A 1031 Exchange for New Construction, also known as a build-to-suit or improvement exchange, allows real estate investors to defer capital gains tax on the sale of an investment property. Instead of simply buying a replacement property as in a traditional 1031 exchange, the investor also constructs improvements on the new property. The process has unique rules: Investors have 45 days to identify the new property and intended improvements and 180 days to complete the acquisition and construction. Additionally, the total value of the replacement property, including improvements, must be equal to or exceed the value of the relinquished property. This strategic tool offers benefits like tax deferment, asset diversification, and appreciation potential, but also comes with challenges like stringent timelines and financing hurdles. It's a complex process, best navigated with the guidance of tax and real estate professionals. Traditional 1031 exchanges and 1031 exchanges for new construction serve the same overall goal: deferring taxes on capital gains. But they diverge in how they achieve this. In a typical 1031 exchange, the investor sells their old property and uses the proceeds to buy a like-kind property. This is a straightforward process: sell property A, buy property B. On the other hand, the 1031 exchange for new construction adds a twist. Here, the investor sells their old property and uses the proceeds to not just buy but also improve a like-kind property. They could add new structures, renovate existing ones, or even build from scratch on a raw piece of land. To successfully navigate the 1031 exchange for New Construction, it's crucial to understand and adhere to its specific rules. Like a traditional exchange, the investor has 45 days from the sale of the relinquished property to identify the replacement property. This identification must be in writing and clearly describe the property. For new construction, the description can include proposed improvements if they are integral to the property's intended use. The complexity comes from the fact that the investor has to detail the improvements they intend to make, which can be challenging if plans aren't fully developed within this 45-day window. The IRS stipulates a maximum of 180 days to complete the exchange, starting from the day the relinquished property is sold. In this period, the replacement property must be acquired and any improvements outlined in the identification period must be completed. This presents a timing challenge as construction often encounters unexpected delays. The investor must ensure that their construction project is feasible within this strict timeframe. To completely defer taxes, the replacement property's total value, including improvements, should be equal to or higher than the relinquished property. This means that investors can't just purchase a cheap plot of land and make nominal improvements; the finished product must meet the required value threshold. The main advantage is, of course, tax deferment. Capital gains taxes on the sale of the relinquished property can be deferred, allowing more capital to be used towards the new construction. This provides investors with increased buying power, contributing to potentially larger returns in the future. By selling one property and buying another, investors can diversify their portfolios. They can move out of a stagnant market and into a growing one, switch property types, or reposition their investments in a way that better aligns with their goals. Since the new property can be built to the investor's specifications, it can often be more valuable than an off-the-shelf property. This can lead to higher appreciation and returns, boosting the overall profitability of the investment. The IRS's strict timing rules can make a 1031 exchange for new construction a risky venture. Construction delays are common, and if the property is not completed and acquired within the 180-day window, the exchange can fail, resulting in hefty tax liabilities. Finding the right financing for a 1031 exchange for new construction can be difficult. Many lenders are wary of construction loans due to the added risk, and finding a lender who is familiar with 1031 exchanges adds another layer of complexity. As with any real estate investment, market risks exist. The market could shift during construction, diminishing the property's value. Investors must be aware of this risk and have strategies in place to mitigate it. During the planning stage, investors must evaluate the feasibility of the project, secure financing, and engage a qualified intermediary. This stage also involves choosing a suitable replacement property and planning the construction project in detail. In the execution stage, the relinquished property is sold, and the funds are transferred to the qualified intermediary. The replacement property is identified within the 45-day window, and construction begins. The project must be meticulously managed to ensure it is completed within the 180-day timeframe. In the post-exchange stage, the property is acquired, and any remaining funds are returned to the investor. The investor now holds a valuable property that meets their specifications and can contribute to their financial goals. The 1031 Exchange for New Construction offers a unique opportunity for real estate investors to defer capital gains tax, diversify their portfolios, and potentially increase returns. However, this method differs significantly from a traditional 1031 exchange, as it involves not only purchasing a replacement property but also improving it. The process follows strict rules, such as a 45-day identification period and a 180-day completion timeline, requiring careful planning and management. Moreover, challenges like construction delays and financing difficulties can pose risks. With careful planning, the right resources, and professional guidance, investors can navigate these complexities and leverage the potential benefits of this strategic investment tool. Understanding its advantages and challenges, as well as the necessary steps to perform a 1031 exchange for new construction, is crucial for successful execution.1031 Exchange for New Construction Overview

