A 1031 Like-Kind Exchange, named after Section 1031 of the U.S. Internal Revenue Code, is a strategic investment tool that allows real estate investors to defer capital gains tax on the sale of a property. This tax deferral is achieved when the proceeds from the sold property, often referred to as the "relinquished property," are reinvested into another "like-kind" property. "Like-kind" refers to the nature or character of the property and not its grade or quality, meaning a broad range of property types can qualify. The purpose of a 1031 Like-Kind Exchange is to encourage active reinvestment in the business or trade sector, stimulate the economy, and allow investors to maintain equity and increase potential returns by deferring tax liability. It's an effective mechanism for wealth accumulation and portfolio diversification in the real estate industry. The Simultaneous Exchange is the original form of a 1031 Exchange. It involves the simultaneous sale of the relinquished property and the acquisition of the replacement property. This exchange must occur concurrently, which, due to logistical challenges, makes it less common in the modern real estate world. The Delayed Exchange, also known as the "Starker Exchange," is the most common form of a 1031 Exchange. In this scenario, the investor sells the relinquished property before purchasing the replacement property. They have a maximum of 180 days to complete the purchase after selling the original property, with specific replacement property or properties identified within the first 45 days. The Reverse Exchange, complex yet advantageous, allows the investor to acquire the replacement property before selling the relinquished property. This strategy provides the benefit of time to sell the original property without losing the potential replacement property due to purchase competition or market factors. In a Construction or Improvement Exchange, the investor can make improvements on the replacement property using the exchange equity during the exchange period. The property, however, must be held by an Exchange Accommodation Titleholder until the improvements are completed and must meet the 180-day rule for completion and acquisition. The term "like-kind" may be somewhat misleading, as it does not necessitate properties to be of the same type. In the context of 1031 Exchanges, "like-kind" refers to the nature or character of the property, not its grade or quality. Therefore, an apartment building could be exchanged for raw land or an office building for a retail complex as long as both properties are used for trade, business, or investment. Engaging the services of a Qualified Intermediary (QI) is crucial when conducting a 1031 Exchange. A QI acts as a facilitator in the exchange process, handling the necessary paperwork and holding the exchange funds until the transaction is completed. Choosing a reputable QI is vital. A QI should have a solid track record, robust financial backing, and comprehensive errors and omissions insurance. The QI's role is to prepare the exchange agreement and other necessary documents, hold the exchange funds in a secure account, and coordinate with the closing agents to ensure a smooth transaction. Choosing a competent QI is not just important; it's necessary for a successful 1031 Exchange. A subpar QI can lead to a failed exchange, resulting in significant tax liabilities. Hence, investors must conduct their due diligence when choosing a QI, considering the intermediary's reputation, expertise, and financial stability. A 1031 Exchange involves a series of steps and follows a strict timeline. Understanding these aspects is critical to a successful exchange. The process begins with the sale of the relinquished property. The proceeds from this sale are transferred to the QI, who holds them until they can be used to purchase the replacement property. The investor then has 45 days to identify potential replacement properties and 180 days to close on the new property. The 45-day rule is one of the most critical aspects of a 1031 Exchange. From the day the relinquished property is sold, the investor has 45 days to identify potential replacement properties. The properties must be clearly described in a written document and signed by the investor. Following the 45-day identification period, the investor has the remainder of the 180 days to close on one or more of the identified properties. Failure to close within this period may result in the exchange being invalidated and the deferred tax becoming due. In a perfect 1031 Exchange, the investor reinvests all the sale proceeds into the replacement property. However, if the investor receives money or other non-like-kind property, it's termed as "boot," which may be subject to taxes. Understanding the implications of the boot is critical to maximizing the tax benefits of a 1031 Exchange. 