A Related Party 1031 exchange transaction involves the exchange of property between two parties who are considered related as per the IRS guidelines. The term "related party" encompasses various relationships, including family members, business associates, or entities with shared ownership. This type of exchange allows taxpayers to defer capital gains taxes on the exchanged property by meeting specific criteria outlined by the IRS. The purpose of a Related Party 1031 exchange is to facilitate property exchanges while deferring tax consequences, thus encouraging investment continuity and fostering various strategic financial decisions. This tax-deferred exchange option is vital for investors looking to re-allocate their investment portfolios, consolidate properties, or engage in family wealth transfers without incurring immediate tax liabilities. The relinquished property (the property being sold) and the replacement property (the property being acquired) must both be held for investment or used in a trade or business. This means that they should not be held for personal use, such as a primary residence, but rather for income generation or investment purposes. This means that the exchange should be done in a manner that reflects fair market value and not be used to manipulate the value of the properties involved. After completing the exchange, both the relinquished and replacement properties must be held for a specific period to maintain the tax-deferred status. The IRS requires the investor to hold the replacement property for investment purposes for an additional period, generally referred to as the "qualifying use" period, which is typically two years. The term "related party" encompasses various relationships, and the IRS provides specific guidelines to determine relatedness. The most common form of relatedness in a 1031 exchange involves direct family relationships. This includes transactions between spouses, siblings, parents, children, and other close family members. While these exchanges are allowed, investors should exercise caution to avoid any appearance of attempting to take advantage of the relationship for tax avoidance purposes. Related parties can also include individuals or entities with shared business interests. For instance, if two individuals co-own a business and decide to exchange properties, they would be considered related parties for the purpose of the 1031 exchange. If one party has a significant degree of control over the other, they may be classified as related parties. This includes situations where one party has substantial ownership in another entity or exerts significant influence over decision-making. The Property Exchange Process is the core of a Related Party 1031 exchange, where the relinquished property is transferred to the related party in exchange for the replacement property. This process requires careful planning, adherence to IRS timelines, and compliance with regulations to maintain the tax-deferred status. The exchange process begins with the investor deciding to engage in a Related Party 1031 exchange. At this stage, they should identify potential related parties who are willing to participate in the exchange and negotiate the terms of the transaction. The first step is to transfer the relinquished property to the related party. This involves executing a valid exchange agreement, which outlines the terms of the exchange, including the properties involved, the agreed-upon values, and any additional considerations. Once the relinquished property is transferred, the investor has a limited time frame of 45 days to identify potential replacement properties. The IRS allows the investor to identify up to three properties, regardless of their value, or any number of properties as long as their combined fair market value does not exceed 200% of the relinquished property's value. After identifying the replacement property, the investor must complete the acquisition within 180 days from the date of transferring the relinquished property or the tax return due date for the tax year in which the exchange began, whichever is earlier. To maintain the tax-deferred status of the exchange, both the relinquished and replacement properties must be held for investment or used in a trade or business for a specific period. The replacement property should be held for a minimum of two years, known as the "qualifying use" period, to avoid immediate tax liability. In a Related Party 1031 exchange, the use of a Qualified Intermediary (QI) or Accommodator is essential. The QI acts as an intermediary to facilitate the transaction, hold the proceeds from the relinquished property, and subsequently acquire the replacement property on behalf of the investor. Throughout the process, it is crucial to maintain accurate documentation of all exchange-related transactions and activities. Properly documenting the exchange ensures compliance with IRS regulations and provides evidence of adherence to related