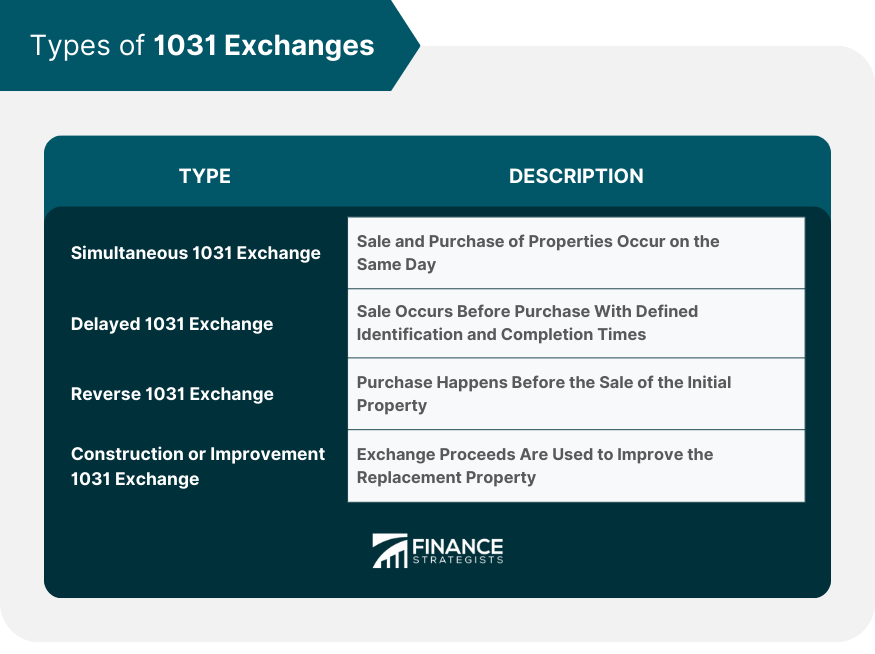

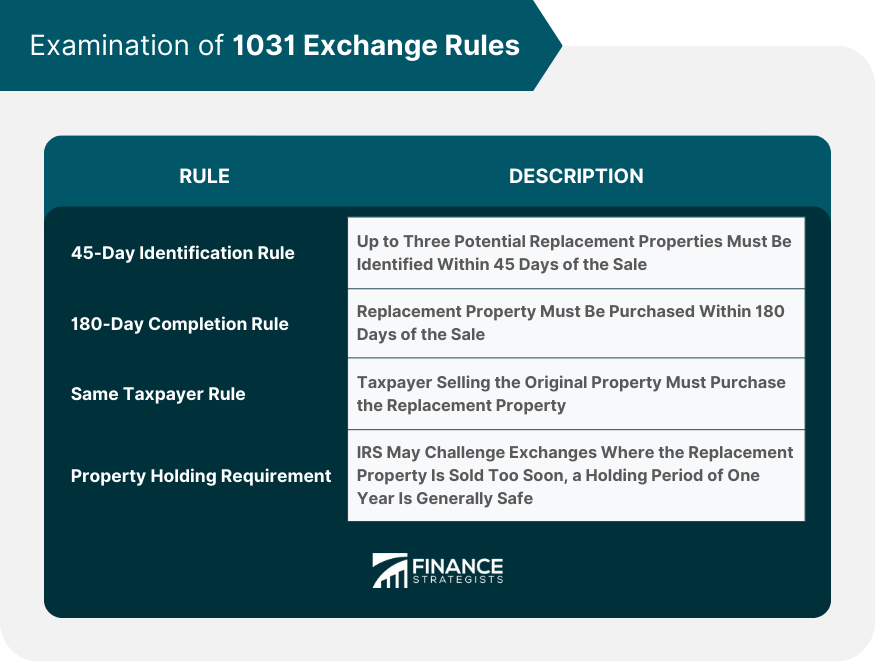

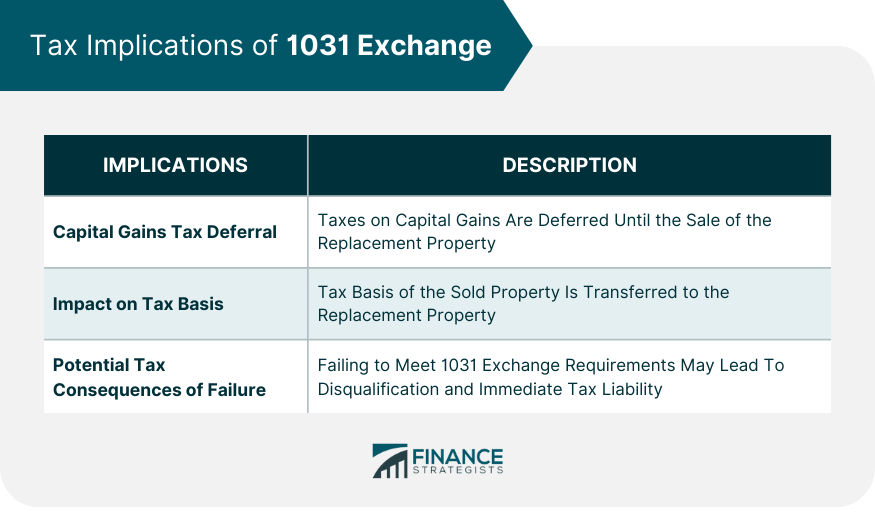

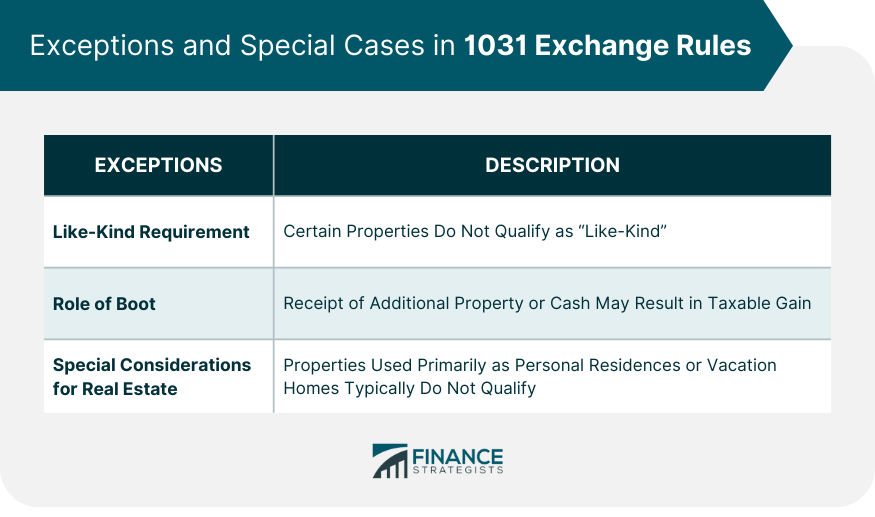

The 1031 Exchange Rules, under Section 1031 of the U.S. Internal Revenue Code, provide investors with the opportunity to defer capital gains taxes when they sell an investment property and reinvest the proceeds into a "like-kind" property. The term "like-kind" is broadly defined and refers to the nature of the investment rather than the type of property. There are stringent timing rules to adhere to. Investors have 45 days post the sale of their original property to identify potential replacement properties, and 180 days to finalize the purchase. A Qualified Intermediary must facilitate the transaction. Failure to follow these rules may lead to a disqualification of the 1031 Exchange, resulting in the capital gains tax becoming due immediately. Therefore, thorough understanding and precise execution of these rules are essential in a 1031 Exchange transaction. There are several types of 1031 Exchanges, each designed to accommodate different investment strategies and situations. Understanding each type can help an investor choose the right one for their specific circumstances. A Simultaneous 1031 Exchange happens when the relinquished and replacement properties are closed on the same day. There is no time gap between the sale and purchase. This type of exchange was more common when 1031 Exchange rules were first introduced, but it is less common now due to the difficulty of coordinating both transactions to close simultaneously. A Delayed 1031 Exchange, also known as a Starker exchange, is the most common type of 1031 Exchange. In a delayed exchange, the investor has 45 days from the date of selling the relinquished property to identify potential replacement properties and 180 days to complete the purchase. A Reverse 1031 Exchange occurs when the replacement property is purchased before the relinquished property is sold. This type of exchange is complex and requires all cash since lenders usually don't provide financing for this type of exchange. In a Construction or Improvement 1031 Exchange, the investor can use the exchange proceeds to improve the replacement property while it is held by a QI in a qualified exchange accommodation arrangement. The full exchange equity must be spent on the purchase and improvements or held by the QI by the end of the 180-day exchange period. The 1031 Exchange rules are quite specific, and strict adherence to them is essential to avoid potential tax consequences. After the sale of the relinquished property, the exchanger has 45 days to identify up to three potential replacement properties. The identification must be in writing, signed by the exchanger, and delivered to the QI. Failing to identify replacement properties within this period can disqualify the entire exchange. The investor has 180 days from the sale of the relinquished property to close on the replacement property or properties. This timeline runs concurrently with the 45-day identification period. This means that the investor does not have an