The 1031 Exchange is a provision in U.S. tax law that allows investors to defer capital gains tax by reinvesting proceeds from the sale of an investment property into a like-kind property. Converting a property obtained through a 1031 Exchange into a primary residence, however, has implications. Firstly, the property must be held for at least five years post-exchange before it can be converted. Further, when selling, the primary residence capital gains exclusion may apply, but only to the portion of gain attributed to the residential use. Some gains, especially from depreciation recapture and non-qualified use, will still be taxable. Navigating these strategies requires careful planning and adherence to IRS rules, and when done successfully, it can offer significant tax advantages. The funds from the sale of the original property must not be received by the investor but must be held by a QI, also known as an exchange accommodator, until they are used to purchase the replacement property. Within 45 days of selling the original property, the investor must identify potential replacement properties in writing to the QI. Up to three properties can usually be identified without regard to their market value (Three Property Rule), or more if certain valuation rules are met. The purchase of the replacement property must be completed within 180 days of the sale of the original property. The replacement property must be of like-kind to the original property. This term is broadly interpreted, and most real estate will be like-kind to other real estate. However, the property must be held for investment or used in a trade or business. There's no fixed holding period for the property to qualify for a 1031 Exchange. However, the IRS looks at each case's facts and circumstances. The longer the holding period, the better the chance the exchange will be considered valid. Properties eligible for a 1031 Exchange must be used for business or investment purposes. Personal residences, even partially, generally do not qualify. Properties that are primarily personal residences but have some business use, such as a home office, can potentially qualify, but only the business use portion of the property. The IRS defines "like-kind" quite broadly, referring to the nature or character of the property, not its grade or quality. This means you can exchange an apartment building for a strip mall, or raw land for an office building, for instance. In many cases, the sale of your old property and the purchase of the new property won't happen simultaneously. To accommodate this, the IRS allows for delayed exchanges, where proceeds from the sale are held by a qualified intermediary until they can be used to purchase the new property. 1031 exchanges can involve more than two properties. You can sell multiple properties and acquire one replacement property, or vice versa. The crucial aspect is that the properties are like-kind, and the exchange fits within the required timelines. Under Section 121 of the IRS code, a homeowner can exclude up to $250,000 of capital gains ($500,000 if married filing jointly) from the sale of a primary residence if they have lived in it for at least two out of the last five years before the sale. Converting a rental property into a primary residence doesn't eliminate the need to recapture depreciation. Any depreciation claimed during the property's time as a rental must be recaptured and taxed when the house is sold, even if it's currently a primary residence. The Housing and Economic Recovery Act of 2008 introduced a "non-qualified use" provision. This stipulates that any period of "non-qualified use" (i.e., when the property isn't used as a primary residence) is not eligible for the tax exclusion. The period of non-qualified use after 2008 will be factored in when calculating the capital gains tax upon the property's eventual sale. For properties obtained through a 1031 Exchange, a mandatory five-year holding period is enforced before you can convert it to your primary residence and qualify for Section 121 exclusion. Besides federal tax laws, local zoning ordinances, and homeowners' association rules can impact the ability to convert a rental property into a primary residence. Under IRS rules, property owners can exclude up to $250,000 ($500,000 if married filing jointly) of gain on the sale of their primary residence, provided they've owned and used the home as their primary residence for two of the five years before the sale. This can result in substantial tax savings. Generally, interest rates on mortgages for primary residences tend to be lower than for investment properties. By converting an investment property into a primary residence, you could refinance for a lower rate. By making your investment property your primary residence, you're effectively consolidating your living and investment strategies. This consolidation can simplify your finances, potentially leading to cost savings in areas like maintenance and management. Beyond the financial benefits, converting an investment property into a primary residence allows you to personally enjoy the property. This can be particularly advantageous if the property is in a desirable location or has special features. The IRS has a rule stating that the capital gain exclusion does not apply to the portion of your gain that is attributed to periods of "non-qualified use", which is the time when the property was not used as your primary residence. If you've claimed depreciation on the property while it was rented, that amount must be recaptured at the time of sale, taxed as ordinary income, and is not eligible for the primary residence exclusion. To qualify for the full tax exclusion, you need to live in the property as your primary residence for at least two of the five years before you sell. Real estate markets fluctuate, and the value of your property can decline. This risk may be more significant for an investment property converted into a primary residence, as the investment was likely initially chosen for its income potential rather than its potential as a long-term home. If the property was previously rented out, converting it to your primary residence means you lose that rental income. Converting a rental property to a primary residence might involve substantial costs to make the property suitable for personal use, which could potentially exceed tax savings. The process of a 1031 Exchange and subsequent conversion to a primary residence can yield significant tax advantages. However, the rules governing these transactions are complex and have strict timelines, requiring careful adherence to avoid penalties. An investor must understand that a 1031 Exchange permits capital gains deferral through reinvestment in like-kind properties, while a primary residence conversion has specific rules for the gain exclusion. The IRS mandates a minimum holding period of five years post-1031 Exchange before a property is eligible for primary residence conversion. This strategy can be a potent wealth-building tool, but it comes with potential drawbacks such as market risks, reduced cash flow, and costs associated with property conversion. As a result, professional advice should be sought to navigate the intricate regulations and maximize potential benefits.1031 Exchange and Conversion to Primary Residence