party rules. In a Related Party 1031 exchange, the investor may have claimed depreciation deductions on the relinquished property over the holding period. When the replacement property is eventually sold, any depreciation that was previously deducted must be "recaptured" and added back to the investor's taxable income in the year of the sale. The recaptured depreciation is taxed at ordinary income tax rates, which can result in a higher tax liability. If an investor exchanged property in a previous 1031 exchange and deferred capital gains taxes, those deferred gains could potentially be subject to recapture upon the sale of the replacement property in the Related Party 1031 exchange. This means that the investor could be liable for the deferred taxes from the previous exchange in addition to any new capital gains taxes incurred. A Related Party 1031 exchange offers the advantage of deferring capital gains taxes, leading to increased investment capital, the compounding effect, enhanced cash flow, strategic wealth management, and estate planning benefits. This tax deferral empowers investors to optimize their real estate investments and make informed decisions in response to market conditions. A Related Party 1031 exchange allows investors to maintain investment continuity by deferring taxes and seamlessly transitioning between properties. It enables portfolio consolidation or diversification, responding to market opportunities, and mitigating tax impact on profitability. This long-term strategy supports wealth building and maximizes investment profitability over time. A Related Party 1031 exchange allows investors to achieve portfolio diversification by exchanging properties in different regions or asset classes. This strategy reduces risk, provides exposure to diverse economic conditions, and hedges against market volatility. By customizing their portfolios, investors can enhance long-term financial stability and align their investments with specific goals and risk tolerance. A Related Party 1031 exchange facilitates seamless inter-generational property transfers, preserving family wealth through tax deferral, and enhancing estate planning strategies. This exchange allows families to transfer properties while maintaining the tax-deferred status, preserving wealth, and ensuring a well-structured estate plan for future generations. A Related Party 1031 exchange is subject to strict IRS regulations, including requirements for arm's length transactions, related party definitions, holding periods, and adherence to specific timelines. Proper reporting and documentation are essential to prevent disqualification and tax liabilities. Avoidance of tax avoidance schemes is crucial to maintain compliance with IRS guidelines. In a Related Party 1031 exchange, disqualified individuals and entities are prohibited from participating to maintain tax-deferred status. Disqualified parties include certain family members and entities under common control. Engaging with disqualified parties can lead to disqualification of the entire exchange, resulting in immediate tax liabilities. Investors must thoroughly assess relatedness and seek professional guidance to ensure compliance with IRS regulations. In a Related Party 1031 exchange, investors must be mindful of depreciation recapture upon the sale of the replacement property. Recaptured depreciation is added to taxable income and subject to ordinary income tax rates, potentially increasing the tax liability. Strategies like cost segregation studies and long-term planning can help mitigate the impact. Exploring alternative tax strategies, such as DST or Opportunity Zone investments, may also provide more favorable tax benefits for investors concerned about depreciation recapture. Participating in a Related Party 1031 exchange entails strict timing constraints and associated risks. The short time frames may lead to rushed decisions and suboptimal property choices. Relatedness issues can also result in failed exchanges and additional costs. To mitigate these challenges, careful planning, due diligence, and seeking professional advice are crucial. Exploring alternative tax strategies, such as DST or Opportunity Zone investments, can serve as fallback options. In a Related Party 1031 exchange, parties involved often have existing relationships or shared interests, which can potentially lead to conflicts of interest. These conflicts may raise concerns about the exchange's legitimacy and compliance with IRS regulations. To ensure a valid and compliant transaction, investors must proactively identify and address any potential conflicts of interest. One way to address conflicts of interest is to obtain independent property valuations from qualified appraisers. Independent valuations can help ensure that the exchange is conducted at arm's length and that the properties involved are accurately valued based on their fair market value. Transparent communication among all parties involved is