additional 180 days post the 45-day identification period. The same taxpayer that sells the relinquished property must buy the replacement property. In other words, the name on the title of the replacement property must be the same as the name that was on the title of the relinquished property. There is no statutory holding period for property acquired in a 1031 Exchange. However, the IRS could potentially challenge an exchange if the property is sold too soon. A holding period of one year is generally considered safe. A 1031 Exchange allows investors to defer capital gains tax that would otherwise be incurred on the sale of investment property. It's important to understand the implications of this tax deferral and how it impacts your investment strategy. In a 1031 Exchange, the capital gains tax is deferred, not eliminated. When you eventually sell the replacement property (unless you do another 1031 Exchange), you'll pay the deferred capital gains tax. However, the tax deferral allows more of your money to remain invested and growing, which can significantly enhance your wealth over time. The tax basis of the relinquished property is transferred to the replacement property in a 1031 Exchange. This means that when the replacement property is eventually sold (not through a 1031 Exchange), the original deferred gain, plus any additional gain realized since the purchase of the replacement property, is subject to tax. If the strict rules of a 1031 Exchange are not met, the transaction may be disqualified, and the investor could be required to pay taxes or penalties. The IRS is quite clear that any mistakes can lead to the exchange being disallowed and the investor could face an unexpected tax bill. While the rules of 1031 Exchange are quite specific, there are some exceptions and special cases that investors should understand. While a 1031 Exchange typically involves like-kind property, there are exceptions. For instance, a domestic property may not be exchanged for a foreign property. Additionally, properties held primarily for sale, inventory, stocks, bonds, notes, securities, and interests in a partnership do not qualify. "Boot" refers to the cash or fair market value of any additional property received by the taxpayer through the exchange. The receipt of the boot will result in taxable gain. To avoid this, investors often aim for a full exchange where they trade their property for like-kind property of equal or greater value. Real estate investments often make up the bulk of 1031 Exchanges due to the flexibility in determining what constitutes "like-kind" property. However, there are special considerations. For example, the investor must consider how they will use the property. Properties used primarily as personal residences or vacation homes typically don't qualify for 1031 Exchanges. The 1031 Exchange rules, stipulated by the U.S. Internal Revenue Code, provide a powerful tool for investors, enabling the deferral of capital gains taxes by reinvesting in "like-kind" properties. It is important for investors to understand the different types of exchanges: Simultaneous, Delayed, Reverse, and