Differences Between Traditional 1031 Exchange and 1031 Exchange for New Construction

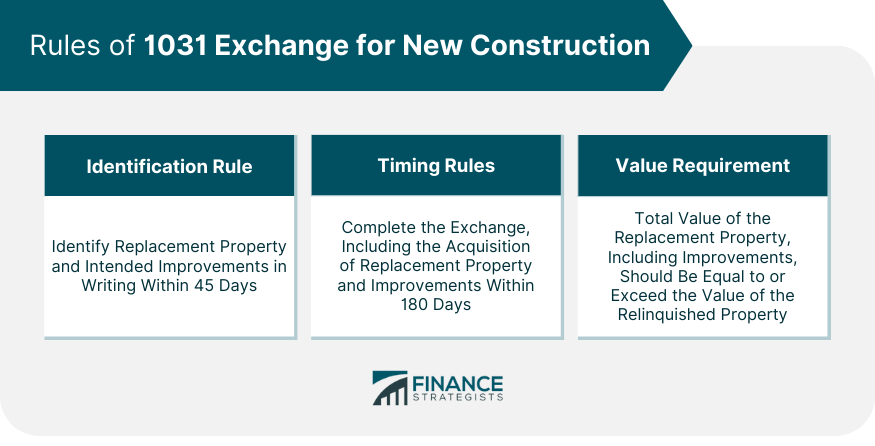

Rules of 1031 Exchange for New Construction

Identification Rule

Timing Rules

Value Requirement

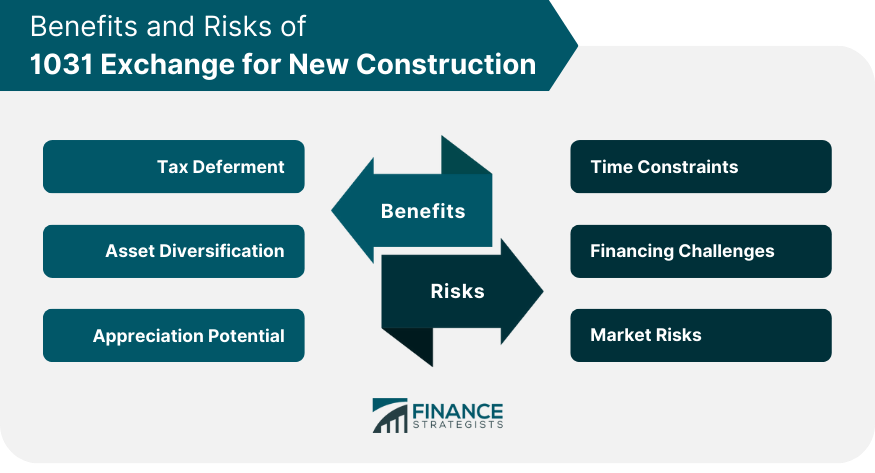

Benefits of 1031 Exchange for New Construction

Tax Deferment

Asset Diversification

Appreciation Potential

Potential Risks of 1031 Exchange for New Construction

Time Constraints

Financing Challenges

Market Risks

Steps to Perform a 1031 Exchange for New Construction

Planning Stage

Execution Stage

Post-Exchange Stage

Conclusion

1031 Exchange for New Construction FAQs

A 1031 Exchange for New Construction, also known as a build-to-suit or improvement exchange, allows real estate investors to defer capital gains tax by using the sale proceeds of an investment property not only to buy but also to construct improvements on a replacement property.

The primary rules include a 45-day identification period (to identify the replacement property and intended improvements), a 180-day completion period (to acquire the replacement property and finish construction), and a value requirement (the total value of the replacement property, including improvements, should be equal to or higher than the relinquished property).

Advantages include deferring capital gains tax, diversifying investment portfolios, and enhancing appreciation potential since the new property can be constructed to the investor's specifications.

Challenges include time constraints (completing the acquisition and construction within 180 days), financing hurdles (securing loans for construction), and market risks (potential shifts in the market during the construction period).

Not necessarily. A 1031 Exchange for New Construction is best suited for investors who understand the process, have access to necessary financing, can manage strict timelines, and are prepared to handle potential market risks. As with any significant financial decision, it's always recommended to consult with tax and real estate professionals before proceeding.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.