Cash flow analysis is an essential tool for businesses of all sizes, enabling them to monitor their financial health and make informed decisions. By examining the inflow and outflow of cash within a company, businesses can gain insights into their liquidity, profitability, and overall financial stability. There are three main types of cash flow: operating, investing, and financing. Each type provides unique insights into a company's financial situation and helps businesses make informed decisions. Cash flow from operating activities represents the cash generated from a company's daily operations, including revenues from sales and expenses such as employee salaries, rent, and utilities. A positive operating cash flow signifies that a business generates sufficient cash to cover its operational expenses, while a negative cash flow indicates potential financial difficulties. Operating cash flow can be calculated using the following formula: Cash flow from investing activities reflects the cash inflows and outflows associated with a company's long-term investments, such as capital expenditures (e.g., purchasing equipment or buildings) and asset sales. Positive investing cash flow indicates that a company sells more assets than it is purchasing, while negative cash flow suggests increased investment in long-term assets. Cash flow from investing activities is calculated using the following formula: Cash flow from financing activities represents the cash generated or spent on financing activities, such as issuing equity, repurchasing shares, and managing debt. Positive financing cash flow indicates that a company is raising capital, while negative cash flow signals that the business is repaying debts or repurchasing shares. Financing cash flow can be calculated by using the following formula: The cash flow statement is a vital financial document that provides an overview of a company's cash inflows and outflows during a specific period. It is divided into three sections: operating, investing, and financing activities, reflecting the various types of cash flow discussed earlier. The primary purpose of the cash flow statement is to provide insights into a company's liquidity and solvency, enabling stakeholders to assess its financial health and performance. By analyzing the cash flow statement, businesses can identify trends, evaluate their ability to meet short-term obligations and make informed decisions regarding investments, financing, and operations. To prepare a cash flow statement, follow these steps: 1. Gather financial data from the income statement and balance sheet. 2. Calculate cash flow from operating activities by adjusting net income for non-cash items (such as depreciation) and changes in working capital. 3. Calculate cash flow from investing activities by summarizing capital expenditures and cash received from asset sales. 4. Calculate cash flow from financing activities by summing the cash inflows and outflows related to debt and equity financing. 5. Combine the cash flows from operating, investing, and financing activities to determine the net change in cash during the period. 6. Add the net change in cash to the beginning cash balance to obtain the ending cash balance. When interpreting the cash flow statement, consider the following: 1. Analyze trends in cash flow from operating activities to assess the company's ability to generate consistent cash flow from its core operations. 2. Evaluate the investing cash flow to determine the company's investment strategy and its impact on long-term growth prospects. 3. Assess the financing cash flow to understand the company's capital structure and its reliance on debt or equity financing. 4. Examine the overall net change in cash to identify any liquidity issues or potential financial difficulties. Several techniques can be used to analyze cash flow, including cash flow ratios, forecasting, and sensitivity analysis. Cash flow ratios are essential tools for evaluating a company's financial health and performance. Some of the key cash flow ratios include: The operating cash flow ratio measures a company's ability to cover its short-term liabilities using the cash generated from operations. The cash flow coverage ratio assesses a company's ability to meet its debt obligations using the cash generated from operations. The cash flow to debt ratio measures a company's ability to repay its debt using the cash generated from operations. Cash flow forecasting is a critical process for businesses, enabling them to