Construction/Improvement. Critical to the process is the 45-day Identification Rule and 180-day Completion Rule, with a Qualified Intermediary facilitating the exchange. Although the tax advantages are significant, investors must also understand the potential risks associated with market fluctuations and debt replacement requirements. Special cases, including exceptions to the like-kind requirement and role of 'boot', play into the strategy. As an investment strategy in the realm of real estate, a 1031 Exchange can provide an effective way for investors to maximize their return on investment while mitigating their immediate tax burden.1031 Exchange Rules Overview

Types of 1031 Exchanges

Simultaneous 1031 Exchange

Delayed 1031 Exchange

Reverse 1031 Exchange

Construction or Improvement 1031 Exchange

Examinations of 1031 Exchange Rules

45-Day Identification Rule

180-Day Completion Rule

Same Taxpayer Rule

Property Holding Requirement

Tax Implications of 1031 Exchange

Capital Gains Tax Deferral

Impact of a 1031 Exchange on Tax Basis

Potential Tax Consequences of Failing to Meet 1031 Exchange Requirements

Exceptions and Special Cases in 1031 Exchange Rules

Like-Kind Requirement

Role of Boot in a 1031 Exchange

Special Considerations for Real Estate Investments

Conclusion

1031 Exchange Rules FAQs

A 1031 Exchange, also known as a like-kind exchange, is a transaction under U.S. tax law that allows an investor to defer capital gains taxes when they sell a property and reinvest the proceeds in a new, "like-kind" property. It's named after Section 1031 of the U.S. Internal Revenue Code.

In a 1031 Exchange, "like-kind" refers to the nature or character of the property, not its grade or quality. Essentially, any type of investment property can be exchanged for another type of investment property. For example, an office building could potentially be exchanged for a rental home, or a retail space for raw land.

In a 1031 Exchange, once the original property is sold, the investor has 45 days to identify up to three potential replacement properties. This identification must be in writing, signed by the investor, and delivered to a Qualified Intermediary. If the investor fails to identify a replacement property within the 45-day period, the 1031 Exchange could be disqualified.

The primary tax implication of a 1031 Exchange is the deferral of capital gains tax. This allows an investor to sell a property and reinvest the proceeds in a new property without immediately incurring a tax liability. However, the tax is deferred, not eliminated, and will be due when the replacement property is eventually sold (unless it's sold through another 1031 Exchange).

While 1031 Exchanges offer significant tax benefits, they come with risks including strict timing requirements, potential for lower-quality replacement properties, market risks, and the need to replace debt on the relinquished property with equivalent debt on the replacement property. If the rules of the 1031 Exchange are not strictly adhered to, the transaction could be disqualified, leading to an unexpected tax bill.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.