1031 Exchanges provide a powerful tool for deferring capital gain taxes. However, they come with their unique tax implications. The key advantage of a 1031 Exchange is the deferral of capital gain taxes. By rolling the proceeds of a sale into a new like-kind property, investors can defer paying taxes on their capital gains, allowing more capital to be reinvested and potentially leading to higher returns. The tax basis of the new property in a 1031 Exchange is generally the same as the tax basis of the relinquished property, adjusted for any boot received or paid and any gain recognized. This carryover basis impacts the depreciation deductions available for the new property and the calculation of gain or loss on a future sale. Depreciation plays a significant role in 1031 Exchanges. Depreciation deductions taken on the relinquished property can affect the basis and, consequently, the calculation of gain or loss on the exchange. Moreover, the carryover basis impacts the depreciation deductions available on the new property. Legislative changes can significantly impact 1031 Exchanges. For instance, the Tax Cuts and Jobs Act of 2017 restricted 1031 Exchanges to real property, excluding personal property. Investors should stay updated on legislative changes that could affect the tax benefits of the 1031 Exchanges. Like any investment strategy, 1031 Exchanges come with potential benefits and risks. Understanding these can help investors make informed decisions. The principal benefit of a 1031 Exchange is tax deferral. By deferring taxes, investors can reinvest more capital, potentially increasing returns. Additionally, 1031 Exchanges can aid in portfolio diversification and strategic estate planning, adding versatility to an investor's wealth management strategies. While the benefits are substantial, 1031 Exchanges are not without risks. These include potential tax liability if the exchange is not correctly executed, complexity and timing constraints, and exposure to market risks. Investors should weigh these risks against the potential benefits before engaging in a 1031 Exchange. 1031 Exchanges, while advantageous, can be complex. Here are some practical considerations to keep in mind. Common mistakes in 1031 Exchanges include failing to meet the identification and exchange periods, receiving "boot," and exchanging for non-like-kind property. Understanding the rules and working with a competent QI can help avoid these pitfalls. Best practices include conducting thorough due diligence, hiring a reputable QI, adhering to the required timelines, and working with experienced tax and legal advisors. Planning ahead and understanding the rules can facilitate a smooth and successful 1031 Exchange. While 1031 Exchanges can be highly beneficial, they may not be suitable for all situations. When the potential tax liability is low, the property market is volatile, or the rules and timelines seem overly restrictive, consider alternatives, such as outright sale and payment of tax, seller financing, or installment sale. The 1031 Like-Kind Exchange is a valuable tool in the realm of real estate investment, offering a strategic avenue for deferring capital gains tax. Originating from Section 1031 of the U.S. Internal Revenue Code, it provides investors the opportunity to reinvest sale proceeds from one property into another like-kind property. The term "like-kind" emphasizes the property's nature, not its quality, permitting a diverse range of real estate exchanges. While the process, governed by specific timelines and rules, can seem intricate, its benefits, including tax deferral, portfolio diversification, and estate planning advantages, are substantial. However, potential risks, such as tax liabilities and market vulnerabilities, exist. Proper due diligence, understanding legislative changes, and employing a reputable Qualified Intermediary can optimize the benefits and mitigate challenges, ensuring successful wealth accumulation through 1031 Exchanges.1031 Like-Kind Exchanges Overview

