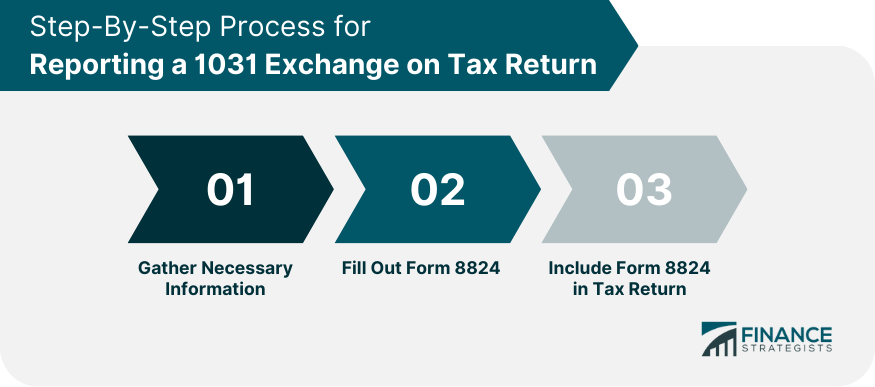

Before you start filling out the IRS Form 8824, it's essential to gather all the necessary information. This includes a detailed description of the properties involved, the dates of the exchange, the fair market value of the properties, and the amount of cash received or paid. It is also necessary to calculate the gain or loss on the exchange, which is the difference between the fair market value of the property received and the adjusted basis of the property given up. Filling out Form 8824 requires inputting basic information such as your name and identification number. Next, the properties' details and the exchange itself should be entered. Line items in this form will help you report the fair market value, cash received or paid, and the basis of the properties. Subsequently, you will calculate and report any gain or loss from the exchange, following the instructions provided by the IRS. After you have filled out Form 8824, it should be included with your tax return. It's important to remember that a separate Form 8824 is needed for each like-kind exchange. Furthermore, any gain from the exchange is reported on Schedule D, and any additional tax due should also be reported. In the realm of 1031 Exchanges, 'boot' denotes any additional property or cash that doesn't fall under the category of like-kind property. Situations that warrant the receipt of boot often arise when there's an imbalance in the values of the exchanged properties. The difference is then compensated with cash or other property types, constituting the boot. Such boot is subject to taxation and forms an integral part of your 1031 exchange report. The very essence of a 1031 Exchange is rooted in deferring tax on potential gains by reinvesting them in like-kind property. These gains, although postponed from immediate taxation, are nonetheless a crucial part of your tax return and must be meticulously reported to maintain transparency. A 1031 Exchange doesn't always revolve around real estate. When it encompasses multiple assets, the complexity multiplies. In such cases, each involved asset class necessitates individual identification and reporting. The basis of the exchange, too, demands precise allocation across all assets to ensure accuracy in reporting. The scope of a 1031 Exchange stretches beyond the common realm of real estate. Personal properties may also qualify for such an exchange but with added layers of rules and complexities. The reporting requirements for such exchanges deviate from standard procedures, warranting extra caution and understanding of the process. While most 1031 exchanges involve real estate, personal property can also qualify. However, the rules for these exchanges are more complex, and the reporting requirements differ. One of the most crucial aspects of successful 1031 exchange reporting is meticulous record-keeping. This includes maintaining documentation such as the original purchase agreement, proof of the exchange, and any related financial statements or invoices. A qualified intermediary can help ensure the exchange meets the stringent requirements of a 1031 exchange. They can also assist with the paperwork and record-keeping, helping to ensure accurate reporting. The tax implications of a 1031 exchange can be complex, and understanding them is vital. It's often recommended to consult with a tax professional to ensure you fully understand these implications and accurately report the exchange. Misclassifying properties during a 1031 exchange is a frequent error. Ensuring both properties in the exchange qualify as like-kind is pivotal. Furthermore, it's necessary to validate that the exchange served business or investment purposes. The properties don't need to be identical but must be of the same nature or character. The qualification of properties as like-kind is not always clear-cut, especially with complex or multi-asset exchanges. Seeking the assistance of a tax professional or a qualified intermediary can provide clarity and prevent misclassification. Another prevalent mistake is the incorrect reporting of gains from a 1031 exchange. Accurate calculation of the gain is vital to avoid substantial tax penalties. This calculation involves understanding the basis of the exchanged properties, the fair market value, and any received boot. The gain should also be reported in the tax year it was realized. Developing a strong understanding of these aspects or consulting a professional can ensure accuracy and compliance. Finally, misreporting dates and fair market values can lead to an incorrect assessment of tax liability. Ensuring all data reported is accurate involves diligent record-keeping. It's necessary to record the dates of identification and receipt of the new property, along with the fair market values of the relinquished and received properties. Keep copies of relevant documents and double-check entries on IRS Form 8824 to avoid errors. This meticulous approach can safeguard against inaccurate reporting and potential disputes with the IRS. Understanding and accurately reporting a 1031 Exchange is crucial for every taxpayer involved in such a transaction. Careful documentation of the process, including details about the properties exchanged, and precise calculation of gains and losses, is fundamental. IRS Form 8824 serves as the primary tool for reporting these exchanges. Various situations, such as receipt of 'boot,' deferred gains, and multi-asset or non-real estate exchanges, add complexity, making meticulous reporting and record-keeping essential. To navigate the intricacies, the engagement of a qualified intermediary or tax professional is often advisable. Mistakes in the classification of properties, reporting gains, or misreporting dates and values can lead to penalties, making the need for caution paramount. With this knowledge and careful attention to detail, taxpayers can optimize the benefits of 1031 Exchanges while complying with tax laws.Gather Necessary Information