anticipate future cash inflows and outflows, identify potential liquidity issues, and plan for contingencies. There are several methods for forecasting cash flow, including the direct method (projecting cash inflows and outflows based on historical data) and the indirect method (using the income statement and balance sheet to estimate future cash flow). Cash flow sensitivity analysis assesses the impact of changes in key variables (such as revenue, expenses, or interest rates) on a company's cash flow. Businesses can identify potential risks and opportunities by conducting sensitivity analysis and developing strategies to manage them effectively. Cash flow analysis has numerous applications in business decision-making, including business valuation, creditworthiness assessment, investment decision-making, and financial health monitoring. Cash flow analysis plays a vital role in business valuation, as it helps to estimate the company's future cash flows, which are then discounted to determine its present value. A higher free cash flow suggests a more valuable company, while a lower cash flow indicates potential financial difficulties. Lenders and creditors often use cash flow analysis to assess a company's creditworthiness, as it provides insights into the business's ability to meet its debt obligations. Companies with strong cash flow ratios and consistent positive cash flow are typically considered more creditworthy. Investors rely on cash flow analysis to evaluate the attractiveness of potential investments. Companies with healthy cash flow ratios and positive free cash flow are often considered more desirable investments, as they have the capacity to reinvest in growth, pay dividends, or reduce debt. Regular cash flow analysis allows businesses to monitor their financial health and identify potential issues before they become critical. By evaluating cash flow ratios and conducting cash flow forecasting, businesses can detect trends, address liquidity concerns, and make informed decisions regarding operations, investments, and financing. While cash flow analysis is an invaluable tool for businesses, it is essential to recognize its limitations and potential challenges: Cash flow analysis often relies on historical data, which may not always accurately predict future performance. Changing market conditions, evolving consumer preferences, or new competitors can impact a company's cash flow in ways not reflected in past data. Cash flow forecasting is inherently uncertain, as it involves making assumptions and estimations about future events. Inaccuracies in these assumptions can lead to incorrect forecasts, resulting in suboptimal decision-making. Some aspects of cash flow analysis, such as forecasting and sensitivity analysis, involve a degree of subjectivity in the assumptions and estimations used. Different analysts may arrive at different conclusions based on their unique perspectives and biases, leading to potential inconsistencies in cash flow analysis. As the business environment and company performance change over time, cash flow analysis must be regularly reviewed and updated to maintain its relevance and accuracy. Failing to update cash flow analysis can result in outdated insights and ineffective decision-making. Cash flow analysis is a crucial aspect of business decision-making, enabling companies to assess their financial health, make informed decisions regarding investments and financing, and plan for future growth. By understanding the various types of cash flow, utilizing cash flow analysis techniques, and recognizing their limitations, businesses can harness the power of cash flow analysis to drive success and maintain a competitive edge in the marketplace. Regular review and adaptation are essential to ensure that cash flow analysis remains an accurate and valuable tool for decision-making. In today's complex and ever-changing financial landscape, it is more important than ever to have expert guidance in managing your business's financial health. To ensure the most effective cash flow analysis and wealth management strategies, consider seeking the assistance of professional wealth management services. These experts can provide tailored solutions to help your business optimize its cash flow, maximize growth potential, and confidently navigate financial challenges. Don't leave your business's financial success to chance – take action today and secure your company's future with professional wealth management services.What Is Cash Flow Analysis?

