Retirement income is a broad term encompassing all the financial resources that support an individual after they retire from full-time employment. A key component in planning for post-employment years is the income that replaces the regular paycheck a person was earning during their working years. Retirement income comes from several streams, each with its unique characteristics and advantages. One of the most significant sources of retirement income in the U.S. is Social Security benefits, which are based on an individual's earning history. Secondly, pensions, if available, provide a steady stream of income based on an employee's salary and years of service. Retirement accounts such as 401(k) plans and Individual Retirement Accounts (IRAs) also contribute to retirement income. Furthermore, many retirees generate income through part-time work or consulting, providing services based on their skills and expertise. Social security represents one of the key pillars of retirement income in the United States. Generally, individuals become eligible to claim Social Security benefits when they reach the age of 62. However, the full retirement age—when one can claim full benefits—ranges from 65 to 67, depending on the year of birth. The Social Security Administration calculates benefits based on an individual's 35 highest-earning years. The higher the earnings during these years, the higher the Social Security benefits in retirement. Pensions are employer-sponsored retirement plans that provide a fixed income to retirees. There are two main types of pension plans: defined benefit and defined contribution. In defined benefit plans, the employer guarantees a specific payout upon retirement, while in defined contribution plans, the employer contributes a specific amount to the employee's retirement fund. Pension benefits are usually based on the employee's salary, years of service, and a percentage factor determined by the employer. A 401(k) is an employer-sponsored retirement plan. Employees can contribute a portion of their pre-tax salary to this plan, which is often matched by employers. An IRA is a retirement savings account individuals can open independently. There are different types of IRAs, each offering different tax benefits. Roth IRAs and Roth 401(k)s are funded with after-tax dollars. The advantage is that qualified withdrawals during retirement are tax-free. Investments in stocks, bonds, and mutual funds offer potential for capital growth and income in the form of dividends or interest. Annuities, often sold by insurance companies, provide a steady stream of income during retirement for a certain period or lifetime. Owning rental properties can provide a steady monthly income. However, managing rental properties also comes with responsibilities and potential challenges. REITs are companies that own or finance income-generating real estate. Investing in REITs offers a way to participate in the benefits of owning real estate without the need for direct property management. Even in retirement, many individuals choose to continue working part-time or offering consulting services. Part-time work or consulting can supplement retirement income, keep retirees engaged, and allow them to share their expertise. Retirees with specialized knowledge can offer consulting services in their field, adding to their retirement income. Inheritances and trusts can also make up a part of a retiree's income. Although these are not as common or reliable as other forms of retirement income, they can significantly contribute to the financial well-being of a retiree if they come into play. The age at which an individual retires can significantly affect their retirement income. For instance, retiring early may reduce the amount of Social Security benefits one can claim. The amount of money earned and saved during an individual's career has a direct impact on their retirement income. The more one earns and saves, the more money is available in retirement. The returns on investments also significantly impact retirement income. Higher returns can lead to a larger nest egg and subsequently, a higher retirement income. The cost of living and inflation rates in the area where a retiree lives also impact the amount of income needed. Higher costs of living and higher inflation rates require a larger retirement income to maintain a certain lifestyle. Healthcare costs are a significant factor for retirees, as these costs often increase with age. Unexpected health issues can also result in high out-of-pocket costs. Longer lifespans require more retirement savings. As life expectancy continues to increase, so does the need for a more substantial retirement income. Retirement income planning is crucial for a comfortable and financially secure retirement. Successful strategy for retirement income planning involves diversifying income sources, estimating expenses, and considering tax implications. Individuals must consider their lifestyle choices, financial goals, and risk tolerance while planning for retirement income. A sustainable withdrawal strategy helps to ensure retirement savings last throughout retirement. The 4% rule is a common strategy, but it might not work for everyone. Consulting with a financial advisor is beneficial to devise a personalized strategy. Understanding the tax implications of different retirement income sources can significantly impact net income. For instance, some income is taxed as regular income, while other income might be taxed at the capital gains rate. Retirees should be aware of potential risks, including market volatility, longevity risk, inflation risk, and health risk. Adequate planning can help manage these risks. Retirement income, a critical component of post-employment life, encapsulates diverse financial streams. These include Social Security benefits, pensions, distributions from retirement accounts, investment returns, part-time work, rental income, and others. Effectively planning these sources helps ensure financial stability and a comfortable lifestyle during retirement. Factors like age, career earnings, investment returns, cost of living, health care costs, and lifespan also impact retirement income. Crafting successful retirement planning strategies involves a comprehensive understanding of these income sources, the tax implications, and the associated risks. Lastly, a sustainable withdrawal strategy, such as the 4% rule, can be beneficial, while staying aware of potential pitfalls and market volatilities. Engaging with a financial advisor could be advantageous for personalized strategies and tax considerations. By comprehending these facets, individuals can enhance their retirement income planning, aligning their financial future with their retirement goals.What Is Considered Retirement Income?