essential in addressing potential conflicts of interest. Clear and open discussions can help identify any areas of concern and allow the parties to find mutually agreeable solutions that adhere to IRS guidelines. Seeking advice from qualified tax and real estate professionals can also help in identifying and mitigating conflicts of interest. These professionals can provide objective insights and guidance, ensuring that the exchange remains compliant and above board. Tax implications in a Related Party 1031 exchange can be complex. Tax advisors with expertise in 1031 exchanges can provide valuable insights into the potential tax consequences, including depreciation recapture and other relevant tax considerations. Engaging real estate experts can assist in property valuation, market analysis, and identifying suitable replacement properties. Their expertise can help investors make well-informed decisions and select properties that align with their investment goals. Consulting with legal counsel is crucial to ensure compliance with all legal requirements and documentation. Legal professionals can review contracts, identify potential risks, and provide guidance on structuring the exchange to protect the investor's interests. Investors must fully understand the tax consequences of a Related Party 1031 exchange. This includes potential depreciation recapture, deferred gain recognition, and any other tax liabilities that may arise during or after the exchange. A comprehensive understanding of the financial implications is essential for risk and reward evaluation. Investors should weigh the benefits of tax deferral against the risks associated with potential conflicts of interest and the complexities of the exchange process. Awareness of the legal implications, reporting requirements, and IRS regulations is vital for a successful exchange. Compliance with these requirements ensures the legitimacy of the transaction and mitigates the risk of disqualification. Delaware Statutory Trust (DST) investments offer an attractive option for investors seeking a more passive approach to real estate investment. A DST is a legal entity that allows multiple investors to pool their funds and acquire fractional ownership in institutional-grade, professionally managed properties. This investment vehicle provides several benefits, including potential tax advantages and diversification opportunities. Delaware Statutory Trust investments offer passive ownership with potential tax advantages. As a pass-through entity, DSTs avoid entity-level taxes, providing tax-deferred income and depreciation deductions for individual investors. DSTs also enable diversification across various properties and markets, reducing risk and enhancing portfolio stability. Opportunity Zone investments provide a tax-advantaged option for related parties and other investors looking to support economic development in designated distressed communities. Created under the Tax Cuts and Jobs Act of 2017, Opportunity Zones aim to stimulate economic growth by incentivizing investment in qualifying areas. Opportunity Zone investments offer tax advantages for investors by deferring taxes on capital gains until 2026 or the QOF's disposition date. Holding the QOF investment for five years reduces the deferred tax liability, and ten years of holding makes gains tax-free. These investments aim to revitalize distressed communities, driving economic development, job creation, and infrastructure improvement, benefiting both investors and local residents. A 1031 Exchange Accommodation Titleholder (EAT), also known as a Qualified Intermediary (QI), is a neutral third party that facilitates complex 1031 exchanges, including those involving related parties. An EAT facilitates Related Party 1031 exchanges by acting as an intermediary, ensuring compliance with IRS guidelines. They simplify the process, handling timing and documentation, reducing administrative burden. EATs' expertise in 1031 exchanges and IRS regulations minimizes disqualification risk and tax liabilities. A Related Party 1031 exchange involves the tax-deferred exchange of properties between related parties, following strict IRS guidelines. The process allows for deferring capital gains taxes and fosters investment continuity and strategic financial decisions. However, challenges include adhering to related party rules, addressing potential conflicts of interest, and complying with timing constraints. Investors can seek professional guidance, consider Delaware Statutory Trust (DST) or Opportunity Zone investments, or utilize a 1031 Exchange Accommodation Titleholder (EAT) to streamline the exchange process. Understanding tax implications and evaluating risk-reward scenarios are essential for successful transactions. Overall, a Related Party 1031 exchange offers opportunities for property transfers and wealth preservation while requiring meticulous planning and compliance.What Is a Related Party 1031 Exchange Transaction?