Types of Cash Flow

Cash Flow From Operating Activities

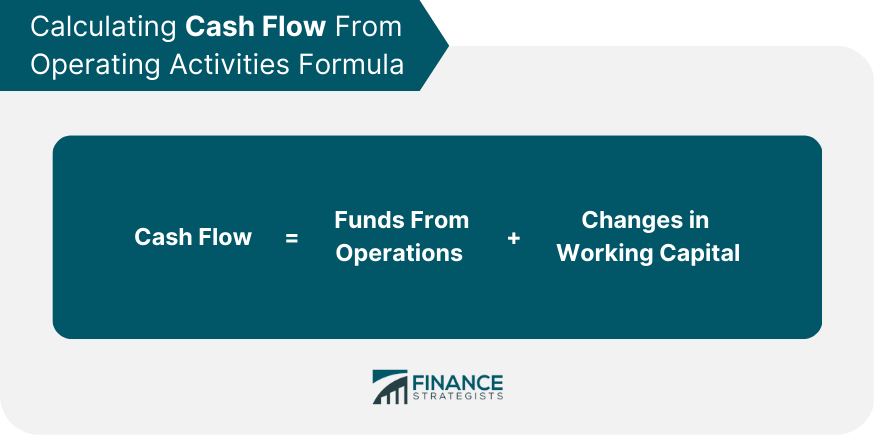

Calculation of Cash Flow From Operating Activities

Cash Flow From Investing Activities

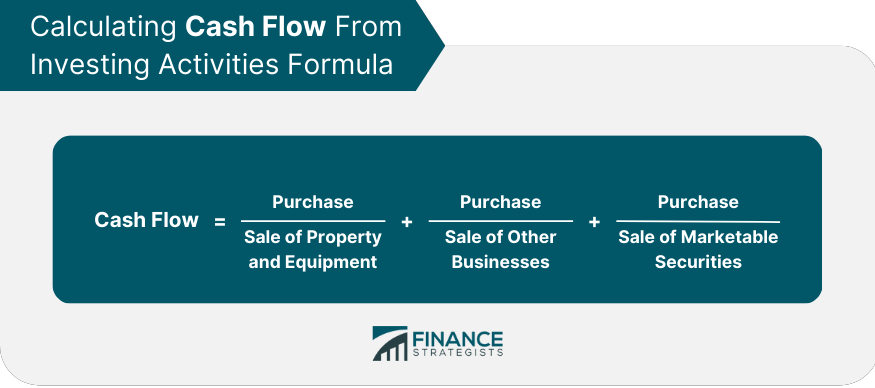

Calculation of Cash Flow From Investing Activities

Cash Flow From Financing Activities

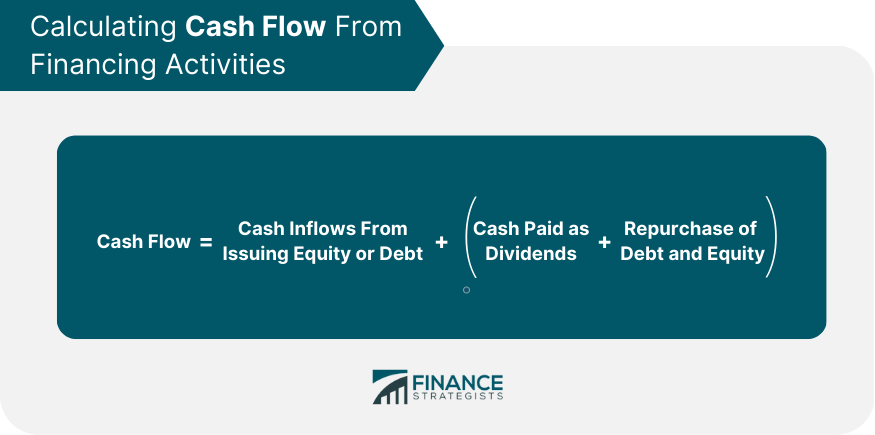

Calculation of Financing Cash Flow

Cash Flow Statement

Purpose of the Cash Flow Statement

How to Prepare a Cash Flow Statement

Interpreting the Cash Flow Statement

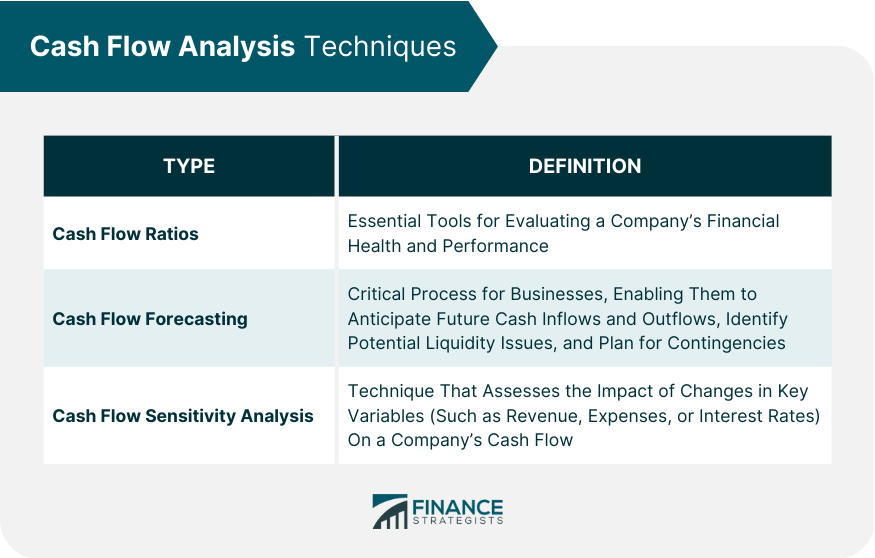

Cash Flow Analysis Techniques

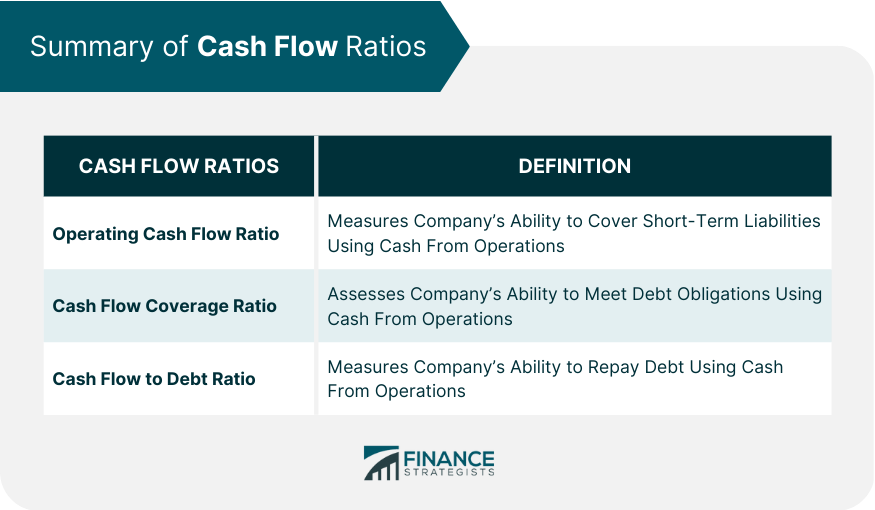

Cash Flow Ratios

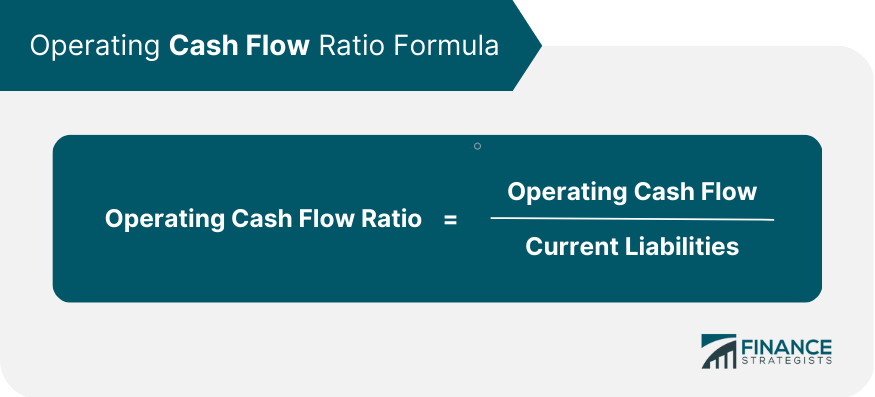

Operating Cash Flow Ratio

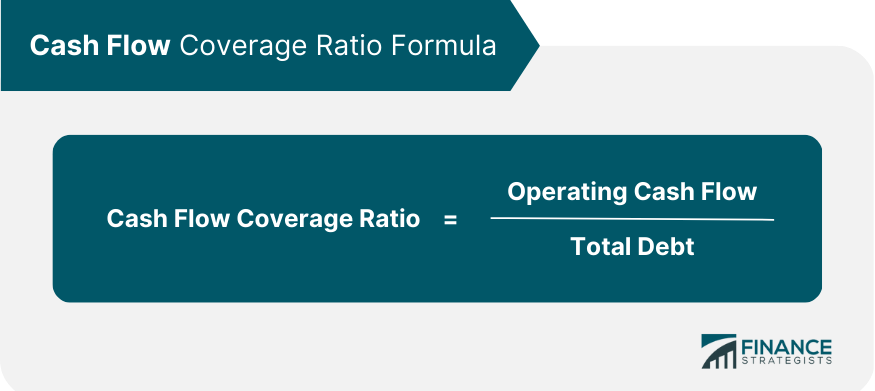

Cash Flow Coverage Ratio

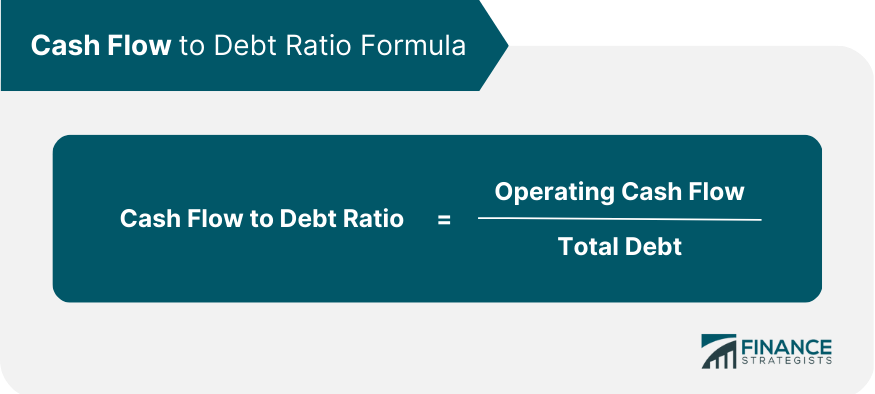

Cash Flow to Debt Ratio

Cash Flow Forecasting

Cash Flow Sensitivity Analysis

Applications of Cash Flow Analysis

Business Valuation

Creditworthiness Assessment

Investment Decision-Making