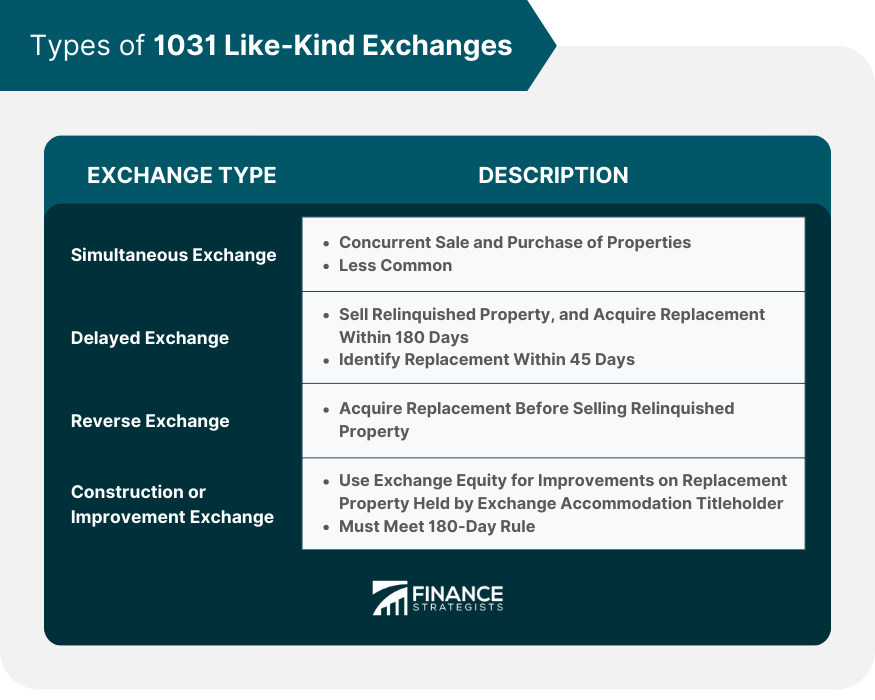

Types of 1031 Like-Kind Exchanges

Simultaneous Exchange

Delayed Exchange

Reverse Exchange

Construction or Improvement Exchange

Identifying the "Like-Kind" Properties

Role of Qualified Intermediaries in 1031 Exchanges

Selection and Role of Qualified Intermediaries

Importance and Risk Management in Choosing an Intermediary

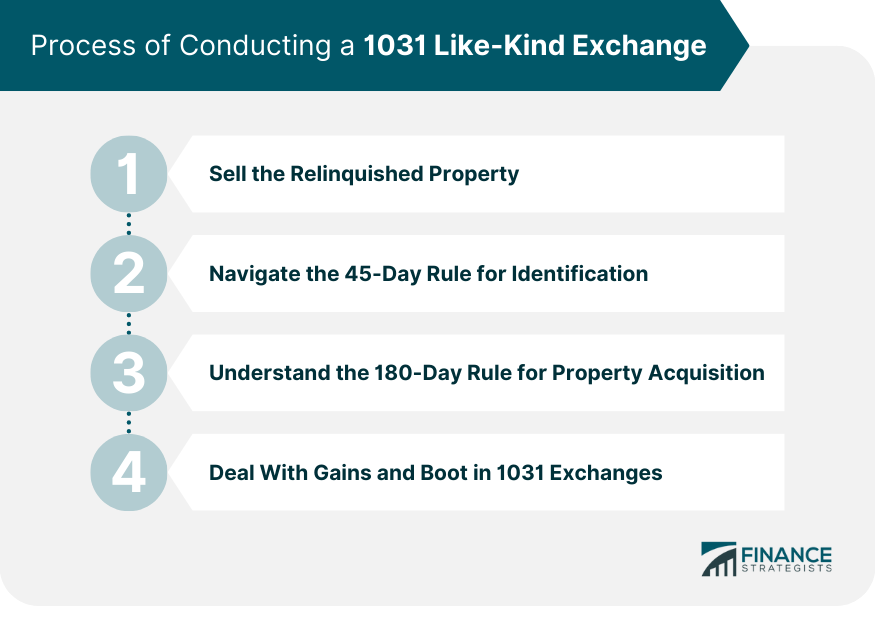

Process of Conducting a 1031 Like-Kind Exchange

Sell the Relinquished Property

Navigate the 45-Day Rule for Identification

Understand the 180-Day Rule for Property Acquisition

Deal With Gains and Boot in 1031 Exchanges

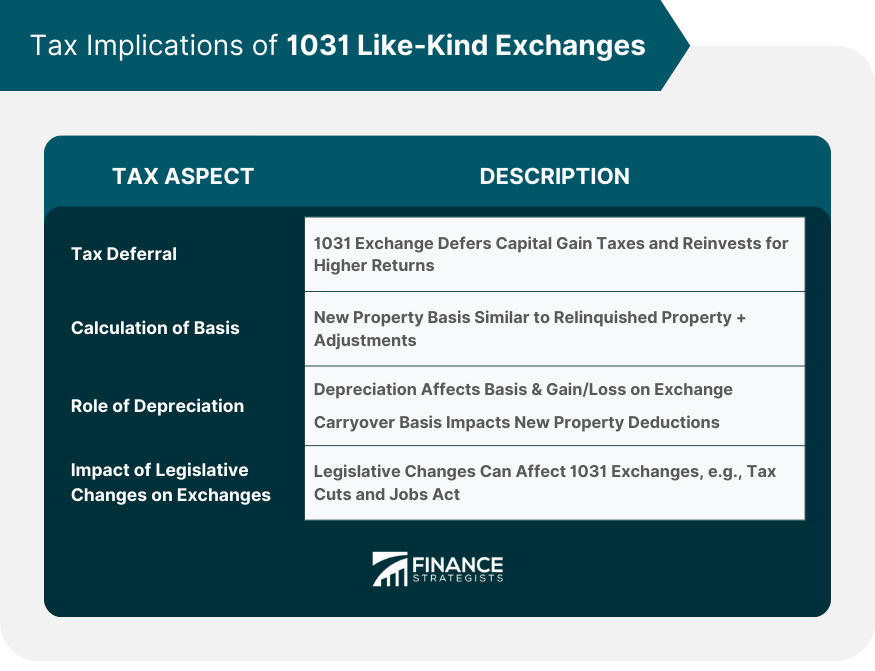

Tax Implications of 1031 Like-Kind Exchanges

Tax Deferral in a 1031 Exchange

Calculation of Basis in the New Property

Role of Depreciation in 1031 Exchanges

Impact of Recent Legislative Changes on 1031 Exchanges

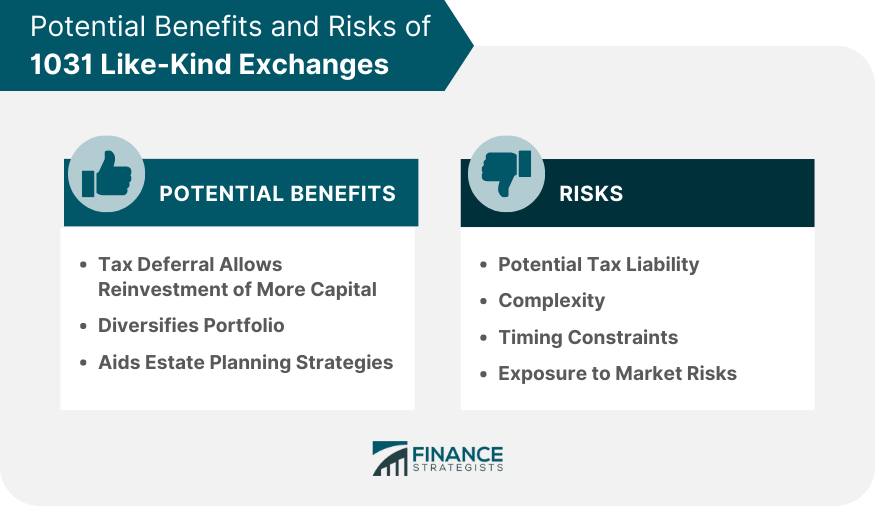

Potential Benefits and Risks of 1031 Like-Kind Exchanges

Benefits of Engaging in a 1031 Exchange

Risks and Drawbacks of 1031 Exchanges

Practical Considerations in 1031 Like-Kind Exchanges

Common Mistakes and How to Avoid Them

Best Practices in Conducting a 1031 Exchange

When to Consider Alternatives to a 1031 Exchange

Conclusion

1031 Like-Kind Exchanges FAQs

A 1031 Like-Kind Exchange is a provision in the U.S. tax code that allows investors to defer paying capital gains taxes on the sale of a property as long as they reinvest the proceeds into another "like-kind" property. This provision can be beneficial for portfolio growth and wealth accumulation.

In the context of a 1031 Exchange, "like-kind" refers to the nature or character of the property, not its grade or quality. This means properties don't have to be of the same type; an apartment building could be exchanged for raw land or an office building for a retail complex as long as both properties are used for trade, business, or investment.

A Qualified Intermediary (QI) facilitates the 1031 Exchange process by preparing the necessary documents, holding the exchange funds in a secure account, and coordinating with the closing agents. Selecting a reputable QI is crucial for a successful 1031 Exchange.

The primary benefit of a 1031 Exchange is the deferral of capital gains tax, allowing more capital to be reinvested and potentially higher returns. It also aids in portfolio diversification and strategic estate planning. However, risks include potential tax liability if the exchange is improperly executed, complexity and timing constraints, and market risks.

While 1031 Exchanges can be beneficial, they might not be suitable for all situations. If the potential tax liability is low, the property market is volatile, or the rules and timelines for a 1031 Exchange seem overly restrictive, considering alternatives such as an outright sale and payment of tax, seller financing, or installment sale may be worthwhile.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.