How Related Party 1031 Exchange Transactions Work

Meeting the Qualification Criteria

Use of Properties

Arm's Length Transaction

Holding Period After the Exchange

Identifying the Related Party

Direct Family Relationships

Shared Business Interests

Control Over Entities

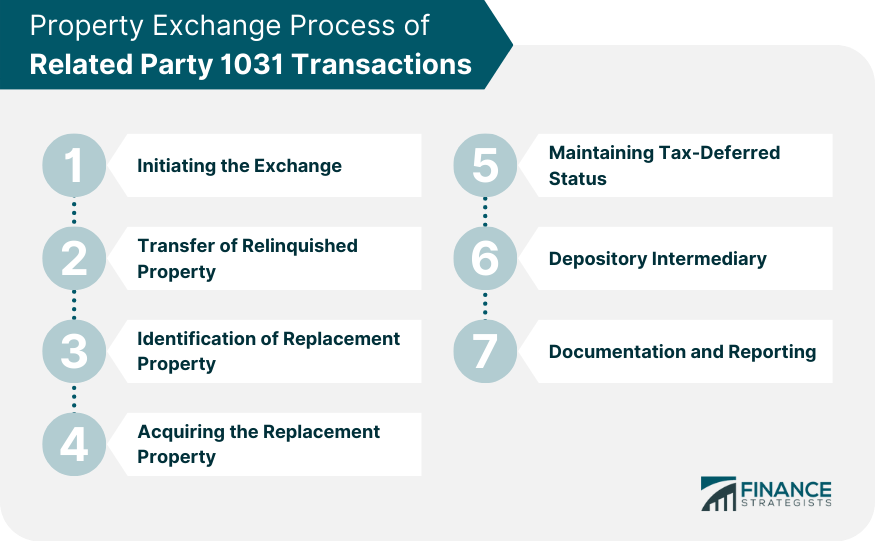

Property Exchange Process

Initiating the Exchange

Transfer of Relinquished Property

Identification of Replacement Property

Acquiring the Replacement Property

Maintaining Tax-Deferred Status

Depository Intermediary

Documentation and Reporting

Tax Implications

Depreciation Recapture

Recapture of Deferred Gains

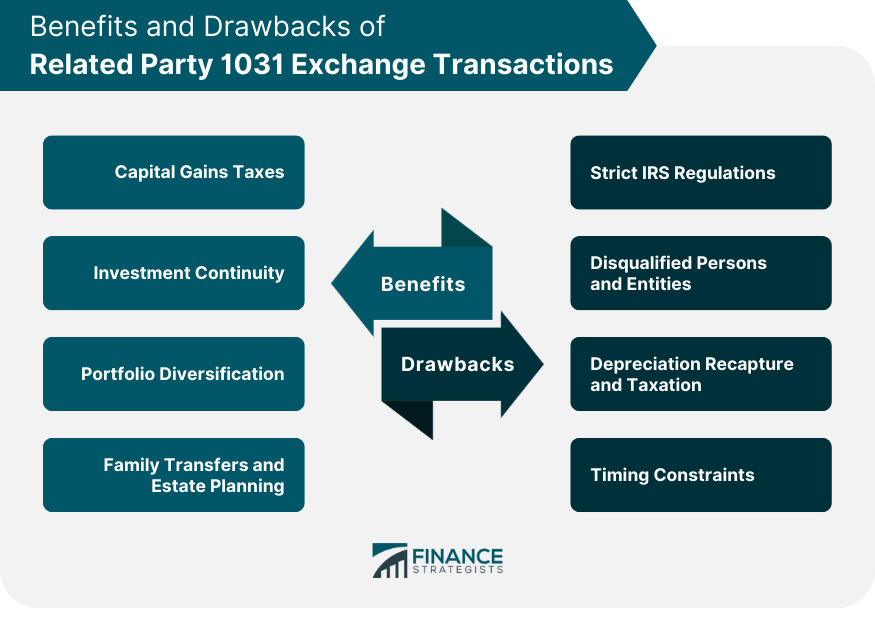

Benefits of Related Party 1031 Exchange Transactions

Capital Gains Taxes

Investment Continuity

Portfolio Diversification

Family Transfers and Estate Planning

Drawbacks of Related Party 1031 Exchange Transactions

Strict IRS Regulations

Disqualified Persons and Entities

Depreciation Recapture and Taxation

Timing Constraints

Risks and Mitigation Strategies

Identifying and Addressing Potential Conflicts of Interest

Independent Valuations

Transparent Communication

Professional Guidance

Seeking Professional Advice and Guidance

Tax Advisors

Real Estate Experts

Legal Counsel

Understanding Financial and Legal Implications

Tax Consequences

Risk and Reward Evaluation

Compliance and Reporting

Alternative Tax-Advantaged Options for Related Parties

Delaware Statutory Trust (DST) Investments

Opportunity Zone Investments

Structuring a 1031 Exchange With a 1031 Exchange Accommodation Titleholder (EAT)

Conclusion

Related Party 1031 Exchange Transactions FAQs

A Related Party 1031 Exchange Transaction involves the exchange of properties between parties with a pre-existing relationship, such as family members or entities with common ownership. It allows for tax deferral on capital gains, but strict IRS regulations must be followed to qualify.

Yes, you can exchange properties with a family member in a Related Party 1031 exchange. However, certain family relationships, such as siblings or cousins, may be disqualified. Make sure to carefully assess relatedness to ensure compliance.

In a Related Party 1031 exchange, you have 45 days to identify potential replacement properties from the date of selling the relinquished property. You must then acquire the replacement property within 180 days to maintain tax-deferred status.

Risks in a Related Party 1031 exchange include potential conflicts of interest due to relatedness, rushed decision-making, and the risk of failed exchanges if related party rules are not adhered to. Proper planning and professional advice can mitigate these risks.

Yes, there are alternatives. Investors can explore Delaware Statutory Trust (DST) investments for a more passive approach, Opportunity Zone investments for tax advantages and community development, or utilize a 1031 Exchange Accommodation Titleholder (EAT) to streamline complex exchanges involving related parties.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.