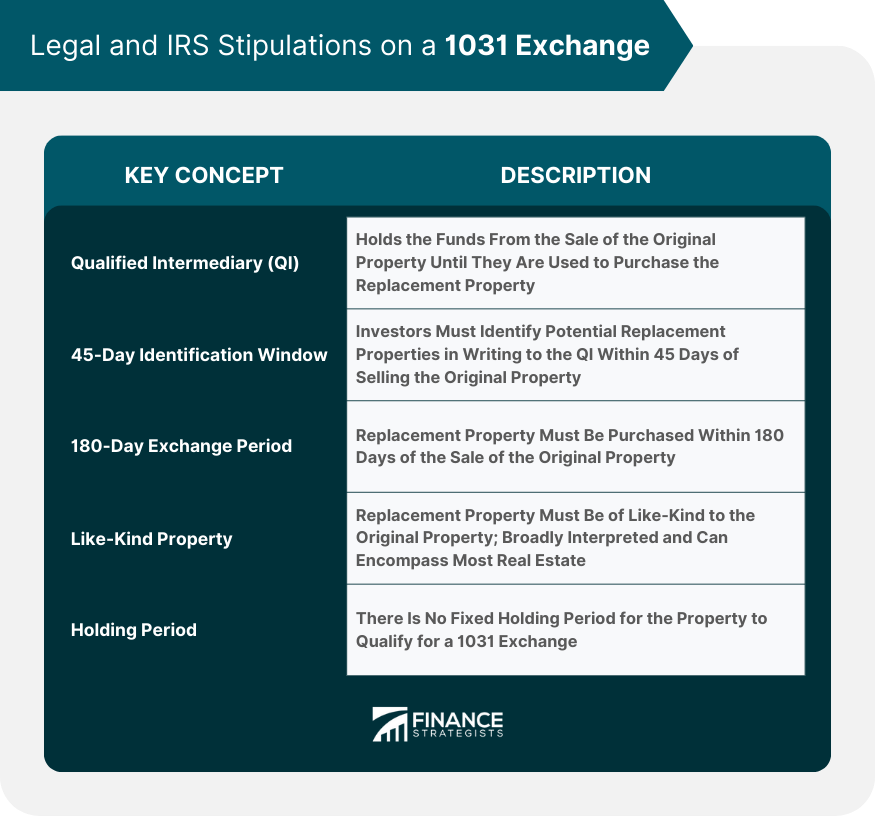

Legal and IRS Stipulations on a 1031 Exchange

Qualified Intermediary (QI)