Financial Health Monitoring

Challenges and Limitations of Cash Flow Analysis

Limitations of Historical Data

Potential Inaccuracies in Forecasting

Subjectivity in Assumptions and Estimations

Need for Regular Review and Updates

Final Thoughts

Cash Flow Analysis FAQs

The primary purpose of cash flow analysis is to provide insights into a company's liquidity, profitability, and overall financial stability. It enables businesses to make informed decisions regarding investments, financing, and operations by examining the inflow and outflow of cash within the company.

Cash flow analysis helps businesses evaluate their financial health by identifying trends in cash inflows and outflows, assessing the company's ability to meet short-term obligations, and providing insights into the effectiveness of its operations, investments, and financing activities.

A cash flow statement, which is essential for cash flow analysis, comprises three main components: cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities. These components provide insights into a company's liquidity and solvency, reflecting the various types of cash flow discussed earlier.

Businesses can use cash flow analysis to improve their investment decision-making by evaluating cash flow ratios, such as the free cash flow ratio, and conducting cash flow forecasting. These techniques help businesses identify potential risks and opportunities, assess the attractiveness of potential investments, and determine the company's capacity for growth, dividend payments, or debt reduction.

Businesses should be aware of several challenges and limitations when conducting cash flow analysis, including the limitations of historical data, potential inaccuracies in forecasting, subjectivity in assumptions and estimations, and the need for regular review and updates. Being aware of these challenges can help businesses maintain the accuracy and relevance of their cash flow analysis and make more informed decisions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.