Fill Out Form 8824

Include Form 8824 in Tax Return

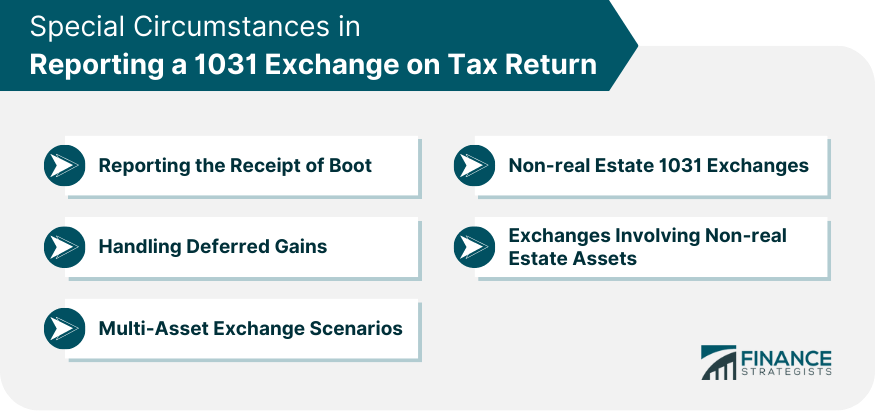

Special Circumstances in Reporting a 1031 Exchange on Tax Return

Reporting the Receipt of Boot

Handling Deferred Gains

Multi-Asset Exchange Scenarios

Non-real Estate 1031 Exchanges

Exchanges Involving Non-real Estate Assets

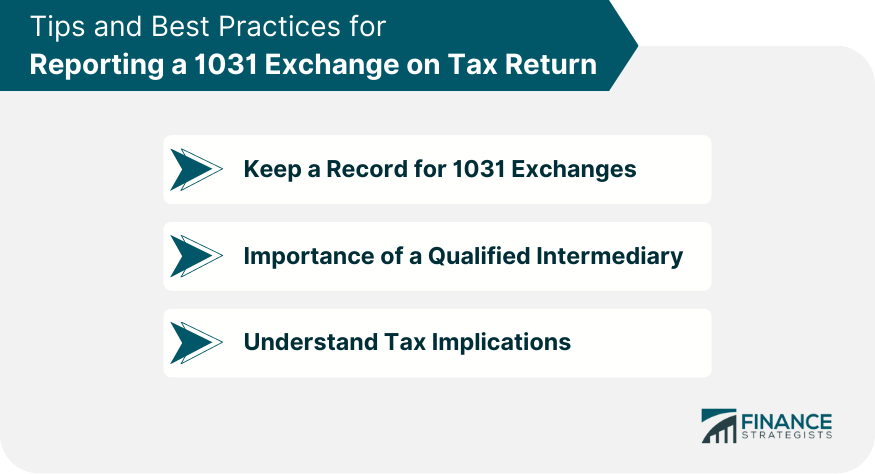

Tips and Best Practices for Reporting 1031 Exchange on Tax Return

Keep a Record for 1031 Exchanges

Importance of a Qualified Intermediary

Understand Tax Implications

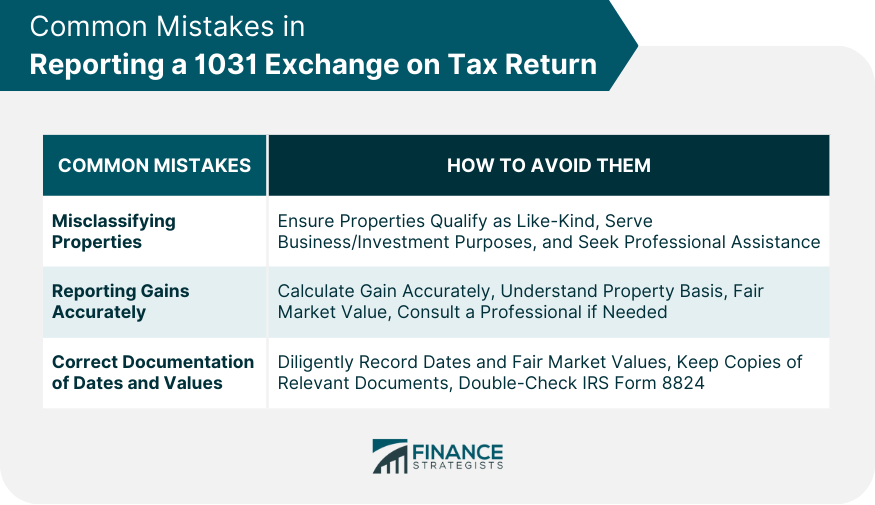

Common Mistakes in Reporting a 1031 Exchange on Tax Return

Classification of Properties

Reporting Gains Accurately

Correct Documentation of Dates and Values

Bottom Line

Reporting a 1031 Exchange on Tax Return FAQs

IRS Form 8824, "Like-Kind Exchanges," is used to report each 1031 Exchange. The form helps taxpayers provide details about the properties exchanged and calculate any realized gain or recognized loss. Accurate completion of this form is vital to avoid potential tax penalties.

'Boot' refers to any cash or non-like-kind property received in a 1031 Exchange. It's often received when the properties exchanged are not of equal value, and cash is added to balance the transaction. The 'Boot' is considered taxable and must be reported as part of your 1031 Exchange on IRS Form 8824.

If a mistake is discovered in the previous 1031 Exchange reporting, an amended return should be filed. This allows you to correct previously filed returns, including those where the 1031 Exchange was reported.

Records of your 1031 Exchange should be kept for at least three years after the exchange has been reported on your tax return. However, keeping them for longer could be beneficial for future reference or in case of disputes.

While it's possible to handle a 1031 Exchange and its reporting on your own, it's often recommended to get professional help due to its complexity. Tax professionals or qualified intermediaries can guide you through the process, help with paperwork and record-keeping, and ensure the exchange complies with IRS rules.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.