45-Day Identification Window

180-Day Exchange Period

Like-Kind Property

Holding Period

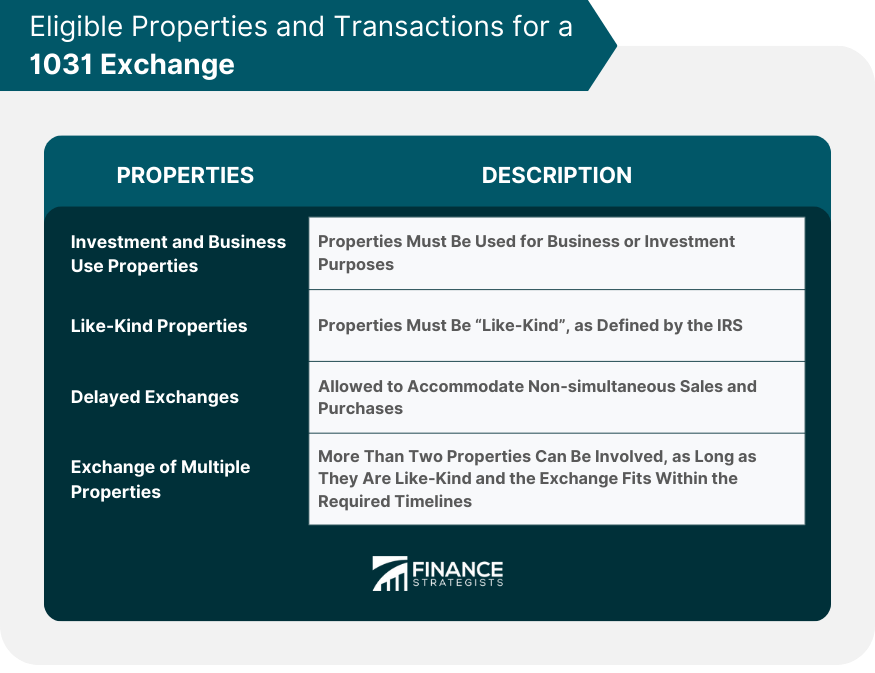

Eligible Properties and Transactions for a 1031 Exchange

Investment and Business Use Properties

Like-Kind Properties

Delayed Exchanges

Exchange of Multiple Properties

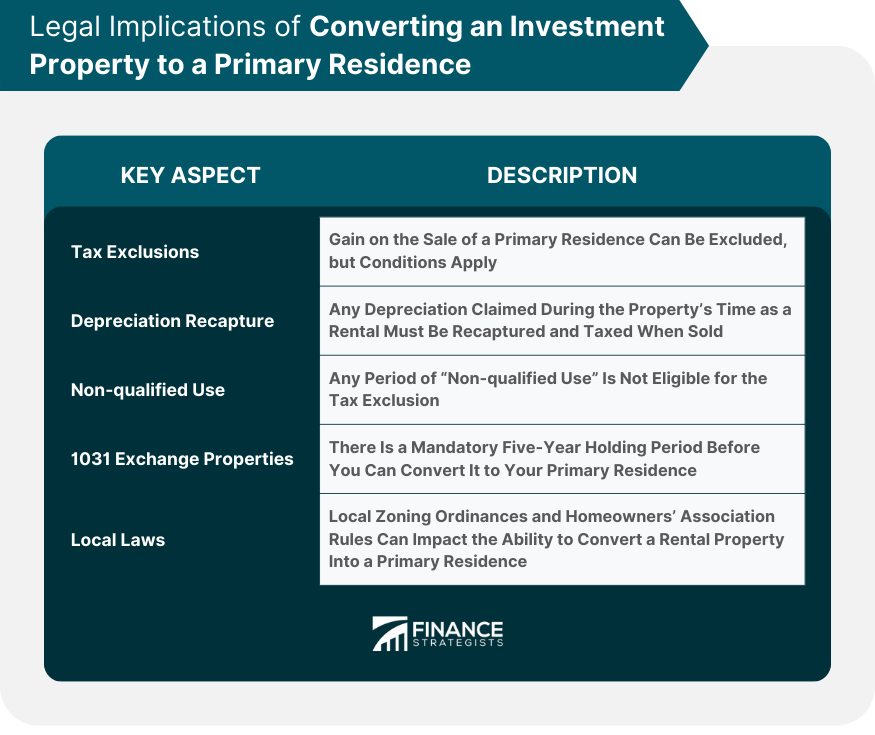

Legal Implications of Converting an Investment Property to a Primary Residence

Tax Exclusions

Depreciation Recapture

Non-qualified Use

1031 Exchange Properties

Local Laws

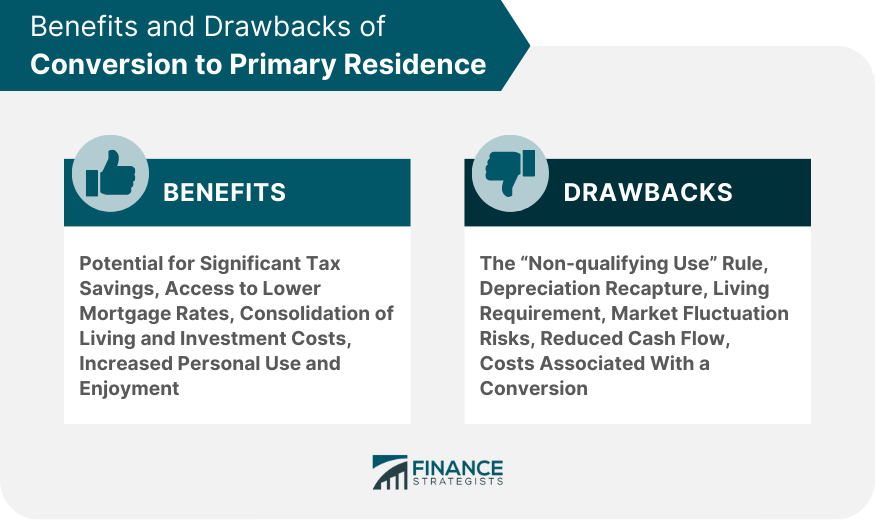

Benefits of Conversion to Primary Residence

Potential for Significant Tax Savings

Access to Lower Mortgage Rates

Consolidation of Living and Investment Costs

Increased Personal Use and Enjoyment

Drawbacks and Potential Issues of Conversion to Primary Residence

The “Non-qualifying Use” Rule

Depreciation Recapture

Living Requirement

Market Fluctuation Risks

Reduced Cash Flow

Costs Associated With Conversion

Conclusion

1031 Exchange and Conversion to Primary Residence FAQs

A 1031 Exchange is a transaction under U.S. tax law that allows you to swap one investment property for another and defer capital gains taxes that would otherwise be due on the sale. This process allows investors to reinvest the profits from a sale into new investment properties, potentially leading to more significant growth.

No, only certain types of property qualify for a 1031 Exchange. The property must be used in a trade, business, or for investment, and it must be exchanged for a "like-kind" property. After a 1031 Exchange, there are specific rules and timelines, such as a minimum holding period of five years, before the property can be converted to a primary residence.

When you convert a 1031 Exchange property to a primary residence, different tax rules apply. While some of the gains from the sale of the property may be excluded under the primary residence rules, any gain from depreciation claimed after May 6, 1997, or from the property's non-qualified use, will still be taxable.

The IRS requires a holding period of at least five years after a 1031 Exchange before you can convert the property to your primary residence.

Some potential pitfalls include not meeting the strict timelines for identifying and acquiring a new property in a 1031 Exchange, failing to hold the property for the required five years before conversion to a primary residence, and not considering the tax implications of non-qualified use and depreciation recapture.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.