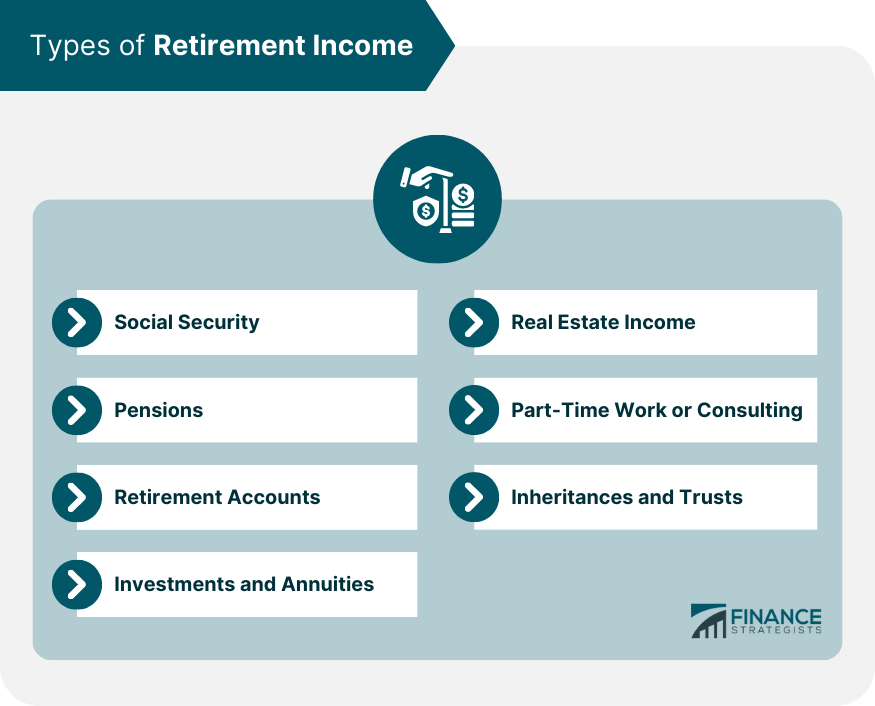

Types of Retirement Income

Social Security

Pensions

Retirement Accounts

401(k) Plans

Individual Retirement Accounts (IRAs)

Roth IRA and Roth 401(k) Plans

Investments and Annuities

Stocks, Bonds, and Mutual Funds

Annuities and Insurance Products

Real Estate Income

Rental Properties

Real Estate Investment Trusts (REITs)

Part-Time Work or Consulting

Inheritances and Trusts

Factors That Impact Retirement Income

Age at Retirement

Career Earnings and Savings Rate

Investment Returns

Cost of Living and Inflation

Health Care Costs

Lifespan and Longevity

Planning and Managing Retirement Income

Retirement Income Planning Strategies

Withdrawal Strategies for Retirement Accounts

Tax Considerations for Retirement Income

Potential Pitfalls and Risks

Conclusion

What Is Considered Retirement Income? FAQs

Retirement income refers to the various financial resources an individual relies on after retiring from active work. Common sources include Social Security benefits, pensions, distributions from retirement accounts such as 401(k)s and IRAs, investment returns, income from part-time work or consulting, and rental income.

The age at which you retire can significantly impact your retirement income. For instance, if you retire early, you may receive reduced Social Security benefits. Similarly, the age of retirement can influence the size of distributions from retirement accounts and pensions.

Investment returns can form a substantial part of your retirement income. Investments in stocks, bonds, mutual funds, and real estate can provide income through capital gains, dividends, and rental income during retirement.

Many retirees continue to work part-time or offer consulting services based on their skills and expertise. This additional income is considered part of their retirement income and can help supplement more traditional sources like Social Security benefits and pensions.

These factors can significantly impact the amount of retirement income you need. A higher cost of living and increasing healthcare costs can mean you need a larger retirement income to maintain your lifestyle. Similarly, longer life expectancies can mean that retirement savings need to last longer, potentially requiring larger or additional sources of retirement income.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.