance, real estate, or a related field. Some may also possess relevant certifications, such as Certified Exchange Specialist (CES) designation. However, hands-on experience with 1031 exchanges is often the most valued credential.

A 1031 Exchange Specialist helps defer capital gains tax by facilitating a 1031 exchange. This involves selling your investment property and reinvesting the proceeds into a "like-kind" property within specific timelines. The specialist ensures compliance with all rules and timelines, thereby allowing you to defer the capital gains tax on your investment.

Yes, a key role of a 1031 Exchange Specialist is to assist investors in identifying suitable "like-kind" replacement properties. Using their deep knowledge of real estate markets and the investor's financial goals, they can recommend properties that best suit the investor's needs and qualify for a 1031 exchange.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.